Sales compensation is more than just pay—it’s a strategic investment. In 2025, forward-thinking companies are designing comp plans not only to reward performance but to shape it. A well-built plan doesn’t just pay reps—it influences which deals they prioritize and how they sell.

The stakes are high: Misaligned or overly complex compensation plans remain one of the biggest culprits behind rep confusion, low morale, and missed business targets. According to recent reports, 39% of revenue leaders admit their plans don’t align with business goals, and most reps don’t fully understand how they’re paid.

The modern comp plan needs to be transparent, data-driven, and adaptive. With evolving go-to-market strategies, multiple sales roles, and dynamic revenue models, building a plan in 2025 means planning for agility and clarity from day one.

Comp plans are performance drivers—not just post-sale math. When sellers can forecast earnings based on pipeline and understand their plan structure in real time, they’re more likely to focus on deals that move the needle. For instance, by prioritizing multi-year, multi-product, or high-margin opportunities).

This guide will break down the essentials.

From understanding the role of compensation in motivation, to modeling, launching, and tracking your plan—this article will walk through the components and steps you need to confidently build and manage a comp plan in 2025.

Design, track, and manage variable incentives with QuotaPath. Give your RevOps, finance, and sales teams transparency into sales compensation.

Talk to SalesUnderstanding Sales Compensation Plans

Before you start building your plan, it’s important to understand sales compensation and why it matters for rep motivation and company growth.

A sales compensation plan is a structured framework that outlines how sales reps are paid based on their performance. It is designed to motivate salespeople to generate revenue and achieve sales goals, thereby driving organizational objectives.

The typical core components of a compensation plan include:

Base salary: a fixed amount of money that an employee is paid on a set schedule, regardless of their performance.

Variable pay: a type of compensation linked to an employee’s performance or outcomes, typically offered in addition to the base salary.

Commission structure: a set of rules that define what reps get paid for as well as when and how they get paid for their sales results.

Incentive programs: monetary and non-monetary rewards and recognition given to sales reps when they hit or exceed their sales targets.

Sales compensation plans are key sales team motivational tools to drive organizational objective achievement. It helps to understand why this is true before you build a sales compensation plan for your business.

Importance in Motivating Sales Teams

Sales compensation is a strategic lever for aligning individual motivation with company success. When thoughtfully designed, comp plans create more than just financial rewards. They provide reps with a clear sense of purpose and direction that links their success to the company’s growth.

Aligning incentives with business goals ensures sales teams focus on outcomes that matter. For example, if expanding in a specific region is a top priority, linking earnings to performance in that territory guides reps to concentrate their efforts there. This alignment improves motivation, sharpens decision-making, and ensures resources are applied where they’ll have the most impact.

Well-aligned plans also encourage greater collaboration across teams. For instance, shared performance targets between marketing, sales, and customer success create a more coordinated, efficient go-to-market strategy where everyone pulls in the same direction. This highlights how comp plans are your most important lever to drive specific selling behaviors.

Key Components of an Effective Plan

Every effective compensation plan is built from core components that work together to drive performance, ensure fairness, and align with business goals.

| Component | What to Cover | Why It Matters |

| Commission Structure | – Define how commissions are calculated- Include accelerators, thresholds, caps, and cliffs- Real-time visibility for reps | Drives clarity, reduces disputes, motivates overperformance |

| Pay Mix: Base vs. Variable | – Align with role (e.g., 50/50 for AE, 70/30 for SDR)- Link variable pay to measurable results | Balances income stability with performance incentives |

| Sales Quotas | – Use historical data and territory insights- Include individual, team, or hybrid quotas | Sets clear expectations and enables goal-setting |

| Performance Metrics | – Tie to revenue, pipeline, deal quality, retention- Combine leading and lagging indicators | Connects comp to business impact |

| Incentive Programs (SPIFs, Bonuses) | – Include time-bound SPIFs- Reward milestones like multi-year or upsell wins | Boosts motivation around strategic initiatives |

| Component-Based Plan Design | – Modular structure with distinct earning types- Example: quota-based, product-specific, bonus | Increases flexibility and makes updates easier |

| Simplicity & Interpretability | – Avoid overly complex rules- Ensure reps can explain how they earn in 30 seconds | Builds trust and drives behavioral alignment |

| Modeling & Forecasting | – Use tools like QuotaPath to simulate earnings- Allow reps to forecast commissions from pipeline | Enables better planning and pipeline prioritization |

| Approval Workflows | – Multi-level review (rep → manager → finance)- Transparent sign-offs for changes and payouts | Reduces errors, builds accountability |

| Benchmarking & Iteration | – Use industry data for comp design- Set cadence for quarterly/annual plan reviews | Keeps plans competitive and aligned with GTM changes |

| Alignment with Revenue Targets | – Every comp element should connect to GTM priorities- Adjust for new products, customer segments | Ensures compensation fuels company growth |

Steps to Build a Sales Compensation Plan

Following these best practices will help you create an effective sales compensation plan.

Define clear sales objectives

Defining clear sales objectives creates a foundation for a compensation plan that drives the right behaviors. When reps understand the outcomes they’re working toward, they’re more likely to stay focused, motivated, and aligned with company goals. Without this clarity, even a well-designed comp plan can miss the mark, rewarding activity that doesn’t contribute to organizational goal attainment.

Common sales objectives include:

Revenue targets set expectations for top-line growth and help shape quotas, accelerators, and thresholds.

Customer acquisition goals focus on bringing in new business and reward reps for landing first-time deals.

Upselling and cross-selling KPIs motivate maximizing value from existing accounts, encouraging reps to expand customer relationships over time.

By anchoring your plan to these objectives, you ensure that compensation is tied to meaningful progress.

Segment your sales roles

Segmenting your sales roles ensures that each team member is incentivized based on the outcomes they directly influence. This step is key to creating fair, effective plans that motivate the right behaviors across the organization.

Start by designing role-specific compensation that reflects each role’s responsibilities and impact. For example, account executive vs SDR pay models prioritize different activities. While AEs are rewarded for closed-won deals, SDRs may be rewarded for meetings booked or qualified opportunities.

Compensation by sales region or product is another type of segmentation. In this case, pay structures are adjusted to account for territory complexity, market maturity, or differences in deal size. Tailoring compensation to each role segment helps drive performance more effectively than a one-size-fits-all model and supports long-term rep satisfaction and retention.

Sales Compensation Statistics

- The median sales representative salary in the U.S. is $63,230.

- The best-paid sales reps (top 25%) made $93,280

- The lowest-paid reps (bottom 25%) made $47,220.

- Sales managers made an average annual salary of $150,530.

- Insurance sales agents made an average of $76,950.

- Real estate agents made an average of $65,850.

- Retail salespersons made an average of $34,730.

From — 27 Sales Compensation Statistics and Benchmarks Every Sales Leader Should Know

Choose the right compensation components

Achieve the right mix of compensation components by selecting elements that reflect your sales strategy, drive desired behaviors, and offer enough upside to keep top performers motivated. Which components you choose will be different for a startup with a small sales team than an enterprise business with a large team.

A single rate commission is the simplest approach, offering a flat percentage for each deal closed. It’s easy to understand and works well for a shorter sales cycle or transactional sales. However, a tiered commission structure increases the commission rate as reps hit higher performance levels, encouraging overachievement by rewarding sustained success and boosting sales team motivation.

Encourage consistent sales performance by adding accelerators and decelerators to your mix of sales incentives. Accelerators boost commissions for exceeding quota, and decelerators reduce incentives when reps fall short. By carefully selecting and combining these components, you can build a plan that balances clarity, fairness, and sales team motivation.

Set performance metrics and quotas

Sales quotas and performance metrics clearly define what is expected of reps, provide them with targets to pursue, help track progress, and motivate behaviors that support business objective achievement. These benchmarks also help management evaluate success, identify improvement areas, and refine compensation plans.

Today’s market requires different sales KPIs than in previous years. Historically, conversion rate, pipeline coverage, or win rate were sufficient. However, customer acquisition cost (CAC), lifetime value (LTV), gross revenue retention (GRR), and quota attainment rates should also be tracked to ensure sustainable growth while minimizing risks. Recurring revenue businesses also track MRR/ARR targets that align closely with long-term growth.

Following quota-setting best practices helps ensure quotas are a balance of challenging and achievable, keeping reps motivated. These practices include aligning sales quotes with business objectives, basing them on historical data, factoring in territory potential, and leveraging industry benchmarks help set you up for success.

Ensure plan compliance and transparency

Compliance and transparency are essential to building trust, increasing plan adoption, and boosting sales team motivation. When reps understand how they’re paid and have visibility into the calculations behind each payout, disputes are reduced, morale is boosted, and time is saved for finance and enablement teams.

For instance, maintain clarity and prevent errors through multi-level approval workflows, where reps approve commissions before the manager and finance sign-off, reducing disputes. Once the books are closed, locked plan data ensures that earnings are immutable, preventing overpayments. Giving reps access to an earnings dashboard, where they can see real-time earnings tied to each deal in HubSpot or Salesforce, further improves visibility.

Deal-level traceability allows reps to click into each payout to see the exact calculation logic behind their commission. In-app flags let reps flag a deal if something looks off, which notifies admins automatically.

Model and test the plan

Before rolling out your compensation plan, it’s critical to model and test how it will perform in real-world scenarios. This step helps you catch potential issues, avoid costly surprises, and ensure the plan is both motivating for reps and financially sustainable for the business. Without thorough testing, you risk overpaying on certain deals or creating incentives that don’t align with your sales goals.

Use plan performance modeling to forecast the costs of commissions across attainment bands before launch. This gives you a high-level view of how payouts scale for different performance levels. Run a scenario simulation to test the impact of paying higher on multi-year contracts on total commission expense, for example. This helps you understand how specific plan tweaks affect cost and behavior.

A blended rate analysis helps you understand the total cost of sale under different deal compositions. Historical back testing, where you apply new plans to last year’s data to estimate over and underpayment risk. These techniques give you confidence that the plan will perform as expected before it hits the field.

Communicate and roll out the plan

Even the best compensation plan will fall flat if it’s not clearly communicated. Reps need to understand how the plan works, how they earn commissions, and how to maximize their earnings. A thoughtful rollout ensures alignment, increases plan adoption, builds trust, and sets your team up for a strong start.

Rep training sessions, where you host a live walkthrough of the plan structure and earnings components are essential. To reinforce key details, use in-app tooltips and guides. Use a tool like QuotaPath to embed explainer text directly within each component to proactively answer reps’ plan questions.

Require e-signatures within QuotaPath so admins know who has reviewed their plan to streamline plan acknowledgment workflows. Keep the lines of communication open beyond launch. As you conduct quarterly comp reviews invite reps to give feedback, then refresh SPIFs as needed.

Track and optimize the plan

The sales compensation plan isn’t static. Ongoing tracking and optimization help determine what’s working, identify gaps, and make data-driven adjustments that improve both performance and cost-efficiency over time.

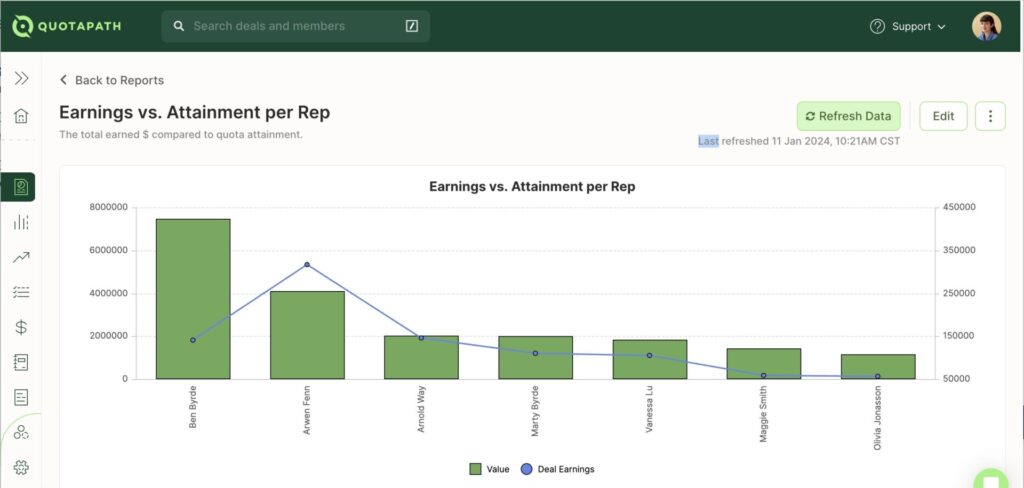

Attainment vs. quota dashboards allow you to view real-time rep performance versus goal to spot trends early. Forecasting pipelines enables reps to see how their pipeline mix impacts projected earnings, encouraging more strategic deal prioritization. Reporting on comp effectiveness shows leaders which components influence behavior and outcomes.

When it’s time to refine the plan, plan iteration and versioning allow you to easily clone, edit, and roll out updated plans mid-year. For data-driven optimization, use blended rate and attainment curve data to adjust next year’s plan. By consistently tracking and fine-tuning your comp plan, you ensure it continues to drive the right results at every growth stage.

Measuring the Success of Your Sales Compensation Plan

It’s essential to track the performance of incentive programs. Measuring success across key areas helps you understand what’s working, identify opportunities for improvement, and ensure the plan continues to drive the right outcomes over time.

- Sales Performance

Measuring overall sales performance helps you understand whether the plan is effectively driving revenue and goal attainment.

– Revenue Growth: Track overall sales growth post-plan implementation.

– Quota Attainment: % of reps hitting quota; compare across roles and tenure.

– Deal Quality: Look for increases in multi-year, multi-product, or strategic deals. - Rep Productivity

Rep activity levels and output reveal if the plan motivates efficient, high-impact work.

– Pipeline Conversion: How efficiently pipeline turns into closed revenue.

– Ramp Time: Time it takes new reps to reach full productivity.

– Activity Metrics: Meetings booked, demos run, proposals sent. - Team Retention & Health

Monitoring turnover and engagement helps ensure your plan supports long-term team stability and morale.

– Rep Turnover: Changes in voluntary/involuntary turnover post-plan.

– Promotions & Career Pathing: Are top performers staying and growing? - Operational Efficiency

Assessing how smoothly the plan runs shows whether it’s scalable and manageable.

– Commission Accuracy: Reduction in over/underpayment errors.

– Admin Time Saved: Fewer hours spent calculating, reviewing, and approving commissions. - Rep Satisfaction

Gathering rep feedback highlights whether the plan feels fair, transparent, and motivating from the field’s perspective.

– Plan Clarity: Do reps understand how they’re paid? Run surveys or feedback sessions.

– Team Morale: Use sales team NPS or pulse checks to gauge motivation and trust - Strategic Alignment

Evaluating how well the plan supports broader company goals ensures it’s driving the right kind of sales.

– Behavioral Impact: Is the comp plan incentivizing strategic revenue such as land-and-expand, upsells.

– Forecast Accuracy: Are reps able to predict earnings based on pipeline?

Try the most collaborative solution to manage, track and payout variable compensation. Calculate commissions and pay your team accurately, and on time.

Start TrialEffective sales incentive programs require continuous optimization. Use the information and best practices we’ve discussed to build a sales compensation plan to increase sales team motivation and drive organizational objective achievement.

Schedule time to learn about QuotaPath as a partner to create strategic comp plans and efficient payroll workflows.