Transparency and Control for Sales Teams

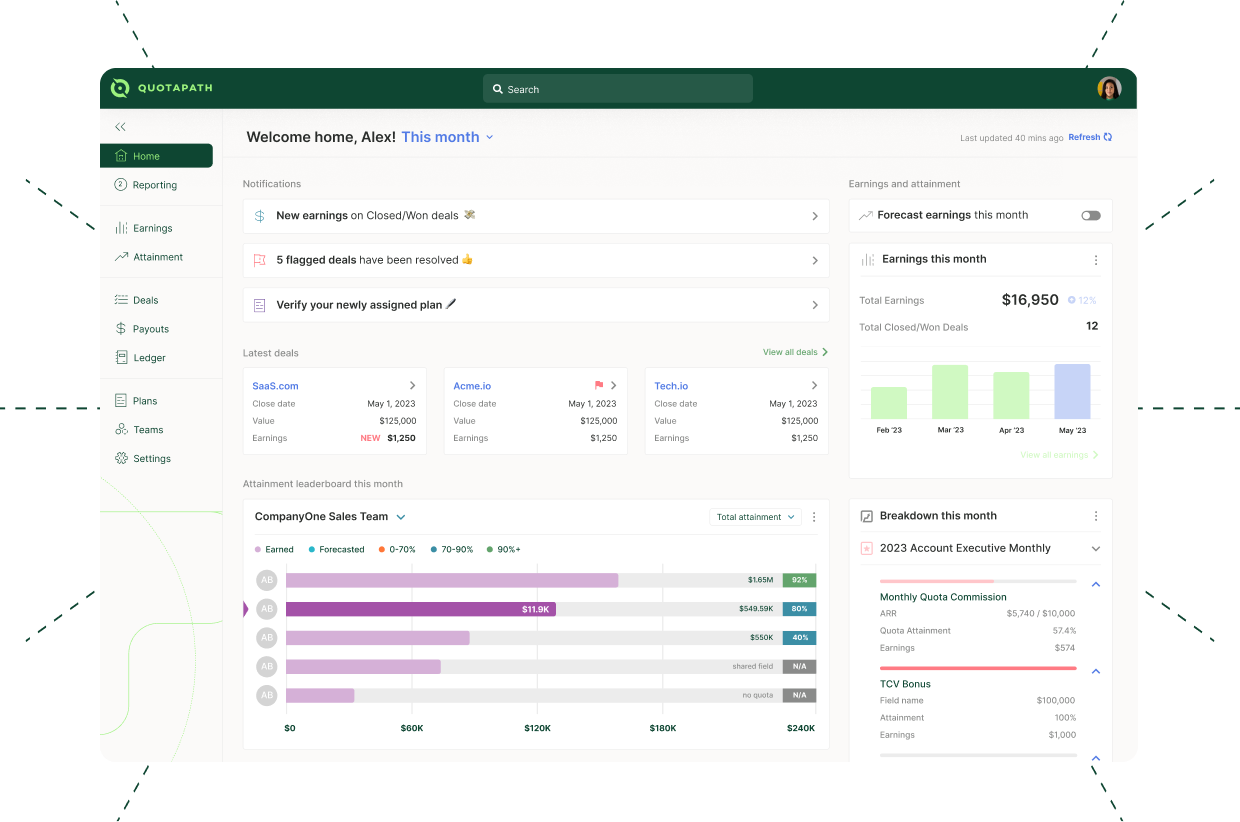

Empower Your Sales Reps

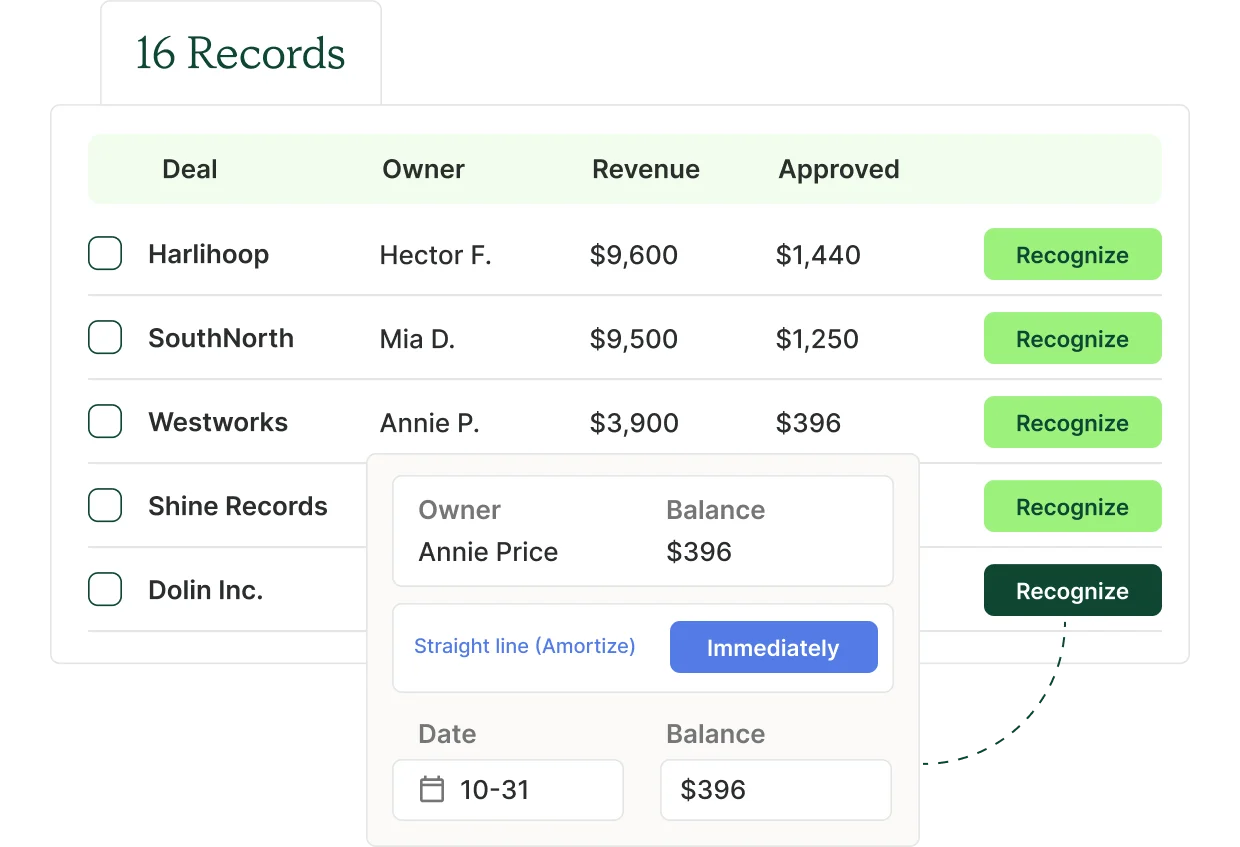

Give your reps insights into their earnings and commission progress. QuotaPath fosters accountability and motivation by providing clear visibility into compensation calculations. Reps see a breakdown of their earnings on every deal.

If something looks off, they can use our in-app dispute resolution tools to streamline communication and track its status.

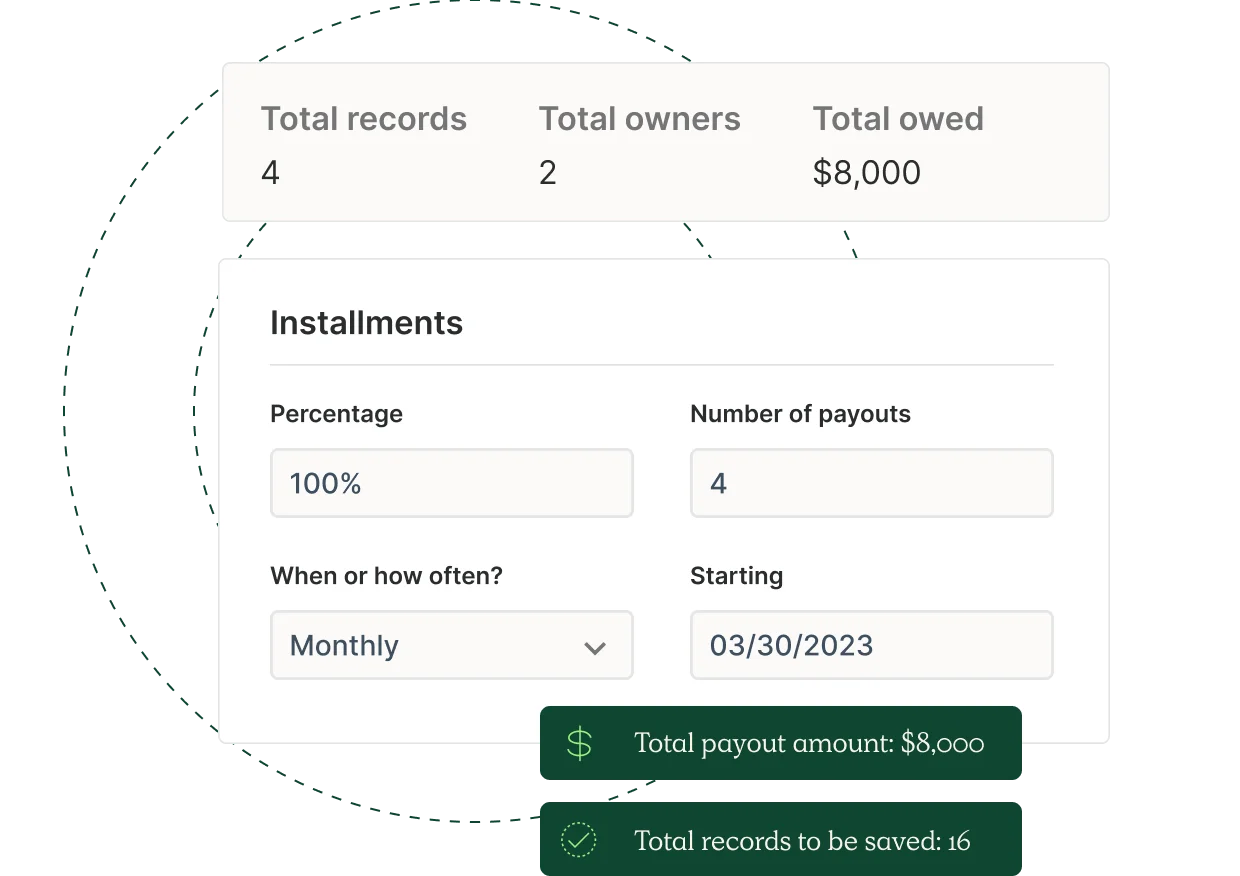

Bring Clarity to Commissions

In addition to seeing deal details and automated calculations, reps can view payment eligibility rules, clawbacks, or overpayments in a user-friendly way, fostering an even greater transparent payment process across your organization.