When designed well, a sales comp plan is a powerful tool for motivating AEs, aligning behavior with company goals, and driving predictable revenue growth.

When a bad comp plan is, well… bad… it can do the opposite… encouraging gaming, demotivating your team, blowing up budgets, and even driving your best reps to competitors.

Over the years, we’ve seen our fair share of head-scratcher comp plans, some of which seemed like they were built to frustrate reps rather than reward them. To save you the pain, we’ve compiled five of the most problematic AE comp plans we’ve ever seen, complete with examples and the math behind why they don’t work.

If your plan looks anything like these, it might be time to make some changes.

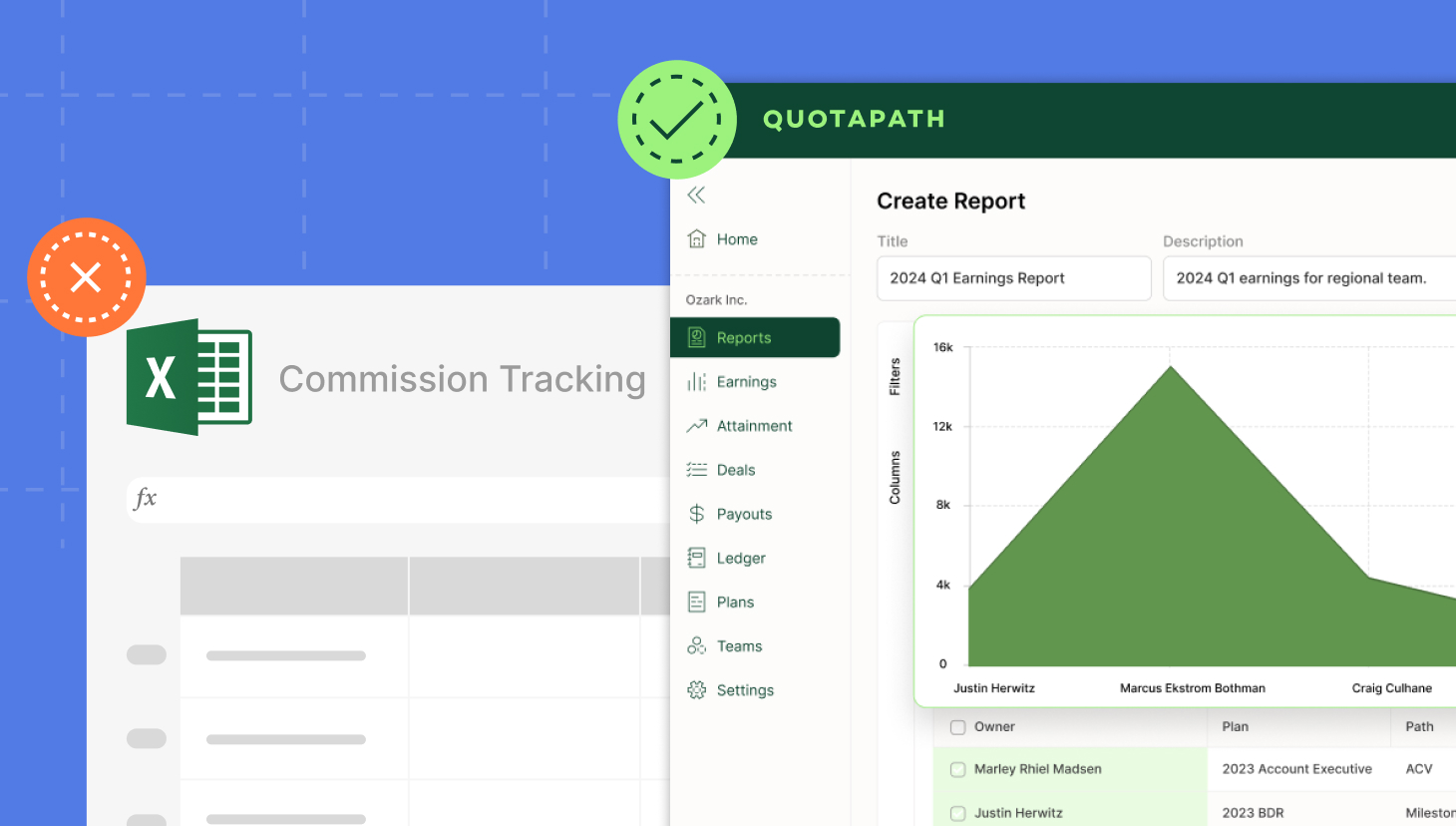

RevOps, sales leaders, and finance teams use our free tool to ensure reps’ on-target earnings and quotas line up with industry standards. Customize plans with accelerators, bonuses, and more, by adjusting 9 variables.

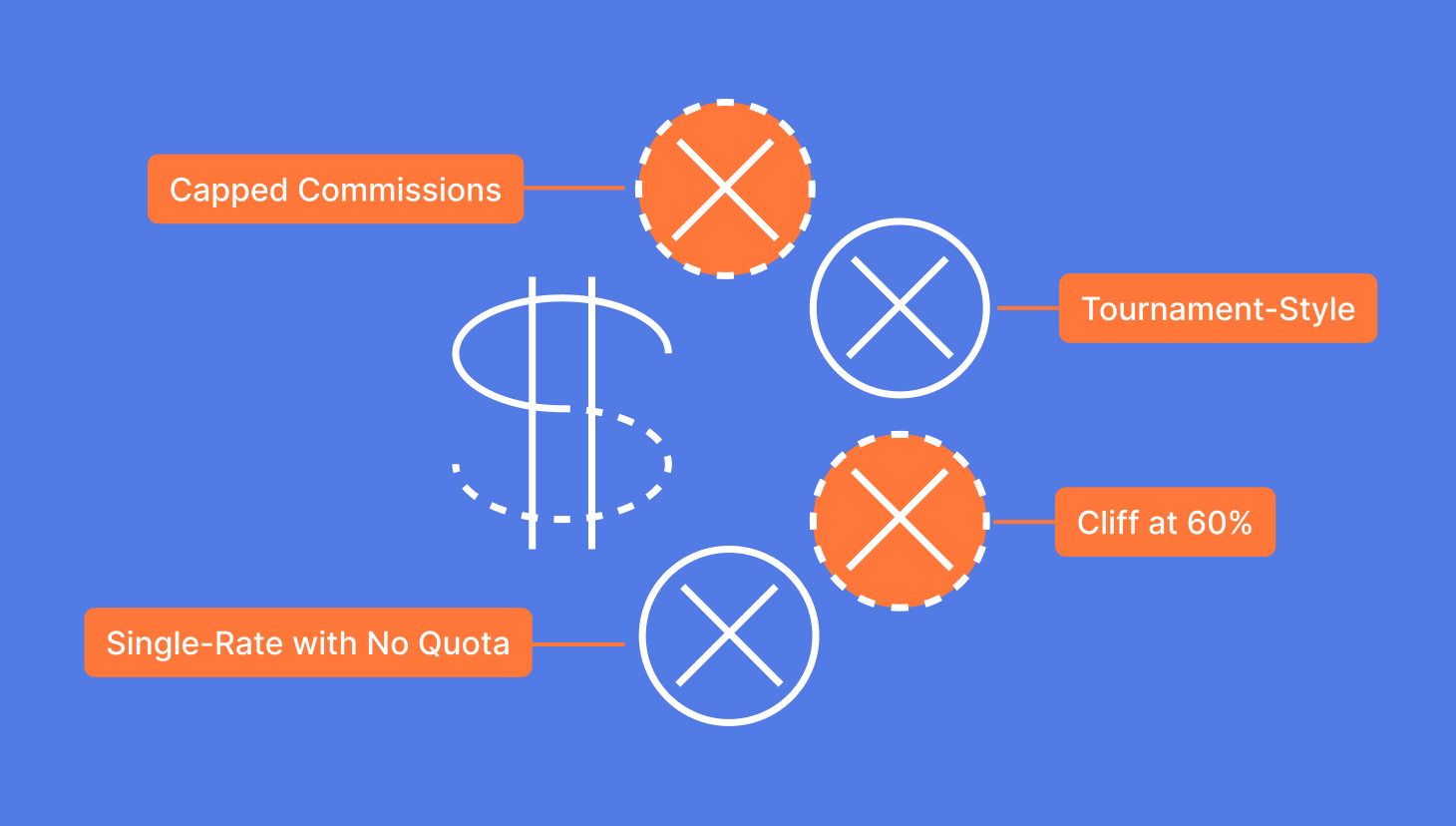

Build a Comp Plan1. Capped Commission Comp Plans

First up is a capped commission plan, or as we like to call it, a rep turnover machine.

Imagine telling your top performer that no matter how much they sell, they’ll stop getting paid commissions after a certain point. That’s exactly what happens with capped commission plans.

Example: An AE earns 10% commission on all closed-won deals, but commissions are capped at $25,000 per year.

- Scenario:

- Quota: $500,000 ARR

- 10% commission rate → Uncapped, they’d earn $50,000 at 100% quota.

- Cap: $25,000 means they stop earning commissions after $250,000 in bookings.

- If they sell $800,000 ARR, they still earn only $25,000 in commissions instead of $80,000.

- Why it’s problematic:

- Disincentivizes selling after the cap is reached.

- Encourages sandbagging deals into the next comp period.

- Top performers feel punished instead of rewarded.

- Can cause attrition of your best AEs.

Caps don’t just hurt motivation; they hurt your company’s bottom line by removing any reason for reps to keep pushing once they’ve hit the ceiling.

You can bet they’ll be on the hunt for an uncapped sales role.

2. Cliff at 60%

Up next is a cliff, or commission floor.

A cliff is meant to drive performance, but when it’s set too high, it becomes a brick wall.

Example: An AE only earns commission if they reach 60% of quota.

- Scenario:

- Quota: $600,000 ARR

- Commission rate: 8%

- If they sell $350,000 ARR (≈ 58% of quota), they earn $0 commission.

- If they sell $370,000 ARR (≈ 62% of quota), they suddenly earn $29,600 in commissions.

- Why it’s problematic:

- Creates massive pressure at the end of the quarter to cross the cliff.

- Makes earnings volatile and unpredictable for reps.

- Can demotivate reps early in the year if they fall behind.

- Leads to desperation discounting to push deals over the cliff.

Instead of inspiring hard work, high cliffs often push reps to make bad decisions just to survive the quarter.

3. Overly Aggressive Accelerators with No Threshold

Now, this one would have your reps singing your praises. Your Finance team? Not so much.

Accelerators can be powerful motivators, but without the right guardrails, they can break your comp budget in a single quarter.

Example: AE earns 8% commission normally but jumps to 30% commission on every dollar sold above 100% of quota — with no minimum performance threshold.

- Scenario:

- Quota: $600,000 ARR

- Commission rate: 8% until 100% quota → 30% afterwards.

- If they close a $300,000 deal early in the year, they’re already halfway to quota.

- Then, if they close a $400,000 deal next, $100,000 of that is at 30%, giving them $30,000 in one shot.

- Why it’s problematic:

- Can cause “quota gaming” — AE front-loads or lucks into one big deal, then coasts the rest of the year.

- Unfair to reps in territories without mega-deal potential.

- Can blow up your comp budget unexpectedly.

A Note from Our Chief of Product: Wyndham Hudson

“I’ve lived through a comp plan variant where aggressive accelerators allowed a few reps to absolutely crush it—hitting 200% attainment—while the rest underperformed. The outcome? We missed overall target but still overspent on CAC because payouts exceeded the assumptions baked into the plan.”

Without thresholds, aggressive accelerators risk rewarding luck over skill and leave finance teams scrambling to cover unplanned payouts.

4. Single-Rate Comp Plan with No Quota

Ever hear of a plan with no quota? This is more common for a startup’s first comp plan because there’s no historical data to build a quota from. But for any other stage, a comp plan without a quota is like driving without a speedometer.

Example: AE earns a flat 12% commission on all closed-won ARR, no quota, no accelerators, no decelerators.

- Scenario:

- One AE closes $200,000 ARR → $24,000 commission

- Another closes $900,000 ARR → $108,000 commission.

- No target, no performance benchmarks — just pay on whatever comes in.

- Why it’s problematic:

- No performance expectations tied to pay

- Rewards “order takers” the same as hustlers.

- Impossible to forecast OTE payouts and budget.

- Can mask underperformance.

Without quotas, there’s a lack of accountability and no way to tell whether your team is truly delivering against business goals.

5. “Winner Takes All” Tournament-Style Plan

Last up is a “winners” comp plan.

Turning sales into a high-stakes game might seem fun, until you realize how many good reps it drives away.

Example: The top AE each quarter earns a $50,000 bonus, everyone else earns nothing in bonus commissions.

- Scenario:

- All AEs have a $700,000 ARR quota.

- Q1 Results:

- Rep A: $800,000 ARR → Wins $50,000 bonus.

- Rep B: $790,000 ARR → No bonus.

- Rep C: $780,000 ARR → No bonus.

- Why it’s problematic:

- Breeds resentment and kills collaboration.

- Can cause extreme short-term behavior: discounting, territory poaching, deal stealing.

- Demotivates solid performers who narrowly miss first place.

- Leads to rep attrition after repeated near-misses.

Healthy competition is good, but in a winner-takes-all world, you lose far more than you gain.

FInal Thoughts

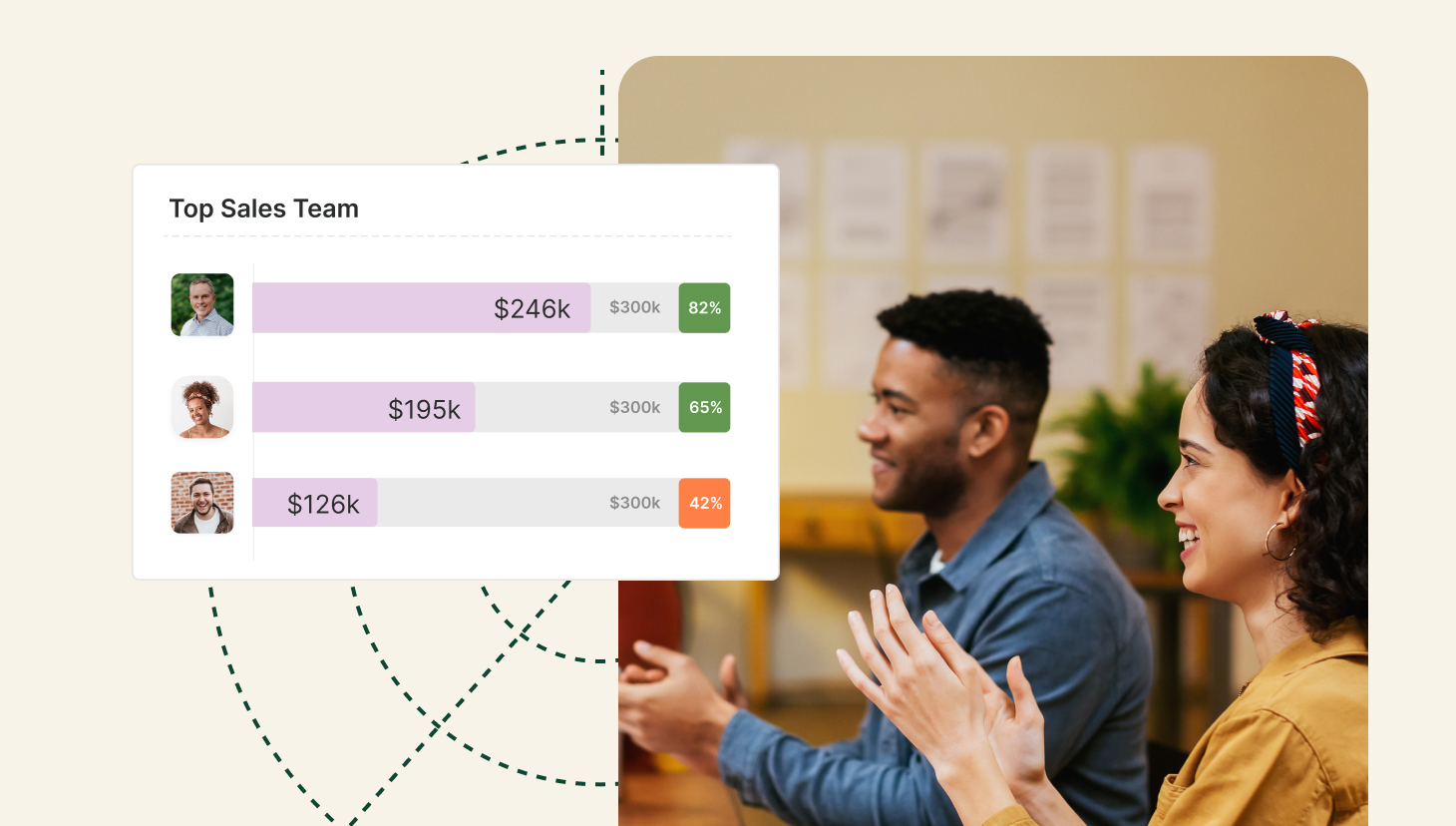

Sales comp plans should reward consistent performance, motivate reps to keep selling, and align with company goals… not create chaos, resentment, or financial unpredictability.

The five examples above illustrate how poorly designed plans can backfire, even when they seem enticing on paper.

If your AE plan has caps, cliffs, extreme accelerators, no quotas, or “winner takes all” elements, it may be time to rethink the structure. Your goal is to create a plan that’s simple, fair, transparent, and motivating, and that drives both company growth and rep satisfaction. To learn more, talk to our team today.