Every January, teams set goals they hope will fix last year’s problems.

And every March, most of those goals quietly fade…especially in RevOps.

That’s because the biggest challenges RevOps leaders face aren’t aspirational. They’re operational. Quarter-end comp surprises. Finance escalations over payout discrepancies. Reps are losing trust because commissions feel opaque or inconsistent.

What makes this more frustrating is that RevOps leaders feel these pain points personally.

Recent QuotaPath research shows RevOps professionals want compensation that’s better aligned to their real influence (not vague bonuses or disconnected metrics). Yet many of the plans they design for Sales, CS, and AM teams still rely on the same reactive processes that frustrate them.

That’s the core shift for 2026: habits beat goals.

The teams that master compensation and planning are setting better resolutions and building better operating rhythms.

Below are five habits that serve as guardrails for clearer comp plans, stronger Finance alignment, and higher rep trust year-round.

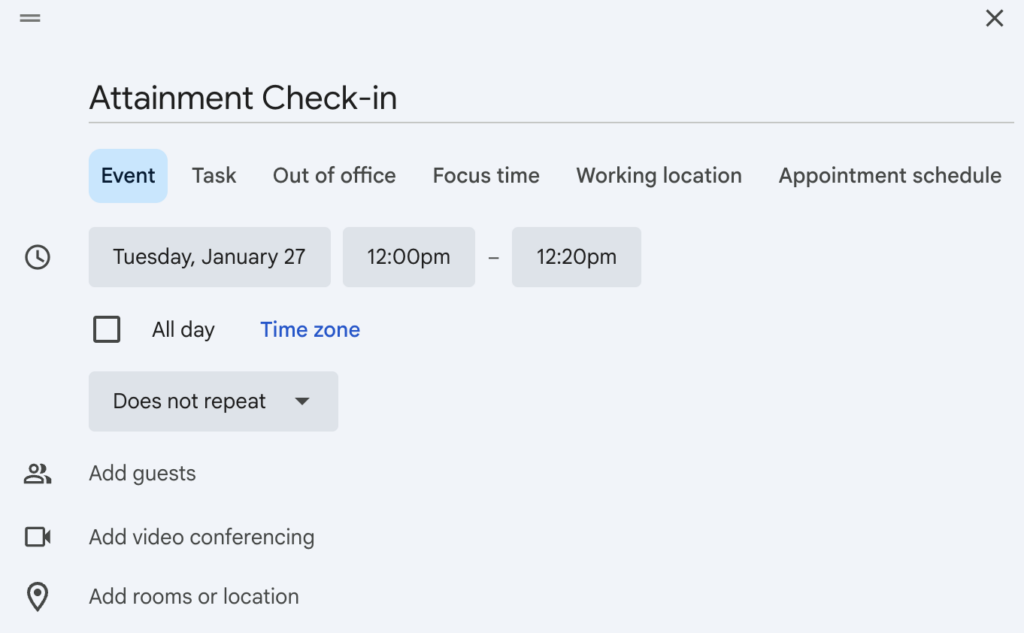

Habit #1: Replace End-of-Quarter Scrambles With Monthly Attainment Check-Ins

If comp conversations only happen at quarter-end, you’ve already lost control of the narrative.

Waiting until the end of the quarter to review attainment creates two predictable problems. First, you miss opportunities to course-correct quotas that were misaligned from the start. Second, you introduce surprise payouts that strain Finance and trigger last-minute debates.

Monthly attainment check-ins shift comp from reactive to predictable.

A strong monthly review should focus on quota progress versus original assumptions and flag early signs of over- or under-performance. Use this time to validate whether the plan itself is working.

Consider the difference between catching a quota imbalance in February instead of discovering it in April. One leads to a clean adjustment. The other leads to retroactive explanations.

RevOps owns signal. Monthly attainment reviews ensure comp plans produce insight, not just outcomes.

Habit #2: Build a Monthly Finance-RevOps Rhythm Around Comp Variance Reporting

Attainment visibility only matters if Finance trusts the numbers behind it.

Comp variance is the difference between expected payouts and actual payouts. And it’s one of the most common sources of friction between RevOps and Finance.

That friction usually comes from predictable places: mismatched data sources, manual reconciliations, and last-minute adjustments during close. When variance conversations occur only at quarter-end, they feel like escalations rather than collaboration.

A monthly Finance-RevOps cadence changes that dynamic.

Effective teams review a simple variance report together, align on definitions and assumptions, and document any changes before they snowball. This habit reduces audit risk, reduces Slack escalations, and prevents quarter-close delays that drain both teams.

Automation plays a key role here. When variance reporting is system-driven instead of spreadsheet-driven, subjectivity disappears, and trust improves.

Habit #3: Document Every Comp Plan Change in a Single Source of Truth

Alignment breaks down fastest when comp information lives everywhere.

Slide decks, Slack threads, one-off email: Each one increases the odds that someone is working from outdated information. That’s how small comp changes turn into big trust issues.

Every comp plan change should be documented in one system of record. That includes plan logic updates, spiffs and accelerators, eligibility rules, and effective dates.

This habit matters because compensation is a coaching tool. Managers need clarity to reinforce the right behaviors. Finance needs documentation for sign-off. Reps need confidence that what they see is what they’ll be paid.

Without a single source of truth, even well-intentioned incentives create confusion instead of motivation

Habit #4: Prioritize Rep Trust by Eliminating Pay Disputes at the Source

While we often associate pay disputes with money, they undeniably also jeopardize your reps’ confidence in your organization.

Most disputes stem from the same root causes: limited visibility into calculations, inconsistent data, or delayed payouts. When reps don’t understand how they’re paid, they assume something is wrong (even when it isn’t).

QuotaPath research shows it takes reps an average of three to six months to fully understand their compensation plans. That’s months of lost focus, unnecessary questions, and preventable frustration.

Proactive dispute prevention starts with real-time earnings visibility, clear plan explanations, and early review windows before payouts are finalized. When reps can self-validate their earnings, disputes drop and trust compounds.

Habit #5: Hold Monthly Comp Plan Check-Ins to Test Understanding and Effectiveness

Lastly, even the best-designed comp plan fails if reps don’t understand it.

Comp plans shouldn’t be “set and forget.” They’re hypotheses that need to be tested regularly. Monthly comp check-ins create a feedback loop before incentives break or behaviors drift.

These conversations don’t need to be heavy. Rather, focus on rep understanding of how they’re paid, whether incentives are driving the intended behaviors, and where questions keep recurring.

Simple prompts go a long way here. Ask reps what part of their plan feels unclear. Ask what behavior an incentive pushes them toward. Patterns emerge quickly when you ask consistently.

This habit improves adoption, strengthens alignment between comp and performance, and surfaces issues while they’re still easy to fix.

Design, track, and manage variable incentives with QuotaPath. Give your RevOps, finance, and sales teams transparency into sales compensation.

Talk to SalesOne Platform That Supports All Five Habits

So much of this is habit-driven. And guess what? Habits don’t scale on spreadsheets.

The five habits above (monthly attainment reviews, Finance collaboration, centralized documentation, dispute prevention, and ongoing plan check-ins)require systems built for operational discipline.

QuotaPath supports each of these habits in practice.

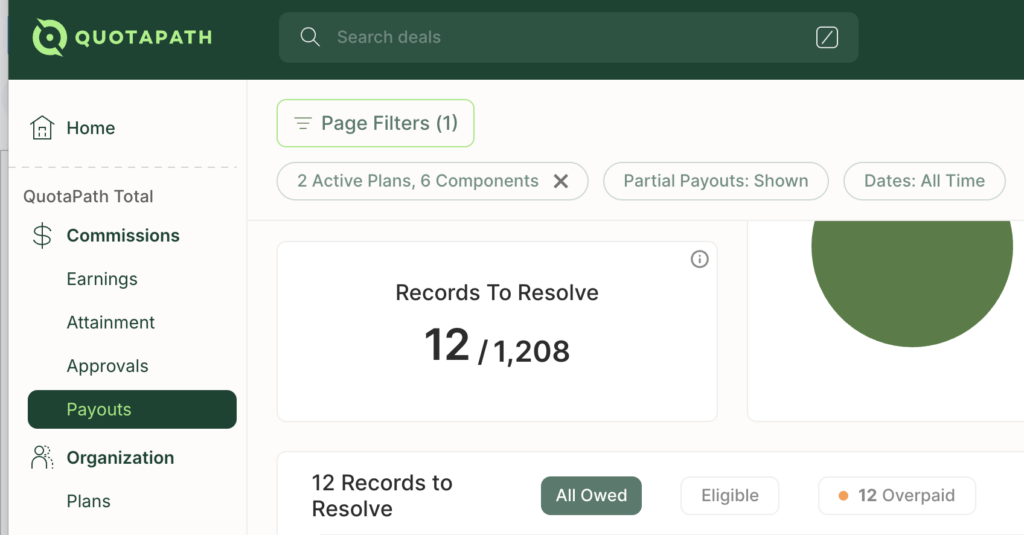

- Real-time attainment tracking eliminates surprises

- Automated variance reporting aligns RevOps and Finance

- Centralized documentation creates a single source of truth

- Transparent earnings dashboards build rep trust

- Ongoing visibility keeps comp plans alive throughout the year

The takeaway for 2026 is simple. The teams that succeed this year will have better habits. And those habits start with treating compensation as an operating system, not a quarterly event.

To learn more, book time with our team today.