The tech downturn is in full swing. Recession talks have dominated the headlines as interest rates saw the highest jump in 22 years and the stock market continues to fall. We’ve watched companies like Netflix, Carvana, and Noom enforce layoffs in the past week, with economists predicting many more in the coming months.

Founders, myself included, have begun having conversations with one another, advisors, investors, and our leadership teams to plan accordingly.

Should we find ourselves in another economic downturn, fresh off the heels of the short (yet painful) one brought forth by the pandemic in 2020, we want to be prepared.

A primary driver of the tech downturn

In the technology sector specifically, a leading cause of this volatility hails from multiples on business valuations that come in much higher than their revenue.

For context, we typically see funding announcements with valuations that amount to 10x to 20x company revenue. But at the beginning of 2021, we started seeing multipliers 50x, 100x, even 250x revenue.

Companies that received huge funding rounds ended up directing significant percentages of those fundings toward customer acquisition costs (CAC). They spent, for example, $30 to $40 million of their $50 million investment on marketing efforts to hit $10 million in revenue. On the outside that looks like a bump to $10 million. But what does the company have to show for it? The CAC far outweighs the revenue, which means they can’t raise at the same multiple again and risk a down round. A down round occurs when an investment leads to a lower valuation.

So, what do leaders do in this position? They reduce the amount of money they spend each month. We refer to this as “burn.”

Investors have begun instructing executives to conserve cash and cut costs via headcount reduction (aka layoffs) or eliminate unnecessary spend. See: Bloomberg’s “Tech’s High-Flying Startup Scene Gets a Crushing Reality Check.”

Where QuotaPath fits in

Fortunately, and unfortunately, I’ve been down this road before.

I took my first job in sales fresh out of college for a PR SaaS platform in 2007 during a recession. Think about that. PR is one of the last industries you want to be selling into when the economy is down. Many of the people I spoke with didn’t know if they would have a job the next week.

But we shifted our mindset. Instead of selling one to two large contracts, we went after six to eight smaller, quick deals to hit our targets. And it worked.

We applied a similar mindset in creating QuotaPath in 2018.

We purposely think about our customers and how economic shifts can impact their hiring plans. We recognize that in times of uncertainty, companies look to cut the burn, whether that’s people or platforms.

We positioned ourselves from the beginning to serve as the commission tool that can move with sales teams as their needs change. We keep our prices transparent and have built a product-led growth model that scales with businesses no matter the size. It doesn’t make sense for businesses to overpay.

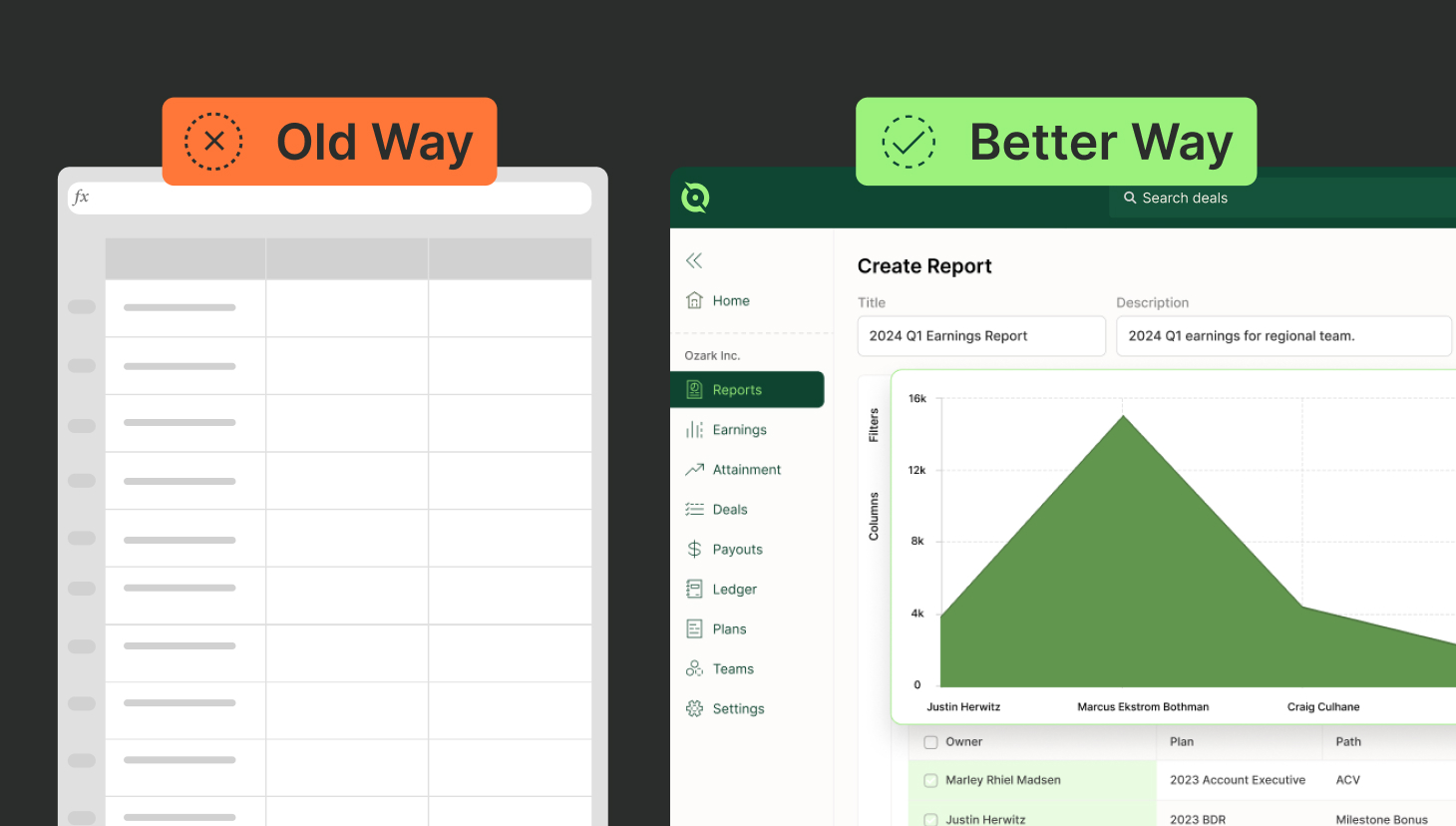

Teams can implement QuotaPath quickly. Our platform allows for fast adjustments in the system, whether that’s adding/removing users or building a new compensation plan.

Even more, we created QuotaPath’s product to play a much larger role than automating commission tracking.

We are the only compensation management software that actually motivates teams, which has led to higher sales, team attainment, and rep retention.

Ask Dennis Dube, SVP of Commercial Operations at OSG, Blackthorn’s VP of Sales Joe St. Germain, or RoverPass’s Director of Sales Kristen O’Hara.

Each of these sales leaders, and many more within our QuotaPath network, can attest to the effect of reps being able to see how their next deal impacts their personal and professional goals. Dennis, for instance, finished 2021 with the highest sales year reported in company history and 70 percent of his team achieving quota.

Motivating your team, keeping spirits up, and driving revenue as reps question their job security will be especially important through the remainder of 2022 – and likely into 2023.

Choices ahead

No doubt, every leader has already begun to evaluate how to maximize revenue and where to save money. We have had those conversations here and will continue to do so.

But we will not be cutting people or programs that have empirically shown to increase productivity, motivation, and retention. We hope you’ll consider the same.

As always, our team is here to support you, and that includes support from me.

Feel free to reach out, aj@quotapath.com, if you have questions about optimizing your QuotaPath experience, or, if you’re a leader looking to chat through today’s economic landscape.

Sincerely,

AJ Bruno