The Financial Accounting Standards Board (FASB) issued a major update to income statement reporting: ASU 2024-03, Disaggregation of Income Statement Expenses (DISE) that you should know about.

This new standard requires public companies to provide a more detailed breakdown of their operating expenses, including compensation-related costs. Designed to improve transparency for investors and stakeholders, DISE represents one of the biggest shifts in financial reporting in over a decade.

The most significant impacts of DISE is the requirement to break down incentive compensation costs, including commissions and bonuses. These expenses have historically been buried within broader categories like SG&A, making them difficult to isolate, analyze, or forecast accurately. This lack of visibility has posed challenges not only for financial reporting but also for understanding how compensation strategies impact profitability and growth.

This is no small line item.

Incentive compensation can represent 30–60% of total compensation spend, according to EY’s 2024 Compensation Reporting Survey. As a result, the new disclosure requirements will greatly influence how finance teams track, report, and manage compensation going forward.

Adhere to Financial Standards

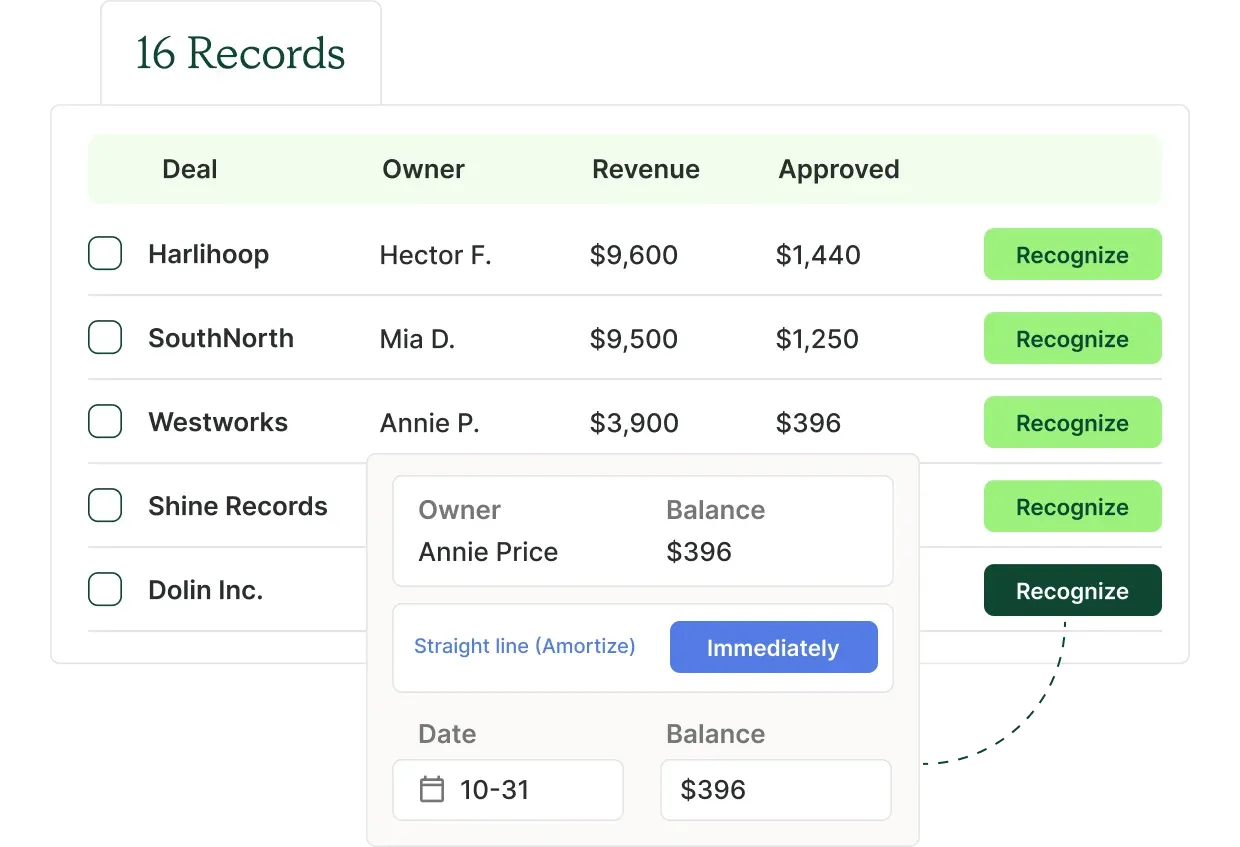

QuotaPath helps your organization stay GAAP-compliant with audit-ready financial reports. Using Ledger, you can capitalize commission expenses in accordance with ASC 340 and automate amortization to align with revenue recognition under ASC 606.

Learn MoreWhat’s Changing Under FASB: Key Highlights

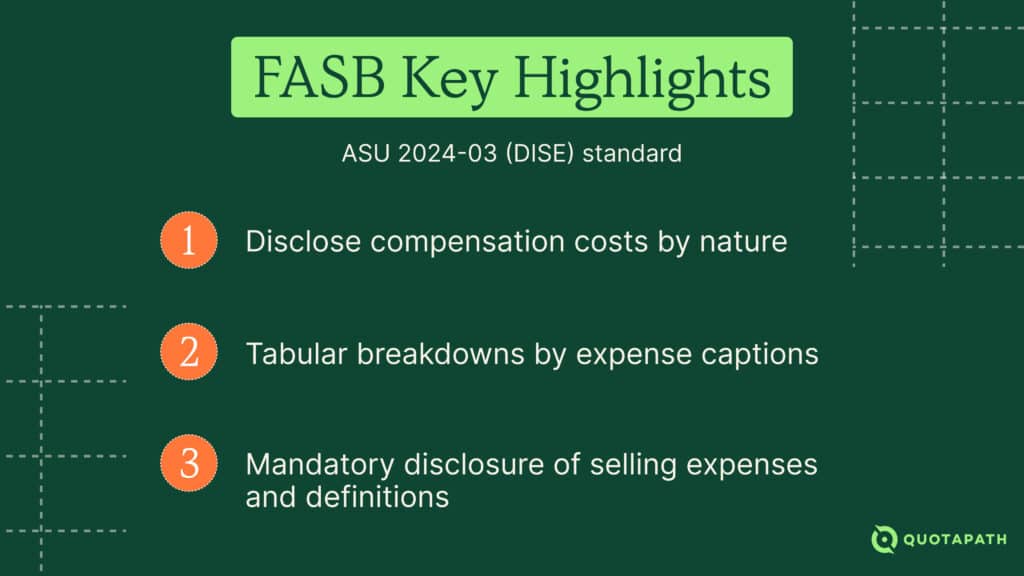

The new ASU 2024-03 (DISE) standard introduces several key disclosure requirements aimed at improving transparency in financial reporting. These updates require a more detailed view of how compensation and other operating expenses are categorized within the income statement.

- Disclosure of compensation costs by nature: Compensation costs that are reported based on the type of expense, such as base pay, commissions, and benefits, rather than grouped in a single line item.

- Tabular breakdowns by expense captions: These natural expense categories must be mapped to income statement line items like Cost of Goods Sold (COGS), Selling, General & Administrative (SG&A), and Research & Development (R&D).

- Mandatory disclosure of selling expenses and definitions: Requires that companies report the total amount spent on selling expenses and clearly define what’s included. For instance, commissions, sales team costs, or marketing-related expenses. on selling expenses, and clearly define what each of these items includes.

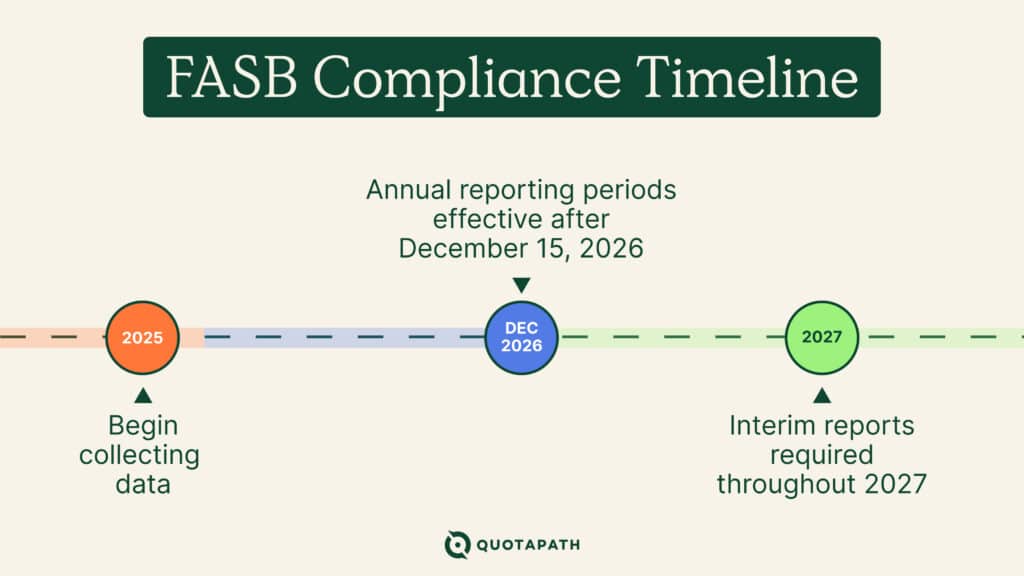

The standard applies to all public business entities (PBEs) for annual reporting periods beginning after December 15, 2026, and interim reports starting in 2027, with early adoption encouraged.

Who This Impacts

The new disclosure applies directly to public companies. However, late-stage, IPO-bound, and private equity–backed companies are also likely to be affected, as they prepare for public filings. Additionally, pre-IPO companies required to furnish financials under SEC regulations, such as Regulation S-X, will be impacted. A cautionary note: many private companies will be affected if acquired by a public company or if they are preparing for an IPO.

The Compliance Timeline

The new disclosure requirements take effect for annual reporting periods effective after December 15, 2026, with interim reports required starting in 2027.

While retrospective application is optional, companies should begin collecting data as early as 2025 to ensure they have sufficient historical information for comparative reporting. Waiting could create significant challenges when the rules become mandatory.

Preparing Your Org: 4 Practical Steps for Finance Leaders

Meeting the new disclosure requirements will require more than updating reports. Here are four useful steps to help prepare your organization.

Step 1: Evaluate Your Current Tracking Capabilities

Begin by assessing whether your current systems can accurately track and categorize compensation data. Do you break out commission costs by plan type? Can you distinguish between base, variable, equity, and benefits? EY’s survey found that 92% of companies currently lack adequate systems to track and report compensation at the required granularity.

Step 2: Implement a Centralized Compensation System

A unified compensation system is essential for meeting the new reporting requirements and reducing the risks of manual errors. Prioritize tools that offer automation and real-time data. This will make it easier to track, calculate, and report compensation costs accurately.

Equally important is ensuring that your compensation system integrates seamlessly with your ERP and CRM platforms, like Salesforce or HubSpot, for a unified data flow. Solutions like QuotaPath’s integration with Rippling provide end-to-end visibility, helping organizations connect compensation management with financial reporting, facilitating compliance, and operational efficiency.

Step 3: Improve Data Accuracy and Standardization

Accurate, consistent data is critical for meeting the demands of ASU 2024-03. Start by building audit trails, validation checks, and reporting templates now to ensure your compensation data is complete, consistent, and reliable.

Relying on manual processes significantly increases the risk of errors, incomplete or inaccurate disclosures, and potential audit failures. Implementing the right systems and controls early will help mitigate risks and facilitate a smoother transition to the new reporting standards.

Step 4: Align Compensation to Financial Metrics

The new reporting requirements offer an opportunity to go beyond compliance by creating visibility into how compensation impacts business performance. More accurate data enables the alignment of incentive structures with key financial metrics, such as Customer Acquisition Cost (CAC), Customer Lifetime Value (LTV), Net Revenue Retention (NRR), and Gross Revenue Retention (GRR).

Tying compensation to these metrics encourages behaviors that drive long-term value creation by reducing acquisition costs, increasing retention, and boosting customer revenue. This shift supports reporting accuracy and strengthens the connection between compensation strategy and sustainable growth.

Beyond Compliance: The Strategic Advantage

With the right systems in place, real-time compensation data enables more informed business decisions. It informs forecasting, headcount planning, and resource allocation, increasing confidence in financial projections.

For instance, Adobe integrated its compensation systems into a unified platform, resulting in a 60% improvement in forecast accuracy.

Greater visibility also enables Finance to partner with Sales in driving margin-focused growth. Access to accurate compensation data allows them to develop compensation strategies that improve profit margins rather than top-line revenue.

Common Pitfalls to Avoid

Next, let’s talk about challenges. Take a look at these common mistakes to avoid to ensure a smoother path to compliance.

- Waiting until 2026 to prepare: Starting late leaves little time to assess your current systems, clean your data, and implement the necessary process changes.

- Using spreadsheets and email for commission tracking: Manual processes increase the risk of calculation errors, missed payments, and inaccurate reporting. They also lack the audit trails and controls needed to meet the standard’s accuracy and transparency requirements.

- Failing to align sales activities to the right expense categories: Without clearly mapping how sales activities, like commissions and bonuses, flow into financial reporting categories like COGS or SG&A, companies risk misreporting and failing audits under ASU 2024-03.

- Not documenting definitions for selling expenses: The new standard requires each company to define what qualifies as a selling expense. Failing to document this leaves room for inconsistency over time and creates confusion for auditors, stakeholders, and internal teams.

Design, track, and manage variable incentives with QuotaPath. Give your RevOps, finance, and sales teams transparency into sales compensation.

Talk to SalesFinal Thoughts: A Moment for Proactive Finance Teams

Don’t wait to act.

Start gathering the right compensation data now. Evaluate existing processes to ensure your systems can support the level of visibility and auditability required by the new standard. Start a phased implementation approach in 2025. This can help reduce risk, spread out the workload, and allow time to refine processes before the rules become mandatory.

QuotaPath builds visibility, accuracy, and flexibility in compensation management. Schedule time with a team member to see how QuotaPath can streamline the process for ASU 2024-03 compliance.