When calculating on-target earnings (OTEs), there’s often a bit of a guessing game.

So, we developed a free tool to make it easier to set OTEs while removing the guesswork! Introducing our Quota:OTE Ratio Calculator.

With this tool, we aim to help leaders from RevOps, sales, and finance set realistic quotas and OTEs based on past performance. To access the Quota:OTE Ratio Calculator, fill out this page to receive it via email. As a heads up, you’ll need Excel to fully utilize it.

Read on for context and tips to understand the tool.

Try the most collaborative solution to manage, track and payout variable compensation. Calculate commissions and pay your team accurately, and on time.

Start TrialOn-target earnings 101

Let’s start with the basics.

What does OTE mean and why are sales leaders always bringing it up?

On-target earnings (OTEs) represent the total amount of money a sales rep or account executive (AE) can earn if they hit 100 percent of their quota. Sales leaders usually set OTEs for a 12-month period and lean on this number to set quotas.

To calculate OTEs, take the base salary and add the total commissions a rep would earn if they hit 100% of their quota.

For example, Amy’s base salary is $60,000, and her total commissions at 100 percent quota is $65,000 on the year. Therefore, Amy’s OTE equals $125,000.

Base + Commission = OTE

Amid the ongoing “War on Talent,” rising OTEs have become especially prevalent. Trends suggest AEs continue to shop for the most lucrative opportunity. As you can expect, the bigger the OTE, the greater the chance a recruit accepts that offer over another.

But, one thing to keep in mind is that OTEs are not guaranteed. If a company lists OTEs of $200,000 and only 40 percent of the sales team hits that number, that’s a red flag. Some would even say that’s false advertising. More to come on this later.

Glad we have an understanding of OTEs. Now, let’s throw a wrench in it. A wrench that we in the biz call multipliers.

Quota multipliers

A multiplier is the number of times more a quota is than an AE’s OTE. To find it, divide the overall quota goal by the OTE.

Here’s an example. Ian is an AE with an OTE of $160,000. His quota is $1 million in annual recurring revenue (ARR). In this instance, Ian’s quota is 6.3x larger than his OTE. The multiplier, or quota to OTE ratio, for Ian’s compensation plan is 6.3.

Now, determining the multiplier for your compensation plans can be tricky. (That’s why we created the Quota:OTE Ratio vs. Sales:Earnings Ratio Calculator.)

We’ve found that most of the companies we speak with set multipliers 5x larger than their OTEs.

“The 5x range is what most people would consider good,” our Chief of Staff Graham Collins said.

But, because there’s always a but!

“There is a range of ‘good,’ and so much of this depends on your company’s revenue,” Graham said.

Next, we’ll look into the range and why it varies.

Factoring ARR with quota multipliers

A smaller multiplier, say 3x, often benefits the sales rep and the company when it’s a smaller organization.

Consider a company that generates $1 million in ARR. A quota that’s set with a 3x multiplier works great in this instance for both the company and the rep. Meaning, the company compensates the rep well for their efforts. Reversely, the rep’s output is worth the company’s investment in the rep.

For companies pulling $100 million in revenue, however, the 3x multiplier works against the company.

That’s because a company with $100M ARR likely dedicates substantially more resources to support their reps. Resources could include heavy investments such as a sales development team, sales enablement, marketing, and management. When factoring in these resources, the cost per sale at a larger company climbs significantly than the cost at a smaller one.

Since the cost per sale is larger at a bigger company, the company can’t afford to pay 16 percent of the sale to the AE who closed it. Instead, that 16 percent gets split to the different areas of the biz that helped support the deal, including the rep. Whereas, at a smaller company, the sales rep collects a greater percentage of the deal with often smaller deal sizes.

To recap, a quota with a multiplier of 5x the OTE is what we’ve observed as the SaaS standard. This ratio, or multiplier, usually changes based on a company’s total ARR. Companies with larger ARR invest more in marketing and sales enablement and often have higher multipliers.

So, how can you tell if your ratio serves both the reps and your business revenue model? This is where our Quota:OTE Ratio vs. Sales:Earning Ratio Calculator comes in.

Introducing the Quota:OTE Ratio Calculator

This is for you — and for free.

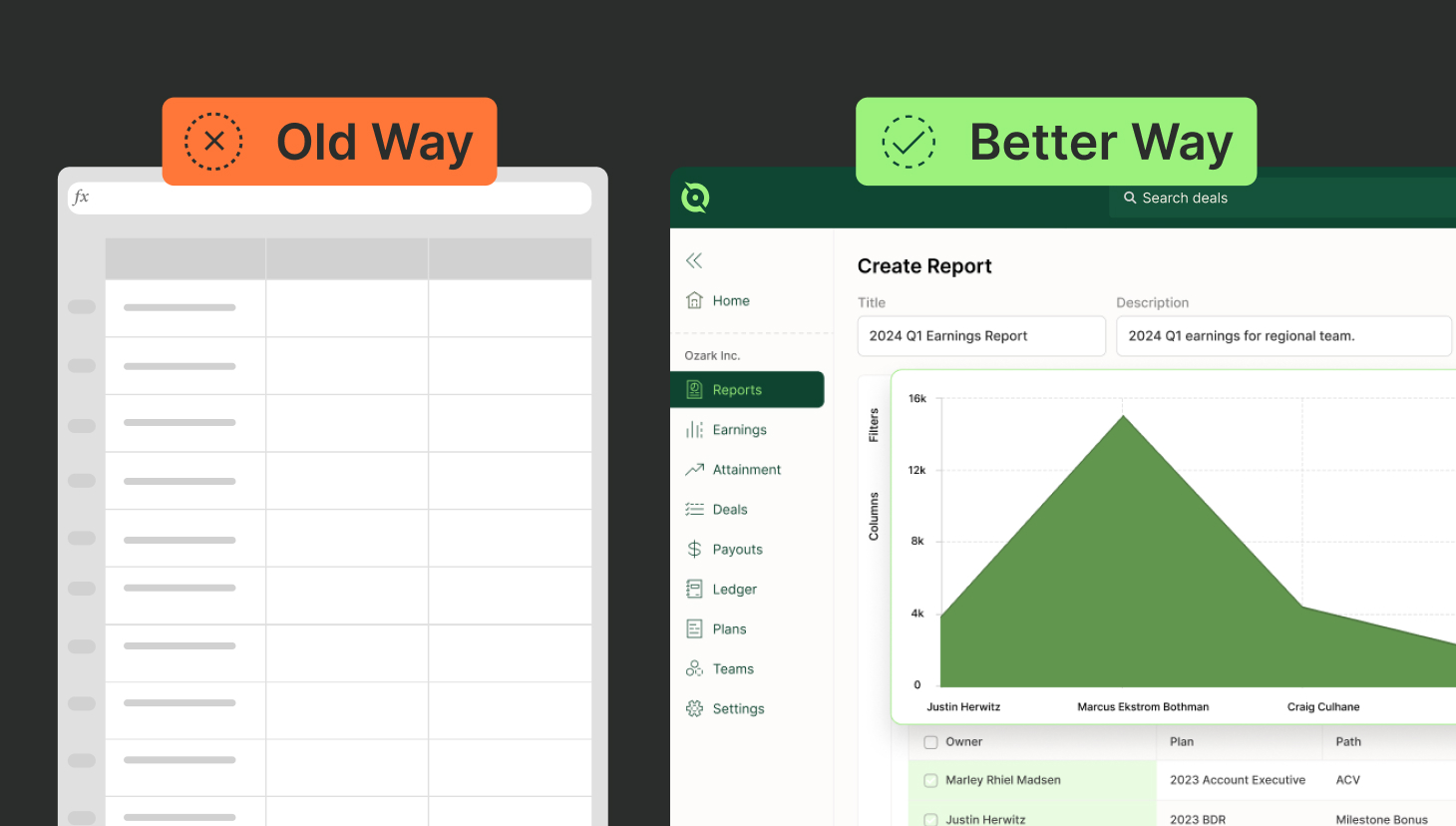

You can use it while building your next compensation plan and setting quotas. Plug in your organization’s numbers into the editable fields, including your ARR at the top. Then, watch our engine determine the ratios, or multipliers, for Quota:OTE and Sales:Earnings.

Change the numbers and see if you can get both dials into the green.

The left dial, Quota:OTE Ratio, takes into account your base salary, on-target commissions, OTE, and annual quota. It’s, as Graham calls it, “more pie in the sky.”

The right dial, Sales:Earnings Ratio, is what’s actually happening with your business.

This ratio factors in the average percentage of your team that reaches their annual quota. Upon filling in the “Average Quota Attainment” field, our engine will break down the total average sales per rep, average commissions earned per rep, and the average total annual earnings per rep.

“The left side is hypothetical,” Graham said. “The right is the real world.”

When both are in green, this means you’re compensating your team well and they in turn are performing well.

Behind the colors

You should strive for green on both sides of the Quota:OTE Ratio Calculator.

However, when your numbers land outside of the green, here are a few scenarios that could indicate.

If one or both dials are in yellow, this could mean you’re underpaying your reps compared to the revenue they are generating. It could also indicate that quotas are too high or perhaps too low. Or, maybe the business spend per rep outweighs their actual performance. In any case, this is an opportunity to dig deeper and identify the problem.

Two red dials warn that quotas are too low, OTEs are too high, or your team’s quota attainment is off. If the latter is the case, time to prioritize sales coaching.

As for when the Quota:OTE side is green and the Sales:Earnings side is yellow or red, this throws up our biggest red flag. In this scenario, you’re advertising unrealistic OTEs. Your OTE has become a false promise because not enough of your reps are actually hitting those numbers. And, when that happens, expect high turnover.

Questions?

If you have additional questions, check out our FAQs page. Or, for additional resources, check out our Sales Compensation Calculator that includes tips and other support.

Lastly, to learn how QuotaPath can automate commission tracking, reporting, and payouts, schedule a team to meet our team!