Sales compensation cliffs, aka thresholds where reps earn nothing until they hit a certain level of quota, are a relic of a bygone era. And they’re still showing up in comp plans today.

But should they?

In a recent viral LinkedIn post, Ryan Milligan, our VP of Sales, Marketing, and RevOps, called out the outdated logic behind cliffs. His take? “I’m not a fan.”

And neither are most GTM leaders.

“A comp plan should always tell a rep to close a deal today,” said Ryan.

He explained the common argument for cliffs: that reps should “feel it” if they don’t hit 70% of their quota.

But, “feel it” shouldn’t mean zero earnings.

Because when a rep realizes they’ll earn nothing for closing a deal late in the quarter, their incentive shifts away from helping the company and toward sandbagging until next quarter.

The Hidden Cost of Cliffs: Sandbagging & Rep Attrition

Cliffs don’t just punish underperformance. They distort behavior.

Matt Green, CRO at Sales Assembly, said in a comment, “The moment a rep realizes there’s zero payout under a threshold, they stop optimizing for revenue and start optimizing for optics.”

These optics, holding back deals, discounting, or even manipulating pipeline, cost your business real revenue. Jordan Kennedy, CEO at Jump, added that even leadership comp plans with cliffs risk backfiring.

“I’ve seen this in leadership plans as well… no reason to have it,” said Jordan.

And Lindsay Rios, a fractional GTM leader, pointed out a cultural risk

“Cliffs won’t change underperformance… but they will make a person feel like they aren’t valuable unless they sell a certain amount, which is not a culture I’m interested in building,” said Lindsay.

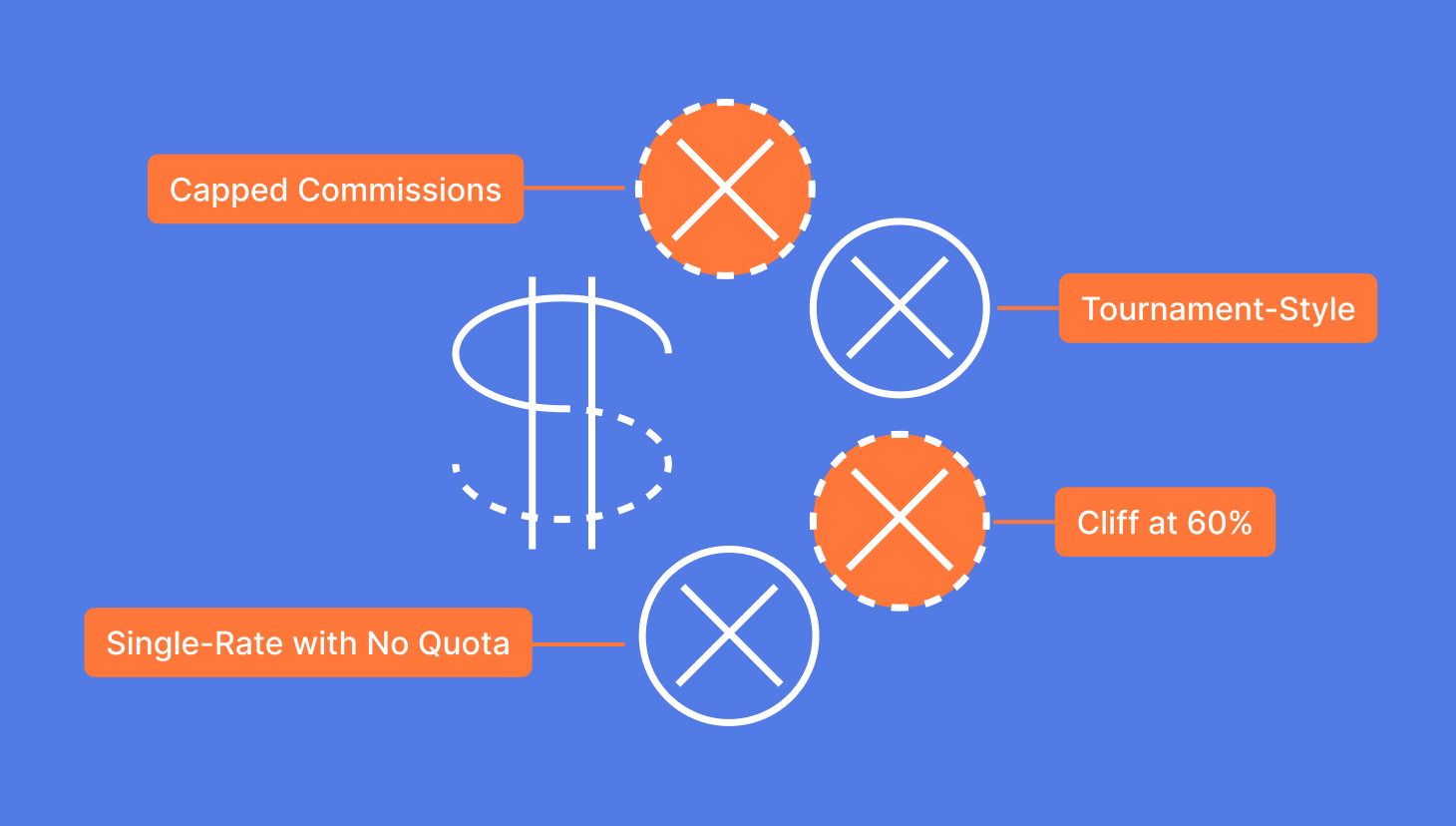

5 of the Most Problematic Comp Plans

Does your plan frustrate reps more than reward?

Take Me to BlogA Better Way: Retroactive Accelerators

Instead of commission floors, Ryan proposed a tiered approach that offers some commission for early efforts and rewards higher performance retroactively once thresholds are met.

This hybrid model:

- Provides reps with motivation to close in-quarter

- Offers the “dopamine hit” of milestone attainment

- Reduces the risk of pipeline gaming

“If I’m at 60% at the end of the quarter, I have zero motivation to close a deal that gets me to 65%. But if I earn something for that, I’m closing it today,” said Ryan.

Report: Ramping Comp Plans

We surveyed revenue leaders from 114 organizations across industries to get a pulse on the most common strategies, payout structures, and ramping time frames.

View ReportWhy Finance Should Care

For finance leaders, cliffs might seem like an efficiency play, holding back comp for sub-par performance. But the real cost is in lost pipeline momentum, future churn from demoralized reps, and operational drag from deal reshuffling.

As Barry Flanagan, VP of Sales at eG Innovations, said “If they get nothing if they don’t make 70%, they absolutely will sandbag… which is bad for the company.”

Plus, when you factor in recruiting, onboarding, and ramp time, replacing one demotivated rep is often more expensive than just paying fair, performance-based compensation in the first place.

Design, track, and manage variable incentives with QuotaPath. Give your RevOps, finance, and sales teams transparency into sales compensation.

Talk to SalesFinal Thoughts

Cliffs not only hurt reps, they also hurt revenue. They reduce trust in comp plans, distort sales behavior, and make it harder for finance teams to forecast earnings and CAC.

If your goal is efficiency, alignment, and growth, then leave cliffs behind.

Want to explore better comp plans? Book a demo with QuotaPath and learn how you can ditch cliffs, model what-if scenarios, and build a comp structure that motivates without surprises