RevOps is changing… and so is their pay.

Once viewed as a behind-the-scenes operations role, Revenue Operations has become a strategic growth driver. That shift has brought increased visibility, influence, and pay.

In 2025, RevOps leaders are earning more, yes, but they’re also being compensated in smarter, more nuanced ways that align directly with company performance metrics.

In this post, we break down how RevOps salaries are trending, what incentive structures are working (and which aren’t), and how top companies are designing comp plans that drive both accountability and growth.

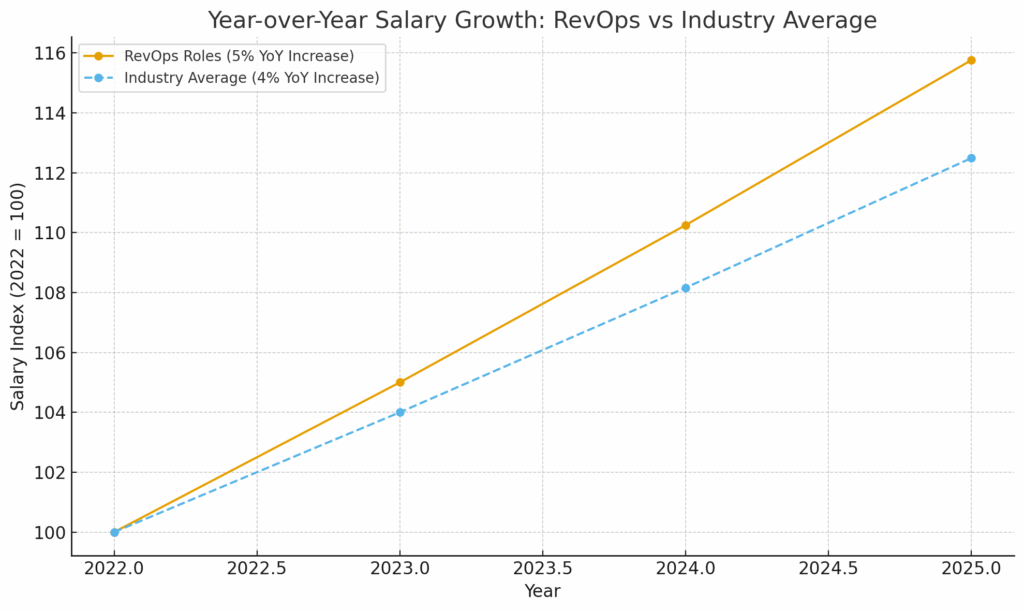

RevOps Salary Trends in 2025

First, let’s check in on RevOps salaries.

According to BoostUp.ai and ZipRecruiter, RevOps roles are seeing a steady upward trend in compensation, with a reported 5% year-over-year salary increase, outpacing the projected 4% average across industries.

Entry-level roles such as RevOps Analysts now command salaries ranging from $85,000 to $124,500, while more experienced managers and directors earn between $150,000 and $250,000, depending on seniority and company size.

Additionally, location and skillset remain key factors.

Professionals in tech hubs like San Francisco and New York earn 20–30% more than the national average, especially those with strong backgrounds in revenue intelligence and data analytics, skills increasingly in demand as RevOps becomes more data-driven.

But this isn’t the only change to RevOps compensation.

Incentive Design: Beyond the Base Salary

One of the most compelling shifts in RevOps comp is the move away from just base salaries and toward performance-based incentive structures.

As Sarah Ditmars, RevOps Manager at Secoda, shared in our interview:

“I’ve been on profit-sharing plans with quarterly payouts based on leader performance, and I loved it. It made me feel like I had ownership over our cash flow.” — Sarah Ditmars, Head of Revenue Operations, Planswell

In addition to profit-sharing, companies are increasingly using:

- Accelerators tied to company-wide goals (e.g., revenue milestones, CRM implementation success)

- Quarterly bonus structures tied to initiatives like churn reduction, customer expansion, and pipeline health

- Equity-based incentives like RSUs and stock appreciation rights for long-term alignment

Recommended Reading

A Look Inside RevOps Compensation Plans with RevOps Leader Sarah Ditmars

Read BlogCustomizing Incentives: Not One-Size-Fits-All

A key insight from both research and interviews is that incentive plans must reflect the RevOps role’s unique impact across multiple departments, not just sales.

Sarah argues against using standard sales structures like “three tiers of BANT”:

“You shouldn’t have the same structure [as Sales]… But there should be some type of quarterly accelerator. We’re in marketing, sales, CS. We touch everything. We need a model that reflects that,

said Sarah.

She also noted that tying RevOps incentives to a blend of Sales, Marketing, and Customer Success KPIs would better motivate cross-functional collaboration and alignment.

Best Practices for 2025 RevOps Comp Plans

Based on research and Sarah’s insights, here are some key takeaways for crafting effective RevOps compensation in 2025:

- Layer incentives by function: Consider tiered accelerators for impact on Sales, Marketing, and CS metrics.

- Make it quarterly: Annual plans are too slow to motivate behavior in today’s fast-moving SaaS orgs.

- Avoid ambiguity: Real-time dashboards and scenario modeling foster transparency and drive adoption.

- Don’t copy sales: Align incentives to outcomes RevOps can actually control.

- Prioritize equity and visibility: Options, RSUs, and forecastable earnings boost motivation and retention.

Final Thoughts

You can be just as strategic with RevOps compensation as you are with the role itself.

As businesses tighten spending while expecting more from every role, finance and RevOps leaders must collaborate to build comp plans that are equitable, motivating, and directly tied to business impact.

As Sarah put it: “We’re not admins. We’re not COOs. Our hands are in three buckets. Give us the tools to move the metrics we touch.”

For help building RevOps comp plans or any role at your organization, chat with our team today.