A sales compensation clawback occurs when a company recovers commissions previously paid to a representative, typically because a customer cancels, requests a refund, or fails to pay within a defined period. While clawbacks are widely disliked, they serve a critical purpose: protecting the business financially, discouraging fraud or misrepresentation, and motivating reps to prioritize high-quality, long-term customers.

To be considered fair, every clawback policy should include three essentials:

- A defined timeframe, within 3–4 months of the sale, for example

- Clear triggers like cancellations, refunds, or non-payment

- Transparent terms, such as a signed clause in the compensation plan, a clear recovery method (usually future commission deductions), and visibility for reps to monitor clawback risk.

In this article, we’re sharing five best practices for creating fair, transparent, and enforceable clawback policies that protect your bottom line while maintaining rep trust and motivation.

Here we go!

Design, track, and manage variable incentives with QuotaPath. Give your RevOps, finance, and sales teams transparency into sales compensation.

Talk to Sales1. Set a Clear and Reasonable Timeframe

Every clawback policy should include a defined timeframe; the simpler, the better.

A clear and reasonable clawback window makes the policy easier to understand and implement, while preventing confusion or resentment among reps. A 3–4 month period post-sale is generally considered standard and fair.

According to HubSpot’s The Ultimate Guide to Sales Compensation, “If a customer cancels their plan one to four months after signing up, the salesperson who sold it to them is forced to give back their commission payment. This ensures reps focus their time and attention on businesses that can really benefit from the product.”

Predictability and simplicity should take precedence over punitive timelines.

Long or ambiguous clawback periods can create anxiety and distrust, especially when reps don’t know when a deal is officially “safe.” A short, well-defined window protects the business financially while enabling reps to plan their earnings and focus on closing more high-quality deals without tracking clawback risk indefinitely.

Download Our Free Sales Commission Agreement

2. Apply Clawbacks to Commission, Not Quota

When a deal falls through, companies have two primary options for clawbacks: recover the commission dollars or revoke the quota credit. While both approaches are technically viable, clawing back only the commission is widely considered the fairer and more effective option.

Quota clawbacks are overly punitive and demotivating for reps. If a rep is forced to “re-earn” quota credit for a churned deal, they may enter the next month or quarter already behind — a position that can feel insurmountable. This kind of policy affects rep morale and may drive shadow accounting, sandbagging, or other behaviors that undermine performance and trust.

By limiting clawbacks to commissions, companies protect their revenue without jeopardizing rep motivation or creating unnecessary friction. It’s a cleaner, more predictable process that encourages reps to keep selling, even when the occasional deal doesn’t stick.

3. Include Clear Language in Comp Plans

A clawback provision is only enforceable if it’s clearly written and acknowledged. That’s why it’s critical to include a specific clawback clause in your sales compensation plans. This clause should be clear and unambiguous, leaving no room for doubt about when and how commissions may be recovered.

For instance, this sample clause sets clear expectations: “Any commissions paid on deals that are refunded or canceled within four months will be deducted from future payouts.”

This language defines both the trigger (refund or cancellation) and the timeframe (four months), while also specifying the recovery method (deduction from future payouts). To avoid misunderstandings, it’s essential to include this clawback provision in a written compensation plan that requires the representative’s acknowledgement to confirm they’ve read and understood the terms.

Leverage our downloadableAE compensation policy andSDR compensation policy templates as a starting point for writing the clawback provision portion of your sales commission agreements.

4. Use CRM and Compensation Software to Automate Clawbacks

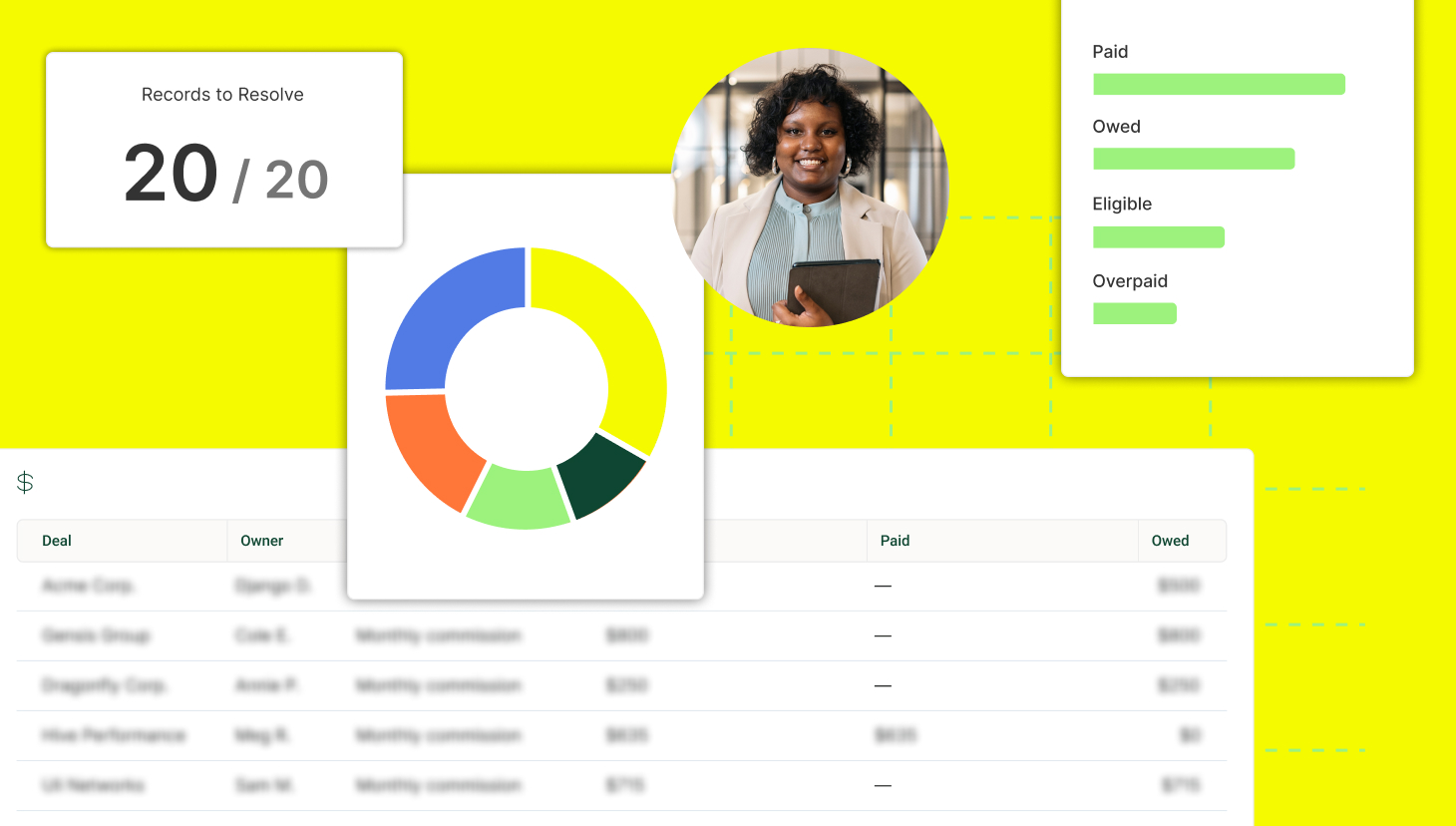

Clawbacks can create unnecessary administrative overhead if handled manually. However, compensation tools like QuotaPath streamline the process by automatically detecting clawback-eligible deals from CRMs like Salesforce or HubSpot and adjusting commissions accordingly.

With filters and time-based automations, you can flag deals that fall within a clawback window, apply the correct deductions, and track everything in one system. This streamlines the process, reducing manual oversight and saving time while minimizing errors.

As Prefect’s finance team shared, “We cut our time spent on commissions calculations by 50%+ and have enjoyed providing real-time transparency to our sales reps and technical pre-sales team.” Automating clawbacks lightens the load for finance and builds trust by giving reps instant visibility into their earnings and potential clawback risk.

5. Communicate Clawbacks Transparently with Reps

Clawbacks are easier to accept and less likely to cause frustration when reps know precisely when and why they occur. That’s why transparency is key. Show them in rep-facing dashboards that indicate which deals are at risk of clawback, when the clawback window ends, and whether a clawback has been applied. Use visuals and calculators to help reps forecast clawback risks, such as when a deal churns or a payment hasn’t been made.

Poor communication around clawbacks can quickly erode trust. On the other hand, a clear and intuitive UI that displays clawback data in real-time builds morale. When reps feel informed and in control, they’re more likely to stay motivated and focused on closing lasting deals.

Try the most collaborative solution to manage, track and payout variable compensation. Calculate commissions and pay your team accurately, and on time.

Start TrialFinal Thoughts

Clawbacks are only fair when they’re clear, limited in scope, and enforced consistently. Although clawbacks are unpopular, businesses benefit from including them in compensation plan documents, as they mitigate revenue risk, motivate reps, and align them on prioritizing specific deals.

The right tools make all the difference. By automating clawback detection and recovery, you can reduce manual work, mitigate revenue risk, and give reps real-time visibility into their earnings.

Automate clawback management. Try QuotaPath for free or schedule a demo.