Reps don’t love them, but clawbacks play an integral role in the sales compensation space. Below, we define clawbacks, how companies present them in comp agreements, example clause copy, and why leaders should protect their businesses with detailed policies.

Try the most collaborative solution to manage, track and payout variable compensation. Calculate commissions and pay your team accurately, and on time.

Start TrialFirst, what does clawback mean?

In the case that a customer is mis-sold and needs refunded or fails to pay for their services, management may issue a chargeback of commission.

As an example, let’s say I’m a sales rep that closed a $20K deal last month and earn a 10% standard commission rate. Per my sales commission payments schedule, and using QuotaPath, I can see that I’ll receive my commissions from the deal in the next check. Hello, $2K!

Fast forward to a month after receiving my sales commissions. I learn that my customer has to cancel their contract after I’ve already received my commissions.

In this instance, not all, but most companies will issue a clawback.

A clawback occurs in sales when a company has paid rep commissions on a sale and then the customer abruptly ends the contract within a certain period of time. The clawback itself is when the employee pays back the commissions per the sales commission plan.

HubSpot, for instance, has a clawback policy in effect for the first four months of the customer’s contract.

“If a customer cancels their plan one to four months after signing up, the salesperson who sold it to them is forced to give back their commission payment. This ensures reps focus their time and attention on businesses that can really benefit from the product.” That’s from HubSpot’s The Ultimate Guide to Sales Compensation.

Clawbacks outside of sales

Now, people view and define clawbacks a bit differently outside of sales.

Per the Corporate Finance Institute, it is “a contractual obligation to return money under special circumstances or events.” In finance, a clawback provision protects the company from employee fraud and misconduct, like inflated performance reports or when an employee fails to deliver on promises made.

What further differentiates clawbacks outside of sales commissions is that these ones can come with additional penalties beyond a refund.

Regardless of what industry you’re in, however, in order for companies to actually enforce a clawback, they need a contract. Then all employees subject to a clawback should sign it. In sales, for instance, this clause lives in an employee’s sales compensation plan.

What is a clawback provision/clawback clause?

When talking about clawbacks, you might also hear the term “clawback provision” or “clawback clause.”

In sales, this provision or clause refers to the specific section in the comp plan that outlines scenarios in which it’s okay for an employer to take back commissions and bonuses from a rep.

In our HubSpot example above, the clawback clause is both specific and easy to understand. If the customer cancels within the first four months, the rep returns commissions. If they cancel in the fifth month, the rep keeps commissions, and the company eats the churn. The end.

RevOps, sales leaders, and finance teams use our free tool to ensure reps’ on-target earnings and quotas line up with industry standards. Customize plans with accelerators, bonuses, and more, by adjusting 9 variables.

Build a Comp PlanClawback clause example for a sales compensation plan

Below, we listed sample copy of a clawback clause within a sales compensation plan. We borrowed this sample from Commission Clawback Sample Clauses and tailored it to the HubSpot example.

Clawback clause example

“Any amount of sales commissions previously paid to the sales rep for any sales that [Company] could not collect or for orders returned or refunded within the first four months of the customer agreement will be deducted from the next sales commission check.”

The importance of clawbacks and provisions

Of course, reps don’t love a clawback. Plus, in some cases, a deal imploding after signing may fall entirely out of their control.

Still, clawback policies encourage reps to vet the best opportunities and build long-term relationships with their customers. Reps comp’ed on renewals and add-ons are likely already doing the latter. However, for reps that hand off customers to account management and success teams after the deal finalizes, clawbacks give them another reason to invest in solid opportunities and relationships from the onset.

“[A clawback] ensures that you are truly compensating your sales team for building the company. It also encourages your sales reps to consider whether a customer is truly staying for the long-haul, instead of only short-term gains,” wrote JT Rimbey in his piece about sales commission rates by industry.

Our recommendation for approaching clawbacks

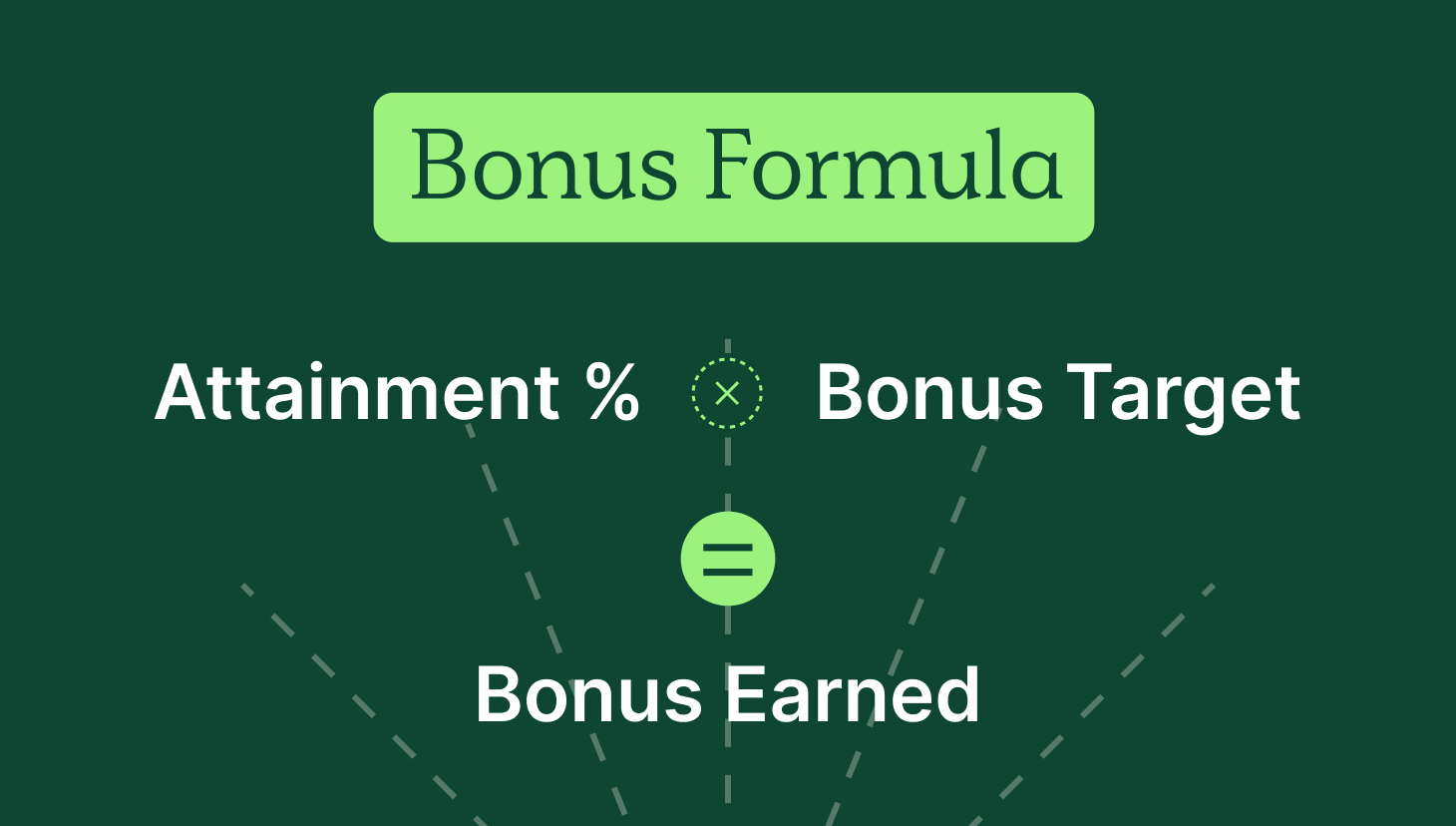

In sales specifically, clawbacks can affect attainment, compensation, or both.

As an example, say I had a $10K deal fall through after signing and earning commissions. Will your clause mandate that I return the commissions ($1K), forfeit the total contract value as it pertains to my quota, or both?

We think the easiest — and least painful — strategy is to only collect the commissions back when a clawback takes effect.

If it does impact my quota, that means that I either have a $10K quota hole to crawl back from last month, or I’m entering the new month down $10K. This can be incredibly discouraging for reps.

That’s why we lean heavily toward commission-only clawbacks.

Design, track, and manage variable incentives with QuotaPath. Give your RevOps, finance, and sales teams transparency into sales compensation.

Talk to SalesSales commission clawback help

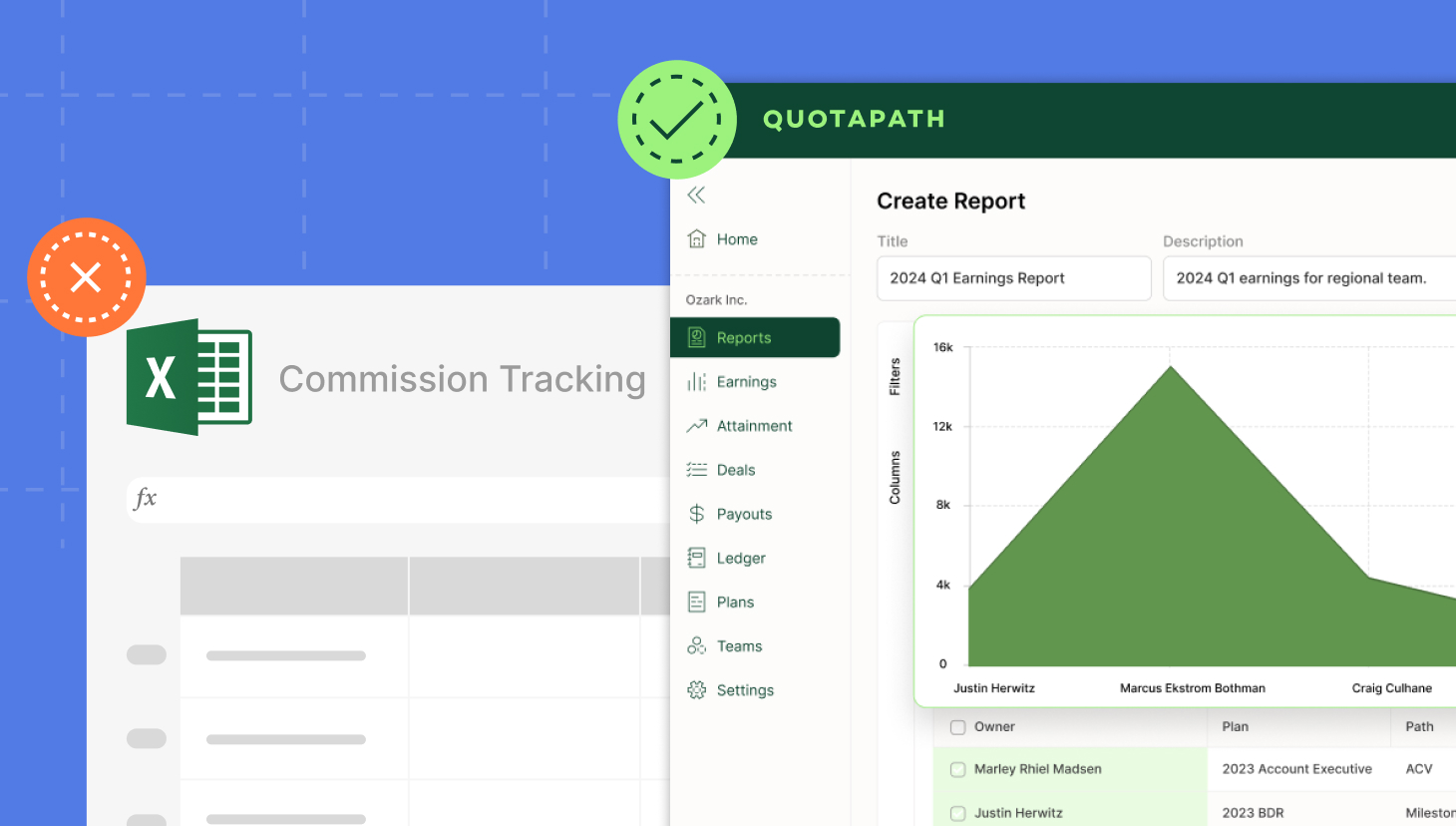

A commission calculation software tool can help teams better manage clawbacks by ensuring accuracy and providing visibility.

Using QuotaPath’s commission tracker, commission recoveries automatically populate when deal values change in your synced CRM. Additionally, in instances when chargeback provisions dissolve after a pre-determined time period, such as four months, we can set up filters to accommodate clawback cycles.

To learn how QuotaPath can automatically track your sales clawbacks and commissions, schedule a live, custom demo with our team.