Ready to become ASC 606 Audit Compliant? We’ve got you.

By this point, you’ve probably heard of ASC 606, but perhaps you’re at a loss for how it impacts your business.

Here’s the skinny.

The Financial Accounting Standards Board issued the new revenue recognition standard in 2014. Public companies adopted the ‘606’ in 2018, and now, private companies have to follow suit.

Under the standard, finance and accounting teams must account and recognize revenue from contracts with customers and incremental costs, which includes commissions and bonuses. The goal is to drive more consistent and comparative financial reporting. Translation: Any company with recurring costs needs to pay attention.

Any company with recurring costs needs to pay attention.

Psst — that’s you, SaaS.

Those who don’t adhere face the risk of hefty fines and a surprise auditor visit. No thanks!

ASC 606 is the head standard, but we’d like to draw your attention to 606’s subtopic, ASC 340-40: Other Assets and Deferred Costs: Contract with Customers. This subtopic calls for ongoing record keeping and reporting of costs incurred while obtaining or fulfilling a contract with a customer. (Think: travel, advertising, and our pride and joy, sales commissions.)

Try the most collaborative solution to manage, track and payout variable compensation. Calculate commissions and pay your team accurately, and on time.

Start TrialAdditionally, it mandates that the related incremental costs to every contract are capitalized as an asset and amortized over time to match the timing of the revenue recognition.

So, what can you do to be ASC 606 compliant as it pertains to ASC 340-40?

For starters —please stop with the manual spreadsheets. ASC requires every deal and earning to be tracked annually. This information should also be readily available and accessible to auditors. Your spreadsheet won’t scale.

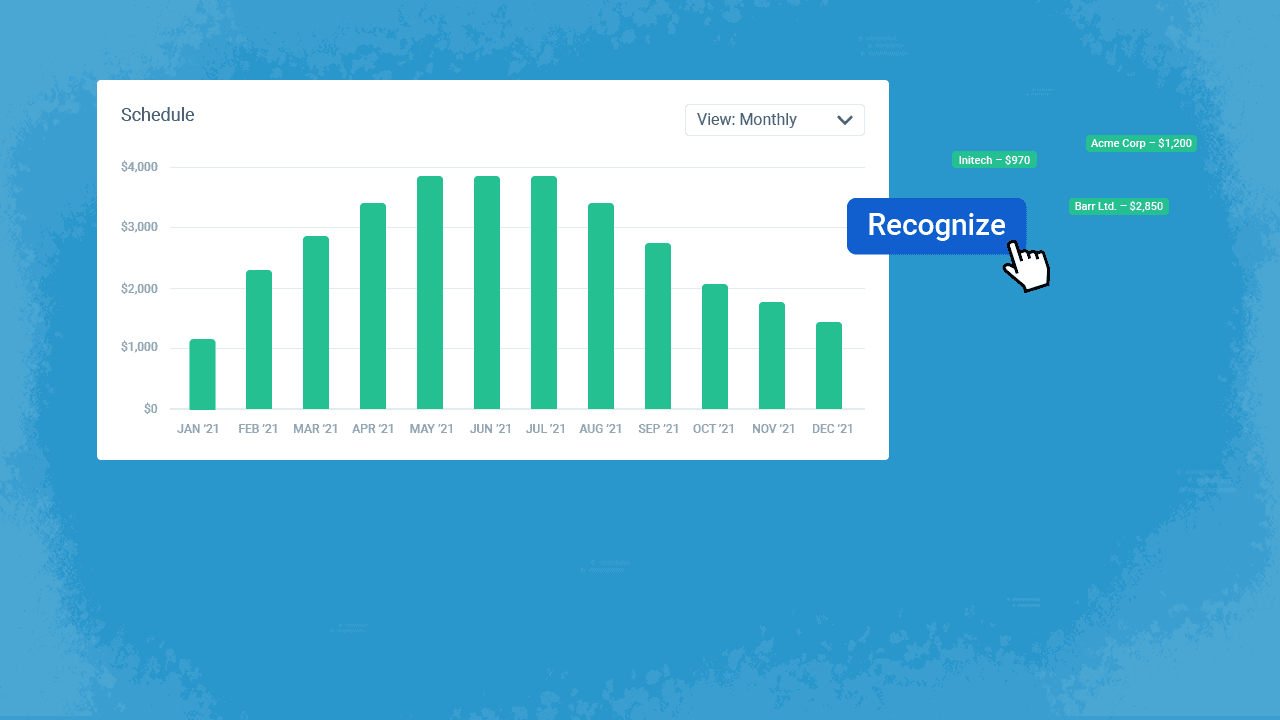

We introduced Ledger to help.

Our new feature provides accounting teams with the flexibility to recognize commission expenses immediately or batch earnings and amortize them to match their revenue recognition schedule.

With Ledger, streamline your month-end close process, eliminate errors and stay on top of every line item that pops up. Plus, save time by quickly producing digestible, audit-ready reports.

Why our customers love Ledger:

- ASC 606 compliant (!)

- Fresh and clean record keeping

- Marie Kondo-levels of data point organization

- One location for all things commissions

- Storage unit for historical data

- Reports that can be easily exported and imported into local accounting systems

Let’s talk more about this together! Schedule a brief demo with a member of our team today. And stay tuned for more enhancements to Ledger. We’ve got a lot lined up to make your jobs easier.