Sales commission expense recognition involves many complexities. In this guide we show you how to achieve accurate recording and documentation of these costs by streamlining accounting, ensuring ASC 606 compliance, and creating revenue alignment with commissions.

Let’s get started.

Automated Commission Expense Recognition

Help your organization stay compliant and audit-ready. Capitalize commission payouts per ASC 340 and amortize commissions to match expenses with ASC 606 revenue recognition.

Show Me MoreDemystifying Sales Commission Expense Recognition

Sales commission expense recognition is the ongoing recording and reporting of commission costs associated with obtaining or fulfilling a customer contract amortized over time in alignment with the corresponding revenue recognition.

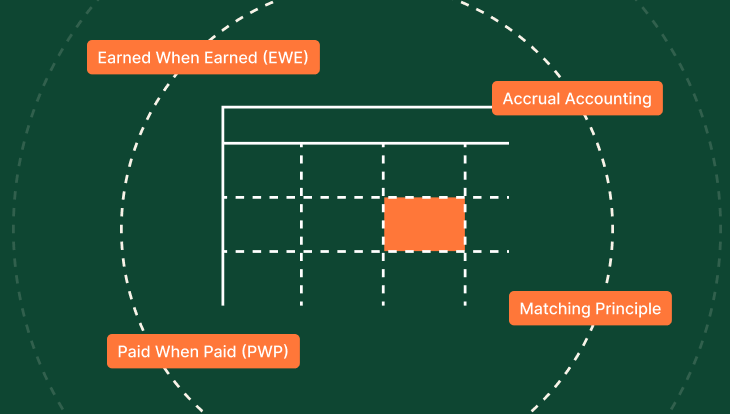

Some businesses prefer to use the Matching Principle, recognizing commission expenses when revenue is earned, whereas others prefer Cash-Basis accounting, recognizing expenses when cash is paid.

The two most common sales commission expense recognition methods are ‘earned when earned’ (EWE) and ‘paid when paid’ (PWP). The EWE method recognizes commission expense proportionally as the associated sales progress through the sales cycle. The PWP method, on the other hand, recognizes the entire commission expense when the commission is paid to the rep.

The chosen recognition method can affect a company’s financial statements regarding profitability and cash flow. For instance, EWE revenue and expenses are recognized when they occur instead of when payment is received.

This may not reflect actual revenue and expense timing, making short-term cash flow management more challenging. On the other hand, PWP can improve short-term cash flow by deferring expenses.

Likewise, profitability assessment accuracy can be more difficult when using PWP because revenue and expense activity is not recorded when it is experienced.

Other factors that might influence expense recognition’s complexity include clawback provisions or sales returns.

How to Scale Finance Operations

Building a solid finance infrastructure is imperative to an org. as it scales. These experts shared what to prioritize and when as your business grows.

Take Me to BlogKey Principles Of Commission Expense Accounting

Proper sales compensation accounting necessitates tax regulation and ASC 606 compliance. Failure to adhere to regulations or keep accurate records can result in significant fines, penalties, and missed funding opportunities.

The following is an overview of the main points involved in commission expense accounting for easy reference:

| Matching Principle | Commission expense is recognized in the same period as the corresponding sales revenue is earned. This aligns costs with the benefits they generate. |

| Recognition Methods | |

| Two main methods exist | |

| Earned When Earned (EWE): Expenses are recognized proportionally as the sale progresses through the sales cycle (e.g., commission on a multi-stage project is spread out across stages). | |

| Paid When Paid (PWP): The entire commission expense is recognized when the commission is actually paid to the salesperson (less common in modern accounting). | |

| Accrual Accounting | Commissions are recorded as a liability (commission payable) in the period they are earned, even if not yet paid. |

| Transparency & Consistency | The chosen method and its application should be clearly documented and consistently applied across all sales transactions. |

| Potential Complexity | Accounting for complex commission structures (e.g., tiered commissions and bonuses) may require additional calculations and considerations. |

Aligning Commission Recognition With Revenue Generation

Aligning commission recognition with revenue generation leads to more accurate financial reporting, better decision-making, a more motivated sales team, and improved overall efficiency within your organization.

The following best practices will help you achieve alignment with commission recognition and revenue generation.

Best practices

- Matching Principle Alignment: Ensure your commission recognition method follows the matching principle. This means recognizing commission expenses in the same period in which the corresponding revenue is recognized. This fosters a more accurate representation of your company’s profitability and aligns costs with the benefits they generate.

- Select the Right Recognition Method: The most appropriate method (Earned When Earned – EWE or Paid When Paid – PWP) is based on your sales cycle length and revenue recognition practices.

- EWE: Ideal for longer sales cycles where revenue is recognized progressively. Commissions are recognized proportionally as the deal progresses.

- Clear and Consistent Policy: Develop a clear and well-documented commission policy that outlines the chosen recognition method and its application. Ensure consistent application across all sales transactions for transparency and fairness among your sales team.

- Leverage Automation: Utilize accounting software or custom tools to automate commission calculations and pay sales commissions based on your chosen recognition method. This reduces manual effort, minimizes errors, and ensures timely and accurate expense recognition.

- Transparency & Communication: Regularly communicate your commission recognition policy to your sales team. Explain the rationale behind the chosen method and how it impacts their earnings. Open communication fosters trust and helps reps understand the connection between their sales efforts and financial rewards.

Leveraging Sales Compensation Software For Accurate Tracking

Navigating the complexities of sales commission expense recognition can be overwhelming. Add in lengthy customer contracts, early renewals or cancellations, and intricate compensation plans, and ASC 606 compliance starts to feel unachievable.

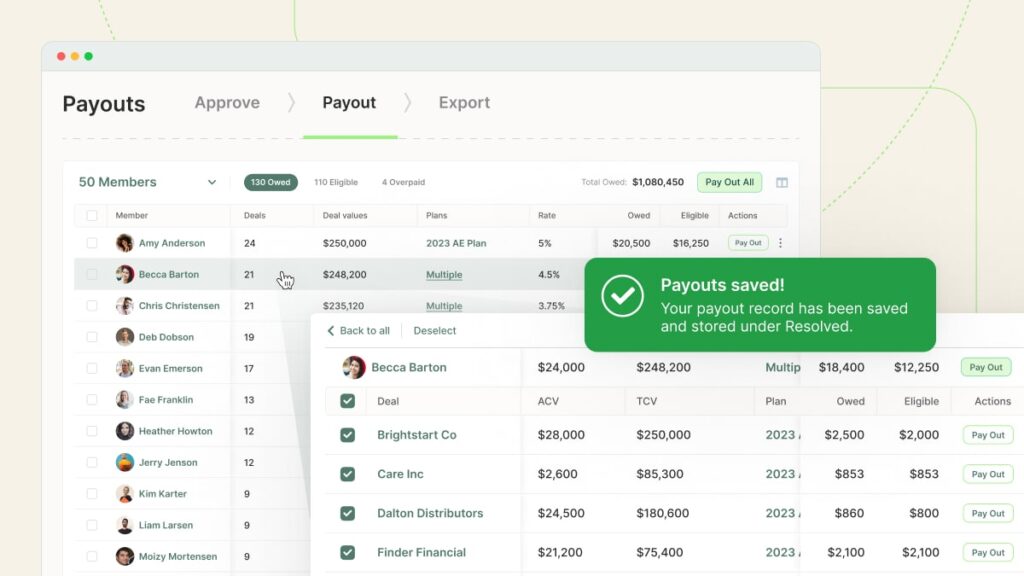

Sales compensation automation software streamlines commission expense recognition and ASC 606 compliance.

It consolidates all relevant information in one place for a single source of truth, making it easier to generate reports and provide real-time insights. The software ensures the accuracy of commission calculations and data across the organization.

Sales compensation software also provides transparency into the sales compensation process making it audit-friendly.

Best Practices For Commission Accounting Policies

Follow these guidelines for creating effective commission accounting policies.

- Clarity and Transparency: Clearly define the commission structure in writing, including details like commission rates, tiers, and bonuses. Outline the chosen commission recognition method, EWE or PWP, and its rationale. Explain how commissions are calculated and paid to sales reps, including information like frequency and thresholds.

- Alignment with Revenue Recognition: Match commission expense recognition with the corresponding revenue recognition period. Ensure the chosen method reflects your sales cycle length and business model, such as EWE for longer cycles.

- Use of Accounting Standards: Adhere to relevant accounting standards for commission expense recognition like ASC 606. Maintain proper documentation to support your chosen accounting practices, including policy documents and calculations.

- Automation and Efficiency: Utilize sales compensation software to automate commission calculations and accruals. Reduce manual errors and streamline the commission accounting process.

- Communication and Training: Regularly communicate the commission policy to your sales team by taking steps like training sessions and FAQs. Provide ongoing training on how to understand and interpret their commission statements. Encourage open communication with the sales team regarding any questions or concerns about the policy.

Integrate Your Tech Stack

Sync the key players from your sales tech stack with QuotaPath’s sales commission software.

Take Me to IntegrationsIntegrating Commission Expense Data Into Financial Systems

The power of automating with sales compensation software is through integrating it with your financial systems and data analytics and business intelligence. This eliminates errors and ensures accuracy.

QuotaPath integrates easily with sources across your tech stack, thanks to self-guided instructions and a stellar customer experience team. Our seamless integrations also refresh automatically, no manual intervention required.

Financial integration options include:

- Chargebee

- Excel

- Google BigQuery

- Google Looker

- JobAdder

- Keap

- Leaflink

- Maxio (Chargity & SaaSOptics APIs)

- Netsuite

- Smartsheet

- Snowflake

- Tableau

- And more (we’re always adding new ones)

Design, track, and manage variable incentives with QuotaPath. Give your RevOps, finance, and sales teams transparency into sales compensation.

Talk to SalesStreamline Sales Commission Expense Recognition

Sales commission expense recognition is complex. However, accurately documenting commission cost amortization doesn’t need to be overwhelming when you streamline accounting, achieve ASC 606 compliance, and align commissions with revenue.

Remember to select the right recognition method, develop a clear and well-documented commission policy, and regularly communicate your commission recognition policy to your sales team. Leveraging software to automatically calculate and pay sales commissions saves time, reduces errors, and boosts compliance.

Schedule time with our team to learn how QuotaPath can streamline the sales commission expense recognition process for Finance and Accounting teams.