Creating a sales compensation plan requires careful consideration of various factors. These include Go-To-Market team size, average deal value, selling motion, sales complexity, team member role, and pricing model — all of which may change throughout the year.

Tailoring your plan to your current situation is crucial rather than simply copying a previous one.

Therefore, creating a sales compensation plan each year and adjusting as factors evolve is essential. Otherwise, you risk misaligning your organizational goals, potentially causing you to fall short of targets.

With so many elements to consider and so much at stake, it’s unsurprising that 100% of surveyed business leaders admitted to having challenges with the compensation plan design process.

Sound familiar? If so, we’re here to help.

In this blog, we will guide readers through building a compensation plan. Let’s get started.

How to Structure Sales Compensation

There are many sales commission structures to choose from that define the rule for the commission aspect of the compensation plan.

Some popular use cases include:

Base salary plus commission

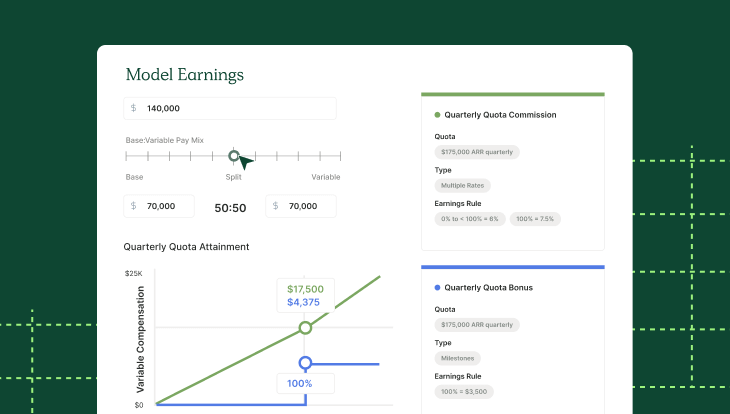

The most common commission structure type across SaaS combines a base salary with a commission plan. We recommend a 50/50 split, where 50% of a salesperson’s pay comes from their base salary while the other half consists of sales earnings. Some organizations adopt a 60/40 ratio, with 60% of earnings from base salary and the remaining 40% from variable pay.

Tiered sales commission

Another popular option is a tiered sales commission structure, also known as a multiple rate, escalators, accelerators, or multipliers.

This is an effective way to incentivize top performers. This structure designates that reps unlock higher commission rates as they attain specific deal or revenue benchmarks.

A tiered sales commission structure example may include a 7% commission rate on deals up to $85K in bookings. Once they’ve exceeded $85K, the rep then begins earning 9% on all new deals within the same period.

Single-rate sales commission

A single-rate sales commission structure is also known as flat-rate commissions, fixed-rate commissions, or simply commissions. We define this structure as variable pay earned off a fixed percentage from every deal closed. In case you’re wondering, the standard commission rate in SaaS is 10%.

Commission payout structure best practices

Once you have chosen a commission structure, follow these compensation planning best practices to tailor it to your business so it will motivate your reps and drive your business goals.

- Make it a team effort: The best commission structures are created collaboratively with revenue operations, finance, and sales reps to build alignment with business goals.

- Keep it simple: Your commission structure needs to be easily explained. If it’s overly complex reps will struggle to understand it and find it difficult to follow.

- Incentivize the right behaviors: Reward behaviors that align with company goals and drive their achievement with goal-oriented compensation.

- Make it fair and equitable: Increase sales compensation equity by standardizing your sales compensation plans for everyone with the same role and then evenly distributing territory.

- Use a clear compensation communication plan: This ensures your team understands the plan, its reasoning, and how you support reps under the new plan.

- Test it: You can run historical compensation data through your new commission structure. Then test it for extreme situations, such as if a rep attained 400% quota. Pressure testing can prevent you from paying a rep more than 100% of their annual recurring revenue.

Test & Model Comp Plans

Next time you’re considering changes to your comp plan, use QuotaPath’s plan performance modeling and testing tools to see total costs based on historical data and quota attainment predictions.

Learn MoreSteps in Designing a Compensation Plan

Next, you’re ready to begin designing your compensation plan.

- Define your company objectives: Target one or two business goals that incentivizing behaviors can achieve. A company objective might be to increase new business or net revenue retention.

- Review the role for whom the comp plan is for: Consider the role’s responsibilities, how their job supports the company objectives, and what you can incentivize that is in their control. For instance, customer success (CS) reps can control license allocation, active users, and new dollar retention. Therefore, the most effective incentives for CS will be tied to these elements.

- Defining your sales compensation objectives: Identify sales compensation levers that can be incorporated into each role’s comp plan and align to company objectives. For example, to promote gross revenue retention, offer AEs a higher commission rate on ideal customer profile (ICP) deals that are more likely to renew.

This can be challenging because Sales, RevOps, and Finance collaborate on comp plans. Our survey revealed that 49% of RevOps leaders felt their plans weren’t fully aligned with business goals despite 64% of Finance leaders declaring alignment. This is caused by Finance having the final say on what’s included in plans.

Recommended Reading: RevOps and Finance Alignment: Enhancing Sales Performance - Set your budget: Determine how much you can allocate for compensation, considering cost-effectiveness and market competitiveness. Remember that budget constraints can influence your compensation mix.

- Choose your compensation mix: This is the blend of different pay elements you’ll offer. Standard options include:

- Base salary: Provides stability and security through predictable earnings.

- Commissions: Rewards performance based on sales attainment. Set your commission rates including standard, decelerated rate for underperformance, and accelerated rate for overperformance.

- Bonuses: Incentivize achieving specific goals beyond quotas.

- Profit sharing: aligns team success with company profitability.

- Establish payout frequency: Determining the right payout schedule for your business involves various factors. You need to establish a frequency that will help you attract and retain top talent while managing cash flow and covering operational expenses. For example, compensation can be paid monthly, quarterly, annually, or based on milestones. An important consideration here is the motivational impact of each frequency and its alignment with your sales cycle.

- Design your commission structure: The sales commission structure defines rules for what, when, and how reps earn commission from sales. An effective sales commission structure aligns with the results you strive to achieve. Consider using a flat rate, tiered commissions, accelerators, or another model to motivate your reps. Then tailor the structure to your business goals. Overly complex plans can cause reps to miss quota. After all, if salespeople can’t understand how they earn commissions, the plan won’t motivate them. So, align it with sales performance metrics and make sure the complexity balances clarity and motivation.

- Define quotas and performance metrics: Set clear and attainable quotas aligning with your objectives. Use the QuotaPath Quota:OTE calculator to determine a quota for each role based on their total on-target earnings (OTE). Next, choose relevant performance metrics to track and measure achievement. Ensure quotas and metrics are fair and objective, avoiding bias or favoritism. Getting this wrong can lead to reps falling short of quota as our survey revealed that 91% of reps don’t hit their quota targets.

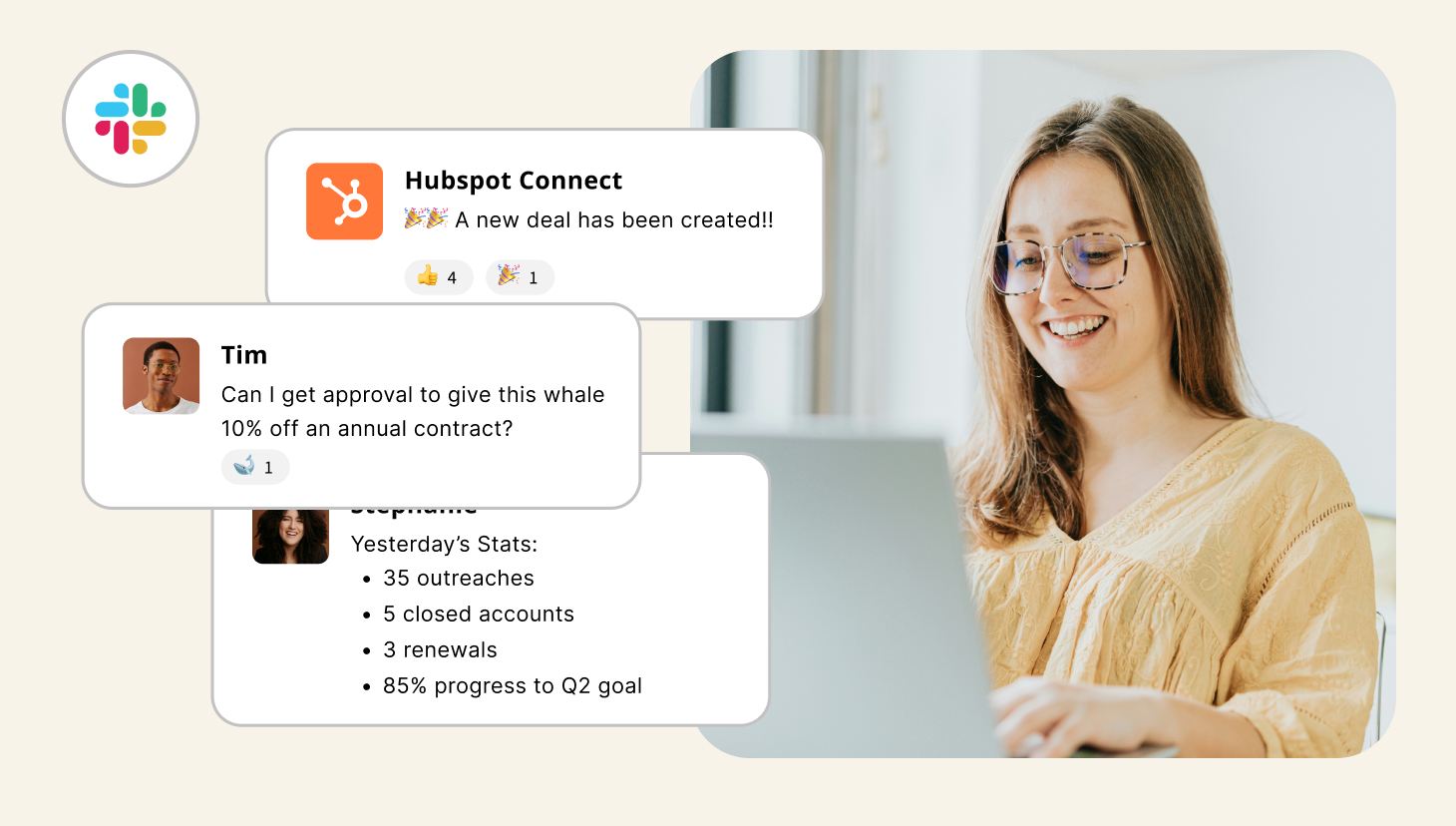

- Implement tracking and reporting systems: Our survey showed it takes reps an average of 3 to 6 months to understand their compensation plan fully. Choose or develop tools to track performance, calculate payouts, and generate reports to streamline commissions for RevOps, Finance, and Sales teams. These tools ensure data accuracy and transparency in reporting systems while allowing reps to understand how they earn commissions more quickly and find it motivating. QuotaPath helps you ensure your team understands their comp plan by increasing transparency. This platform allows reps to see how much they earn based on deals in their pipeline and forecast how much to expect in their paychecks.

Calculate OTE:Quota ratios

Use this free calculator to ensure your reps’ on-target earnings and quotas mirror what they’re bringing in for the business.

Try it NowTypes Of Sales Compensation Plans

Each role requires a different type of sales compensation plan. This section outlines a few comp plan examples to demonstrate the differences.

(AE) Commission

An account executive is a type of sales rep. When creating an AE commission plan start simple and add complexity later as needed. A simple comp plan doesn’t always involve paying a flat rate commission. You can add accelerators/decelerators or a bonus or change the commission rate based on the length of the contract, for example. It depends on the specifics of your company and what you’re hoping to achieve.

Below, is a sample AE commission plan that an effective option.

Sample AE Commission Plan:

Quota: $160,000 of ARR per quarter

On-Target Earnings: $140k per year

Base Salary: $70k per year

On-Target Variable: $70k per year

Commission Structure: 11% commission on all ARR sold until quota is reached then 17% commission on all ARR above quota

Notes: This plan features a simple accelerator to encourage overperformance. The sales rep’s commission is flat until they achieve their quota. Once that quota is reached, the commission rate increases for all subsequent revenue. Because this commission rate doesn’t apply to the previous tier, they only get the higher rate on the revenue above their quota, not everything they sold that quarter.

CS compensation plan – Retention-based commission

This sales compensation plan example is for businesses that pay CSMs a commission for each renewed account. In this case, the CSM has a target retention number with an expectation of renewing a percentage of the contracts that they manage.

For example: A customer success manager has a monthly retention quota of $33,000 ARR and earns a 10% commission of every deal they close

The details of this plan are as follows:

Retention-based commission with 1 Path to earnings

Quarterly net revenue quota of $300,000

Earnings rule:

0% – 100% = 7.5% commission rate

> 100% – 150% = 12.5% commission rate

> 150% = 15% commission rate

SDR compensation plan

An SDR, or sales development rep, is typically responsible for scheduling meetings for the sales team. This role is sometimes referred to as a MDR (market development rep), BDR (business development rep), or LDR (lead development rep). Regardless of their title, they manage the top of the funnel for a sales team by qualifying marketing leads, running outbound calls and emails, or holding discovery calls. The three plans below are the most common SDR comp plans.

- Number of meetings: This SDR compensation plan is often instituted by early organizations that want to fill their sales reps’ calendars. For each meeting the SDR sets (that actually takes place) they receive a bonus. This bonus varies based on the company’s ASP (average sales price) and demo-to-close rate. Generally, the bonus falls anywhere between $20 and $300.

- Number of qualified opportunities: This SDR comp plan is most effective for organizations with a clearly defined ICP (ideal customer profile) that only wants sales reps on the phone with qualified prospects. It’s important to establish clearly defined rules as to what a qualified opportunity is so there is no confusion. This bonus also varies greatly by company but is typically a higher dollar figure than simply paying for demos.

- Percentage of revenue generated: While many organizations believe this is the perfect SDR compensation plan, it is only the right choice for specific companies. Essentially, in this example comp plan, SDRs get paid a commission on all closed won deals that originated from the opportunity they created. This is only effective if you have a shorter sales cycle (ideally less than 60 days) because the SDR should have control over their income. The SDR commission percentage typically ranges from .5% to 4%.

The most common SDR compensation plan is often a combination of 2 or more of these components. Below is an example of this.

Sample SDR Compensation Plan:

Quota: 10 qualified opportunities per month and $60,000 of revenue per month

On-Target Earnings: $70k per year

Base Salary: $46k per year

On-Target Variable: $24k per year

Commission Structure: $100 per qualified opportunity and 1.66% of all deals they generate

Notes: There are two different quotas and therefore two different commission rules for this sample SDR plan. They are paid a flat $100 bonus for every qualified opportunity they generate and are expected to create 10 qualified opportunities per month. Their second target is to generate $60,000 of revenue per month and they are paid 1.66% of all revenue generated.

Sales Manager Compensation Plan

Sales managers are responsible for managing salespeople.

Unlike sales reps whose quotas are unique to themselves, sales managers’ quotas are usually based on the combined quotas of the reps reporting to them. Their quota is not always the total of their team’s quota. They are sometimes given a “buffer” of 10-20%. This means that if a sales manager has 5 reps reporting to them, each with a $150k quota, the manager’s quota is 90% of that sum. So, instead of $750k (5*$150k) it is $675k ($750k*90%).

Because the sales manager compensation plan sample is based on the deals their reps close, it enables them to spend their time coaching their sales team to close more deals.

Sample Sales Manager Compensation Plan:

Quota: $945k per quarter (based on a team of 6 reps at a $175k/quarter quota, held to 90%)

On-Target Earnings: $200k per year

Base Salary: $100k per year

On-Target Variable: $100k per year

Commission Structure: 2.65% of all deals their reps close

Notes: This plan is a very straightforward plan, utilizing a single rate commission. That means that the manager earns the same amount on all deals their team closes, regardless of their team quota attainment. This type of plan is somewhat common because it is easy to understand, very simple to roll out, and allows additional complexity to be added in at a later date.

RevOps, sales leaders, and finance teams use our free tool to ensure reps’ on-target earnings and quotas line up with industry standards. Customize plans with accelerators, bonuses, and more, by adjusting 9 variables.

Build a Comp PlanSample Sales Compensation Plan Templates

Use our Compensation Plan Templates Library to build your first sales compensation plan or modify existing plans. You can auto-populate commission and bonus rates based on your business numbers, determine deals per quota period, and balance quota to OTE ratios.

Here are some popular templates and their use cases to help you get started:

- Single Rate Commission: A near-perfect plan for early-stage startups

- Commission with Accelerators & Milestone Bonus: Excellent plan to incentivize consistency when you have a high velocity of sales and lower contract values.

- Commission with Accelerators: This tiered commission structure that rewards over performance is best for companies confident in the math behind quotas and targets.

- Multiple Rate Bonus (Revenue): This comp plan best suits sales with high seasonality and adjusted quotas throughout the year. It extends the Single Rate Bonus plan by offering a higher bonus rate after surpassing quota.

- Opps Created & Demos Completed Bonuses with Closed Won Commissions: Best for mature sales teams who want to reward SDRs across the entire funnel.

- Demos Completed Bonus: This is a great first SDR plan.

- Qualified Opportunity Bonus & Close Won Commission: This SDR comp plan well suited for fairly mature sales organizations focused on quality leads and preparing their SDRs to advance to AEs.

Top Sales Compensation Strategies

When creating sales compensation plans, the goal is to strike a delicate balance between motivating your team, achieving your business goals, and staying within budget. Here are 3 top strategies to keep in mind:

1. Align your plan with your objectives: Don’t just throw money at goals. Clearly define what you want your sales team to achieve (e.g., increased revenue, shorter sales cycle, higher customer retention).

Tailor your compensation mix and quotas to reward progress towards these objectives directly. For example, if shortening the sales cycle is key, consider a tiered commission structure based on deal turnaround time. Remember, misalignment leads to confusion and demotivation. Ensure every element of your plan is pulling in the same direction.

2. Prioritize clarity and fairness: Complexity kills motivation. Keep your plan simple and easy to understand for your sales team. Avoid convoluted formulas and hidden incentives.

Transparency is key. Clearly communicate the plan, including payout calculations, eligibility criteria, and potential adjustments. Openly address concerns and answer questions.

Ensure fairness and equity. Quotas and performance metrics should be attainable and objective, avoiding bias or favoritism based on territory, product, or individual relationships.

3. Focus on motivation beyond just money: While commissions are powerful, they aren’t everything. Consider incorporating non-monetary sales team rewards like recognition programs, leadership opportunities, or exclusive experiences.

Create a positive and engaging sales culture that values collaboration, knowledge sharing, and continuous improvement. Celebrate successes and acknowledge individual contributions.

Offer flexibility and choice. When possible, consider options like allowing reps to choose their preferred benefits package or participate in profit-sharing initiatives.

By focusing on these three key strategies, you can design a compensation plan that not only rewards performance but also motivates your team to consistently strive for excellence, ultimately driving sustainable success for your business.

Bonus Tip: Track the effectiveness of your plan continuously using a solution like QuotaPath. Monitor key performance indicators, gather feedback from your team, and adapt your plan as needed to ensure it remains relevant and impactful.

Communicating Your Sales Compensation Plan Effectively

Communication is key to the success of your sales compensation plan. Make sure your reps understand their plans. Otherwise, you risk poor performance and falling short of your business goals. Here are a few best practices for communicating your sales compensation plan to help you get started. You can find additional compensation planning tips for a successful comp plan rollout in this blog.

- Transition from general to detailed messaging. Start with a broad overview of the plan when you introduce it to the entire sales force. Then provide more specific details for increasingly smaller groups or 1:1.

- Plan documents should balance detail with clarity and brevity. Keep comp plan documentation as brief as possible but clearly provide enough details.

- Use various methods to explain the new plan. Options include group presentations, 1:1 conversations, written documents, and an explainer video. Exposing reps to this information allows them multiple opportunities to present their questions and receive immediate responses to increase understanding.

- Create a Frequently Asked Questions (FAQs) document. Share it with the plan documents to answer common questions and accelerate plan understanding.

- Provide various calculation examples. Share this information with your plan documents or offer the sales team forecasting software that calculates earnings based on each pipeline opportunity. This type of tool answers questions while increasing clarity and plan understanding.

Design, track, and manage variable incentives with QuotaPath. Give your RevOps, finance, and sales teams transparency into sales compensation.

Talk to SalesHow To Monitor and Adjust Your Plan For Success

The success of your sales compensation plan hinges on many evolving factors. That’s why it’s essential to create a new sales compensation plan each year that’s aligned with and drives company objectives.

Start to design your compensation plan considering individual roles, company objectives, and your budget. Choose your compensation mix, establish payout frequency, design your commission structure, define quotas and performance metrics, and implement tracking and reporting systems.

Various types of sales compensation plans exist. You can get started by referring to the examples in this guide or leverage one of the free templates in our compensation plan templates library.

Whichever approach you choose to get started, remember that it’s essential to align your plan with company objectives, prioritize clarity and fairness, and focus on motivation beyond monetary incentives.

Finally, prepare an effective sales compensation communication plan to ensure the success of your new sales compensation plan. It will boost rep understanding, getting them onboard and motivated to go the extra mile.

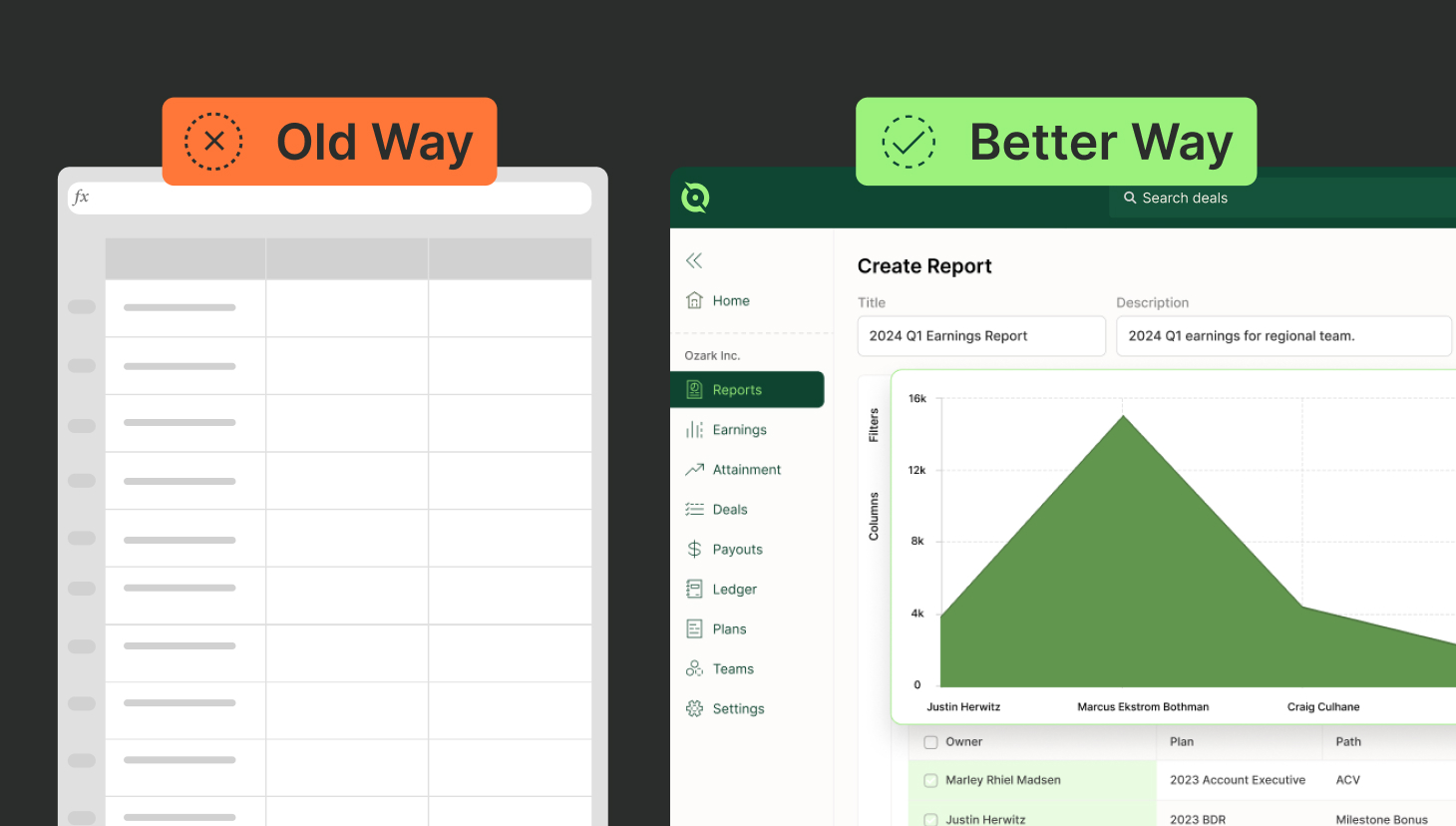

QuotaPath’s new compensation reporting and modeling tools allow leaders to measure and model the effectiveness and costs of their compensation strategies. You can predict new plan costs, see real-time attainment health, and identify performance anomalies in one place to gain confidence in your compensation structures and optimize your team’s success.

No more scenario modeling through a series of compensation spreadsheets and reporting based on data from your CRM and payroll platforms. Now you can reference, report, and predict plan performance directly in QuotaPath.

See QuotaPath in action by booking a demo and witnessing the power of these new features firsthand.

Or, experience it yourself: Sign up for a free trial and start building smarter compensation plans today.