Obviously, we talk about sales commission errors a lot because that’s why QuotaPath exists.

Mistakes like incorrect payouts due to manual errors from a commission tracking spreadsheet or reps opening up their commission paystub, excited for a big bonus, only to find a check much smaller due to a misunderstanding of their compensation plan, are frequent.

In fact, our 2024 Compensation Trends report found that 22% of sales reps have at least one commission dispute yearly. What’s more, we learned that it takes reps an average of 3 to 6 months to understand how they earn variable pay, so of course, their commission checks will look wonky to them.

What about instances where a company has to claw back commissions, but the compensation policy left too much room for interpretation? That’s a mismanagement of compensation at its worst.

We haven’t called attention to any significant commission horror stories recently.

Until now.

We sourced LinkedIn and professional communities RevOps Co-Op and Pavilion for costly commissions-gone-wrong stories in the field.

Here are the top three.

Rep Commission Dashboards in QuotaPath

Give reps an accurate, automated commission tool to track earnings. Build trust and motivate your reps to bring in the next deal through forecasted views.

Book a DemoAn Almost-Lost $36,000

Our first story comes from Dan Goodman, a name you might recognize from LinkedIn. Dan, a crusader for employee advocacy, is the Founder and CEO of Dan Goodman Employment Advisory, which supports individuals who have experienced unjust or illegal actions by their employers.

Dan recently shared the story of his client, Josh. This seasoned sales representative faced commission discrepancies and intimidation from his employer but ultimately fought for transparency and fairness, resulting in a significant payout and recognition for his hard work.

Here’s what happened.

- Josh joined a new company in the middle of 2023

- An all-star rep throughout his career, Josh earned the President’s Club trip 15 of the past 17 years.

- In his new role, his comp plan consisted of a 6-month, $600K margin quota, with a $25K bonus for meeting the quota.

- On all margin sales, he earned a 12% commission rate

- An accelerator of 18% kicked in for all deals after $600K

With 5 weeks remaining in 2023, Josh found himself $60K short of goal, which seeemed off.

So, he proactively contacted leadership and accounting for reports to look into it himself.

But instead of simply sending him the data, he was met with some backlash, like “Don’t you trust us?” “Why is no one else asking for this information?”

In fact, he didn’t receive any reports until Josh escalated it multiple times to the C-suite. Then, when he finally got access to the report, he met a spreadsheet 4,000 rows deep with data.

“It was a general ledger report where the expected revenue by line item was offset by a separate line item showing the cost from the vendor,” said Dan. “The difference had to be manually calculated to derive the gross profit that Josh was paid on. That was only half of it.”

To estimate how much Josh could expect to make on his remaining deal, he needed to create a bookings report, which required additional data.

That’s when Dan stepped in to review the data.

“Eight deals out of 30 appeared to have not been paid properly,” Dan said.

Those 8 deals estimated more than $50K in gross profit that Josh wasn’t paid commissions on, plus $100K that didn’t count toward his attainment.

And they had evidence of it, thanks to Dan’s calculations.

As a result of Dan’s and Josh’s commission deep dive, Josh ended up exceeding his quota for the year, earning his $25K bonus, another P-club trip, and $36K in commissions.

“Check your commissions. Demand pay transparency,” said Dan. “It’s your right. It’s your money. You earned it.”

Revenue Recognition

Ensure your revenue recognition is correct and easily reportable using QuotaPath.

Learn MoreThe $2M Revenue Recognition Error

Our second commission horror story is the thing of RevOps nightmares.

Before this anonymous company went public a few years ago, an account executive sold the company’s largest contract in Asia.

Think: 3-year deal worth $5M in revenue.

“The AE made bank on it, was promoted to director, etc.,” our anonymous RevOps source said.

But, as the 3-year renewal approached, the Ops team uncovered that the only person assigned to the account post-sale was a man from professional services.

No AE. No customer success manager.

Suddenly, SalesOps noticed $2M in forecasted churn, and no one could figure out why — except for our source and the VP of professional services.

“Apparently, they had embedded deep down in the contract terms that they got 2 full-time professional services employees for the duration of their contract, valued at $2M,” our source said. “So when they renewed, they dropped that part because it would have had to be paid for.”

What’s more, the Ops team uncovered that at the time of the contract, the AE mistakenly listed the $2M as a “license” instead of correctly labeling it as professional services. This led to the professional services team missing revenue. It had to be reported to the auditors, and it still “churned.”

The result?

They had to report the situation to auditors

The $2M still “churned”

That quarter’s earnings report caused the stock price to drop from $350 to $30 ahead of its IPO

The company fired the AE-turned-Director.

Inconsistent Clawback Policies

Our last story could trigger any sales rep and involves the dreaded clawback.

A clawback occurs when a company compensates a sales representative for a sale, and the customer terminates the contract within a specified timeframe. When this happens, a clawback issues the employee to return the earned commissions as stipulated in the sales compensation policy.

Download This Commission Agreement Template

“Many years ago, I worked for a tech company whose commission policies needed to be better documented,” said our source. “This led to two similar scenarios, resulting in two different outcomes.”

The first situation involved a considerable enterprise customer churning due to not paying their invoice. As a result, the company clawed back commissions from everyone who earned a piece from the deal, ie: SDR, AE, Manager, VP.

Not fun, but it happens.

However, the second time this happened with a different customer, the company allowed the rep to keep their commission, causing a (rightful) uproar amongst those who felt the pain of the first clawback.

“It was really frustrating,” our source said. “This may have been about the Chief Customer Officer at the time and their decision-making process. But as someone impacted by the first scenario, the decision-making process and how they ended up in two places with the same scenario was lame and caused a lot of heartache.”

What did we learn here?

Have a documented process to follow, and stick to it.

This creates consistency, and although your team might not love a clawback, they’ll at least understand that it’s policy.

The Takeaways

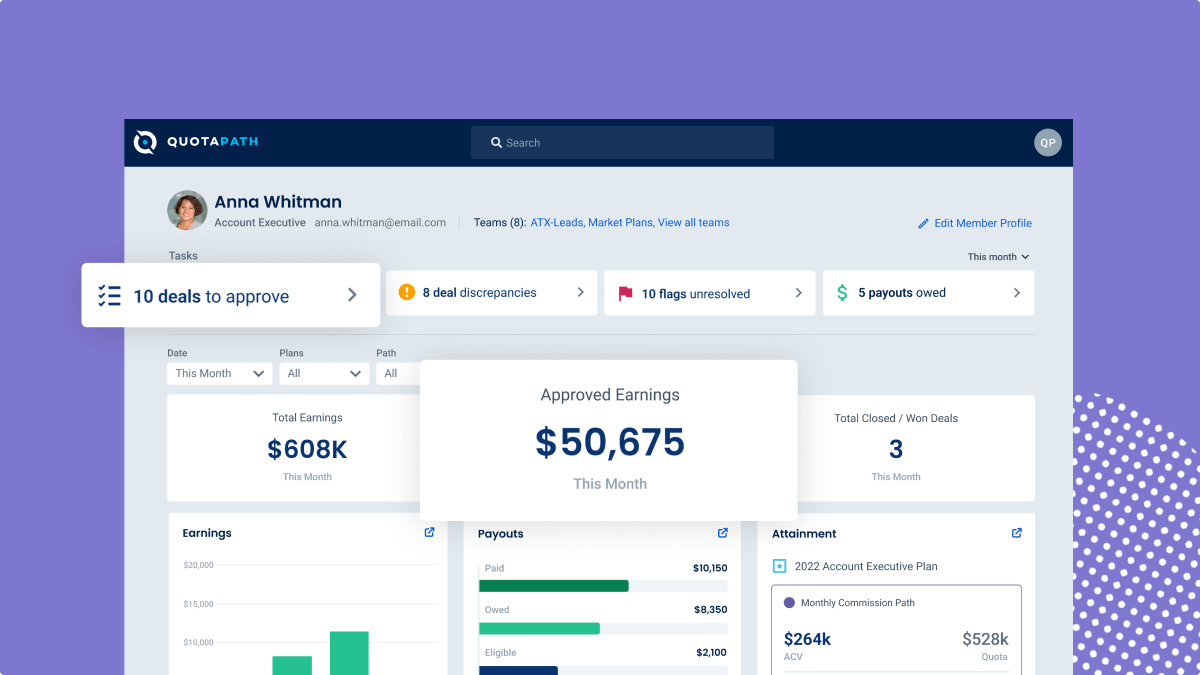

These commission horror stories serve as a stark reminder that mistakes can happen. But with the right tools and a commitment to visibility and process, you can mitigate these errors and foster trust across your team.

QuotaPath exists to eliminate commission errors and confusion around compensation and give Finance, RevOps, and Sales leaders and reps visibility into deal, earnings, and attainment data. This makes it easier to identify issues long before they jeopardize team morale (or future stock prices).

Learn more about QuotaPath by scheduling time with our team today.