Compensation planning is the strategic process of designing and implementing a fair, effective, and motivating compensation structure for your sales team.

It’s a crucial component of any successful sales and go-to-market organization, directly impacting employee morale, performance, and overall business outcomes.

However, many companies struggle with their compensation planning efforts.

Our recent study revealed that 44% of sales reps aren’t motivated by their compensation plans, and 75% don’t trust they are paid fairly. This indicates the need for a well-thought-out and executed compensation strategy.

Easier said than done, though, right?

These challenges experienced by the reps stem from problems at the management levels.

For instance, only 1% of RevOps leaders are confident that their compensation plans align with key business metrics. If retention is your organization’s most important business driver, your compensation structures (across teams) do not include payouts that foster growing retention.

Solving the Biggest Sales Compensation Challenges

Over 450 Finance, RevOps, and Sales executive leaders identified the top pain points surrounding sales compensation.

Get ReportWhat’s more, revenue leaders said maintaining simplicity ranks as their biggest challenge during compensation planning, attributing to another alarming statistic: 60% of reps take 3 to 6 months to understand their comp plan.

So, as you plan for next year, how can you get ahead in your compensation planning to avoid these missteps?

In this blog post, we’ll explore the key steps in compensation planning, including strategies for large and small teams, and discuss the nuances of executive and individual contributor compensation.

We’ll also provide insights into how compensation planning and administration are typically done and introduce how compensation planning software like QuotaPath can streamline the process.

What Is Compensation Planning?

Compensation planning is about creating a pay and benefits system that attracts, keeps, and motivates your best employees. It should align with your company’s goals and ensure everyone is fairly rewarded for their work.

A well-crafted compensation plan should:

- Attract and retain top talent: Offering competitive compensation packages can help your organization attract and retain the best people.

- Motivate employees: A well-designed compensation plan can motivate employees to perform at their best by rewarding high achievement.

- Align with business goals: Your compensation plan should be aligned with your company’s strategic objectives to ensure that employees are incentivized to contribute to the company’s success.

- Comply with legal requirements: Your compensation plan must comply with all applicable labor laws and regulations.

What Are The Steps Involved In Compensation Planning

Creating an effective sales compensation plan requires careful consideration of various factors, including team size, deal value, selling motion, sales complexity, team member roles, and pricing models. These factors can change over time, making it crucial to tailor your plan to your current situation rather than simply copying a previous one.

The key steps involved in compensation planning include:

- Define your company objectives: Identify the specific business goals you want to achieve through your compensation plan, such as increasing revenue, shortening sales cycles, or improving customer retention.

- Review the role for whom the comp plan is for: Consider the responsibilities, skills, and contributions of the role to your company’s objectives.

- Set your budget: Based on your company’s financial resources and market competitiveness, determine how much you can allocate for compensation.

- Choose your compensation mix: Decide on the combination of base salary, commissions, bonuses, and other incentives you will offer.

- Establish payout frequency: Determine the appropriate frequency for paying out compensation, such as monthly, quarterly, or annually.

- Design your commission structure: Select the commission structure that best aligns with your business goals and motivates your sales team.

- Define quotas and performance metrics: Set clear and achievable quotas and metrics that are fair, objective, and aligned with your objectives.

- Implement tracking and reporting systems: Use tools to track performance, calculate payouts, and generate reports to ensure transparency and efficiency.

- Calculate OTE: Determine the on-target earnings (OTE) for each role to ensure fair compensation.

- Communicate your plan effectively: Clearly communicate your compensation plan to your sales team to ensure understanding and motivation.

Key considerations when designing a compensation plan:

- Alignment with business goals: Ensure your plan supports your company’s strategic objectives.

- Clarity and fairness: Keep the plan simple, transparent, and equitable.

- Motivation: Consider both monetary and non-monetary incentives to motivate your team.

- Flexibility: Be prepared to adjust your plan as your business evolves.

By following these steps and considering these factors, you can create a compensation plan that attracts, retains, and motivates top talent while driving your company’s success.

Calculate OTE:Quota ratios

Use this free calculator to ensure your reps’ on-target earnings and quotas mirror what they’re bringing in for the business.

Try it NowCompensation Planning For Large And Small Teams

While the core principles of compensation planning remain consistent across team sizes, some specific strategies and considerations are more suitable for larger or smaller startup sales organizations.

Similarities:

- Alignment with business goals: Both large and small teams need compensation plans that align with their company’s objectives.

- Fairness and equity: Ensuring fair treatment and avoiding favoritism is essential for both team sizes.

- Motivation: Using a mix of monetary and non-monetary incentives is necessary to motivate employees in both types of teams.

Differences:

Larger Teams:

- Complexity: Compensation plans for larger teams can be more complex due to factors like multiple sales roles, diverse territories, and varying deal sizes.

- Communication: Effective communication is crucial in larger teams to ensure everyone understands the compensation plan and its implications.

- Technology: Leveraging technology can help streamline compensation processes, improve transparency, and facilitate data-driven decision-making.

- Tiered commission structures: Implementing tiered commission structures can incentivize high achievers and reward top performers.

- Regular adjustments: Larger teams may require more frequent adjustments to their compensation plans to accommodate changes in market conditions, sales goals, and team dynamics.

Smaller Teams:

- Simplicity: Smaller teams can often benefit from simpler compensation plans that are easier to understand and implement.

- Flexibility: Smaller teams may have more flexibility to experiment with different compensation structures and adjust their plans quickly.

- Personal relationships: Building strong relationships between team members and management can foster trust and motivation in smaller teams.

- Direct communication: Open and direct communication can be more effective in smaller teams, allowing for better understanding and feedback.

Sales Manager Compensation Plans Examples

Read MoreExecutive Compensation Planning

Now that we’ve explored compensation planning for both large and small teams, let’s get into executive compensation.

Executive compensation can be tricky because it is often tied to a percentage shy of 100% of the financial goal, involves equity, and higher, negotiated base pay and benefits (sign-on bonus, relocation stipend.)

Key Tactics and Best Practices:

- Align with company strategy: Ensure executive compensation is aligned with your company’s long-term strategic objective and financial plan. This helps drive focus and accountability.

- Consider performance metrics: Use a mix of financial and non-financial performance metrics to evaluate executive performance and determine compensation.

- Balance short-term and long-term incentives: Incorporate a mix of short-term incentives (e.g., bonuses) and long-term incentives (e.g., stock options) to encourage a focus on both immediate and sustainable results.

- Benchmark against peers: Regularly benchmark executive compensation against similar companies in your industry to ensure competitiveness.

- Transparency and disclosure: Maintain transparency in executive compensation practices and comply with regulatory requirements for disclosure.

- Consider company size and stage: Tailor executive compensation to your company’s size and stage of development. For example, startups may prioritize equity-based compensation, while mature companies may offer a mix of cash and equity.

- Evaluate regularly: Regularly review and evaluate your executive compensation plan to ensure it remains effective and competitive.

Much of that will hold for your individual seller compensation plans, but there a few differences.

Key Differences Between Executive Compensation Plans and Individual Contributor Comp Plans:

- Scope: Executive compensation plans typically cover a more comprehensive range of benefits and incentives than individual contributor plans.

- Complexity: Executive compensation plans are often more complex, involving factors like perquisites, deferred compensation, and performance-based bonuses.

- Alignment with company strategy: Executive compensation is more closely aligned with the company’s overall strategic goals and objectives.

- Regulatory requirements: Executive compensation is subject to stricter regulatory oversight and disclosure requirements.

- Benchmarking: Executive compensation is typically benchmarked against peers in the same industry and at similar levels of seniority.

Following these tactics and best practices, you can design an effective executive compensation plan that attracts and retains top talent, aligns incentives with company goals, and supports your organization’s long-term success.

RevOps, sales leaders, and finance teams use our free tool to ensure reps’ on-target earnings and quotas line up with industry standards. Customize plans with accelerators, bonuses, and more, by adjusting 9 variables.

Build a Comp PlanIndividual Contributor Compensation Planning

You’ll follow similar best practices for your reps with a few differences, underlined below.

1. Alignment with Business Goals:

- Company Objectives: Ensure the plan aligns with your company’s strategic goals and objectives.

- Sales Team Goals: Clearly define the specific goals and metrics that the rep will be responsible for achieving.

2. Role-Specific Considerations:

- Responsibilities: Understand the rep’s specific role, responsibilities, and contributions to the company.

- Skills and Experience: Consider the rep’s skill set, experience level, and growth potential.

3. Compensation Structure:

- Base Salary: Determine a competitive base salary that attracts and retains top talent.

- Variable Pay: Choose appropriate variable pay components, such as commissions, bonuses, or incentives, that align with the rep’s role and performance metrics.

- Commission Structure: Select a commission structure that motivates the rep to achieve their goals, such as single-rate, tiered, or accelerator-based.

4. Quotas and Performance Metrics:

- Attainability: Set realistic and achievable quotas that challenge the rep but are not overly burdensome.

- Relevance: Ensure that performance metrics are relevant to the rep’s role and align with the company’s objectives.

- Fairness: Avoid bias or favoritism in setting quotas and metrics.

5. Communication and Transparency:

- Clarity: Communicate the compensation plan clearly to the rep, ensuring they understand the rules, expectations, and potential earnings.

- Transparency: Maintain transparency in the calculation and payment of commissions and bonuses.

- Feedback: Provide regular feedback on performance and address any questions or concerns.

6. Flexibility and Adaptability:

- Market Changes: Be prepared to adjust the compensation plan as market conditions, company goals, or the rep’s performance change.

- Individual Needs: When designing the plan, consider individual needs and preferences, such as flexible work arrangements or additional benefits.

Consider these factors to create a sales compensation plan that motivates the rep, aligns with company goals, and supports overall business success.

How Compensation Planning and Administration Is Done

Next, we look into the administration and accounting of commission reporting.

Compensation planning and administration are multifaceted processes that involve designing, implementing, and managing your company’s compensation programs. They require collaboration among various departments, including human resources, finance, sales, and legal.

To effectively manage this process while ensuring ASC 606 compliance, follow these steps:

- Define your company objectives: Clearly outline your company’s strategic goals and how compensation can support them while adhering to ASC 606 principles.

- Conduct a compensation survey: Gather data on market rates and industry standards to ensure your compensation is competitive and compliant with ASC 606 requirements.

- Design your compensation structure: Determine the appropriate mix of base salary, variable pay, and benefits for different roles, ensuring that commission payouts align with revenue recognition criteria.

- Set quotas and performance metrics: Establish clear and measurable goals for employees to achieve, ensuring they are consistent with ASC 606 principles.

- Implement tracking and reporting systems: Use technology to track employee performance, calculate pay, and generate reports that accurately reflect ASC 606 requirements.

- Communicate your compensation plan: Clearly explain the plan to employees, ensuring they understand the rules, expectations, and potential earnings while emphasizing the importance of ASC 606 compliance.

- Monitor and evaluate: Regularly review and evaluate your compensation plan to ensure it remains effective, aligned with your company’s goals, and compliant with ASC 606.

- Address compliance: Ensure your compensation practices comply with all applicable labor laws and regulations, including ASC 606.

While motivating your employees and driving business results are important, you must remember to be compliant and mitigate bookkeeping risks.

Accounting For Sales Commissions

In this blog, get an overview of the basics of commissions accounting, the different types of sales commissions, how to calculate sales commissions, and how to record sales commissions in your accounting system.

Read MoreQuotaPath, Your Compensation Planning Tool

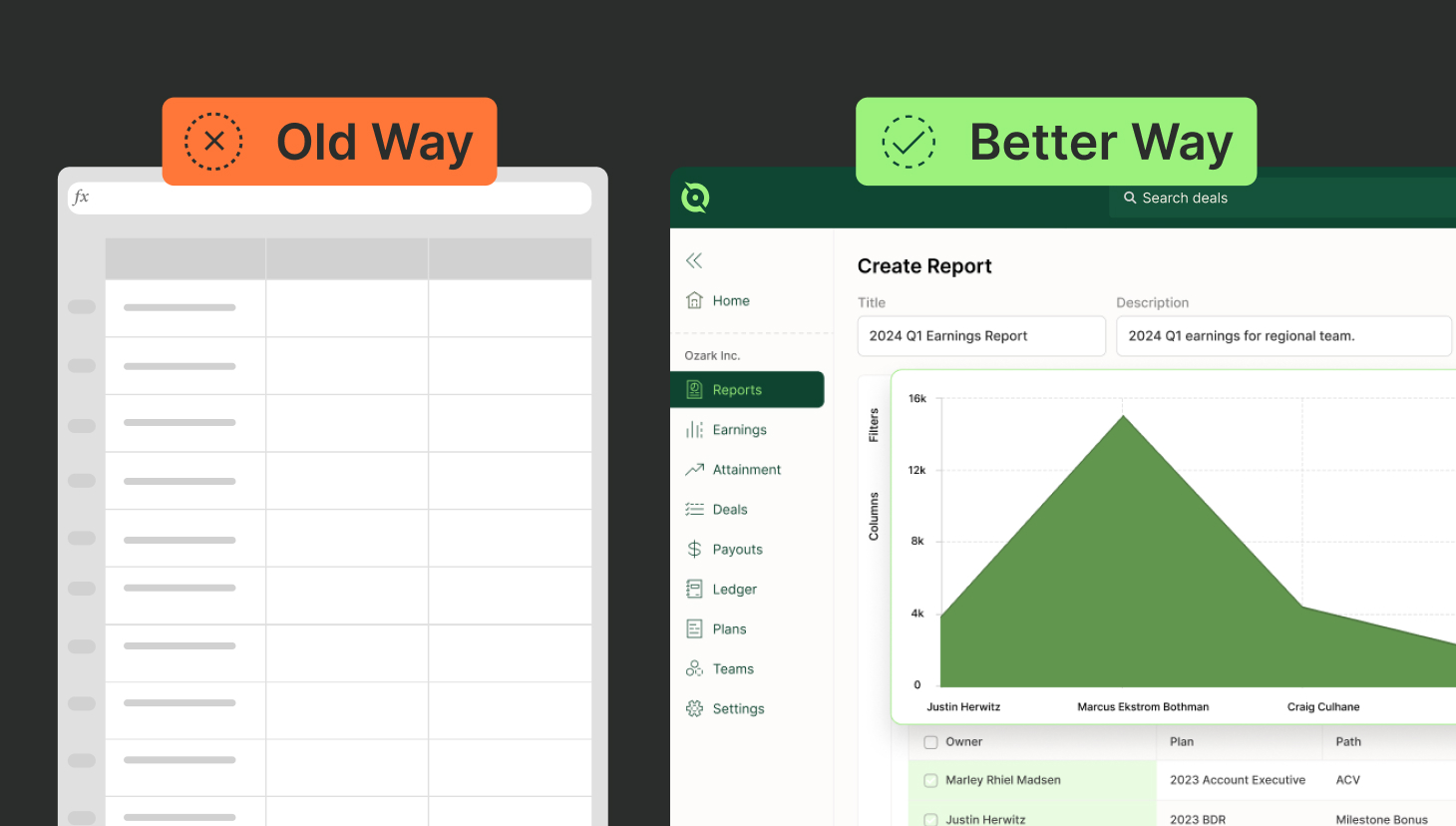

Lastly, one way to immediately improve your sales compensation process is to partner with trusted experts and implement user-friendly technology to support and automate your strategy.

QuotaPath is a powerful tool that can streamline your compensation planning and administration process.

With QuotaPath, you can:

- Create and manage compensation plans: Easily design and customize compensation plans for different roles and teams in partnership with their team.

- Track performance and calculate payouts: Accurately track employee performance, calculate commissions and bonuses, and generate detailed reports to measure success.

- Ensure compliance: Maintain compliance with ASC 606 and other relevant accounting regulations.

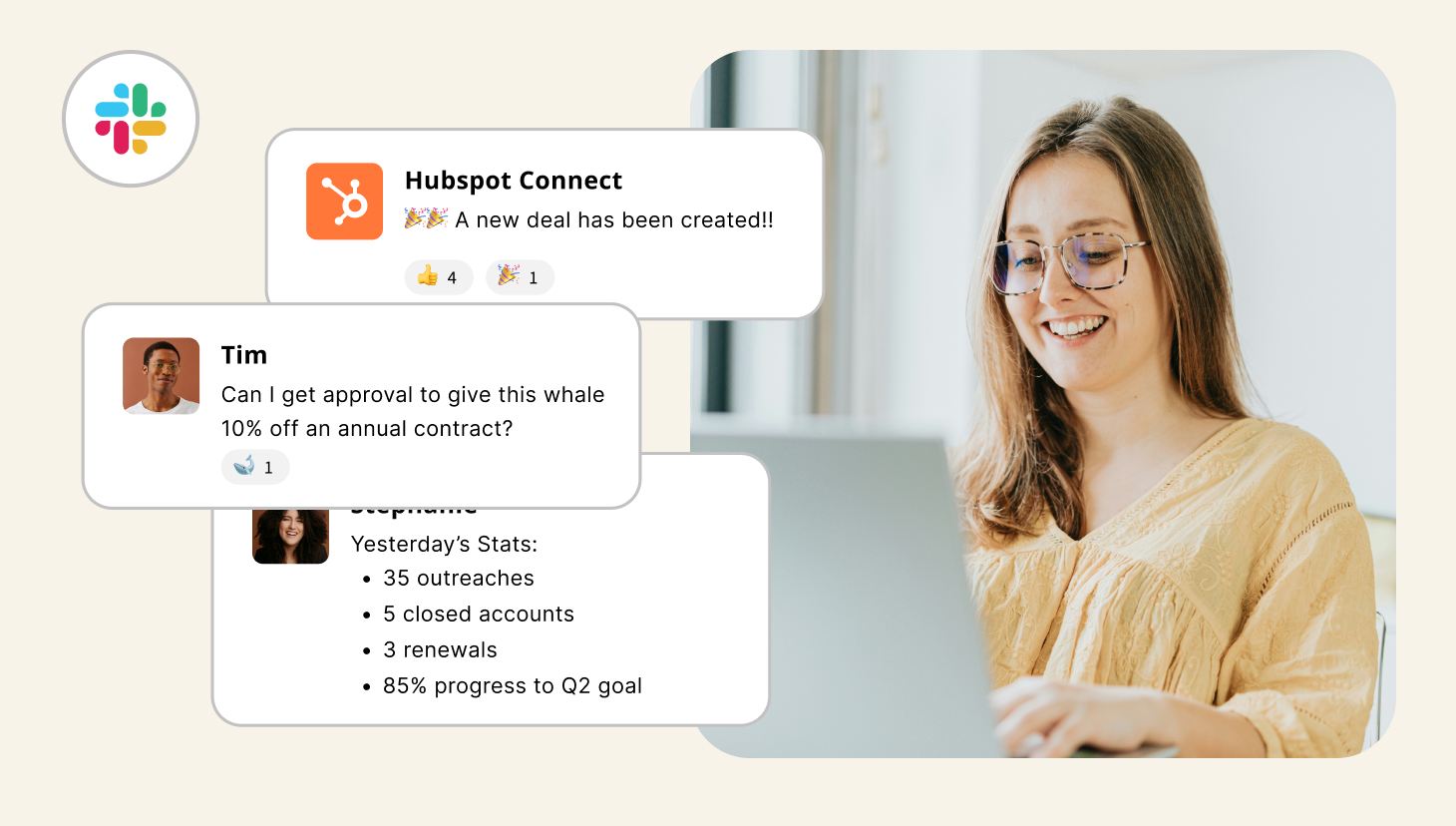

- Improve communication: Enhance transparency and communication between employees, managers, and finance teams.

By leveraging QuotaPath, you can optimize your compensation planning efforts, improve efficiency, and drive better business outcomes.

To learn more, schedule time with our team.