Orchestrating the perfect deal and aligning sales compensation to said deals is no easy task.

That’s true for all companies and is especially challenging in the startup space.

“People pay unsustainable rates and ignore the true economics of the business,” said Pavilion CEO and serial entrepreneur Sam Jacobs.

For instance, paying a salesperson 20% of a deal as a base compensation rate in addition to a base salary is not sustainable. That’s not profitable long-term, especially when you factor in the high churn rates of today’s market and everyone else who earns a cut from the deal.

“There’s a lot of other people that need to get paid from that when it comes time to compensate, and the revenue is supposed to cover everything,” Sam said. “So, if you’re paying 20% to the rep, a SPIF to the sales development rep, a percentage to the sales manager, and another cut to the VP, it eats so much into the economics of the business.”

Really, the only real way to make that work is if customers never churn.

“As much as everybody acts like they have massive lifetime value and zero churn, that’s just not how the world actually works,” Sam said.

So, what do you do?

Below, Sam and Stage 2 Co-Founder Mark Roberge and Partner Liz Christo offer how to approach sales compensation plans for startups.

Read on for their best practices, plus three sales compensation plans for startups.

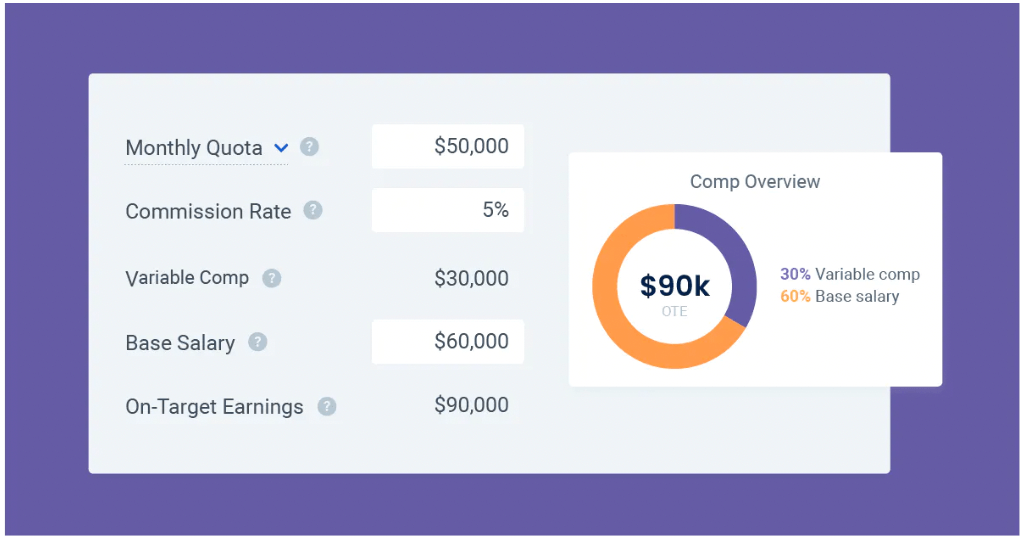

RevOps, sales leaders, and finance teams use our free tool to ensure reps’ on-target earnings and quotas line up with industry standards. Customize plans with accelerators, bonuses, and more, by adjusting 9 variables.

Build a Comp PlanAlign outcomes of the comp plan with the goals of the company

Instead of paying the highest commission rates to attract top talent, focus on aligning the compensation plan’s outcomes with the company’s goals. If you don’t, you’ll end up with a plan that contradicts your sales process or end goals, which happened to Sam as a VP of Sales.

“Many years ago, one of my reps came to me and said, ‘You’re paying us on annual recurring revenue, but we’re selling less than 12-month deals. You’re gonna break the company.’” Sam said.

That same rep then figured out how to sell super short-term deals that messed up the comp plan. As a result, the rep racked up over $200,000 in commissions in one quarter.

“We had to pay him in two installments because we literally were worried about running out of cash for the business,” said Sam. “He was right, and I was wrong.”

To avoid making similar mistakes, identify your fundamental focuses as a business — gross revenue retention, net new revenue, customer acquisition cost, etc. From there, build intentional drivers within your compensation plan for every role that motivates those behaviors.

For startups, customer acquisition cost (CAC) usually ranks as one of the top metrics. It measures the cost of obtaining new customers and is used to determine the effectiveness and efficiency of a company’s sales and marketing efforts.

With CAC in mind, you can design your comp plan by paying higher commission rates or bonuses on logos that fit your ideal customer profile (ICP). Your ICP will consist of customer profiles most likely to renew as well as those who see time-to-value the fastest. That means lower CAC because getting them set up successfully in your platform won’t take as long or as many resources.

Calculate OTE:Quota ratios

Use this free calculator to ensure your reps’ on-target earnings and quotas mirror what they’re bringing in for the business.

Try it NowStart comp plan design at the C-suite and board level, then let RevOps drive

Mark recommends starting the design process with your C-suite and board members to align your comp plans to business goals succinctly. This group of leaders will nail down the business objectives so that you can then go backward to model the comp plan to drive those targets.

These targets might include CAC, like above, entering a new market, launching a product, improving churn, increasing rep productivity, and bettering forecasting accuracy.

“One of the most powerful tools every CEO has in their tool chest to align their organization around the strategic plan is the sales compensation plan,” said Mark.

You can do this by identifying the top 3 to 5 business objectives and then asking your leadership, “Can any of these priorities be reinforced by sales compensation design?”

“Sometimes they can’t — but sometimes they can,” Mark said. “And if they can, in my experience, that line of thinking yields the optimal plan and is the number one tactical implementation to drive the strategic objective.”

As far as who owns it, Mark said if your team has RevOps, allow your RevOps team to drive the design with your VP of Sales as the plan’s executive sponsor or approver.

Design, track, and manage variable incentives with QuotaPath. Give your RevOps, finance, and sales teams transparency into sales compensation.

Talk to SalesCreate a sales compensation plan for startups that’s flexible

Next, remember that your startup sales compensation plan must be flexible.

At Stage 2, Liz supports Series A to Series B-stage companies. As such, her suggestions on how to approach comp plan building allow for more flexibility and include some key differences from industry-wide comp plan inputs.

For instance, most comp plans include a Quota:OTE multiplier between 5x and 7x (quota is 5-7x larger than the on-target earnings). But for startups, Liz recommends a 4x multiplier.

She also suggests testing the comp plan with a few of the sales reps to get “market feedback” before implementing. Look at the pricing of your product and how you compensate your sales team to come up with the best product pricing and packaging and rep compensation.

Lastly, Liz recommends shying away from annual quotas for early-stage organizations.

“I’d pull back to a quarterly quota,” Liz said. “This allows you to mimic building an annual plan but gives you the flexibility to set appropriate quotas as you see changes in your sales cycles.”

“It also sets everyone up for success knowing they aren’t signing on for a plan that is daunting and too far away.”

Sales Compensation Calculator

Calculate OTEs, sales quotas, and commission rates to design your sales compensation plans.

Try for FreeDon’t spend a ton of time testing edge cases

Our last piece of advice on startup sales compensation plans comes again from Sam, regarding edge cases.

His tip? Recognize that your plan won’t be perfect, and avoid over-testing outlier scenarios.

“You’re solving for most of the time — not every single time,” said Sam.

Mainly, solve for rep understanding. Because when they know what to do, they’ll stay late, as Sam says.

3 sales compensation plans for startups

Some of the most common startup sales compensation structures are the most simple. Below are 3 comp plan examples to get you started.

| Single-rate commission | This plan is simple to execute and understand. You set a flat commission rate that applies to every deal regardless of attainment. The standard commission rate in SaaS in 10%. This template includes a 10% commission rate with adjustable fields for on-target earnings, average sales price, and more. Input your numbers, then automate commission tracking in QuotaPath for free for 30 days. |

| Commission with accelerators | A compensation plan with accelerators pays out a higher accelerator commission rate when a rep surpasses an attainment threshold. So, if you take the standard rate of 10% from the above example, the accelerated rate might jump to 15% after a rep achieves 100% quota. This comp plan template includes a 10% rate and a 15% accelerator. The pre-set inputs also include a 50/50 paymix and OTE of $140K, although these fields are adjustable to better align with your organization. |

| Commission with decelerators and accelerators | Unlike an accelerator that ups the commission rate after reaching a key performance milestone, decelerators entail a commission rate lower than the standard rate. You would use a decelerator when you’re trying to encourage reps to meet a specific threshold before unlocking the standard rate. For instance, this interactive comp plan template pay a decelerator of 5% for every deal sold between 0 and 50% to target. Once the rep surpasses 50%, they begin earning the standard rate of 10%. Then, after 100% is achieved, the accelerator, 15%, unlocks on all deals thereafter. |

For additional comp plan templates, check out our free resource Compensation Hub.

Design, track, and manage variable incentives with QuotaPath. Give your RevOps, finance, and sales teams transparency into sales compensation.

Talk to SalesAutomate your startup’s sales compensation management

Need guidance on designing compensation plans that drive your business goals? We’re here. Use QuotaPath to partner on building impactful compensation plans that drive efficiency and success toward your financial goals. Then, automate your sales compensation management process using QuotaPath to give visibility into commissions, build accountability, and rally your team.

Schedule a demo with our team, or start your free trial today.