Compensation plans are a huge part of your team’s motivation and what drives your business results. We spend hours analyzing and perfecting rules for bonuses and commissions that reward sales teams for behavior that makes both them and your company successful.

And then COVID-19 happened…

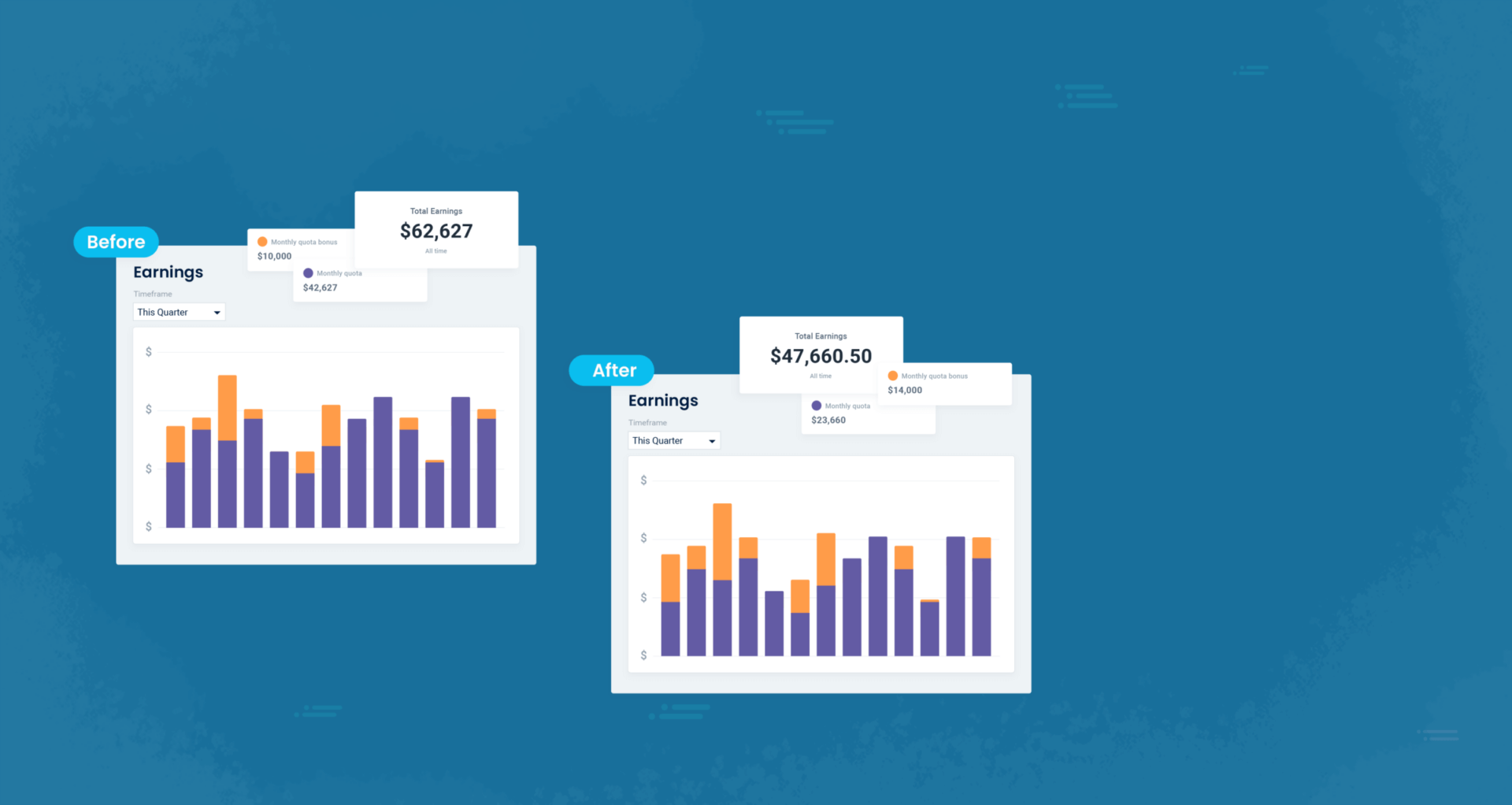

The rules on which our previous compensation plans were based are no longer valid. The market has changed drastically and we need to change with it. Below, we outline the types of changes you might consider and how you can model and analyze those in QuotaPath.

What updates should I consider?

Earlier this month our Head of Growth, Graham Collins, outlined changes you may want to consider as you create a new sales compensation plan in response to COVID-19. These include:

- Lowering quotas

- Removing decelerated commission and commission cliffs

- Adding additional incentives, bonuses, or spiffs

- Compensating on something other than revenue

- Removing performance improvement plans

Check out the full post for more information on each of these.

How should I forecast revenue?

Now that you have a few variables to adjust in your compensation plan, let’s talk about revenue forecasting. There are still so many unknowns in this equation, but what we do know is that your revenue forecast should not be the same as it was before. There are categories such as travel that have been negatively impacted and others like software optimizing for remote teams that have shown positive growth.

Start simple – We’d recommend creating a new field in your CRM at the Account or Opportunity level that represents a level of risk – Low, Medium, and High. This will allow easy grouping and reporting on specific deals in each of these categories.

Adjust revenue – Next, consider creating a field that produces a new revenue number based on these risk-levels. Something as simple as 50% of revenue for High Risk opportunities and 80% of revenue for Medium Risk opportunities is a good place to start. If you want to get more sophisticated, add weighted probabilities for each risk category and/or the industry of each account. Whatever your approach, the end result should be an additional field that represents an adjusted revenue amount for each deal.

Finally, let’s model your new comp plans with adjusted revenue

Brandon Smith, our Customer Activation and Engagement Manager, outlines exactly how to do this using QuotaPath’s free functionality.

Our goal is to provide you with some guidance so we can navigate these uncharted waters together. Everything described in the post–comp plan modeling and revenue forecasting–is completely accessible to you in our free app. Furthermore, we’d be happy to help you build your plans in QuotaPath – no catch, no strings attached.