Deferred commissions are sales incentives paid in advance for revenue earned over time. These incentives are then capitalized and recognized as assets over the entire contract period.

This is important in industries like SaaS, telecom, and insurance as it complies with accounting standards like ASC 606 and provides a more accurate picture of a company’s financial health.

ASC 606 sales commissions significantly impact commission accounting by requiring capitalization and amortization of commissions associated with customer contracts. Commissions used to be included on a business’s income statement as expenses when they were paid. However, under ASC 606, incentives are handled as assets and recognized over the contract’s duration, along with the related revenue recognition.

According to Deloitte, over 85% of sampled entities adopted the new revenue standard using the modified retrospective method, indicating widespread challenges in transitioning to ASC 606. Let’s break down everything you need to know about deferred commissions, with examples, data, and best practices.

Design, track, and manage variable incentives with QuotaPath. Give your RevOps, finance, and sales teams transparency into sales compensation.

Talk to SalesWhat is a Deferred Commission?

A deferred commission is a sales commission paid upfront but recognized as an asset instead of an expense. Companies amortize these commissions over time to align with revenue recognition. In other words, the cost of an intangible asset is spread out throughout a contract, rather than being deducted in a single accounting period.

This is done to match the expense with the revenue generated by the contract. This ensures compliance with ASC 606 and prevents financial misstatements.

How Are Deferred Commissions Treated in Accounting?

Understanding how deferred commissions are recorded in accounting is essential for ASC 606-compliant financial reporting.

- Deferred commissions are recorded as a long-term asset.

- They are amortized over time, aligning with contract revenue recognition.

- ASC 606 sales commissions require companies to capitalize commission costs and expense them over the contract term.

Deferred Commission Journal Entry Example:

| Account | Debit | Credit |

| Deferred Commission Asset | $50,000 | |

| Cash | $50,000 | |

| (At the time of payment to the rep) | ||

| Account | Debit | Credit |

| Commission Expense | $10,000 | |

| Deferred Commission Asset | $10,000 | |

| (As the commission is amortized over five years) |

Deferred Commission Examples

Deferred commissions vary by industry. For instance, in the SaaS industry, capitalized commissions are amortized over the contract period and can range from months to years, depending on renewal rates and customer retention. However, broker commissions are deferred in real estate until the sale is finalized. Deferred commissions differ by industry depending on business model, contract length, and accounting standards.

| Industry | How Deferred Commissions Work |

| SaaS | Commissions are capitalized and amortized over a multi-year contract |

| Insurance | Agent commissions are paid upfront but recognized over the policy life |

| Real Estate | Broker commissions are deferred until a sale is finalized |

| Telecom | Sales commissions spread across contract terms (e.g., 24-month plans) |

How Amortization Works

Deferred commissions are amortized under ASC 606 rather than expensing them upfront. This practice aligns expenses with the revenue they generate, ensuring financial statements accurately reflect the economic reality of sales. The process involves capitalizing the commission as an asset and then amortizing it throughout the contract, mirroring the timing of revenue recognition.

Step 1: Capitalize the Commission Cost: When a sales commission is paid, it is recorded as a deferred commission asset on the balance sheet.

Step 2: Determine the Amortization Period: The amortization period is based on the expected customer benefit period.

This often aligns with contract length (e.g., 3 years) for SaaS and subscription businesses.

Step 3: Recognize Commission Expense Monthly: A portion of the deferred commission is expensed monthly or quarterly over the contract term.

The Impact of ASC 606 on Commission Accounting

ASC 606 significantly changed commission accounting. Previously, companies could expense sales commissions immediately. However, under ASC 606, commissions must be capitalized and amortized over time to align with revenue recognition. This impacts financial reporting by increasing deferred commission assets, affecting EBITDA and profitability, and requiring businesses to adjust incentive compensation structures.

Businesses also face several key compliance challenges, especially in commission tracking. Accurate commission tracking is essential for ASC 606 compliance, ensuring that commission expenses are properly amortized over the life of a contract, according to revenue recognition principles.

| Before ASC 606 | After ASC 606 |

| Commissions expensed immediately | Commissions capitalized as assets |

| No amortization required | Amortized over the customer benefit period |

| Minimal impact on EBITDA | Affects profitability and EBITDA calculations |

Financial Impact of ASC 606 on Commissions

Beyond just changing accounting entries, ASC 606 has a broad financial impact on companies’ balance sheets, profitability metrics, and even sales compensation strategies.

Increases Deferred Commission Assets: Instead of expensing commissions upfront, companies must record them as an asset on the balance sheet.

Affects EBITDA & Profitability: Since commissions are amortized, companies see higher net income in the first year but lower net income in later years as expenses gradually increase.

Alters Sales Compensation Strategies: Some businesses adjust commission structures to minimize the financial impact (e.g., lower upfront commissions, higher renewals).

Compliance Challenges with ASC 606

While the principles of ASC 606 are clear, many companies struggle with the day-to-day operational challenges of accurately tracking and managing deferred commissions.

Tracking Different Amortization Periods: New vs. renewal commissions may require different amortization schedules.

Commission Adjustments & Clawbacks: Businesses may need to adjust recognized expenses if customers cancel early.

Data Complexity: Companies need accurate commission tracking software to manage amortization schedules and ensure compliance with ASC 606 sales commissions rules.

Try the most collaborative solution to manage, track and payout variable compensation. Calculate commissions and pay your team accurately, and on time.

Start TrialHow QuotaPath Simplifies ASC 606 Compliance

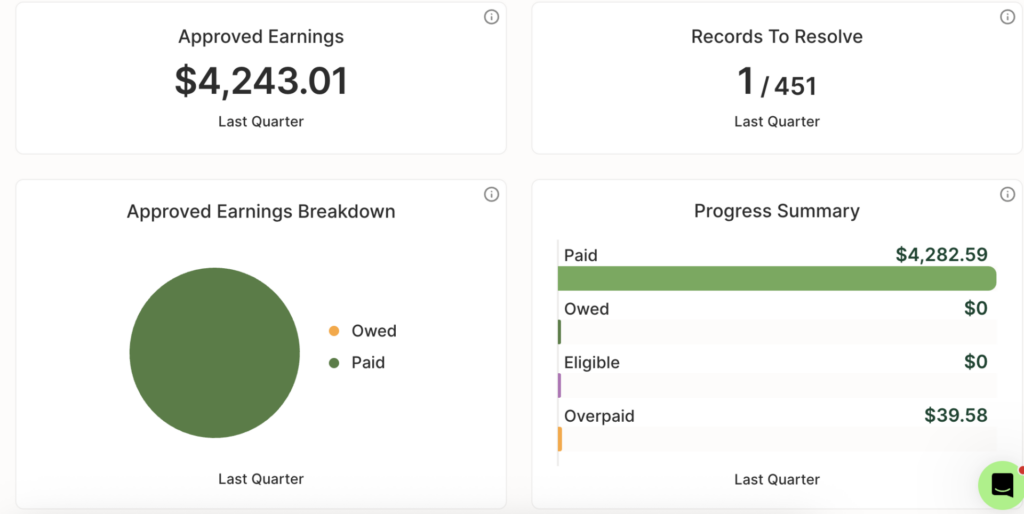

QuotaPath helps businesses navigate ASC 606 compliance with ease. Automating commission capitalization and amortization significantly reduces the risk of manual errors in revenue recognition. The software tracks compliance-ready reports that streamline audits and ensure transparency. QuotaPath also integrates seamlessly with leading CRMs and ERPs for accurate commission tracking.

See how QuotaPath can simplify ASC 606 compliance. Schedule a demo today.