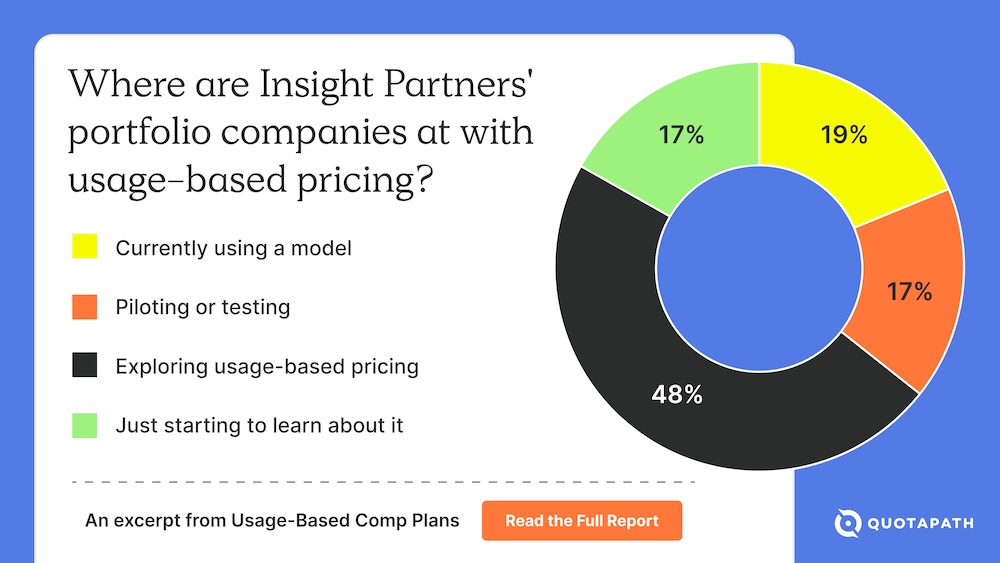

News just in: usage/outcome-based pricing models are more than a popular trend.

At a recent private event with Insight Partners’ portfolio companies, 84% of attendees reported that they were either using, piloting, or exploring usage-based pricing models.

This signals a transformation in how SaaS and fintech companies monetize value.

As pricing evolves, so must the systems that support it. Usage-based models shift how and when revenue is recognized, which means compensation structures need to evolve, too. Reps can no longer rely on fixed contract values; they’re now incentivized to drive activation, adoption, and long-term usage.

This blog explores how to navigate that shift, including defining value metrics and designing comp plans that align sales performance with customer outcomes. Enjoy the read. And, for a deeper dive, including five real-world comp plan examples, download the full Usage-Based Comp Plans Report.

REPORT: Usage-Based Compensation Plans

Trends, models & examples from high-growth revenue teams.

View ReportWhy Shift Away from Seat-Based Pricing?

Seat-based pricing was built for a different era, an era when user count was a reliable proxy for product value. In that world, usage remained relatively flat, teams grew in predictable ways, and it made sense to equate value with the number of logins.

But today’s software doesn’t work like that.

Modern SaaS products, especially infrastructure, fintech, and AI-driven tools, scale with activity, not seats. Whether it’s API calls, data processed, or transactions completed, value comes from usage, not headcount.

That shift has triggered growing pressure from buyers for pricing flexibility.

Customers expect to pay for what they use…not what they might use.

And in PLG or land-and-expand sales motions, this flexibility often fuels faster adoption and lower barriers to entry.

From the company’s side, usage-based models provide a stronger foundation for revenue alignment. Instead of trying to lock in large contracts based on estimated needs, revenue leaders can now tie pricing directly to customer outcomes.

“Usage-based models are a key lever for increasing ACV and driving Net Dollar Retention (NDR),” said Andrea Kayal, Chief Revenue Officer at HelpScout.

Put simply, usage-based pricing better reflects how modern software is bought, sold, and consumed. And for companies ready to make the jump, it opens the door to better expansion economics and stronger customer alignment, when done right.

Both usage-based and outcomes-based pricing models are designed to do one thing: align what customers pay with the value they actually receive.

Usage-Based Pricing

Usage-based pricing ties revenue directly to product consumption.

Instead of paying a flat fee per seat, customers are billed based on how much of the product they actually use, whether that’s:

- GBs stored

- API calls made

- Transactions processed

- Emails sent

- Background checks run

This model is particularly common in infrastructure, fintech, and data platforms, where consumption scales linearly with value. It also gives customers the flexibility to start small and expand usage as they grow, a perfect match for PLG and modern SaaS motions.

Outcomes-Based Pricing

Outcomes-based pricing goes a step further by tying payment to results delivered rather than raw usage. Think:

- Hires made (for a recruiting platform)

- Leads generated (for a marketing tool)

- Cost savings achieved (for a spend management platform)

This approach is less common—due to its complexity—but incredibly powerful in industries where ROI is measurable and high stakes.

Examples

- Tremendous, a fintech platform, charges based on payout volume. The more their customers spend through the platform, the more Tremendous earns.

- Data infrastructure providers often price based on API calls, which tend to scale predictably with customer growth.

- Customer support platforms are replacing seat-based models with metrics like “contacts helped”, better reflecting the actual impact of the product on customer experience.

In both models, pricing shifts away from assumptions and toward value realization, rewarding vendors for impact, not access. This alignment opens the door to stronger customer retention, more transparent pricing conversations, and a better foundation for revenue growth.

Design, track, and manage variable incentives with QuotaPath. Give your RevOps, finance, and sales teams transparency into sales compensation.

Talk to SalesHow to Make the Transition

Shifting from seat-based to usage- or outcomes-based pricing isn’t just a pricing change; it’s an organizational transformation. To pull it off successfully, your company needs to rethink how it defines value, aligns teams, and motivates sales performance.

Here are the three core steps:

1. Pick the Right Value Metric

Your pricing model lives or dies by the clarity of your value metric.

Choose something that’s:

- Measurable

- Intuitive

- Aligned to customer outcomes

- Consistent across customer segments

For instance, “contacts helped” is clearer than “agents licensed.” And “API calls” beats “monthly active users.”

Your value metric doesn’t just define pricing… it drives comp plans, forecast models, and customer conversations.

It helps to get this right first.

2. Educate Internally

Additionally, a pricing shift is a company-wide change. That means internal education is critical.

You have to get RevOps, Sales, Finance, CS, and Product on the same page:

- Sales needs to understand how usage maps to revenue.

- RevOps must adapt quota and commission structures.

- CS plays a vital role in driving activation and early usage.

- Finance needs visibility into usage trends and forecast reliability.

“Prepare your teams with internal doctrine and decision records,” said Andrea Kayal, Chief Revenue Officer at HelpScout. “A successful rollout starts with internal alignment.”

“Prepare your teams with internal doctrine and decision records. A successful rollout starts with internal alignment.”

Andrea Kayal, Chief Revenue Officer at HelpScout

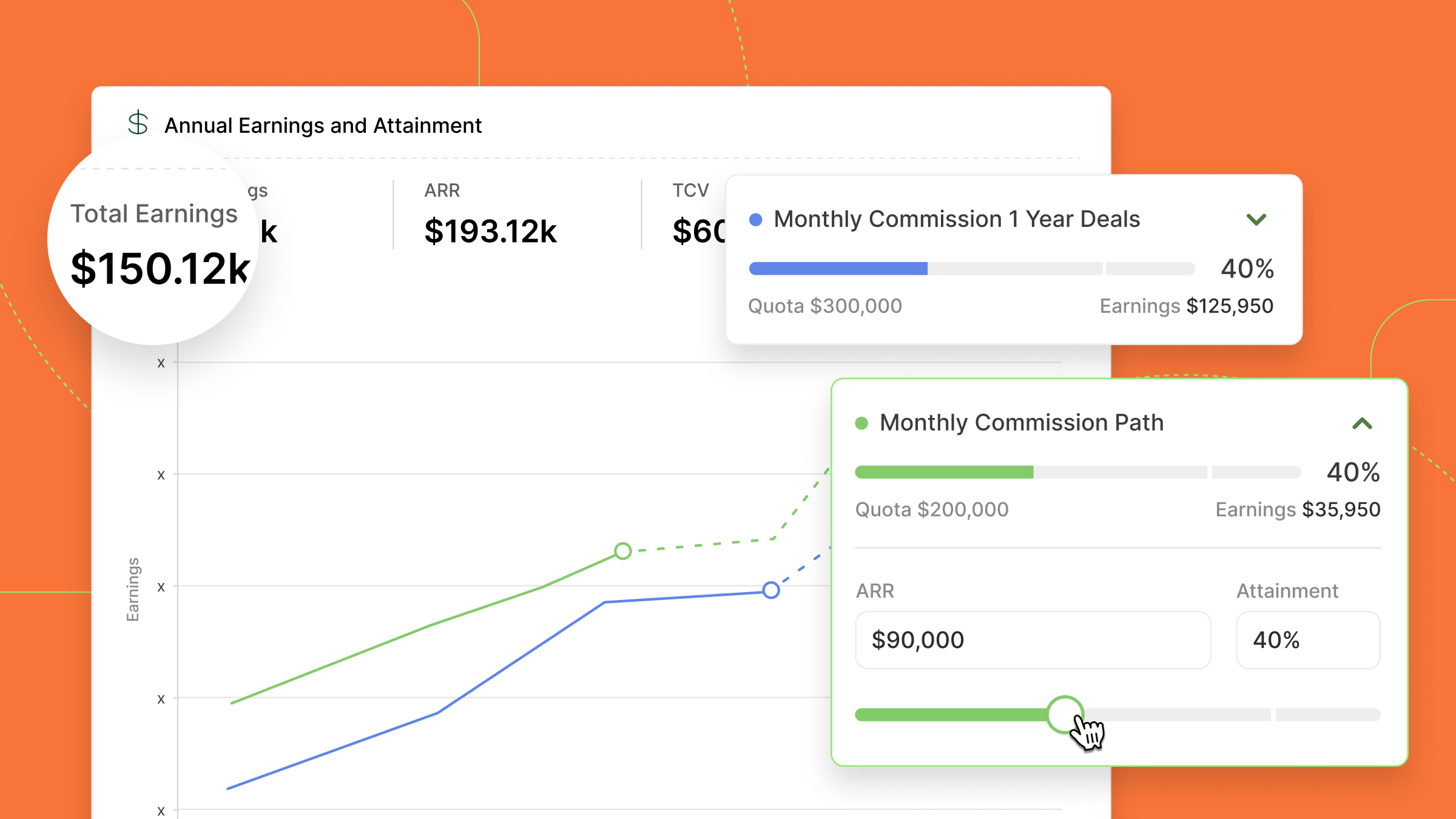

3. Update Comp Plans to Match

Usage-based pricing without a matching comp plan is a recipe for frustration. Reps are left chasing numbers they don’t control, or worse, waiting months to see any commission at all.

That’s why compensation must evolve alongside pricing.

“We tied AE comp to gross profit, not contract value. Because that’s when we make money, when customers spend,” said Scott Shepard, Head of Sales at Tremendous.

Here are the three most common models we see in the field:

Estimated Revenue

- Structure: Reps receive quota credit and partial payout at close, based on projected usage.

- ✅ Motivating for reps (immediate earnings)

- ❌ Risk of clawbacks if forecasts miss

Estimated Revenue

- Structure: Reps receive quota credit and partial payout at close, based on projected usage.

- ✅ Motivating for reps (immediate earnings)

- ❌ Risk of clawbacks if forecasts miss

Hybrid

- Structure: Combines upfront payouts with performance-based triggers and usage validation.

- ✅ Best of both worlds: motivation + risk management

Example: For a rep earning 10% on an $80K forecasted deal:

- 25% of the payout is paid at close

- 25% is released at customer onboarding

- Final 50% unlocks once the customer hits 50% of forecasted spend

Recommended Reading

Usage-Based Compensation Model: Aligning Compensation with Consumption

Read BlogReal World Examples

| Use Case | Metric | Model | Notes |

| Fintech (15 reps) | Gross Profit | 10% on GP | 12-month contribution window; quota based on spend |

| SaaS Infrastructure | API Calls | 12% base + accelerators at 110% / 125% | Forecasts enable quarterly true-ups |

| SMB SaaS (10-person GTM) | Payment Volume | Hybrid (25/50/25 split) |

When Not to Make the Switch

Usage-based pricing works best when usage data is reliable and scalable. But it’s not always the right move.

Avoid usage-based pricing if:

- Your usage patterns are erratic or seasonal

Example: a recruiting tool during a hiring freeze - Your infrastructure can’t track usage accurately

- You’re an early-stage and still testing your pricing model

- Your reps need fast, predictable earnings to stay motivated

“We really are flying blind into this. Our estimates are still way off,” said a Sales Operations leader at an AI startup.

Try the most collaborative solution to manage, track and payout variable compensation. Calculate commissions and pay your team accurately, and on time.

Start TrialFinal Thoughts

Shifting to usage-based or outcomes-based pricing is more than a tactical change—it’s a strategic upgrade.

Done right, it improves revenue alignment, deepens customer value, and unlocks more scalable expansion motions.

- Start with a hybrid model.

- Align compensation with realized value.

- Educate your teams and create a clear internal doctrine.

This isn’t just the future of pricing…it’s the future of GTM strategy.

To modernize your compensation strategy, book time with our team today.