By the time Q2 rolls around, most Finance and Sales leaders know which reps are tracking toward quota…and those lagging behind. Time for quota adjustments?

While some underperformance is due to ramp time or market shifts, it’s often a signal to evaluate whether quotas, territories, or compensation structures need to be reset. In fact, 91% of organizations reported that fewer than 80% of their reps hit quota in 2023, highlighting a widespread disconnect between expectations and execution.

That disconnect doesn’t just belong to Sales. Finance has a seat at that table, too.

When comp plans are tied to quota attainment and accelerators, underperformance can lead to disengagement and even attrition.

That means Finance not only needs to understand the cost implications of mid-year changes but also how those changes could prevent bigger budget hits down the line, such as rep turnover to missed targets.

To protect both performance and profitability, Finance leaders should play an active role in identifying when, and how, to course-correct comp plans mid-year.

In this blog, we’ll cover:

- The hidden risks of ignoring mid-year underperformance

- How to spot when compensation adjustments are warranted

- Tactical levers Finance can pull without overcomplicating payouts

- Examples of how leaders are using mid-year tweaks to re-engage reps and drive results

Read on to see if quota adjustments are needed.

The Hidden Risk: Motivation Drain

One of the biggest risks of keeping the status quo is losing rep motivation.

In accelerator-heavy comp plans, missing early milestones can leave reps feeling like there’s no way to catch up, especially if the majority of their upside is locked behind hitting their full quota.

As Thomas Egbert, Head of Finance at Prefect, put it:

“The whole point of having generous incentives is to energize the team and not have it be mysterious,” said Thomas. “If you’ve got a great plan, but no one can see how they’re tracking or what’s realistic, it kills the motivation”.

A well-structured comp plan can become demotivating if it’s not achievable. And when reps start to mentally check out mid-year, not only is performance at risk, but rep churn, too.

Finance’s Role: Advocate for Data-Driven Adjustments

Our report found that the above percentage of companies that missed quota attributed these misses to market conditions.

However, a third of leaders said misaligned sales activities and a lack of motivation were root causes.

And guess what? While comp plans can’t fix a market, they can directly impact motivation and rep attention to business metrics.

So, what should Finance leaders be looking at?

- Quota:OTE Ratios: Are they realistic based on historical rep performance and current market conditions?

- Time-to-Ramp Data: Are underperformers actually ramping slower, or is quota misaligned?

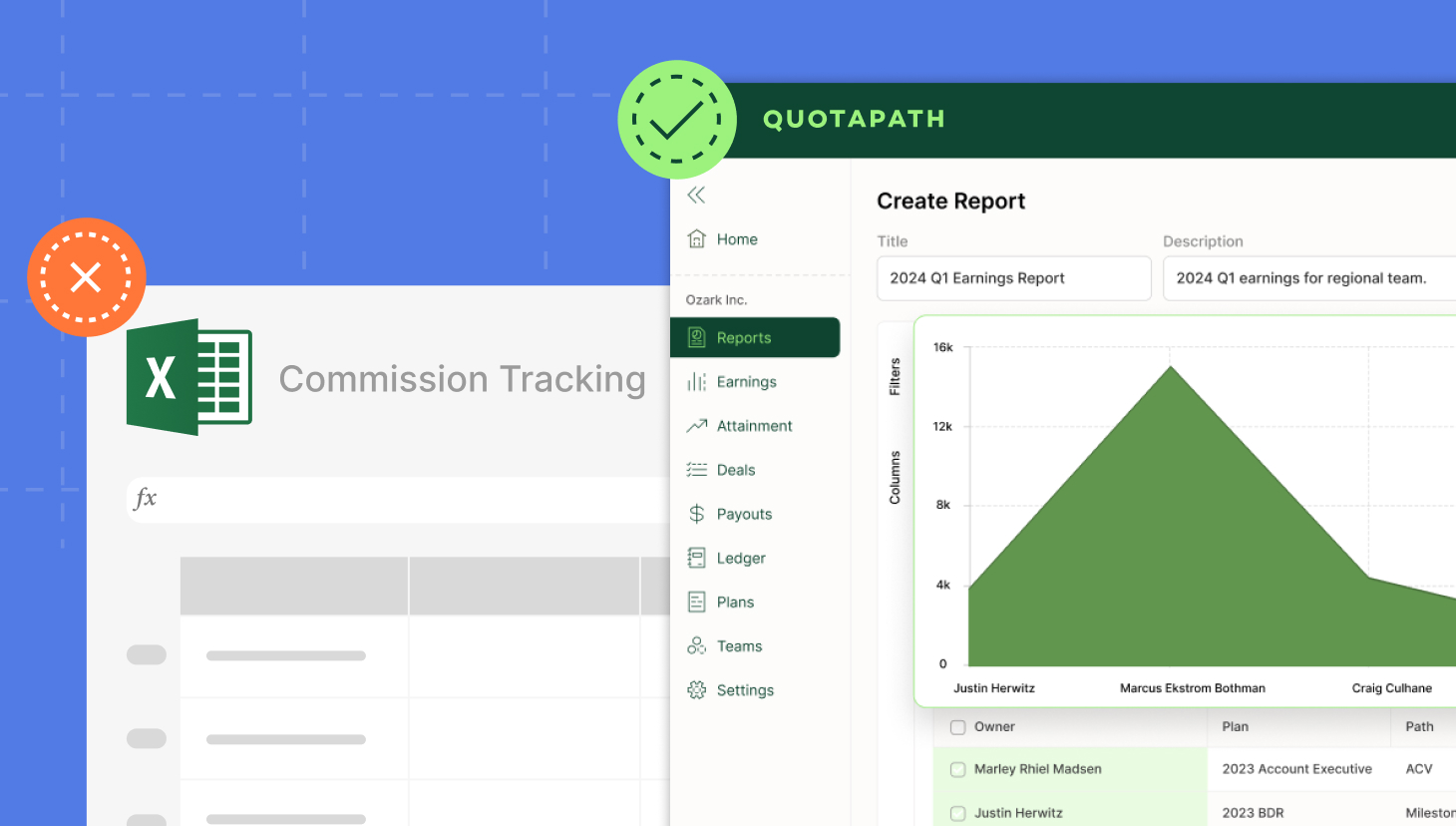

- Forecasting Models: Use tools like QuotaPath’s scenario modeling to test how tweaks to quotas or accelerators would impact payouts and morale.

Our CEO, AJ Bruno, offered a rule of thumb: “Your plan should be structured so that 80% of your team can realistically hit quota. That promotes consistency and sustainable growth, especially in tougher markets”.

Calculate OTE:Quota ratios

Use this free calculator to ensure your reps’ on-target earnings and quotas mirror what they’re bringing in for the business.

Try it NowMid-Year Levers You Can Pull (Without Breaking the Bank)

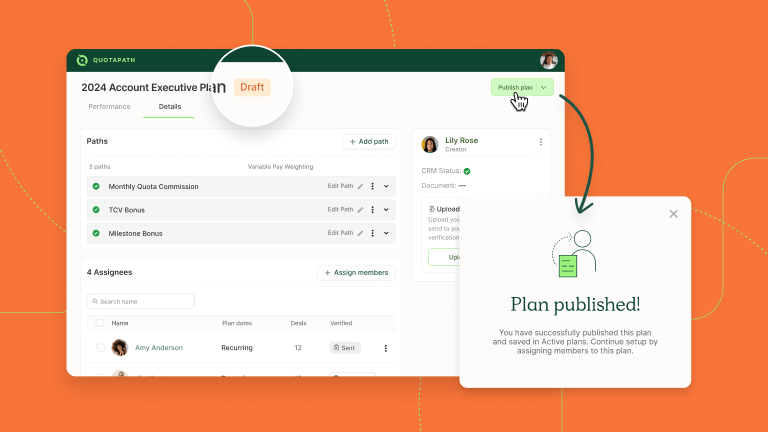

Now with that said, let’s say you need to adjust comp plans mid-year.

First and foremost, don’t be afraid to change it. The key is to keep changes simple and targeted (and when you use a tool like QuotaPath, these changes become much easier to implement at scale).

Here are three approaches that balance motivation and budget control:

1. Quota Relief (Targeted and Temporary)

Instead of making permanent quota adjustments, you could offer partial quota forgiveness for specific periods or segments. This is especially useful when reps were assigned territories or ideal customer profiles (ICPs) that underperformed due to external market changes.

“During a recent rough Q1, we gave quota relief on a deal-type basis. It helped reps refocus on what they could control and salvaged our pipeline health,” said Ryan Milligan, VP of RevOps at QuotaPath.

2. Territory Realignment

Another tactic is adjusting territories.

Because, as much as it will pain you to admit this, sometimes the issue isn’t the rep, it actually is the territory.

Utilize performance and lead volume data to redistribute accounts and provide underperforming accounts with a fresh start. Just be mindful of perceived fairness and how overlays (like SEs and BDRs) will be affected.

3. New Accelerators for Late-Stage Deals

Next, consider accelerators.

Introduce temporary accelerators for Q3 and Q4 to reignite motivation. This is especially powerful if you can align them with company-wide efficiency metrics, like gross margin or GRR.

Christine Leclercq, Finance Manager at Botify, emphasized the importance of aligning reps and Finance around the same numbers:

“QuotaPath gave us the ability to make small, mid-cycle tweaks without triggering massive recalculations or eroding trust. Everyone sees the same data, and Finance doesn’t get stuck fielding questions or reworking models”.

Design, track, and manage variable incentives with QuotaPath. Give your RevOps, finance, and sales teams transparency into sales compensation.

Talk to SalesIt’s Not Too Late: Keep Reps in the Game

Remember, letting underperformance linger is more expensive than fixing it.

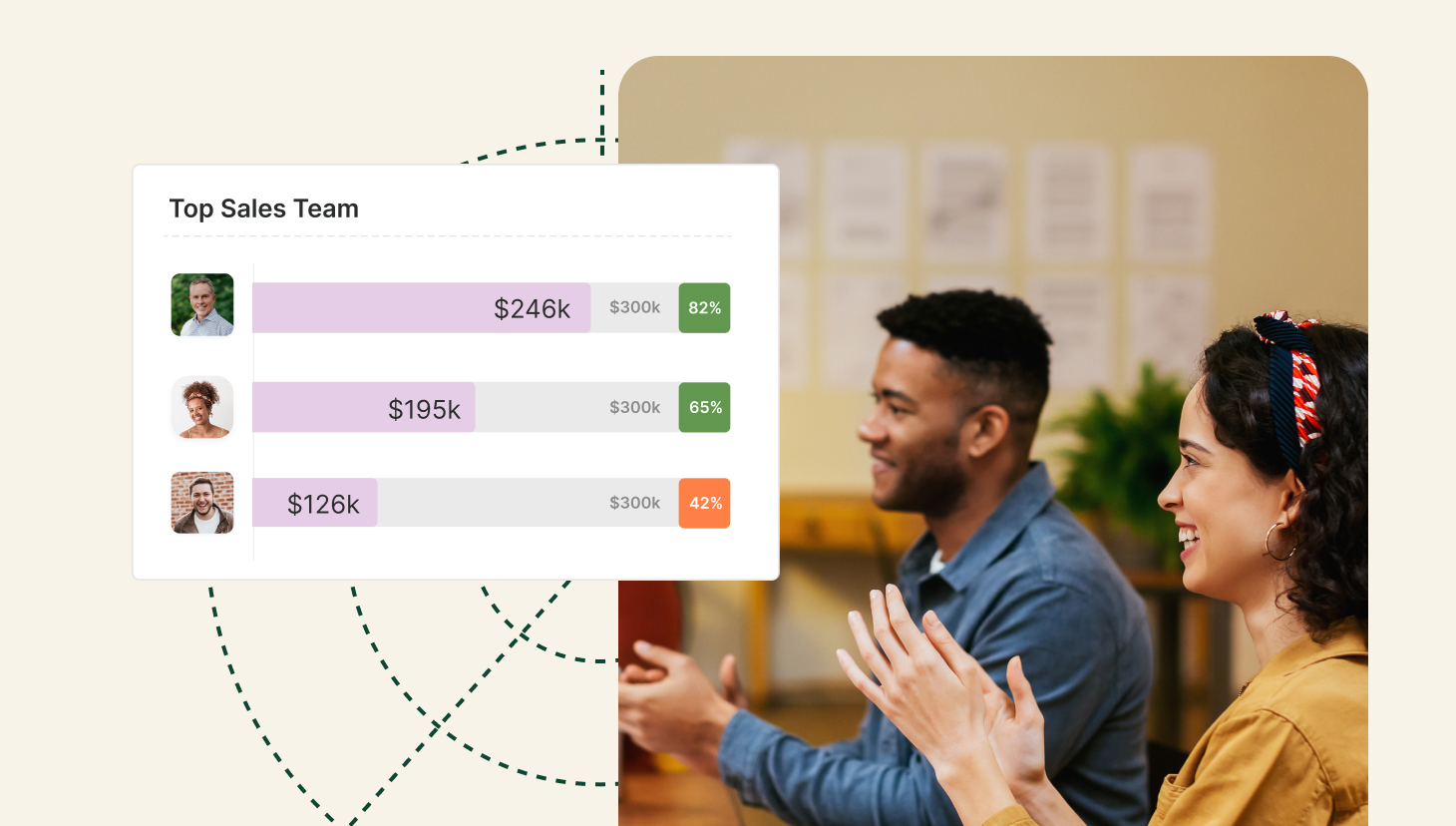

According to our report, 65% of companies had a rep quit over commission disputes or confusion in the last two years. Even if they don’t leave, reps who feel like they can’t win are unlikely to put in their best effort.

Visibility matters. As does simplicity.

That’s why companies like NeuroFlow prioritize transparency across the entire commission cycle.

“The transparency we have back to the team is fantastic,” said Genevieve Moss-Hawkins, Sr. Systems Operations Manager at NeuroFlow. “Reps can look at their pipeline and forecast what they’d earn if certain deals close. Then, when a deal does close, they see exactly how their commission was calculated, without having to come through Finance. That kind of visibility keeps them engaged”.

Final Thoughts: Motivation Is a Metric, Too

If Q2 shows your reps are off pace, resist the urge to wait and see. Misaligned plans and stagnant motivation have a real cost: lost revenue, higher attrition, and greater strain on your Finance team.

Instead, take a data-backed approach.

Assess where the gaps are. Use tools to test potential fixes or quota adjustments. And above all, bring clarity to the people responsible for driving your top line.

Whether that means quota relief, adjusted accelerators, or simply giving reps better visibility into how they earn, don’t underestimate the power of a mid-year reset.

Want help modeling what those changes could look like?

Schedule time today to learn about our plan modeling and testing capabilities.