Incentive compensation plans motivate and reward employee performance and are commonly used in sales and sales-adjacent fields.

At its core, an incentive comp plan aims to motivate employees to achieve specific goals or objectives tied to company targets.

That’s well-known and widely understood.

However, in our recent study, 97% of revenue leaders reported challenges during compensation plan design. Moreso, 100% admitted to struggling with the management and execution of their compensation strategy.

At the design and management stages, common themes popped up throughout the report, such as unnecessarily complex plans, their compensation structure’s inability to motivate reps, and a lack of alignment at the leadership level and between comp plans and business goals.

In our experience, the best incentive compensation plans align with the organization’s overall goals and motivate revenue teams to achieve those goals. They are fair, logical, easily understood, and, most importantly, equitable.

Read on to learn how to build compensation plans that motivate, align, and impact the results your organization seeks to achieve while rewarding employees.

Objectives of incentive plans

First, let’s start with the objectives of annual incentive plans.

The primary objective of an incentive compensation plan is to motivate employees to achieve certain goals or objectives. These goals can be specific to the individual employee, the team, or the organization.

Some common goals that incentive compensation plans are designed to achieve include:

- Increasing sales

- Improving customer satisfaction

- Reducing costs

- Launching new products or services

- Expanding into new markets

- Improving employee engagement

- Rewarding overperformance

- Aligning and driving business goals

- Recruiting and retaining top sales talent

Effective incentive plans: Key elements

Next, let’s review the key elements.

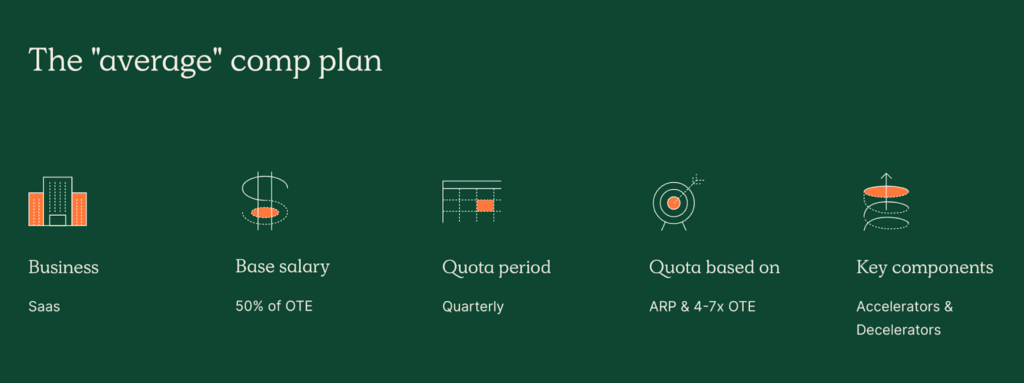

We’ve seen and supported thousands of compensation plans. The most effective structures include healthy quota to on-target-earnings (OTE) ratios, high team-wide attainment results, and commission rates that are high enough to drive selling behaviors but low enough to maintain appropriate effective rates.

| On-target earnings | Your OTE is the total amount of money you will earn if you hit 100% of your quota and consists of base salary plus variable pay |

| Quota:OTE Ratio | The Quota:OTE ratio is the difference in multiple increases between a rep’s on-target earnings and their quota. In SaaS, this multiplier is normally a quota that is 5x larger than the OTE. (Free calculator) |

| Effective rate | The effective rate in sales is the percentage a company pays out on a sale via commissions. This includes the director, sales development rep, and anyone else who earns commission from a singular deal. |

To measure your incentive program effectiveness, consider the following.

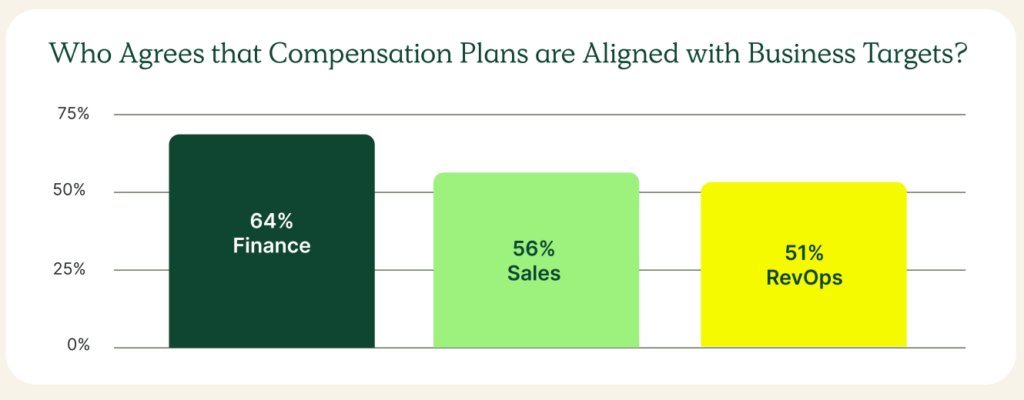

Do your compensation plans align with your most important business metrics?

From this year’s compensation trends report, 39% of leaders said their comp plans do not align with their key metrics, like gross revenue retention, gross margin, and customer acquisition cost.

Some plans even contradict business goals.

For example, if your company focuses on increasing gross revenue retention, the comp plans should drive GRR. To do that, you might add accelerated commission rates on multi-year deals (comp plan template) or when a customer signs from a segment that data shows has the highest retention rates or your ideal customer profile.

Will your company hit this quarter’s targets?

Look into how close or far your team is from hitting this quarter’s goal.

If it’s far off, you’ll need to change something, but it might not be at the comp plan level. For instance, you may need to reconfigure business goals and financial projections first and then adjust your compensation plan to help get there.

What percentage of your team has or is on pace to finish the quarter at goal?

80% of your team should hit their quotas. Our report found that 91% of companies are well below 80%.

If that sounds familiar, look into the problem. Is it for lack of pipeline opportunity? Subpar closing abilities from your team? Reps aren’t motivated?

Identify the problem first so that you can address it. Then, look into the compensation structure. How realistic are the quotas and OTEs?

What data did your team collect to set these initially, and does that data match today’s market? If not, consider lowering quotas to avoid disgruntled reps who will eventually churn.

Does Sales Leadership offer coaching, training, and support?

To succeed, your sales team should have access to continued coaching, support, and training. Give them your time, resources, and enablement to help them grow and do their jobs more efficiently.

Take a look at the difference between your lowest-performing rep and your highest

Look into the gap between your highest and lowest-performing reps. Why is there such a difference? Is it territory-related? If so, you should adjust your plans or territories to make them more equitable.

Is your effective rate too high?

Your effective rates could indicate that you’re paying your team too much per sale, especially if they’re not hitting goals.

If so, consider adding a commission floor or cliff so that reps must meet a minimum threshold before being eligible to earn commissions. But be careful with commission floors. If they too low, you probably shouldn’t have one. Reversely, if the cliff is too high, you’ll discourage reps who may start sandbagging.

Rep feedback

While numeric data is always helpful, you should also collect anecdotal data. Get rep feedback. Do they understand how they make commissions? Are they motivated by it? If not, find out what would.

Designing incentive compensation: What works best?

In addition to comp plans that are logical, fair, and simple to understand, the best sales compensation plans often include an accelerator, pay earnings as close to the sale date as possible, and have no cap.

This is according to data we gathered for our 2023 Sales Compensation Trends report.

An accelerator in sales pays reps a higher commission rate, usually 1.5x their commission rate, for achieving a quota attainment milestone or selling a more extended contract, for example. Similarly, decelerators pay less than the base commission rate until reaching a threshold. They work like cliffs, except the rep earns commissions at a lower rate versus no commissions.

Although, keep in mind that you can’t go wrong with a single-rate commission plan for its simplicity.

Additionally, your quota period or frequency should be tied to the length of your sales cycle. For those with shorter sales cycles, consider a monthly or quarterly period. For longer deals, an annual frequency will be more appropriate.

Some general principles to follow when designing incentive compensation plans:

Base the plan on clear and measurable goals | The goals that employees are rewarded for achieving should be clear and measurable. This will help ensure the plan is fair and equitable versus an unfair compensation structure. |

Use a variety of rewards | Employees should be rewarded for their performance in a variety of ways. This could include financial rewards, non-financial rewards, or a combination of both. |

Make the rewards meaningful | Incentives should matter to the reps and employees. This means that the rewards should be something employees value and are motivated to achieve. |

Communicate the plan effectively | Your incentive compensation plan should be communicated effectively to all employees. Employees should understand how the plan works and how they can earn rewards. A commission management tool can help. |

The role of performance metrics in incentive plans

We use performance metrics to measure employee performance against the goals in the incentive compensation plan. The performance metrics used should be relevant to the goals of the plan and to the job that the employee is doing.

Some common performance metrics used in incentive compensation plans include:

- Sales revenue: The total money a company generates from selling its products or services. It is calculated by multiplying the quantity of products or services sold by the selling price

- Customer satisfaction: Measures how satisfied customers are with a company’s products or services, often through surveys or customer feedback forms

- Cost savings: The amount of money a company saves by reducing costs. Leaders often realize cost savings by increasing efficiency, reducing waste, or negotiating better prices with suppliers.

- New product launches: New product launches can be a way for companies to increase sales, grow market share, and differentiate themselves from their competitors

- Market share growth: The increase in the percentage of a market that a company controls. You can increase market share growth by increasing sales, attracting new customers, or acquiring competitors

- Employee engagement: The level of commitment and enthusiasm that employees have for their work

Other common performance metrics that may be used in incentive plans include:

- Profitability: Weighs how much a company is worth

- Efficiency: Measures how well a company uses its resources and is an important metric to track because it can help a company reduce costs and improve profitability

- Quality: Measures how well a company’s products or services meet customer expectations, which can help predict retention

- Innovation: The development of new products or services to stay ahead of the competition and grow market share

Streamline commissions for your RevOps, Finance, and Sales teams

Design, track, and manage variable incentives with QuotaPath. Give your RevOps, finance, and sales teams transparency into sales compensation.

Talk to SalesBalancing risk and reward

One of the challenges when it comes to designing an incentive compensation plan is balancing risk and reward.

On one hand, the plan should motivate employees to achieve their goals. Conversely, the plan should not create too much risk for the organization.

To balance risk and reward, use a tiered reward system. In a tiered reward system, employees earn rewards at different levels based on performance. For example, an employee might earn a 10% bonus for achieving 100% of their goal, an accelerator of 15% or achieving 110% of their goal, and a 20% bonus for achieving 120% of their goal.

You could also put in cliffs or decelerators to mitigate risk and add measures that guarantee a rep meets a certain performance level before earning higher commissions.

Check out this blog to learn how to test your comp plan for risks.

Case Studies: Successful incentive compensation models

One of the most successful case studies we’ve seen from a company that underwent a comp plan makeover is EverView.

Before implementing QuotaPath and leveraging our team’s expertise in comp plan guidance, Everview had 35 compensation plans for their 80 reps, with some plans having as many as 12 components or routes to earn commissions.

Their sellers had no visibility into how they made commissions and went into paydays without knowing how much their checks would be.

Not only did this collection of comp plans create a headache for those who had to calculate and pay commissions, but the reps didn’t understand their comp plans.

EvervView partnered with team members to reduce comp plans from 35 to 8 and again to one plan. This simplification of the plan, paired with rep visibility into their earnings and forecasted commissions, led to record-breaking deals for the EverView sales org.

“From the top down, we consistently communicated the comp plan, the area or vertical our team should be focused on and directed our sellers to review in QuotaPath what their earning potential could be,” said Ron Morgan, EverView’s Director of Commercial Operations.

“Our comp plan was easily measured and viewed by our sellers in QuotaPath, which drove positive selling behaviors.”

Aligning incentive plans with organizational goals

If you take nothing else from this blog, remember the importance of aligning your incentive plans with your company’s goals.

You can ensure alignment by bringing Finance to your comp planning proposal discussions early to learn the main objectives.

Then, follow these steps.

First, do not start the comp plan design process until you clearly understand your business goals. Host meetings with the executive team, board, and whomever else involved in the planning to ensure you’re clear on this.

Next, create a compensation plan design committee that includes cross-collaboration from Finance, Sales, your C-Suite, and even Marketing and HR.

Schedule time to collect feedback from your reps face-to-face or over a survey. This will help you create a plan that aligns with your targets and motivates your reps.

You’re ready to work with your comp plan design group to create compensation components that directly push this year’s metrics.

Then, you test it. Use last year’s numbers to see what the plan would pay out. Run some edge cases and plug in the earnings numbers using next year’s projections to see how viable the plan is.

Calculate OTE:Quota ratios

Use this free calculator to ensure your reps’ on-target earnings and quotas mirror what they’re bringing in for the business.

Try it NowPitfalls to avoid

We’ve listed pitfalls to avoid throughout, but to double down, stay away from:

- Overcomplicating by providing too many streams or boundaries to earn commissions

- Building plans that don’t have your critical metrics in mind

- Quotas that are too easily obtained, or reversely, unrealistic quotas and OTEs

- Not providing reps visibility into progress and their compensation plans

About QuotaPath

You should feel well-equipped to build an effective comp plan. However, we are still here to help.

Connect with our team to learn comp plan best practices and how to run and manage sales compensation more efficiently through accurate commission tracking.