Companies with thoughtful incentive compensation plans see an average of 22% increase in sales performance. Traditional compensation structures can leave employees feeling unmotivated and disengaged, yet aligning employee performance with company goals can be complex.

Incentive compensation management offers a strategic approach to sales team motivation and retention through performance-based rewards. Implementing a well-designed incentive program can boost employee engagement, improve performance metrics, and ultimately drive business growth.

Streamline commissions for your RevOps, Finance, and Sales teams

Design, track, and manage variable incentives with QuotaPath. Give your RevOps, finance, and sales teams transparency into sales compensation.

Talk to SalesUnderstanding Incentive Compensation Management

Incentive compensation management creates, establishes, and administers an incentive compensation plan. Incentive compensation typically consists of performance or results-based variable pay.

Variable pay commonly consists of a base salary plus some form of incentive reward. Various types of variable pay include commissions, bonuses, stock options, and performance-based pay tied to performance or results metrics.

Incentive compensation management is intended to motivate employees to drive specific behaviors, reward the desired performance, and achieve business objectives.

The Importance of Incentive Compensation In Sales

Both businesses and employees benefit from effective incentive compensation management, making it a win-win.

| For Businesses: | |

| Increased sales and revenue generation | |

| Improved employee performance and productivity | |

| Enhanced employee engagement and satisfaction | |

| Alignment of employee and company goals | |

| For Employees: | |

| Opportunity to earn more money based on performance | |

| Increased sense of ownership and accountability | |

| Recognition for achieving goals and exceeding expectations | |

| Feeling valued and appreciated by the company |

Key Components of Incentive Compensation Plans

The essential elements of incentive compensation plans include:

- Designing Effective Incentive Plans

Building an effective incentive compensation plan requires the selection of bonus and commission structures, setting goals, and aligning incentives with company strategy.

There are various types of incentive structures to choose from such as commissions, bonuses, profit sharing, and stock options. Consider which of these bonus and commission elements you’ll include in your incentive plans.

Set SMART goals for your incentive compensation plans that are Specific, Measurable, Achievable, Relevant, and Time-bound.

Align incentives with company strategy by rewarding behaviors that drive business goal achievement. Otherwise, you’re setting yourself up to fall short of company objectives.

- Communication and Transparency

Your methods and clarity in communicating, implementing, and managing compensation greatly influence the plan’s overall success.

Effective compensation communication plans are essential to the success of your incentive plan. They help employees understand the plan details, its intent, and what support reps can expect under the new plan.

Provide regular feedback on performance to eliminate miscommunications or misunderstandings. This allows you to gauge the incentive plan’s effectiveness of driving desired behaviors and increases employee understanding.

Standardizing compensation plans for every person with the same role will ensure fairness and consistency in plan application. Then, by evening out territory, everyone can have the same shot at achieving on-target earnings (OTE) for their position.

- Technology and Tools

Software facilitates effective incentive compensation management.

Utilizing software for automating calculations and tracking performance data ensures accuracy while reducing errors and commission disputes.

Leveraging data analytics to monitor plan effectiveness provides insights and sales performance metrics to identify trends and facilitate plan improvement easily.

Streamlining administration and reporting processes, saving valuable staff time by reducing manual data input. Software integration capabilities make this possible by pulling relevant data from CRMs and accounting software.

Integrate & Automate

Harness the power of your existing tech stack with QuotaPath’s intuitive integration capabilities.

Show Me IntegrationsThe Role of Software in Incentive Compensation Management

Compensation management software boosts efficiency, accuracy, and plan effectiveness in the following ways:

- Automating Calculations: Eliminate manual calculations for things like commissions, bonuses, and other payouts. This reduces errors and ensures accuracy in incentive compensation which builds trust with employees.

- Tracking Performance Data: Consolidate and track sales performance metrics relevant to the incentive plan. Providing individual and team real-time performance tracking provides additional plan transparency while increasing the team’s understanding of the plan. The ability to track their own progress also boosts individual and team motivation as they strive to hit targets and milestones in the plan.

- Streamlining Administration: Automate workflows for approvals, payouts, and reporting to reduce the administrative burden for HR and finance teams–a huge time-saver.

- Testing and Modeling: With QuotaPath specifically, revenue leaders can draft their next comp plan, test them against last year’s data, and even model potential attainment scenarios to estimate the total cost of the compensation model. This helps you avoid unpleasant surprises and potential compensation plan pitfalls while ensuring the plan won’t break the budget.

- Data Analytics and Reporting: Analyze incentive program effectiveness and identify areas for improvement. Generate reports for tracking trends and monitoring program performance to facilitate data-driven compensation decisions. Democratize the data and provide one source of truth vs. gated spreadsheets to increase transparency and trust while streamlining processes.

- Improved Communication and Transparency: Facilitate clear communication of plan details and performance data to employees, increasing their plan understanding and adoption. Enhancing transparency and trust in the incentive program also boosts the plan’s effectiveness in increasing team performance and goal achievement.

5 Incentive Compensation Best Practices For Sales Teams

Ready to start creating your incentive plan? Here are some best practices for successfully designing an effective compensation plan for sales teams:

- Align Incentives with Business Goals: Don’t incentivize activities that don’t ultimately drive business growth. Ensure your incentive plan rewards behaviors directly contributing to achieving your company’s strategic objectives. For example, if increasing customer lifetime value is a key goal, the plan might reward sales reps for securing longer-term contracts or upselling additional products to existing customers.

- Transparency and Clear Communication: A well-defined and clearly communicated plan is essential. Sales reps need to understand eligibility criteria, performance metrics, commission rates, and payout structures. Regular communication and updates on performance progress keep reps motivated and engaged.

- Balance Individual and Team Performance: A healthy balance is key. While rewarding individual achievement can motivate top performers, neglecting team incentives can hinder collaboration and teamwork. Consider incorporating elements that reward both individual sales quotas and team-based goals like exceeding overall sales targets or achieving high customer satisfaction ratings.

- Data-Driven Plan Design and Monitoring: Don’t rely on guesswork. Utilize sales data and performance metrics to design your incentive plan and track its effectiveness. Analyze the impact of the plan on sales performance and adjust components like commission rates or target setting as needed to ensure alignment with your business goals.

- Recognition and Rewards Beyond Money: Financial rewards are a powerful sales motivator, but recognition programs can go a long way in boosting morale and fostering a culture of achievement. Public recognition within the team or company, awarding titles or badges for exceeding targets, or offering non-monetary rewards like extra vacation days can add value and create a well-rounded incentive program.

Measuring The Success of Your Incentive Compensation Plan

Gauging the effectiveness of your chosen incentive compensation strategies is essential for various reasons. It offers insights into how well aligned the comp plan is with business goals, aids with budgeting and financial planning, and sales performance optimization. Measuring incentive plan success also helps improve operational efficiency, informs data-driven plan decisions, supports regulatory compliance and fairness, and helps assess motivation and retention effectiveness.

Organizations can optimize incentive compensation plans by analyzing key metrics relevant to commission effectiveness. We recommend tracking the following data points to assess incentive plan success:

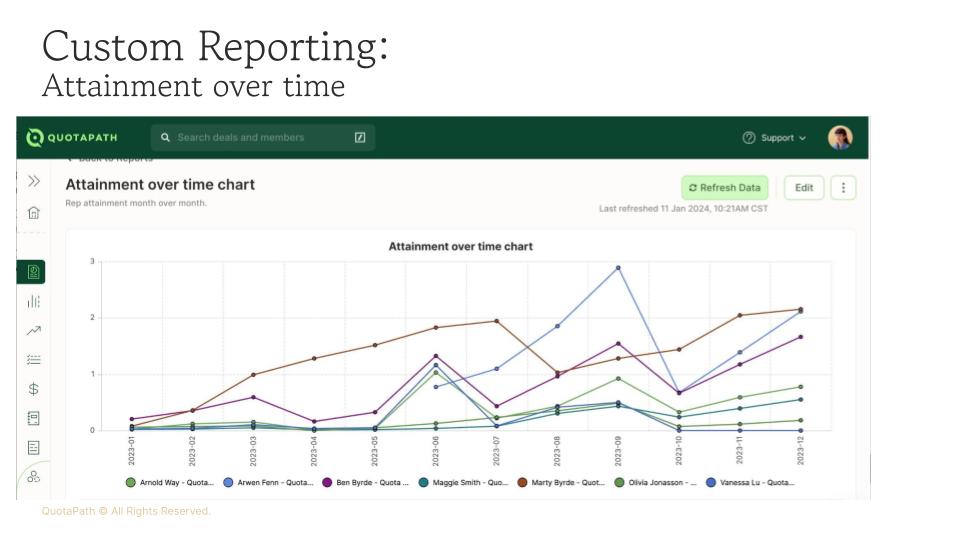

Assess business goal alignment with metrics like attainment over time, revenue growth rate, and earnings by comp plan component.

- Attainment over time: Measures how effectively sales commissions align with overall business objectives by tracking sales target attainment over time to reveal seasonality and rep consistency across periods.

- Revenue growth rate: Gauges the impact of sales commissions on driving revenue growth and achieving business goals. Calculate the revenue growth rate using the following formula:

To calculate the revenue growth rate

= (Current revenue – previous revenue) x 100

Previous revenue - Earnings by comp plan component: To assess how well your comp plan is driving your North Star metrics or key business objectives, look at which parts of your comp plan you’re paying the most commissions on.

Useful metrics for budgeting and financial planning include commission expense ratio, commission payout ratio, and effective rates.

- Commission expense ratio: Helps ensure commissions are within budget by comparing commission expenses with gross margin or total revenue.

- Commission payout ratio: Enables accurate financial forecasting and planning by monitoring the percentage of revenue allotted to commissions.

- Effective rates: Combined commission percentage per deal across every commission-earning role. NOTE: This needs to be below 25%

Sales performance optimization metrics to review when gauging the success of the incentive plan include sales conversion rate and average deal size.

- Sales conversion rate: Measures the effectiveness of sales activities in converting leads into customers, revealing the influence of commission structures on sales performance.

- Average deal size: Quantifies the average value of sales transactions, showing how commission incentives affect sales representatives’ prioritization of high-value deals.

Gauge operational efficiency with metrics like sales cycle duration and time to quota attainment.

- Sales cycle duration: Measure the effectiveness of sales processes and the impact of commission structures on sales cycle length.

- Time to quota attainment: Reveals how rapidly sales representatives achieve their targets, gauging the efficiency and effectiveness of commission plans.

Metrics that aid data-driven decisions include commission payout variance and sales performance analytics.

- Commission payout variance: Identifies deviations from anticipated commission payouts, facilitating data-driven commission plan adjustments based on performance trends.

- Sales performance analytics: Leverages individual and team sales performance data to guide commission adjustments and optimize incentive structures.

Assess regulatory compliance and fairness by reviewing measurements including commission payout accuracy, commission dispute resolution time, and discrepancy/resolution count.

- Commission payout accuracy: Gauges commission calculation accuracy to confirm regulatory compliance and fairness in compensation.

- Commission dispute resolution time: Measures the amount of time taken to resolve commission disputes, confirming fairness and compliance with regulatory standards.

- Discrepancy/resolution count: Tracks the number of commission errors or questions per pay period to discern how well your reps understand how they earn commission and how accurate (or inaccurate) your incentive calculations and data are.

Gauge the effectiveness of the incentive plan for motivation and retention with metrics such as sales team turnover rate, employee satisfaction with commission plans, and SPIF success.

- Sales team turnover rate: Reveals the rate at which sales representatives leave the organization, expressing the effectiveness of commission structures in motivating and retaining talent.

- Employee satisfaction with commission plans: Measures the average level of sales rep satisfaction with their commission structures, which is an indicator of motivation and retention levels.

- SPIF success: Assesses the impact of short-term incentive plans like sales performance incentive funds or special performance incentive funds (SPIFs) to determine how effectively they drive selling behaviors and whether it’s a valid full-time addition to your compensation plan.

By tracking these essential metrics, organizations can gauge the effectiveness of their sales compensation plans in driving business objectives, optimizing sales performance, supporting financial stability, maintaining operational efficiency, guiding data-driven decisions, complying with regulations like ASC 606, and nurturing motivation and retention among sales teams.

Try QuotaPath for free

Try the most collaborative solution to manage, track and payout variable compensation. Calculate commissions and pay your team accurately, and on time.

Start TrialFuture Trends In Incentive Compensation Management

Despite a select few leaders who question the validity of variable pay structures, more companies are adopting them not only for sales, but also across other departments such as Marketing, Solutions, Partnerships, and RevOps.

For instance, in 2018, 77% of companies in the U.S. were using variable pay programs as part of their total rewards packages, with an additional 9% reporting they were planning to adopt a variable pay plan within the next two years. Then, by 2021, that number increased by 6%, according to Harvard Business Review, which included 250 of the largest S&P 500 firms implementing variable compensation.

Schedule time with our team to see how QuotaPath can simplify your incentive compensation management.