This blog explores the intricacies of offering startup equity compensation to employees.

Startups offer equity as a way to attract and retain talented employees and to raise capital from investors.

In doing so, startups gain an edge over some of the larger tech corporations by opening up stock option ownership. The idea is that employees who get in early take a salary cut in hopes of a healthy payout upon the startup’s exit.

But it’s not so simple as offering up a percentage of options and calling it a day.

“Startup compensation equity is a tricky thing,” QuotaPath CEO and Co-Founder AJ Bruno said. “There’s definitely been an evolution of options over the last decade.”

A lot of founders and venture capitalists have done a pretty good job of teaching their companies and their teams about it, AJ said. But usually, the topic lives internally — leaving those outside of the organization quite clueless.

To help clarify, AJ offered some best practices around the challenges surrounding equity compensation plans.

Before we explore those, let’s begin with the basics of startup equity.

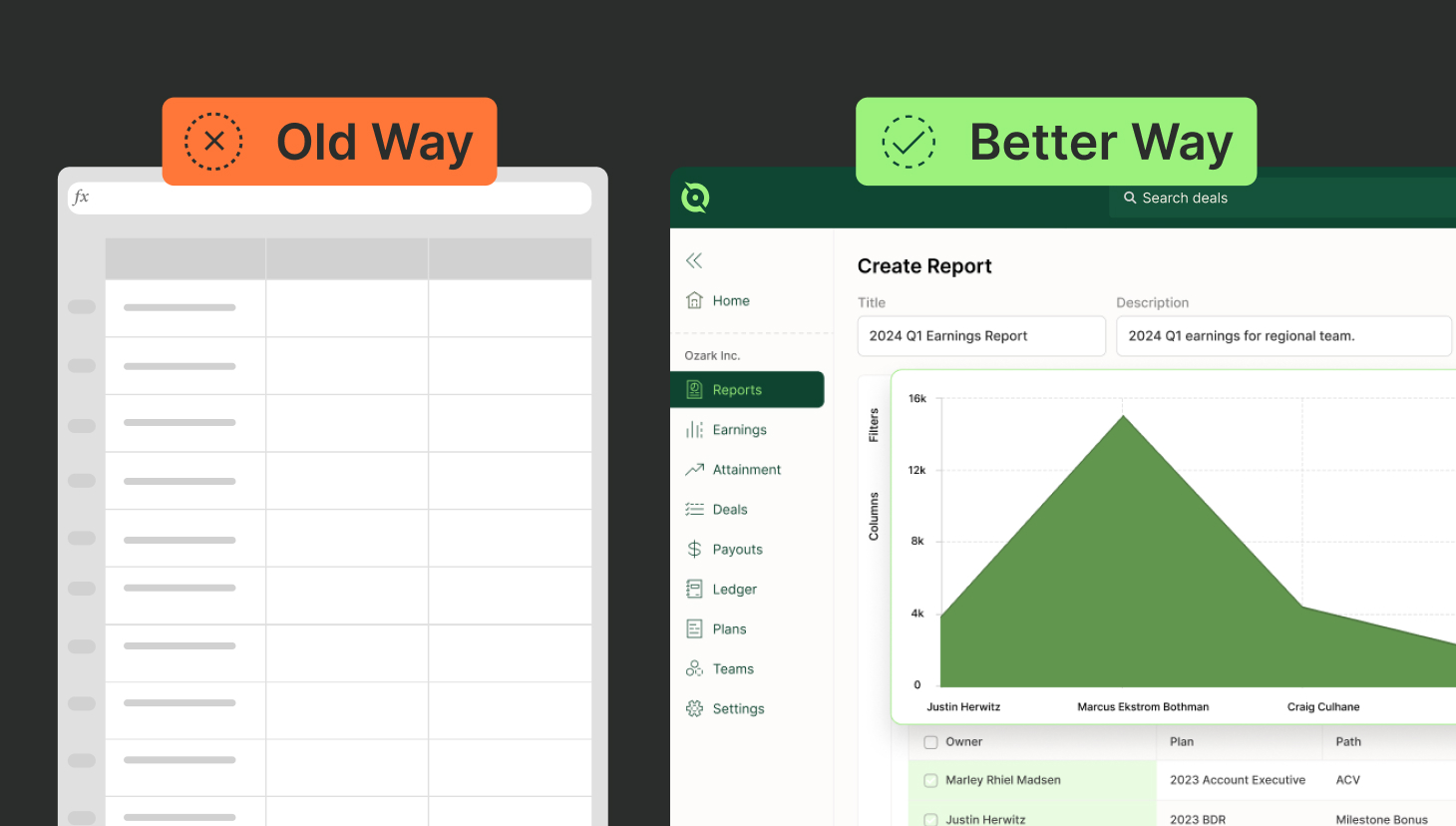

RevOps, sales leaders, and finance teams use our free tool to ensure reps’ on-target earnings and quotas line up with industry standards. Customize plans with accelerators, bonuses, and more, by adjusting 9 variables.

Build a Comp PlanBasics of startup equity compensation

Startup equity refers to a percentage of ownership in a company offered to employees, founders, and investors in exchange for their contributions to the company. Equity represents a share of the company’s assets and profits, and its value fluctuates depending on the company’s performance and funding.

Employees who accept equity typically receive stock options, which give them the right to purchase shares of the company’s stock at a fixed price (the “strike price”) at a later date. That later date, we refer to as the “vesting period,” which is the time an employee must work for an employer in order to own outright their shares of company stock.

What is a vesting period?

The typical vesting period for startup equity is usually 4 years with a 1-year cliff. This means that the founder or employee would receive 1/4 of their equity after one year of service, and the rest of the equity would vest over the next three years, with 1/48 of the equity vesting each month.

Vesting schedules like this are aimed to align the interests of the employee with those of the company and to encourage them to stay with the company for the long term.

However, vesting schedules can vary widely and depend on the specific terms agreed upon between the company and the founder or employee.

“To understand options, you first have to understand how the company is organized,” AJ said. “C Corp, Delaware, B Corp, S Corp, Sole proprietorship, individual. They all have nuance.”

But they all tie back to what’s called a “charter.” The charter is what governs the organization and changes over time with more funding.

Additionally, the amount of equity depends entirely on the stage of the company and the employee’s position and experience.

Meaning, the younger the company and the more senior your role, then the more likely you are to get a bigger percentage of options. Whether you’re in a technical role or not also impacts your options.

“In my experience, if you’re in a business or sales role, you can expect equity to range anywhere from 0.1 to 0.9%,” wrote Belicia Tan, manager at Ladder. “For engineering or product roles you can expect 0.2 to 1.25%, and if you’re a designer, you can expect 0.2 to 1%. However, not all startups will follow these bands, and some are flexible to adjusting the weight between your base salary and equity based on your preference.”

Benefits of offering equity

By offering equity, early-stage startups can substitute or complement cash with ownership options. This comes in handy for young startups without a lot of cash available to pay for top talent.

Other benefits include:

Alignment of interests: Employee equity aligns the interests of employees with those of the company, as they now have a financial stake in the success of the business.

Motivation: Ownership in the company can serve as a powerful motivator for employees, as they will be more invested in the company’s success and will work harder to make it happen.

Potential for long-term wealth creation: Employee equity can provide employees with the potential for long-term wealth creation, as the value of their equity may increase as the company grows and becomes more valuable.

Sense of belonging and pride: Equity also can give employees a sense of belonging and pride in the company, which can lead to higher employee retention and job satisfaction.

Of course, paying via equity brings a few challenges.

Try the most collaborative solution to manage, track and payout variable compensation. Calculate commissions and pay your team accurately, and on time.

Start TrialThe challenges

For starters, at this point in people’s tech careers, they’ve probably seen a friend “get rich” from getting in early at a startup with a successful exit.

“They think it’s easy money,” AJ said. “And that’s just not true. The fact remains that 90% of startups fail.”

AJ turned to today’s market dip for a sobering lens.

“The downstream effect from the economic downturn we’re in right now is that the ability for companies to raise capital will dry up,” AJ said. “Then comes the threat of layoffs or restructuring. It’s a tough position for the team and company to be in and the company’s chance of going under increases significantly.”

As a result, startups will have to offer competitive salaries and compensation if they want a shot at exceptional talent. Equity isn’t enough in today’s world.

Another challenge stems from the volatility of the market. Stock information communicated by founders to employees grows quickly out of date due to the market and fundraising. This clouds transparency.

“Further complicating this is the amount of venture capital that flowed into organizations and pumped up valuations,” AJ said. “Now, you have stock prices — even for private companies — that are underwater.”

Best practices for employees

To align employees and promote transparency around compensation and equity, AJ recommends putting an equity management solution in place, such as Carta.

“Being able to zoom out and have the total picture is the first step to understanding what options exist in an organization,” AJ said.

For employees considering equity compensation packages, AJ recommends taking a step back to understand your goals.

“Is the goal to learn, or is the goal to earn? If it’s to learn, you could join these companies that may or may not be overvalued, inherit a lot of responsibility and learn. You take the risk-reward because your options might be worth something,” AJ said.

If it’s to earn, go to a bigger company and push for that cushy salary.

Also, instead of focusing on the amount of options, learn the number of total outstanding shares relative to the number of your shares and the strike price.

“If I were a new employee, I would want to understand how long it’s going to take for the company to grow into its valuation,” AJ said. “Because, yes, you usually get more equity as the company grows, but that equity gets more expensive.”

What is a strike price?

The strike price is the price at which an option contract can be exercised. For call options, the strike price is the price at which the holder of the option can buy the underlying asset. For put options, the strike price is the price at which the holder of the option can sell the underlying asset. The strike price is also known as the exercise price or the strike rate.

Startup equity compensation best practices for leaders

Be honest. Be open. And give people as much information as you can to help them make an informed decision.

“That way, when they get here, it doesn’t feel like a bait and switch like I’ve seen a lot of startups pull,” AJ said.

As for another sound piece of advice, put a formal and transparent framework in place to level inequity equality.

“Wherever you are in the process, or your stage in the company, start something formal,” AJ said.

For additional resources around startup compensation equity, check out the following:

- Here’s How Startup Founders Should Offer Employee Equity (Gong)

- Startup equity: how much to give employees (SeedLegals)

- The Complete Guide to Employee Equity (acelr8)

- Startup employee equity: What founders should know (Carta)

Sales Compensation

Thanks, AJ, for sharing your thoughts on equity as compensation.

For more information on QuotaPath, a sales compensation management platform and commission tracking software, chat with our team today.