So you’re creating a new compensation plan for your sales team. It needs to accomplish the company’s financial objectives, motivate your reps, and pay a fair rate, all while being straightforward enough to explain on the back of a napkin. Not an easy task by any means. We’ve written about some of our favorite compensation plans and about some nightmare situations (hint: you want to prevent nightmares) but here are some things to avoid when building a commission plan.

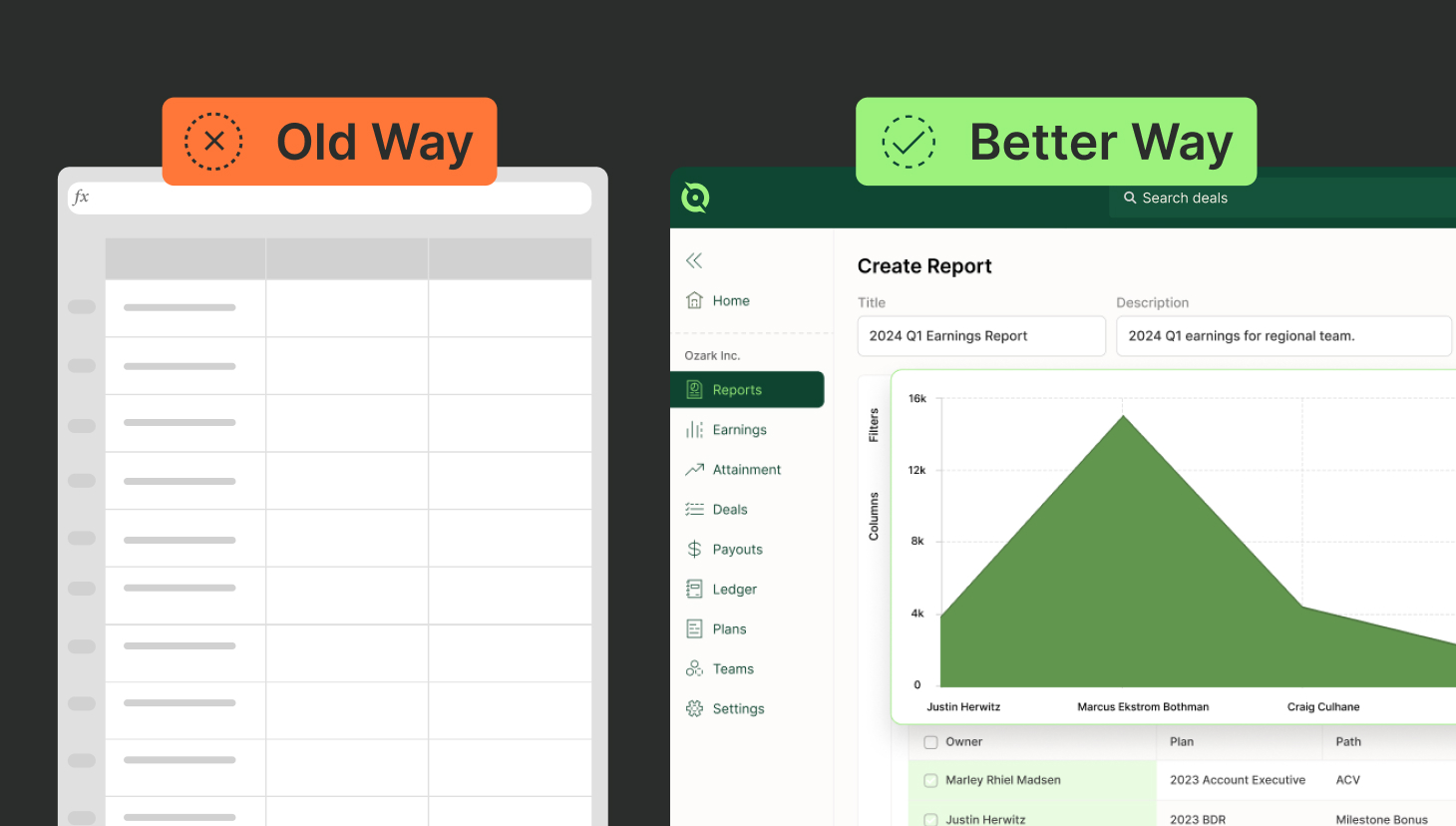

RevOps, sales leaders, and finance teams use our free tool to ensure reps’ on-target earnings and quotas line up with industry standards. Customize plans with accelerators, bonuses, and more, by adjusting 9 variables.

Build a Comp PlanComplex numbers

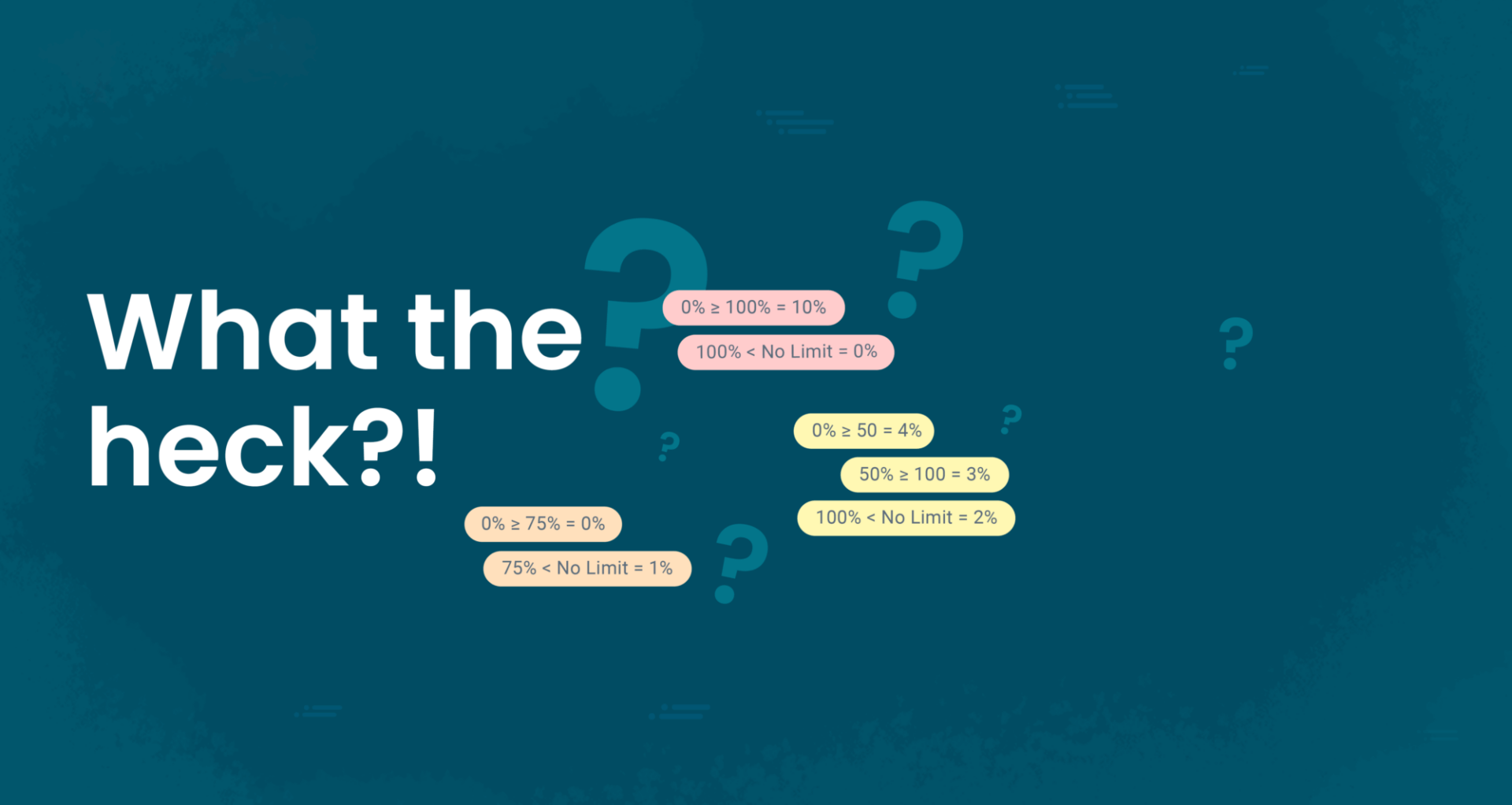

Okay, I don’t mean complex numbers the way your high school math teacher might have. I don’t expect any sales organizations to pay (−2 + πi)% of every deal closed, but it might feel that way to some sales reps. I would highly encourage you to limit your percentages to 1 decimal place, and even then keep it to an easy number. A commission rate of 7.5% is a lot easier than 7.333% for a sales rep to understand. The same goes for bonuses: $96.32 is more difficult to comprehend than $100 per meeting.

Capped commission

There’s a scene in The Office where Jim Halpert has hit his commission cap and therefore has no incentive to keep trying to close deals and instead spends his time scheming devious pranks. This is what actually happens when you cap commissions. Salespeople aren’t motivated to work, so they don’t sell anything. I’ve yet to find a compelling reason to cap commissions, so if you have one, let me know. If encouraging employees to NOT sell isn’t confusing, I don’t know what is.

Commission cliffs

A more common technique (at least recently) than capping commissions is to create a commission cliff or floor. This means that a sales rep who fails to hit a certain quota attainment percentage earns nothing until they surpass that attainment. These can be very powerful tools. But where they get confusing is when the cliff is way too high, especially when it’s at 100% attainment. You’re telling your reps that if they do their job 95% of the way, they earn nothing. Try explaining that to a rep who pushed some last-minute deals across the line to hit a company target!

Decelerated commissions

Similarly to cliffs, “decelerators” have a time and place. If a sales rep only hits 40% of their quota, it’s fair to say they don’t get 40% of their total commission, no one would argue that. This can get confusing when you drop the commission rates people earn the more they sell. I’ve seen situations where a salesperson gets 10% commission until they hit their quota, then 5% of anything over 100% attainment. Why would you discourage someone from over-attaining? It doesn’t make sense.

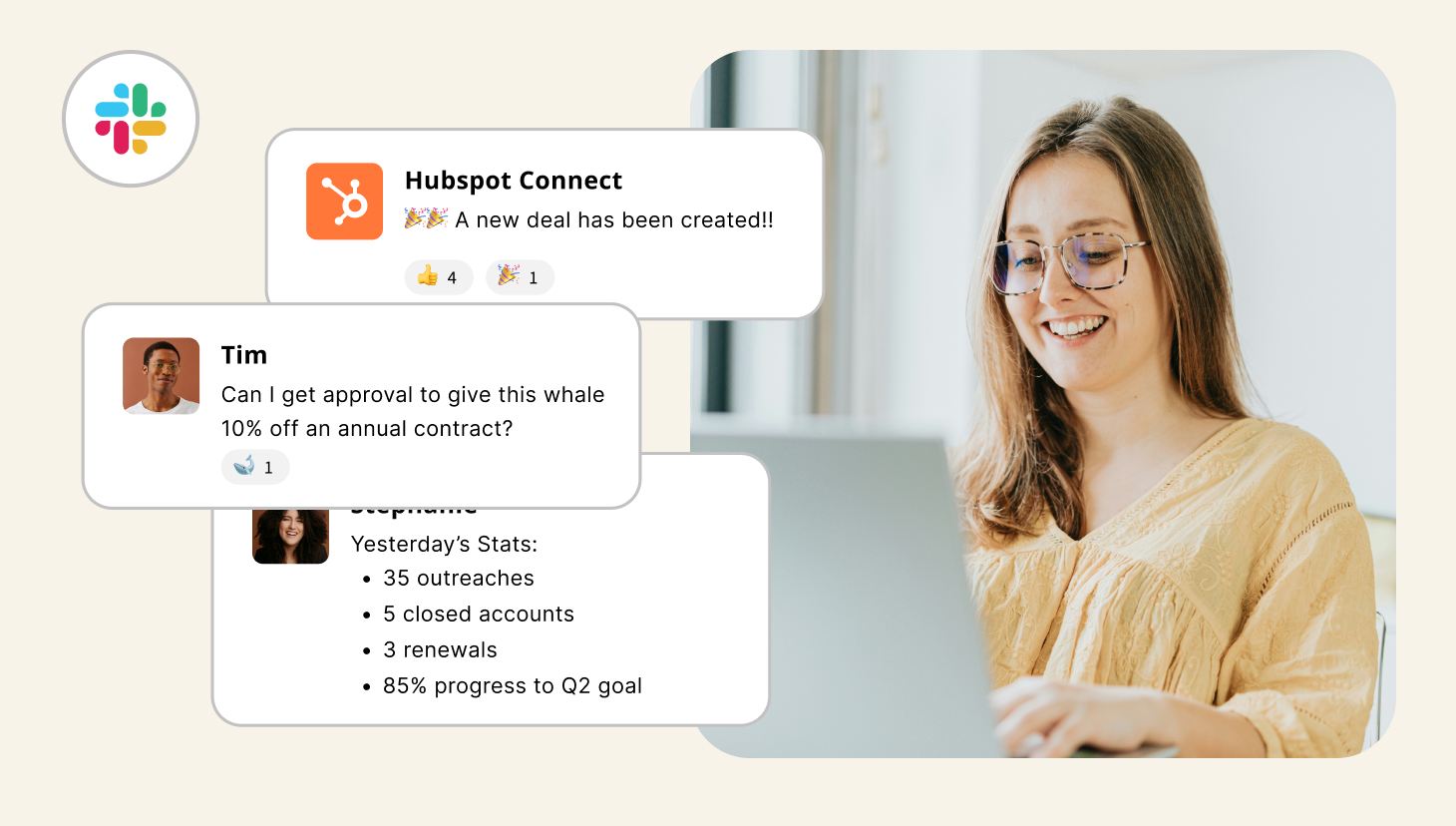

While you absolutely should avoid the above confusing commission rates, if you plan already includes them don’t panic! QuotaPath can handle nearly every commission rate, confusing rates included… and it’s free to check it out. Sign up and build your compensation plan today!