January is the first paycheck month for many reps after Q4, making it the perfect time to address audit risks around commissions. When payouts spike and complexity increases, even minor errors can quickly become disputes, compliance issues, or audit red flags.

Yet most Finance teams don’t think about commission audits until audit season arrives. Instead of scrambling to reconstruct calculations and documentation after the fact, audit readiness should be built into commission processes year-round.

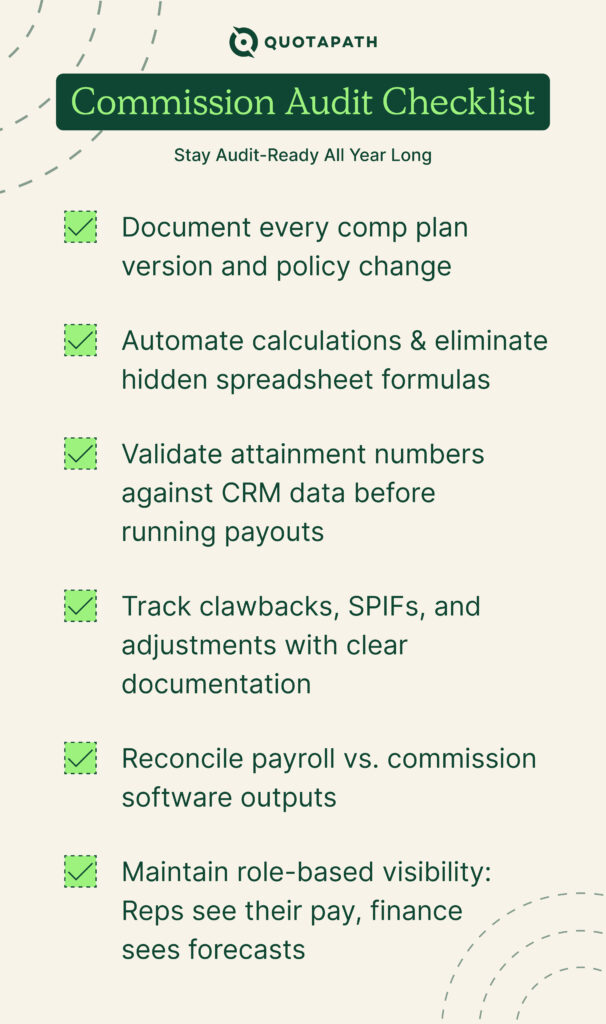

This commission audit checklist provides a practical framework to stay audit-ready 365 days a year.

Below, we walk through a six-step checklist.

Key Takeaways: Commission Audit Checklist Essentials

- Commission audits shouldn’t be seasonal.

A strong commission audit checklist focuses on year-round readiness—documenting comp plans, approvals, and changes continuously to avoid last-minute audit scrambles. - Manual spreadsheets are the biggest audit risk.

Hidden formulas and inconsistent calculations make audits harder to defend. Automating calculations is a core requirement of any audit-ready commission audit checklist. - CRM data validation prevents disputes and audit findings.

Reconciled attainment data between your CRM and commission system reduces payout errors, rep disputes, and compliance red flags before they surface in an audit. - Every adjustment must be traceable and approved.

Clawbacks, SPIFs, and manual overrides should always include documented reasoning, approvals, and audit trails—an essential step in any effective commission audit checklist.

The Commission Audit Checklist: 6 Steps to Year-Round Readiness

Stay ahead of commission audit risk with this repeatable audit readiness checklist, designed to support consistent documentation, accuracy, and compliance year-round.

✅ 1. Document Every Comp Plan Version and Policy Change

Auditors need to see a clear trail of plan changes, rate updates, and policy modifications throughout the year.

How to implement:

- Maintain version-controlled documentation of every comp plan iteration

- Timestamp and store all plan modifications with approval records

- Track mid-year changes to rates, accelerators, or SPIFs

- Store all communications about plan changes (emails, memos, approval workflows)

QuotaPath automatically logs every comp plan change with built-in audit trails, giving Finance a single source of truth for sales commission documentation.

✅ 2. Automate Calculations and Eliminate Hidden Spreadsheet Formulas

Manual calculations and buried Excel formulas are error-prone and impossible to audit effectively. Auditors need transparent, repeatable processes.

How to implement:

- Move away from spreadsheets with complex, undocumented formulas

- Use software that shows calculation logic clearly

- Ensure calculations are consistent across all reps and territories

- Create calculation documentation that non-finance stakeholders can understand

QuotaPath’s transparent, rules-based logic removes the “black box” of spreadsheet calculations and improves commission tracking accuracy.

Design, track, and manage variable incentives with QuotaPath. Give your RevOps, finance, and sales teams transparency into sales compensation.

Talk to Sales✅ 3. Validate Attainment Numbers Against CRM Data Before Running Payouts

Mismatched data between CRM and commission systems creates audit red flags and payout disputes.

How to implement:

- Reconcile deal data between CRM and commission platform before each payout cycle

- Flag discrepancies immediately and document resolutions

- Establish a regular review process (weekly or monthly) to catch data sync issues

- Create a standard operating procedure for investigating variances

QuotaPath’s native CRM integrations keep data in sync with audit trails automatically, reducing reconciliation gaps that commonly derail audit-ready commissions.

✅ 4. Track Clawbacks, SPIFs, and Adjustments with Clear Documentation

Commission adjustments—whether clawbacks from churned customers or bonus SPIFs—must be documented with clear business justification.

How to implement:

- Maintain a log of all clawbacks with reason codes and supporting documentation

- Document SPIF criteria, eligibility, and payout calculations

- Track manual adjustments with approval workflows

- Store evidence (customer churn records, contract modifications, etc.)

QuotaPath automatically handles clawbacks and adjustments with audit trail commissions, making every correction easy to trace, explain, and defend.

✅ 5. Reconcile Payroll vs. Commission Software Outputs

The final payroll payout must match commission calculations exactly. Discrepancies create audit issues and erode rep trust.

How to implement:

- Compare commission system outputs to actual payroll before processing

- Investigate and document any differences (even small ones)

- Maintain records showing reconciliation was performed

- Establish a sign-off process involving Finance and RevOps

QuotaPath’s integrations with payroll systems like Rippling help Finance seamlessly reconcile commission outputs to payroll, reducing commission expense accounting errors before payouts are finalized.

✅ 6. Maintain Role-Based Visibility: Reps See Their Pay, Finance Sees Forecasts

Audit-readiness requires both transparency for reps and comprehensive reporting for Finance. Different stakeholders need different views.

How to implement:

- Give sales reps real-time visibility into their earnings and how they’re calculated

- Provide Finance with detailed reports on commission expenses, accruals, and forecasts

- Ensure RevOps can access plan performance data and make strategic adjustments

- Lock down sensitive data with role-based access controls

QuotaPath provides reps with transparency while equipping Finance with audit-ready reports that support commission audit compliance at scale.