Commission management includes the process of tracking, calculating, and paying commissions to sales reps. It is an essential part of any sales compensation plan with the ability to make a big impact on the motivation and performance of sales reps, as well as those who oversee compensation.

Take Executive Vice President of Revenue Operations Dennis Dube, for example.

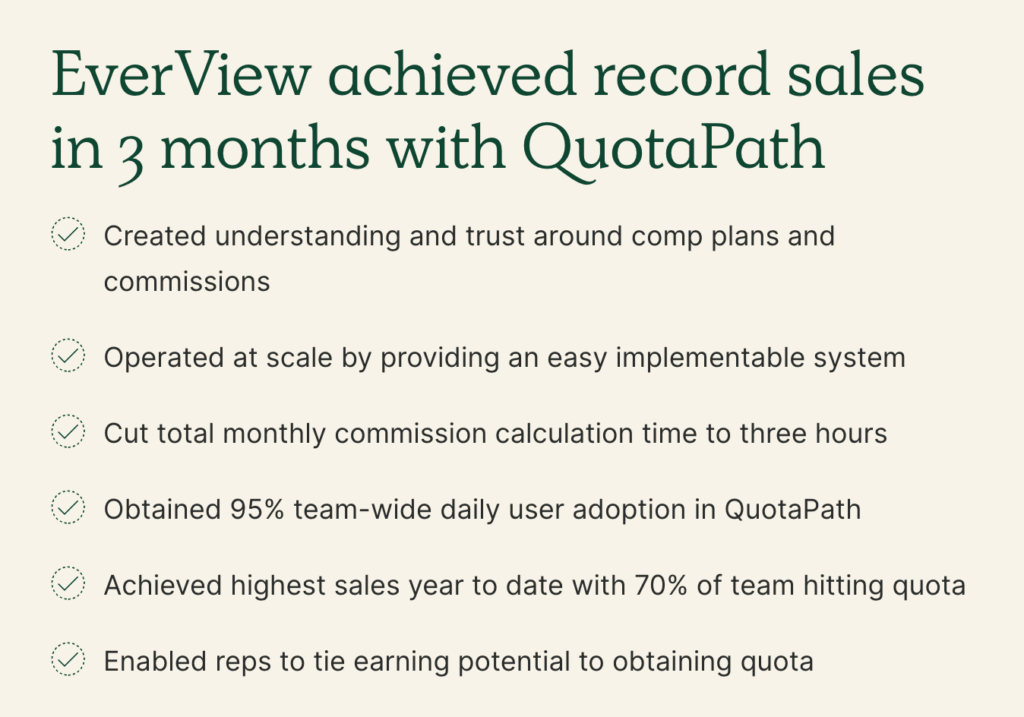

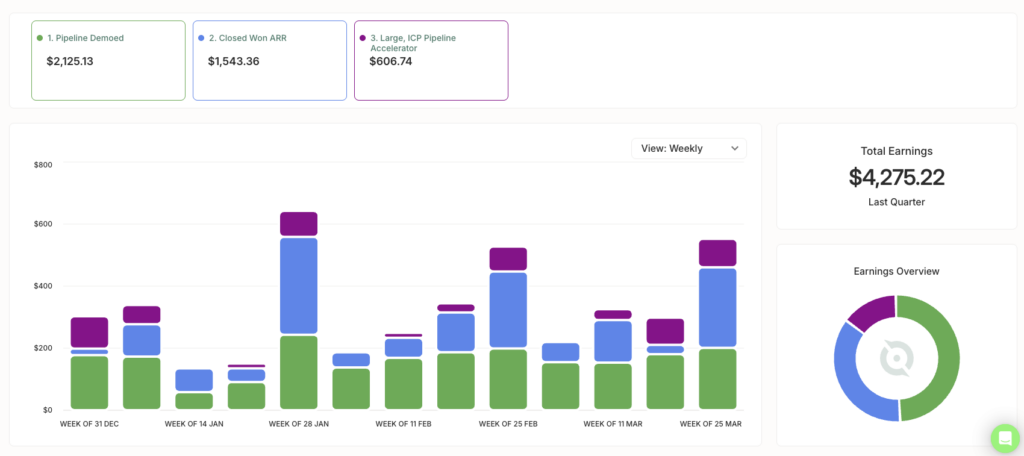

Dennis leads EverView’s 100+ person sales team. Today, they use QuotaPath to set up commission structures and automate commission tracking.

But that wasn’t always the case.

Try QuotaPath for free

Try the most collaborative solution to manage, track and payout variable compensation. Calculate commissions and pay your team accurately, and on time.

Start TrialBefore implementing our help, Dennis and his team calculated commissions manually for 80 reps under one of 35 compensation plans.

“At the time, sellers didn’t know how much their paychecks would be until they received those checks,” Dennis said.

What’s more, a survey revealed that his reps spent two hours per week trying to track and calculate their earnings in Excel. Plus, half of them didn’t understand their comp plans or how they earned commissions.

These survey results, and a text message on a Saturday that read “If you don’t approve a commission calculation within the next hour, then our sellers won’t get paid on time,” led Dennis to QuotaPath.

“It was then that I knew it was time to get a better system in place,” Dennis said.

What’s more, after adopting QuotaPath, EverView had a record sales year.

A well-designed commission management system can help to ensure that sales reps are motivated to sell, and that they are compensated on time for their efforts.

Solutions like ours can also help to track the effectiveness of the sales compensation plan and showcase where adjustments are needed. But maybe even most importantly, it can remove the need for any panic-fueled texts on a weekend for those who oversee commission payments.

Read on to learn more about commission management.

Commission Management: Understanding the Basics

First, we’ll start with the basics of commission management.

You should begin your compensation strategy by setting clear goals and objectives that align with your organization’s key north star metrics.

As an example, if gross revenue retention (GRR) is your company’s biggest focus, your compensation strategy should support that across every role.

In practice, this would look like account executives earning higher commission rates on multi-year contracts and higher bonuses for sales development reps who qualify leads that classify as your ideal customer profile. For account management, you could incentivize GRR by paying higher bonuses or commission rates on early renewals or those that convert from monthly to annually, or annually to multi-year.

Some other best practices include:

| Set clear goals and objectives | The first step in sales commission management is to set clear goals and objectives. What do you want your sales reps to achieve? Once you know what you want to achieve, you can start to design a commission plan that will help you reach your goals. |

| Choose the right commission structure | There are many different commission structures to choose from, including revenue-based, consumption-based, and shared territories. |

| Set the right commission rates | The commission rates you set will determine how much money your sales reps earn. Set rates that are fair and competitive and understand that the average standard commission rate in SaaS is 10%. |

| Track and report commissions | Preferably with a commission tracking system like QuotaPath so that you can eliminate the heavy upkeep of a manual process and reduce errors. |

| Pay commissions on time | Don’t put yourself in a position that Dennis found himself in. Pay your commissions on time to keep sellers motivated and productive. A tool like QuotaPath can help you ensure your team meets payout schedules. |

Free Sales Commission Calculator Template

A free spreadsheet to simplify the commission tracking process. Track what you or your team have earned in 4 inputs.

Download NowCommission Structures

There are several commission structures available to organizations, each designed to drive different behaviors and business outcomes. Here are the most commonly used models:

- Flat Commission

Also known as a single rate commission, this is a straightforward approach where reps earn a fixed percentage for every deal closed. It’s simple to administer and easy for reps to understand, but it lacks nuance when it comes to rewarding strategic behaviors or deal quality. - Tiered or Accelerated Commission

In this model, reps earn higher rates once they reach certain quota thresholds (e.g., 10% up to 80% of quota, then 12% from 81–100%, and 15% above that). Tiered plans encourage overperformance and align well with growth-stage businesses looking to maximize top-line revenue. - Revenue-Based or Margin-Based Commission

Revenue-based commissions incentivize closing large deals regardless of margin. On the flip side, margin-based structures reward reps based on profitability, ideal for businesses prioritizing efficient growth or operating in lower-margin industries. - Draw Against Commission

Typically used during ramp periods, reps receive a guaranteed payment (draw), which is later reconciled against commissions earned. Non-recoverable draws offer stability during onboarding, while recoverable draws are treated like advances that must be paid back. - Milestone or Bounty-Based Bonuses

Instead of percentages, reps receive fixed dollar bonuses for specific achievements, like bringing in a new logo or selling a strategic product. These are easy to track and can supplement other plans to reinforce key behaviors.

How to Choose the Right Commission Structure: A Step-by-Step Guide

Selecting a commission plan isn’t just a matter of preference; it requires thoughtful alignment with financial strategy, rep behavior, and business goals.

Here’s how to do it:

Step 1: Assess Your Sales Cycle and Revenue Goals

Start with your revenue targets and work backward. Are you focused on rapid ARR growth? Expanding within existing accounts? Boosting cash flow?

- For fast ARR growth: Consider accelerators or new logo bounties.

- For account expansion: Blend in upsell or multi-year contract incentives.

- For cash-focused metrics: Incentivize prepaid or upfront payments.

Step 2: Map Incentives to Deal Types and Roles

Differentiate between roles and motions. An AE closing enterprise deals should be comped differently than an SDR sourcing pipeline.

- AE plans may include multi-tier accelerators and margin bonuses.

- SDRs often benefit from a mix of bonuses for meetings booked and qualified pipeline generated.

Step 3: Balance Motivation and Profitability

While aggressive accelerators can drive revenue, they can also erode margin if not monitored. QuotaPath recommends ensuring total commissions paid on a deal don’t exceed 25% of deal value. Higher rates may indicate comp inefficiencies.

Use reporting tools to monitor your deal-level commission rate and uncover hidden comp costs across overlays (BDRs, SEs, managers).

Step 4: Prioritize Transparency and Rep Engagement

Plans should be easy to understand and track. Real-time visibility into pipeline-to-earnings forecasts empowers reps and reduces disputes. As Thomas Egbert, Head of Finance at Prefect, said:

“The whole point of having generous incentives is to energize the team and not have it be mysterious”.

Step 5: Test and Model Before You Roll Out

Use scenario modeling to simulate outcomes under different rep performance bands. Tools like QuotaPath help forecast commission impact across plans, so finance can see how comp decisions will affect CAC, gross margin, and attainment—before a single dollar is paid.

Streamline Sales Compensation to Drive Revenue Without Overspending

Incentive compensation can be both a growth lever and a financial liability.

For finance leaders, the challenge lies in maximizing the return on every commission dollar, ensuring reps are motivated and rewarded, without inflating the company’s cost of sales.

QuotaPath helps finance teams find this balance by giving them the tools to:

Lower the True Cost of Compensation

When plans are too complex or built in spreadsheets, inefficiencies snowball, leading to costly errors, delayed payments, and rep frustration. By automating plan logic, approvals, and payouts, QuotaPath enables you to reduce administrative burden and increase accuracy, all while staying GAAP-compliant and ASC 606-ready .

Align Payouts to the Metrics That Matter

Paying reps more doesn’t automatically generate better outcomes. Instead, tying earnings to high-margin products, multi-year contracts, or ideal customer profiles helps steer GTM teams toward outcomes that grow the business efficiently. Our platform makes it easy to layer in these levers without adding complexity. More on this below.

Visualize Real-Time Financial Impact

With centralized reporting and CRM-connected dashboards, finance can see commission accruals, deal-level payout rates, and quota attainment in real-time. This visibility means you can prevent runaway comp costs—and spot overpayment risks before they affect your P&L.

Iterate Faster With Scenario Modeling

When revenue slows or priorities shift, waiting until the next fiscal year to update comp plans isn’t an option. QuotaPath’s modeling tools allow finance teams to test new structures against historical data and project their impact before rolling anything out. No more flying blind.

By adopting a platform like QuotaPath, finance can confidently manage compensation as a strategic tool, not just an operational cost.

Key Metrics & KPIs to Track

When finance leaders evaluate the health of their compensation strategy, it’s no longer just about how much is being paid out; it’s about why, to whom, and what outcomes those dollars are driving. The right metrics give you the visibility to manage sales compensation like a business investment, not just an expense line.

Here are the three key KPIs every CFO should monitor regularly:

1. Commission Cost of Sales (CCoS)

CCoS is one of the most critical metrics in your compensation program. It indicates the percentage of revenue allocated directly to commissions. According to QuotaPath data, when CCoS exceeds 30% on a per-deal basis, you’re likely overspending.

Tracking CCoS across reps, deal types, and territories helps pinpoint inefficiencies. It also supports strategic decisions around margin protection, comp plan design, and headcount planning. For finance leaders, this is the north star KPI that ties comp directly to gross profit.

Pro tip: Use QuotaPath’s deal-level commission reporting to uncover where blended comp rates are quietly eating into margin.

2. Forecasted vs. Actual Payouts

Missed commission forecasts can throw off everything from cash flow to payroll operations. With tools like QuotaPath, finance leaders can compare real-time earnings forecasts (driven by CRM pipeline data) against actual payouts to spot gaps, anomalies, or sandbagging behaviors.

This visibility helps ensure accruals are accurate, budgets stay intact, and that comp plan expectations are being met in real financial terms.

3. Quota Attainment & Accuracy Rates

A healthy comp plan should drive consistent quota attainment, without making it too easy or impossibly out of reach. Tracking attainment distribution across the team highlights if your targets are realistic, and whether accelerators or tiered payouts are doing their job.

QuotaPath’s data shows that only 9% of companies currently have 80%+ of their team hitting quota, despite that being the ideal benchmark for sustainable growth. Monitoring this alongside plan “accuracy” (how closely payouts match expected earnings) ensures you’re balancing motivation with predictability.

Common Challenges

Common challenges when it comes to sales commission management include overly complex plans, manual processes, and a lack of compensation visibility across the team. Below, we delve into each one.

First up is the complexity of commission plans.

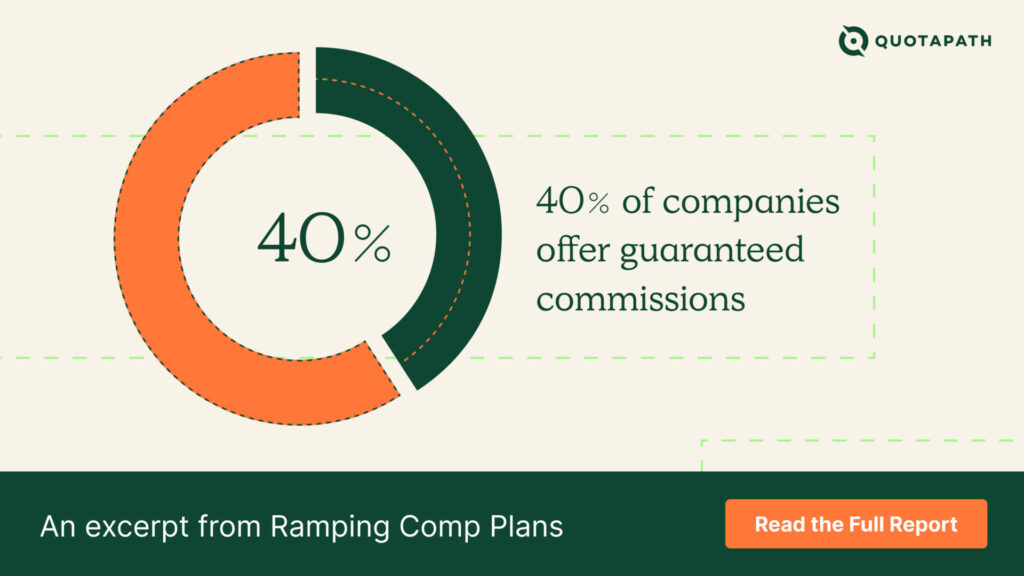

Out of a survey we conducted with 400+ RevOps, Finance, and Sales executives, 30% ranked “maintaining simplicity” as the biggest challenge during the sales compensation plan design process.

That’s because leadership tends to complicate commission plans as companies scale, which leads to errors and disputes. This often leads to misalignment of sales activities, distrust from reps on how they’re paid, and illogical comp plans that double dip on pay or motivate incorrect selling behaviors. An example of this might occur when a company pays a higher commission rate on a product they plan to sunset versus a new product.

Manual processes also pose challenges. According to data from last year, 60% of businesses still rely on spreadsheets to manage commissions, which can be time-consuming and error-prone. When errors happen, reps are more likely to quit. In fact, we found that 66% of companies reported losing between 1-9%of their salesforce to commission errors every 1-2 years.

Lack of visibility marks another challenge and one that Dennis’s team experienced first-hand. Sales reps often don’t have visibility into their commissions and how they’re calculated. When they don’t understand how they’re rewarded for performance, how can leaders expect them to perform?

Another issue that’s popped up over the last decade is compliance. ASC 606 revenue recognition compliance introduced new accounting standards that called for businesses to account for commissions in new ways. This has led to confusion that the use of spreadsheets for manual tracking and amortization scheduling has contributed to.

Fortunately, all of these challenges can be mitigated with the help of trusted sales and commission tracking software.

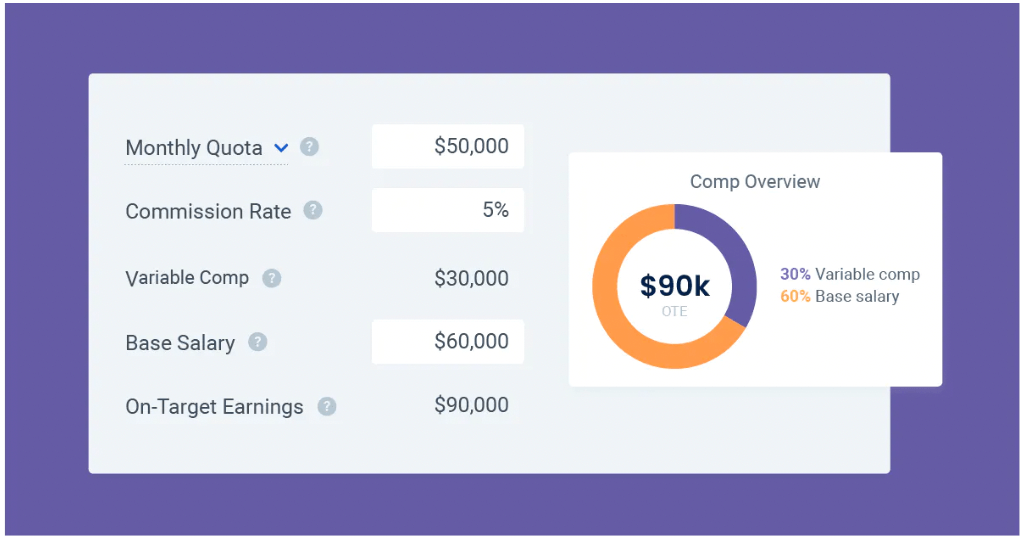

Sales Compensation Calculator

Calculate OTEs, sales quotas, and commission rates to design your sales compensation plans.

Try for FreeEffective Commission Management Implementation

You’re probably thinking, “Okay, but can automated commission management really address all these challenges?”

Yes, if implemented correctly.

An effective commission management implementation will typically include the following:

- Compensation plans that are simple, logical and fair

- Reps have visibility into commission calculations and when to expect payouts

- Sales compensation stakeholders have access and custom views based on roles and responsibilities

- Individual tasks in the commission management system are surfaced with quick access to complete

- Full onboarding delivered in a timely manner

- Friendly user interfaces appropriate for various roles in commission processes

- Insights into sales compensation strategy effectiveness

- In-app collaboration to resolve disputes, address questions, and more

- Ability to save, duplicate, and edit compensation structures to quickly add or remove new teams, sellers, or comp plans

- Forecasting features that enable leadership and sellers to see real-time attainment and earnings progress and future forecasts based on pipeline

Most importantly is leadership’s compensation communication plan of your organization’s strategy and any changes throughout the year. This will help to build trust and understanding between your team and your sellers.

To see if QuotaPath will work for your organization, chat with our team today.

Fairness and Transparency in Commission Management

In addition to a successful implementation, your company should base your commission management philosophy off two key principles: fairness and transparency.

What is fairness in commission management? Fairness in commission management means that all sales reps are treated equally and that their commissions are based on their performance. This means that the commission plan should be clear, concise, and easy to understand. It should also be aligned with the company’s overall goals and objectives.

What about transparency?

Transparency in commission management means that sales reps know how their commissions are calculated. This means that they have visibility into the factors that affect their commissions, such as the sales goals, the commission rates, and the calculation methodology.

Both of these pillars are vital to your selling team.

First, they help motivate and retain sales reps. When sales reps know that they are being treated fairly and that their commissions are transparent, they are more likely to be motivated to sell and stay with the company.

Second, fairness and transparency help to build trust between sales reps and the company. When sales reps trust that the company is treating them fairly, they are more likely to be open and honest with the company. This can lead to better communication and collaboration, which can ultimately benefit the company.

Third, fairness and transparency help to avoid disputes. When sales reps understand how their commissions are calculated, they are less likely to dispute their commissions. This can save the company time and money in the long run.

Streamline commissions for your RevOps, Finance, and Sales teams

Design, track, and manage variable incentives with QuotaPath. Give your RevOps, finance, and sales teams transparency into sales compensation.

Talk to SalesHow to Ensure Your Fair and Transparent

To ensure fairness and transparency throughout your commission management process, create a clear and concise commission plan. Make sure your reps understand how their commissions are calculated and show the math behind your comp plan.

You should also provide your sellers with visibility into commissions so that they can check to see what they’re getting paid on and peer into the calculations behind each deal to clear up questions on upcoming commissions checks.

Pro-tip: recruit the help of QuotaPath to do so.

Lastly, include a session on your commission management system as part of your new hire onboarding for employees across RevOps, Finance, and Sales. This will help ensure that they know how commissions are being calculated and tracked, and, of course, how to use it.

See how this Business and Data Operations Manager added an onboarding session to cover their compensation policy and processes using QuotaPath.

What is a Sales Commission Management System?

A sales commission management system is a software solution designed to automate and streamline the tracking, calculation, and payment of sales commissions. It integrates with CRM and payroll systems to ensure accurate and transparent commission payouts based on predefined compensation plans. By reducing manual errors and providing real-time visibility into earnings, it helps sales teams stay motivated while enabling finance and RevOps teams to manage compensation efficiently.

How Does a Sales Commission Management System Work?

A sales commission management system works by integrating with a company’s CRM, payroll, and accounting systems to automatically track sales performance and calculate commissions based on predefined compensation plans. It collects deal data, applies commission rules (such as flat rates, tiered structures, or accelerators), and provides real-time visibility into earnings for sales reps and finance teams. Once approved, the system processes payouts, ensuring accuracy, compliance, and alignment with business goals while reducing manual errors and administrative workload

Key features and benefits of commission management systems

So, what are the main benefits of commission management solutions? We’ve mentioned several throughout the article, but here are the key value adds:

| Improve compensation management process efficiency | Give leaders and individual contributors automated access to accurate commission calculation, tracking, and payouts. Eliminate confusion and questions by providing a source of truth and surface urgent tasks so that each stakeholder knows what to do and where to do it. |

| Visibility increases trust and motivation | When reps can see how much they have earned and how they are being compensated, trust between your sellers and those who design the compensation plans will increase. (Did you know 75% of sales reps don’t trust they are paid fairly?) Plus, if they can see that the next deal advances them over their attainment target and unlocks a new commission tier, you can bet they will be more motivated to reel the next deal in. |

| Better reporting and insights | Track the performance of your team as well as the effectiveness of your compensation plan using analytics and insights from a solution like QuotaPath. |

| Up your accuracy | Increase the accuracy of your commission payouts by integrating your CRM or invoice system with QuotaPath. All data will pull directly from what is listed in your CRM. If there’s a number error, it doesn’t stem from QuotaPath but rather something in the CRM. |

| Stay compliant | Commission management solutions can help to improve compliance with tax laws and other regulations, such as ASC 606, which can protect the company from legal liability and audits. |

Try QuotaPath for free

Try the most collaborative solution to manage, track and payout variable compensation. Calculate commissions and pay your team accurately, and on time.

Start TrialChallenges of Manually Managing Commissions

Actually managing commissions presents several challenges, including:

- Errors and Inaccuracies – Spreadsheets and manual calculations often lead to miscalculations, overpayments, or underpayments.

- Time-Consuming Process – Admins and finance teams spend hours reconciling data, verifying calculations, and approving payouts.

- Lack of Transparency – Sales reps often struggle to track their earnings, leading to confusion and potential disputes.

- Delayed Payouts – Approvals and manual data entry slow down the commission process, impacting rep morale.

- Difficulty in Scaling – As teams grow, managing commissions manually becomes increasingly complex and inefficient.

- Data Silos – Disconnected systems (CRM, payroll, finance) create inconsistencies and additional reconciliation work.

- Limited Auditability – Without automated records, tracking past payouts, approvals, and plan changes is cumbersome.

- Compliance Risks – Errors in commission calculations can lead to tax compliance issues or financial reporting inaccuracies.

- Inability to Model & Forecast – Manually managing commissions makes it difficult to analyze trends, forecast costs, or optimize comp plans.

- Low Sales Motivation – Unclear or incorrect commission payments can frustrate sales reps and reduce motivation.

Switching to an automated sales commission management system helps overcome these challenges by improving accuracy, efficiency, and transparency.

Future Trends in Commission Management

Finally, what can you expect over the next few years from commission management tools? We’re already seeing an uptick in AI (think: ChatGPT) language processing to support comp plan design.

In fact, we’ve introduced our own AI tool for building and translating compensation plans within QuotaPath.

Another trend we’re noticing is with mutli-year accelerators for account executives and account managers.

Multi-year deals tend to be better for the company. With current economic conditions, predictable revenue growth is more important toward profitability.

— Andrew de Geofroy, SVP, of Global Revenue Platform for Quantive

Executed in an AE comp plan, this might look like a standard commission rate of 10% on 1-year deals, with accelerated rates of 12% on 2-year contracts, and 15% on 3-year congrats. On the renewal side, you might see an AM earn 8% on a multi-year deal (or grab a flat bonus for converting an annual customer to a multi-year), versus 4-5% on a 1-year renewal.

Our third trend relates to SPIFs.

SPIFs have always been popular in sales to quickly motivate or change a specific selling behavior. More frequently, however, we’ve encouraged (and noticed) companies leveraging SPIFs to test potential changes to upcoming compensation plans.

So, want to see if a 2% increase in a commission rate will impact the number of multi-year contracts? Test it out for a quarter with a SPIF first before adding it into your plan. Maybe you’ll find you need to increase the rate in order for your reps to ask for longer terms.

In conclusion, the biggest thing to remember regarding the future of commission management is that technology is on your side.

Make your process more efficient for you and your team with QuotaPath.

To learn more, schedule time with our team or start a free trial.

FAQs:

How does a commission management solution help streamline sales compensation processes?

A commission management solution can help streamline sales compensation processes in a number of ways, including:

- Sales performance management: Companies with sales incentive programs can use commission management solutions for sales performance management. Using attainment leaderboards and forecasted earnings from pipeline, leadership can get a quick pulse on real-time team performance and what’s to come.

- Automating commission calculations: A commission tracking solution can automate commission calculation, which can save time and prevent errors when it comes to commission payout.

Try QuotaPath for free for 30 days - Tracking sales activity: By integrating with a CRM, a commission management solution can track sales activity automatically to ensure that commissions are calculated correctly and that sales reps are compensated fairly.

- Providing visibility into commissions and incentive compensation: A commission management solution can provide visibility into commissions, commission reconciliation, as well as your sales compensation planning process. This can all help to bolster sales force motivation, rep accountability to track their progress, and fair commission allocation to ensure compensation plans are equitable and fair.

- Managing compliance: A commission management solution can help to manage compliance with tax laws and other regulations.

Read: What does ASC 606 revenue recognition mean for commissions? - Reporting and analytics: A commission management solution can provide reporting and analytics, which can help to track the effectiveness of the sales compensation plan and to make adjustments as needed.

Streamline commissions for your RevOps, Finance, and Sales teams

Design, track, and manage variable incentives with QuotaPath. Give your RevOps, finance, and sales teams transparency into sales compensation.

Talk to SalesHow do commission management software handle complex commission calculations?

Compensation technology can handle complex commission calculations by using a variety of methods, including:

- Rules-based calculations: Rules-based calculations are based on a set of rules that are defined by the company. These rules can be used to calculate commissions based on a variety of factors, such as the type of product or service sold, the amount of revenue generated, and the number of deals closed.

- Formula-based calculations: Formula-based calculations use mathematical formulas to calculate commissions. These formulas can be used to calculate commissions based on a variety of factors, such as the sales price of a product or service, the cost of goods sold, and the profit margin.

- Algorithmic calculations: Algorithmic calculations use algorithms to calculate commissions. These algorithms can be used to calculate commissions based on a variety of factors, such as the customer’s lifetime value, the number of leads generated, and the number of sales opportunities created.

The specific method that is used to calculate commissions will depend on the complexity of the commission plan and the needs of the company. However, commission management software can typically handle even the most complex calculations with ease while providing transparent commission tracking.

How can businesses choose the right commission management solution?

When choosing the right commission management solution, you should consider:

- The complexity of your sales commission structure

- Guidance and expertise in compensation plan design

- Size of sales team/user limits

- Budget and pricing transparency

- Ease of use

- Flexibility

- Scalability

- Sales performance analytics and visualization

- Support

- ASC-606 Compliant

- Time to value

- Integration to tech stack

You can try QuotaPath’s commission automation for free by signing up for a free trial (no credit card required).