This is a guest post on aligning compensation plans with business objectives written by RevPartners, a management and consulting firm that designs and executes revenue engines to supercharge their customers’ growth with services such as HubSpot Onboarding, RevOps as a Service, and SEO/PPC. Through automation and tools, the RevPartners team orchestrates, optimizes, and reports on their client’s marketing, sales, and operations processes. RevPartners’ mission is to democratize revenue operations by making it accessible, consumable, and actionable in HubSpot.

It’s vital for companies to have harmony between their compensation plans and business objectives. But this intricate and often complex task is not an overnight process. To do it right, companies need to take a holistic approach and blend strategic planning and execution.

Let’s take a look at some of the most important objectives for a business and how compensation plans can align accordingly.

Try the most collaborative solution to manage, track and payout variable compensation. Calculate commissions and pay your team accurately, and on time.

Start TrialCustomer Acquisition Cost

One metric to consider is customer acquisition cost (CAC), which speaks volumes about a company’s health and efficiency. The lower the CAC, the more profitable the company is.

When calculating CAC, it’s important to consider all the expenses associated with acquiring new customers. This includes marketing costs, advertising campaigns, sales team salaries, and any other expenses directly related to customer acquisition. Companies can gain valuable insights into their overall financial performance by analyzing these costs.

Balancing CAC with employee compensation is essential. Pay structures that incentivize employees to drive down the cost of acquiring new customers can enhance a company’s profitability. However, ensuring that such incentives do not lead to compromised quality or customer experience is crucial.

Examples of how to align comp plans to CAC

Performance-based bonuses

Perhaps the most basic example is when companies offer bonuses based on the ability to bring in customers at a lower cost.

Referral programs

Companies can create/introduce employee referral programs that reward employees for referring customers who are more likely to be acquired at a lower cost.

Customer quality metrics

Companies can measure the quality of customers brought in by employees and align compensation with the long-term value of customers, ensuring that employees focus on acquiring customers who are likely to stay and spend more.

Long-term goals

When companies design compensation plans that consider the long-term impact of customer acquisition, employees could earn more if the customers they bring in have low acquisition costs and contribute to the company’s growth over time.

Recorded Webinar

Getting crafty with comp plans to maximize revenue efficiencies: Webinar recap

Watch WebinarGross revenue retention

Gross revenue retention (GRR) is another indicator of business health. A high GRR means that a business retains its revenue, irrespective of its growth. Ensuring that compensation plans encourage practices that enhance GRR is critical.

Examples of how to align comp plans to GRR

Renewal performance bonuses

When companies provide bonuses to sales teams for successfully renewing contracts with existing customers, it encourages them to focus on acquiring new customers and retaining the ones they already have.

Customer health metrics

When compensation plans are tied to customer health metrics (e.g., usage frequency, satisfaction scores, engagement levels), employees who contribute to improving these metrics can earn additional compensation.

Retention-linked bonuses

If companies design bonuses that are tied to specific retention targets, teams or individuals who meet or exceed these targets can earn extra compensation.

Reducing customer complaints

Companies can create compensation plans encouraging teams to promptly and effectively address customer complaints. Fewer complaints can lead to higher customer satisfaction and retention.

Predictive analytics bonuses

When employees use predictive analytics to identify customers at risk of churning and successfully intervene and prevent churn through targeted efforts, they can receive bonuses.

Net revenue retention

Distinct from GRR, net revenue retention (NRR) considers the revenue growth from existing customers. An ideal compensation plan should both safeguard existing revenues (GRR) and cultivate growth (NRR).

Regarding NRR, it’s important to understand the significance of nurturing and expanding relationships with existing customers. By focusing on retaining and growing revenue from these customers, businesses can establish a stable foundation for long-term success.

Examples of how to align comp plans to NRR

Expansion revenue incentives

Companies can design compensation plans that provide additional rewards to sales and account management teams when they successfully upsell or cross-sell additional products or services to existing customers.

Customer satisfaction metrics

When companies link compensation to customer satisfaction scores or feedback, teams that maintain high customer satisfaction levels are rewarded for their efforts to nurture positive relationships.

Customer education success

Companies can reward employees who effectively educate customers about the full range of offerings and how they can benefit from them. This can lead to customers using more services and products, increasing their value.

Customer feedback utilization

Companies can give bonuses to employees who actively gather and apply customer feedback to improve products, services, and overall customer experience. This showcases a dedication to nurturing relationships.

Customer success milestones

Companies can create compensation milestones based on the length and strength of customer relationships. The longer and more successful the relationship, the higher the compensation.

RevOps, sales leaders, and finance teams use our free tool to ensure reps’ on-target earnings and quotas line up with industry standards. Customize plans with accelerators, bonuses, and more, by adjusting 9 variables.

Build a Comp PlanCustomer lifetime value

Customer lifetime value (CLV) is a metric that businesses use to understand the net profit they can expect to generate from a customer over the entire duration of their relationship. Companies can make informed decisions about resource allocation, marketing strategies, and customer retention by analyzing CLV. The higher the CLV, the more beneficial it is for the company, as it indicates a greater return on investment.

Calculating CLV involves various factors, such as the average purchase value, purchase frequency, and customer lifespan. By considering these variables, businesses can gain insights into the potential value of each customer and make strategic decisions accordingly.

However, understanding CLV is important for financial forecasting and plays a significant role in shaping compensation design and employee motivation.

Examples of how to align comp plans to CLV

Tiered commission structures

Companies can implement tiered commission structures that reward higher commissions for customers demonstrating greater CLV. This encourages employees to prioritize customers who are more likely to make repeat purchases and remain loyal over time.

Profit sharing

Companies might consider implementing profit-sharing plans that tie a portion of employees’ compensation to overall company profitability, which can be influenced by increased CLV. This fosters a sense of ownership and encourages employees to work collectively to enhance customer value.

Long-term focus

Companies can design compensation plans that emphasize long-term gains over short-term wins. This discourages quick, transactional behavior and encourages strategies that enhance CLV over time.

Calculate OTE:Quota ratios

Use this free calculator to ensure your reps’ on-target earnings and quotas mirror what they’re bringing in for the business.

Try it NowSales cycle length and velocity

The sales cycle length and velocity significantly affect the rate of revenue generation and cash flow. A streamlined process usually indicates a more efficient team and organization.

Compensation plans that reward employees for shortening the sales cycle and increasing its velocity resonate with business growth. Incentives catering to these metrics ensure the business has a smooth cash flow and remains competitive.

The sales cycle length refers to the time it takes for a potential customer to move through the entire sales process, from initial contact to making a purchase. This can vary greatly depending on the industry, product complexity, and customer behavior.

A shorter sales cycle can have several advantages. First and foremost, it allows for a quicker revenue generation, as deals are closed faster. This can be particularly beneficial for businesses that rely on a steady cash flow to cover expenses and invest in growth initiatives.

Also, a shorter sales cycle can lead to increased customer satisfaction. Customers appreciate efficiency and promptness, and if they can make a purchase or get the desired solution without unnecessary delays, they are more likely to be satisfied with their overall experience.

Conversely, velocity refers to the speed at which deals move through the sales cycle. It measures how quickly prospects progress from one stage to the next, indicating the overall efficiency of the sales process.

A high velocity suggests that deals are progressing smoothly and efficiently, with minimal bottlenecks or delays. This can be achieved through effective lead nurturing, clear communication, and a well-defined sales process that eliminates unnecessary steps or redundancies.

Examples of how to align comp plans to sales cycle

Time-based incentives

Companies can introduce incentives that reward sales representatives for closing deals within a shorter time frame. This could be in the form of bonuses or commission multipliers for deals closed ahead of schedule.

Early progress bonuses

Companies can offer bonuses or rewards for hitting certain milestones early in the sales cycle. This approach encourages sales reps to maintain momentum and engagement throughout the process.

Win-win commission structures

Companies should design commission structures that balance sales cycle length with deal value. For example, higher commissions could be offered for shorter sales cycles, but also consider factoring in the overall revenue generated.

Lead scoring

Companies can introduce a lead scoring system that helps sales reps prioritize leads with higher potential to close quickly. Compensation can be tied to successful conversions of these high-priority leads.

Wrapping up

Creating a balance between business objectives and compensation plans involves continual monitoring and fine-tuning to determine what works best for the organization and its employees.

By focusing on the metrics identified above and aligning them with compensation plans, businesses can drive profitability, growth, and employee satisfaction concurrently. When compensation plans are in tune with business objectives, they pave the path for a win-win situation.

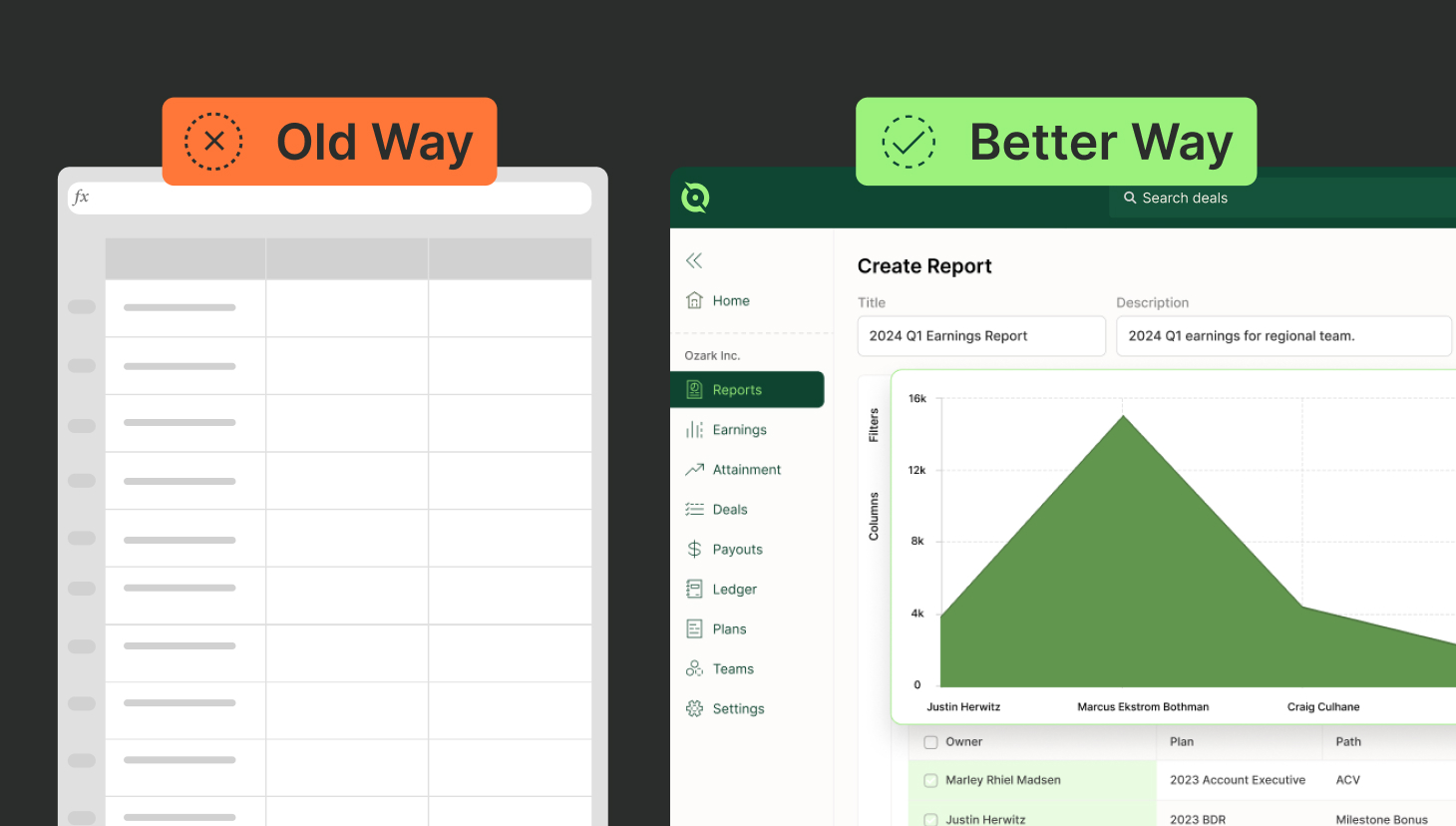

Looking for the right company to help align your sales compensation plans to your business objectives? Look no further than QuotaPath!

To learn more about RevPartners, visit revpartners.io.