If your top sales rep is making more than your VP, is that a problem? Or proof the system is working?

For most companies, it sparks panic.

A rep blows past quota at 180% attainment, earning $400K in commissions. Finance balks: “That’s more than the VP makes. We can’t pay that.” The solution?

Cap commissions at 150%.

Here’s the irony: instead of protecting the business, caps cripple it.

By capping commissions, companies unintentionally tell their best performers to stop performing. High achievers sandbag, Q4 pipelines stall, and culture shifts from growth to limits. Matt Green, CRO at Sales Assembly, said it bluntly in his LinkedIn post: “Pay for performance, or explain to your board why your top talent works for competitors.”

Today, when replacing a top rep can cost six figures in lost revenue and 6–12 months of productivity, the math is simple.

Commission caps don’t save money; they burn it.

And for Matt, the solution is equally straightforward: let your best reps out-earn leaders.

Leadership is a trade-off: more responsibility, less pay. Top performers, on the other hand, drive revenue that justifies their outsized earnings.

To unpack his philosophy, we sat down with Matt for a conversation on comp plan design, progressive commission rates, and why CFOs and sales leaders need to rethink how they motivate reps.

Free Calculator

Determine the full cost of commissions per deal across roles with our free Total Commission Rate Calculator.

Use calculatorQ&A with Sales Assembly CRO Matt Green

You’ve been outspoken about how commission caps demotivate top performers. What’s the most effective comp plan structure you’ve seen that avoids this while still managing CFO concerns?

Matt: Keep it simple. For a mid-market AE, a clean 50/50 split with 10% flat commission on ARR and accelerators after 120% works best. That structure rewards consistent performance without creating unnecessary loopholes. The more complexity (spiffs, multipliers, exceptions) you add, the more reps try to game the system. I’m also a big believer in rewarding pipeline coverage. If reps are self-sourcing quality meetings or driving renewals and expansions, tie 10–15% of comp to that. It builds healthier deals and better customer stickiness.

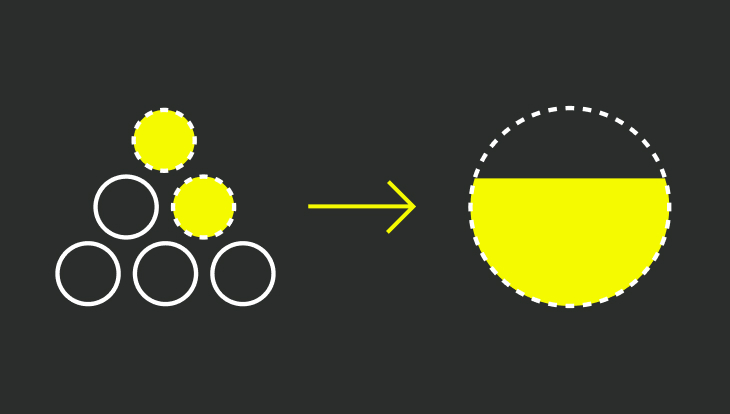

You mentioned progressive commission rates as a healthier alternative. How would you structure one for a $1M quota AE?

Matt: Instead of a flat rate, I’d tier the attainment. Something like:

- 0–50% attainment → 5% commission

- 51–100% attainment → 10% commission

- 101–125% attainment → 12% commission

- 126%+ attainment → 15% commission

This structure motivates reps from the start because they’re earning even at 50%, but also creates a powerful pull effect as they approach quota. For a $1M target, someone finishing at 120% would earn $120K–$125K in commission, which is above OTE but completely justified by the $200K in additional revenue they generated. It’s far cheaper than hiring incremental headcount to close the same gap.

How should companies handle reps who exceed quota but close low-quality or risky deals?

Matt: Quality gates are key. I’m not against clawbacks or tying part of comp to customer success. One approach I like: link a small percentage of comp to NPS scores after the CSM handoff. It’s not huge, but it’s meaningful. Another version I’ve seen (though pretty extreme) included commissions that were only paid if deals fit strict ICP criteria. If you closed a deal outside ICP, you didn’t get paid. It’s a dial turned to 11, but it makes sure reps are thinking long-term.

How do compensation philosophies shift across startups, growth-stage, and enterprise companies? Where do comp plans most often go wrong?

Matt: The danger zone is startup to scale-up. Startups often overpay early to attract talent before they have product-market fit. That’s fine at Series A, but by Series B or C those legacy comp plans start bleeding money. I’ve seen reps making $800K–$900K on outdated structures. At the enterprise level, companies usually stabilize with lower bases, clearer quotas, better balance with culture. For example, Sprout Social is known for low bases but excellent retention because reps feel supported and consistently hit quota.

Do you believe top sales reps should out-earn sales leaders?

Matt: Yes, absolutely. Commission is the most quantifiable ROI a company has. A rep delivers revenue, they get paid for it. It’s math. Leadership is a trade-off: more responsibility, less pay. Good leaders know that. If a rep is pulling in $600K+ and the leader isn’t, it’s because that rep is driving the revenue engine. And that’s a good thing.

What’s the best comp plan you’ve ever been on?

Matt: A decade ago at Kapow. I joined after their Series A, and the comp plan was pure Wild West. We were getting paid on signatures—even before revenue was collected. For reps, it was gold. For CFOs, a nightmare. Two CFOs came and went before they shut it down. It wasn’t sustainable, but it showed me how much latitude sales leaders have in shaping comp, and how critical it is to balance rep motivation with financial responsibility.

Design, track, and manage variable incentives with QuotaPath. Give your RevOps, finance, and sales teams transparency into sales compensation.

Talk to SalesFinal Thoughts

Matt’s philosophy is clear: compensation should fuel performance, not limit it. And we agree wholeheartedly. When companies cap commissions, they lose dollars and momentum, talent, and culture.

The key lessons from his approach are simple but powerful:

- Commission caps backfire by demotivating reps and encouraging sandbagging.

- Simplicity wins when it comes to comp plans; complex structures only invite loopholes.

- Progressive rates drive performance, motivating reps before and after they hit quota.

- Quality matters, and comp plans should reward not just deal volume but the right customer deals.

- Top reps should out-earn leaders because paying for performance is the surest way to drive revenue growth.

At the end of the day, if a rep generates $3M in ARR and takes home $400K, the company still nets $2.6M. Cap that earning, and you risk losing both the revenue and the talent that produced it. Want to build smarter, cap-free comp plans? Try QuotaPath’s AI-powered plan builder and book a demo today.