Recently, in partnership with RevOps Co-op, we hosted the webinar Mastering Retention, AI, and Sales Optimization to discuss 2024’s trends and best practices.

Our panel included HubSpot’s Director of CS Daphne Costa Lopes, Carabiner Group CRO Cliff Simon, and QuotaPath VP of RevOps Ryan Milligan.

Together, they examined:

- Retention strategies

- AI & advanced analytics across revenue teams

- Sales process and compensation trends

- Product signal optimization

- Tooling & technologies

Now, let’s dive into the five key insights we gained from this insightful webinar.

5. Customers must see results.

Daphne pointed out how difficult maintaining and growing customer retention is right now.

“Companies could afford to have tools in their stack that went under-utilized. Now, companies can no longer afford that. Every spend goes through the magnifying glass,” Daphne said.

As such, it’s on customer-facing teams to show results.

“If you claim your product enables leaders to be more productive, what is the time and dollar savings tied to that?” Daphne said.

She offered suggestions on how to tackle that.

“I’m a big fan of the ‘Jobs to be done’ framework. This framework asks, ‘What are the jobs we’re doing for the customers?’” Daphne said.

By applying this mentality, you align your customer metrics to the metrics the customer tracks for that job. If you can capture that within your system, you can prove the ROI and results of using your tool, strengthening the likelihood of renewal and upsell.

“The CFO has a massively bigger stake at the table,” Cliff added. “It has to come down to dollars and cents.”

4. Manage upsells like sales leads

On top of retention, the trio unpacked upsell opportunities and various ways to approach this strategy.

At HubSpot, Daphne has successfully implemented a “success-qualified lead” strategy. This strategy involves the CSM teams finessing their skills to identify growth opportunities with existing customers. Once they determine an opportunity, they hand off the “lead” to sales or the account managers, depending on how the organization is structured.

“In that way, the CSM can continue to retain their status as their trusted advisor,” Daphne said. “Then sales takes over that qualification and leads the sales convo with the customer.”

That’s not to say she is against CSMs running upsells, however.

“It’s a matter of maturity and complexity,” Daphne said.

Cliff, who said he’s a big fan of this setup, stressed the importance of setting up a solid operating cadence that allows the AMs, CSMs, and AEs to walk in lockstep.

“Look at product data and identify the green field opportunities,” Cliff suggested.

RevOps, sales leaders, and finance teams use our free tool to ensure reps’ on-target earnings and quotas line up with industry standards. Customize plans with accelerators, bonuses, and more, by adjusting 9 variables.

Build a Comp Plan3. Blend GRR + NRR for CS compensation structures.

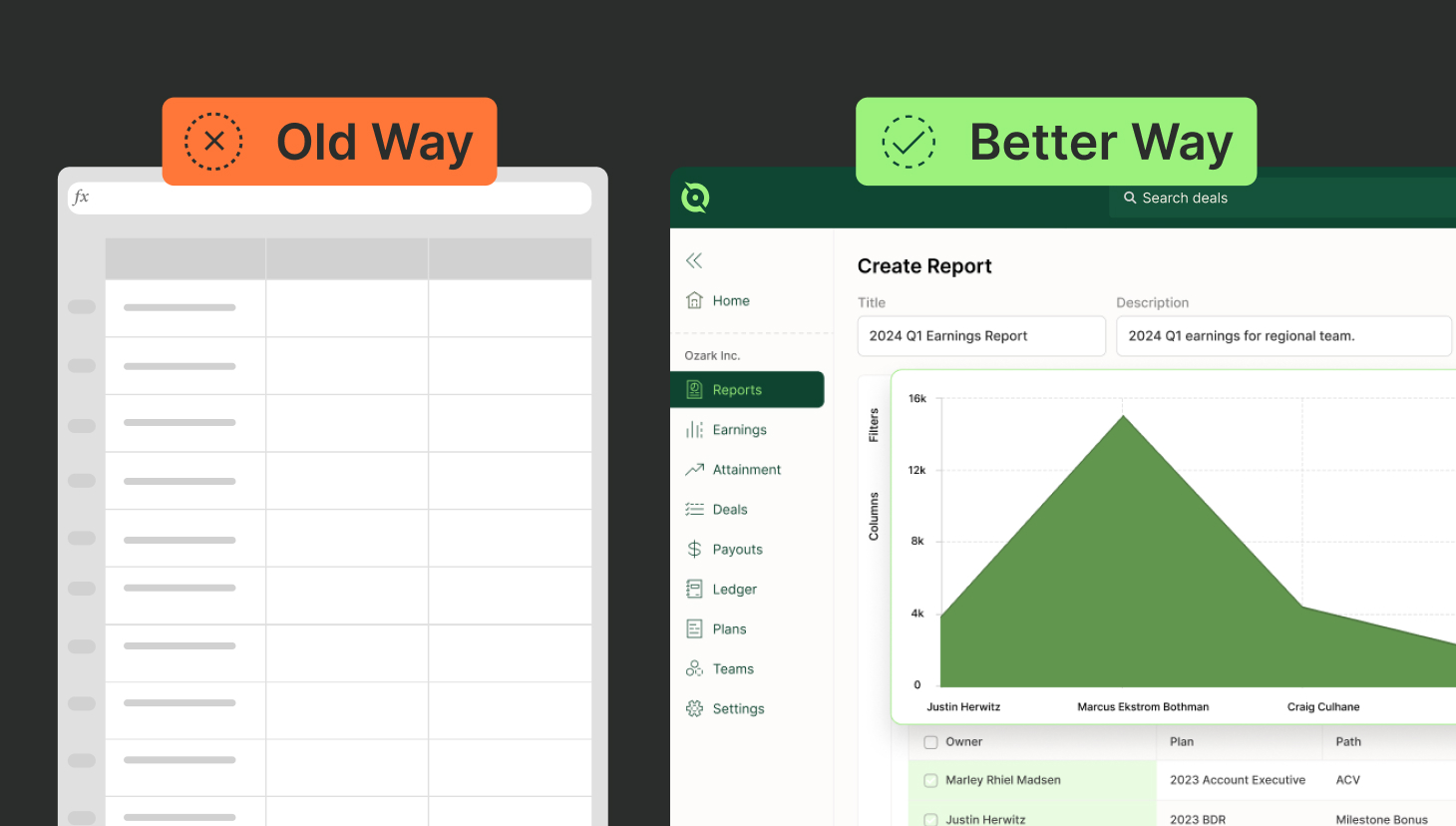

To expand on that, Ryan offered some best practices for structuring compensation plans to drive retention.

“If you’re selling completely different products within an organization, pulling in someone else can be extremely helpful,” he said. “But if you’re a smaller org., it’s optimally efficient to have your CS run upsells and renewals.”

He suggests compensating on two major drivers, gross revenue retention (GRR) and the upsell, which backs into net revenue retention (NRR).

“I like to split them because NRR can hide bad behavior,” Ryan said. “If you have one big whale customer that keeps growing, your NRR rate can hide the fact that you have all these other customers churning.”

Remember, it’s easier to sell to the customers you have. You don’t want the number of customers to be shrinking.

2. Win retainable customers from the sale.

Another way to master retention is by winning customers who are most likely to renew from the jump.

Ryan pointed out that this is a slight shift in mindset and strategy from a few years ago when teams were most concerned with signing up customers who would sign up today rather than those who would stay a while.

That’s where ideal customer profiles (ICP) come in.

“Identify characteristics down the funnel that make them a good customer,” Ryan said. “This could be types of roles, sizes of businesses, industry, for example.”

Then, move that definition up the funnel and compensate everyone who brings those conversations to the door.

“If you give BDRs $50 for every demo that occurs, give them another $25 if it’s an ICP demo,” Ryan said. “Reward higher commission rates for your sales team if it’s an ICP account.”

This will help incentivize your team to bring on great customers.

1. Complement AI with personalization.

Lastly, as organizations continue to introduce AI into their practices, it’s worth noting that personalization remains the key to delivering good experiences.

“Everyone is learning and playing with the same playbook,” Cliff said. “You have to create excellent customer experiences, show up consistently, and do what you said you would do. That’s how you stick out.”

So, instead of using AI to create generic messaging, consider using it as Ryan does for quick categorization and classification of high volumes of text (think: churn, win, and loss reasons, understanding key features, or summarizing long transcripts or notes).

“I think people care most about that you know the problem they are facing and how you can solve it,” said Ryan. “If I use AI to read one of your quarterly reports and pull key findings from it, then I can personalize my messaging based on that problem.”

Design, track, and manage variable incentives with QuotaPath. Give your RevOps, finance, and sales teams transparency into sales compensation.

Talk to SalesConclusion

That’s some excellent advice from our three experts.

Visit our Resources page for more content supporting RevOps professionals and ways to run your business more efficiently. We’ve got free commission calculators, compensation plan templates, reports, and guides to help.

And if you’d like to see how QuotaPath can align your compensation strategy with your business objectives while tracking and predicting its performance and cost, schedule time with our team today.