In our 2024 Compensation Trends report, “Solving the biggest sales compensation challenges: Insights from 450+ Finance, RevOps, and Sales Leaders,” leaders identified “alignment to business goals” as the most needed improvement in the sales compensation management process.

This report is based on a global survey we conducted during the first half of 2023, which targeted directors, VPs, and C-level executives from RevOps, Finance, and Sales leaders

We asked leaders, “What area of your sales compensation management process needs the most improvement?”

25% reported “alignment to business goals” as the top focus, followed by improving simplicity, optimization, visibility, and automation.

Today, we’re focusing exclusively on alignment with business goals because it’s imperative in today’s economic environment. As companies continue to set their key business metrics based on driving efficiencies, the comp plans must account for these changes.

Because if they don’t align, companies often end up with plans that drive the wrong selling behaviors or promote types of deals that jeopardize the organization’s strategic targets.

The rest of this blog will focus on what causes misalignment, how confidence over alignment varies by role, and 6 steps for ensuring alignment.

Let’s get started.

What causes misalignment?

So, how does misalignment happen? Usually, it’s one or more of the following.

Creating the plan before finalizing goals: Organizational goals must come first, then you can design your comp plan with those in mind. Then, include targets and tactics specific to those goals.

Lack of communication: If sales compensation plans are created in silos, without collaboration from multiple departments, the chances of the plans not aligning with the overall goals of the business increase.

Short-term focus: If sales compensation plans focus exclusively on short-term goals, such as hitting sales quotas or generating new leads, reps tend to focus on activities that help them achieve their individual goals vs. company-wide goals.

Plan replication: Sometimes, new leaders bring compensation plans from their previous company. This risks misalignment because what worked elsewhere likely won’t work in a brand-new setting. Existing leaders who want to re-use last year’s plans instead of updating the terms can also lead to misalignment.

Varying levels of confidence between roles

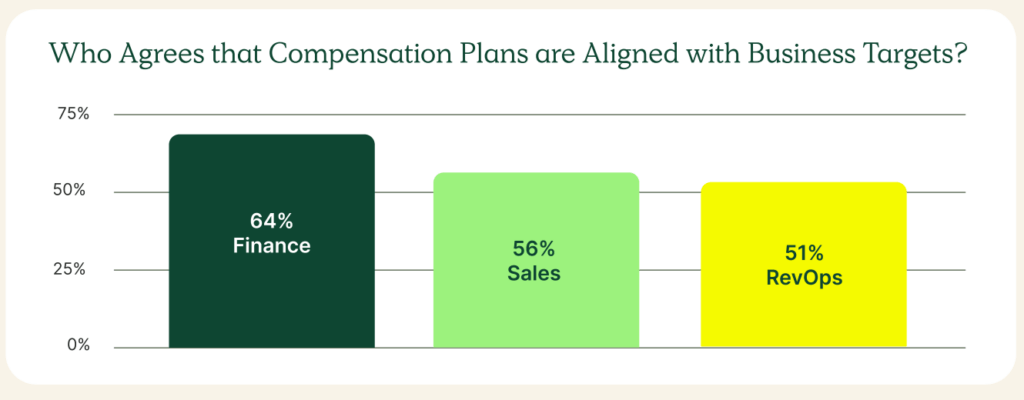

In addition to misalignment, as the top area leaders wish to see improvements, a discrepancy of confidence between roles unfolded in the report. When we asked leaders to rank their confidence that their comp plans align with business goals, 39% admitted their plans are misaligned.

Broken down between roles, nearly half of RevOps leaders (49%) disclosed that their comp plans are not fully aligned with their business goals. Whereas Finance leaders were the most confident, with 64% declaring alignment.

This may signify a worrisome inconsistency, particularly for RevOps, whose responsibility is to ensure alignment between comp plans and business goals.

“There’s usually a collaboration on the plans between Sales, RevOps, and Finance, with Finance having the final approval and installing their guard rails,” said QuotaPath VP of Finance Ryan Macia. “Since Finance typically has the final say, it makes sense that they are most confident, whereas Sales and RevOps may have asked for something that Finance felt wasn’t viable for the business.”

So what does this mean?

There’s an opportunity to partner with Finance earlier in the comp plan design process. In doing so, collaborative conversations can occur to align departments, ensure there are plan components that motivate reps and don’t break the plan model, and drive behaviors that push the core business goals.

Streamline commissions for your RevOps, Finance, and Sales teams

Design, track, and manage variable incentives with QuotaPath. Give your RevOps, finance, and sales teams transparency into sales compensation.

Talk to SalesOvercome sales compensation misalignment in 5 steps

To help, bring Finance in earlier and follow these steps to ensure you align sales comp plans to business goals.

Step 1: Establish your business goals or objectives with your executives and Board. If you have leaders not present during these conversations who are responsible for building the compensation structures, host additional meetings to ensure they clearly understand these.

Step 2: Assemble a compensation plan design committee. Invite senior leadership from your revenue-generating teams (Sales, Customer Success, Marketing, Finance).

Step 3: Solicit feedback from reps to discern what they like and dislike about their past and present compensation plans.

Step 4: Collaborate with the plan design committee to incorporate compensation levers into all revenue team plans that bolster the objectives from Step 1.

For example, if your business focuses on gross revenue retention for the year, you might include the following elements in your various comp plans.

- Account executives: Greater commission rate on ideal customer profile (ICP) deals with greater potential to renew.

- Sales development reps: Higher bonus for every ICP-qualified lead.

- Account managers: SPIF on multi-year contract conversions and early renewals.

- Customer success: Bonus for each flawless net promoter score following onboarding.

Step 5: Pressure test the proposed plan against the prior year’s performance and the upcoming year’s objectives to gauge financial viability.

Align sales comp with business goals

From our report, revenue leaders identified “alignment” as their most needed area of improvement for comp planning.

To ensure alignment, remember to establish business goals first. Assemble a comp plan design committee after objectives are finalized.

Then, solicit rep feedback and collaborate to include compensation methods to drive behaviors that support objectives. Test for financial viability and gain final approval.

Looking for more help with compensation? Download the full report or chat with our sales team on sales compensation management improvements using QuotaPath.