The shift is on: Sales comp is following the usage-based pricing model.

Usage-based pricing has been the conversation in SaaS and fintech for the last few years. Now, sales comp plans are catching up.

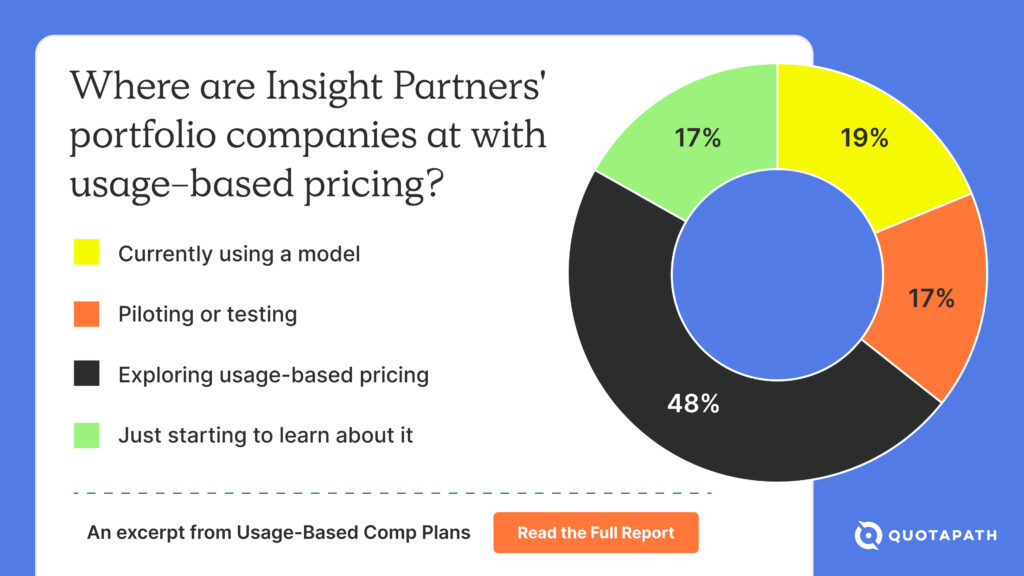

At a recent private event with Insight Partners portfolio companies, the momentum was clear:

- 19% are already on a usage-based pricing model

- 17% are piloting or testing

- 48% are actively exploring

- Only 17% are still just learning

This model works beautifully when customer spend ties directly to operational metrics (think: data volume, payment transactions, or API calls). But changing how you price often means rethinking how you pay your sales team.

That’s where things get tricky.

Report: Usage-Based Compensation Plans

Turning customer consumption into revenue requires rethinking sales compensation. In this report, learn when usage-based comp works, design frameworks, payout strategies, and five anonymized examples from high-growth teams.

View ReportThat’s why we created our Usage-Based Compensation Plans: Trends, Models & Examples from High-Growth Revenue Teams Report.

It’s a deep dive into the state of usage-based comp today, who’s using it, what’s working, what’s not, and the exact plan structures teams are putting in place. Packed with benchmarks, best practices, and anonymized examples, it’s designed to help you decide if (and how) this model could work for you.

Why We Built This Report

We wanted to cut through the noise and give Revenue and RevOps leaders real-world insights from leaders who’ve been in the trenches.

We analyzed dozens of compensation consultation calls, spoke with industry leaders, and pulled in external benchmarks to answer:

- When does a usage-based comp plan make sense (and when doesn’t it)?

- What are the top challenges, and how do teams solve them?

- What frameworks work best?

- What do actual usage-based comp plans look like?

What You’ll Learn

In this report, you’ll find:

- Adoption trends: 60% of SaaS companies use some form of usage-based pricing (OpenView, 2023).

- Common pain points: Forecasting accuracy, delayed revenue realization, clawbacks, and rep motivation.

- Best practices: Hybrid payout models, quota credit vs. payout separation, and onboarding-aligned incentives.

- Five anonymized comp plan examples spanning fintech, infrastructure SaaS, SMB SaaS, and more.

Voices From the Field

You’ll hear directly from leaders like:

-

- Graham Collins, Head of Partnerships at QuotaPath, on the importance of forecasting usage and how this is often industry-dependent.

-

- Scott Shepard, Head of Sales at Tremendous, on tying rep behavior to gross profit instead of just spend, and why onboarding milestones matter for motivation.

-

- Andrea Kayal, CRO at HelpScout, on picking the right value metric and preparing your team with an internal doctrine before rolling out usage-based pricing.

-

- Ryan Milligan, VP at QuotaPath, on hybrid models that keep reps motivated and protect the business from overpayment.

-

- Graham Collins, Head of Partnerships at QuotaPath, on the importance of forecasting usage and how this is often industry-dependent.

A Few Nuggets We Couldn’t Keep to Ourselves

- Hybrid structures are where it’s at. Most successful teams blend forecast-based payouts with true-ups tied to actual usage.

- Quota credit ≠ payout timing. Giving full quota credit at close (even if payouts drip over time) keeps reps engaged without draining cash.

- Early usage is everything. When reps drive onboarding and adoption, usage ramps faster, benefiting both the customer and the business.

Ready to See the Full Report?

If you’re considering or already navigating a usage-based pricing or compensation model, this report will give you the frameworks, examples, and pitfalls to watch for so you can build a plan that motivates your team and protects your bottom line.