QuotaPath’s Senior Director of RevOps Ryan Milligan originally published a version of “How to design sales compensation plans” with Pavilion.

A good compensation plan is like anything in business: If you set it up in the right way, you’ll get results. This might sound counterintuitive, but the salary isn’t everything when it comes to building a productive sales team. Your approach to design sales compensation plans can increase revenue, decrease churn, and drive change with your customers.

Competition is fierce for talent. There’s been up to a 15% bump in sales comp in the last year alone for sales positions. Companies aren’t getting much of a discount for hiring people who don’t work in New York or San Francisco. For companies that want to scale up rapidly, it’s important to meet salary expectations.

Below, we’ll guide you through how to get there — from developing a business plan to aligning compensation to making it all simple and usable.

Try the most collaborative solution to manage, track and payout variable compensation. Calculate commissions and pay your team accurately, and on time.

Start TrialAbout the author

Ryan Milligan is the Senior Director of Revenue Operations at Quotapath. He previously led marketing and RevOps teams at Homebase and solved customer acquisition, revenue attribution, and customer segmentation problems as a member of Wayfair’s Data Science team.

Steps to building a compensation plan

To an extent, a sales compensation plan model represents a math problem. You can’t pay for more employees than your income allows. The goal, of course, is growth, and that can make it hard to project how much income you’ll have. You’ll want to be conservative in setting sales quotas, assuming your team will make around 80% of the planned goal. But you’ll also want to be aggressive to design compensation plans that prioritize and reward sales growth. To set up sales incentive compensation in a thoughtfully executed plan, follow these steps.

1. Understand and prioritize the goals for your business.

What are your goals? You can’t do everything, but you can target a business improvement or two through your compensation plan. Choose the behaviors you want to incentivize, and build your comp plan accordingly.

Driving increased top-line revenue.

How much time can your team afford to spend on outbound work, calling potential customers? And how much growth potential is there from your existing customers? You’ll want to make sure you’re incentivizing growth through designing compensation plans.

Decreasing churn.

The fewer customers we lose to churn, the more money our company makes. A 5% increase in retention can mean a 25 to 95% increase in profits, according to a Harvard Business School report. It pays to keep customers happy and reward salespeople for keeping their business in-house.

Expanding revenue from existing customers.

Have a sales compensation system in place to encourage opportunities with customers you already have. Reps should look at if customers subscribe to all your services. Could they benefit from a more in-depth relationship? Encourage your reps to upsell with the right incentives.

Selling new products/product lines to customers.

This entails outreach, both to new and existing customers. You don’t know the answer if you’re not talking to your people. Incentivize your reps to talk with customers regularly and discover what they’re missing.

Driving change within existing customers

How are you getting paid by existing customers? There could be an opportunity to convert monthly contracts to annual or move annual deals to multi-year agreements. Incentive compensation management that rewards your reps for these conversions will drive these behaviors.

2. Understand who you have on your team and how success is measured for each of them

Now that you’ve outlined your business goals, think about what you want each team member to do. It’s more than pie-in-the-sky thinking. Sales teams have crossover responsibilities. Be clear about what you expect from each position and be clear about how they get compensated for their work.

Sales development reps

Sales development representatives (SDR) and business development representatives (BDR) often have nearly identical job descriptions. While the roles vary, they’re typically focused on finding new customers or starting sales to existing customers. These usually involve entry-level positions. Responsibilities include:

- Doing homework. An SDR or BDR will research prospects and verify their contact information.

- Reaching out to prospects. It’s their job to start the ball rolling by cold-calling, emailing, or messaging through LinkedIn.

- Qualifying leads. They are essentially asked to make sure the prospects are real and valuable before moving to the next step.

- Booking meetings. Typically, the last step for an SBR or BDR is setting up a meeting with an account executive.

One important thing to consider here. Are these employees at all involved in the sales process? It’s important to reward them with commissions if they’re doing more than setting up meetings. We recommend SDR comp plans that include incentive pay for qualified opportunities and the amount of revenue on closed/won opps that come from them.

Account executives

Account executives have more wide-ranging job responsibilities. At companies without SBR and BDR, account executives are “full-cycle,” meaning they handle every aspect of the sales transaction. Here’s what additional duties account executives have:

- Run demos. Show the product in action and how it can soothe companies’ pain points.

- Sign up new accounts / book revenue. This is simple enough: they’re responsible for closing the deal.

A typical sales commission structure for an AE will include measures that incentivize overperformance and decentivize underperformance, such as decelerators, accelerators, and multi-year kickers.

A few other points you should consider: Do you have a full-cycle sales team? Are AEs at all responsible for the post-signature onboarding? Do you have a quick-churn issue? The toughest transition point in churn is getting customers on board and happy with your product. More than ever, business is about relationships. Since your new customers know the salesperson, it often makes sense for them to be involved in the handoff to an account manager.

Account managers

Account managers run the show after the contracts are signed. They represent the face of your company, as far as your clients are concerned. It’s more than customer service, it’s also about keeping customers with your business for the long haul. Account manager responsibilities include:

- Onboard new customers. The transition from sales to actual use of the product can be tricky. This part of the post-sale is crucial.

- Get customers actively using the product. This is about keeping customers happy in the long run.

- Expand revenue from existing customers. Account managers are excellent resources for your company because they get to know customers, see their needs, and identify solutions your company can help with.

- Decrease churn. As the face of your company, your account manager’s job is to keep customers happy with your product.

AM comp plans usually entail a base salary plus commission structure with a set commission rate for upsells.

RevOps, sales leaders, and finance teams use our free tool to ensure reps’ on-target earnings and quotas line up with industry standards. Customize plans with accelerators, bonuses, and more, by adjusting 9 variables.

Build a Comp Plan3. Determine target total compensation for each team member

The Betts Compensation Guide is a great place to start to design sales compensation plans. It’s free to sign up for and provides data for the largest tech markets in the country. The key points to know: Salaries are going up, with average starting pay hitting $50,000 in the 2022 guide. And, instead of reps in New York and San Francisco making tons more, costs have started flattening as remote work becomes the norm.

4. Determine target earnings

The formula here is simple. Determine what you want the annual salary to be for each sales team member, then split the pay by base pay and commissions, or variable compensation. For instance, if $140,000 is the goal for an account executive, and SDR and account executives typically get paid 50% base and 50% variable, the annual salary would be $70,000 with $70,000 of expected variable compensation. Account managers work on a 65/35 ratio, or sometimes 70/30. Figure out what works best for your company.

5. Determine a quota for your sales team

Next, use the QuotaPath Quota:OTE calculator to determine what a healthy annual quota is for an account executive based on their total earnings. Look at your financial plan, expected quota attainment, and on-target earnings (OTE) on a per-rep basis to calculate how many reps you will need to hit your financial plan.

Let’s work with a real example.

Suppose your company wants to close on $400,000 in new business each quarter. Each account executive has an OTE of $100,000 per year ($50,000 in base, $50,000 variable). Set the rep quota at $400,000 annually (four times the quota-to-OTE ratio from our calculator). That’s a healthy range for a business with less than $1 million a year in annual recurring revenue – and that quota is $100K per rep, per quarter. Estimate 80% quota attainment across your team. That means you’re expecting to close $80,000 per rep, per quota. That means you’ll need five reps to close $400,000 in new business per quarter.

6. Give team members visibility into their compensation

Lastly, everybody on your sales team will value transparency.

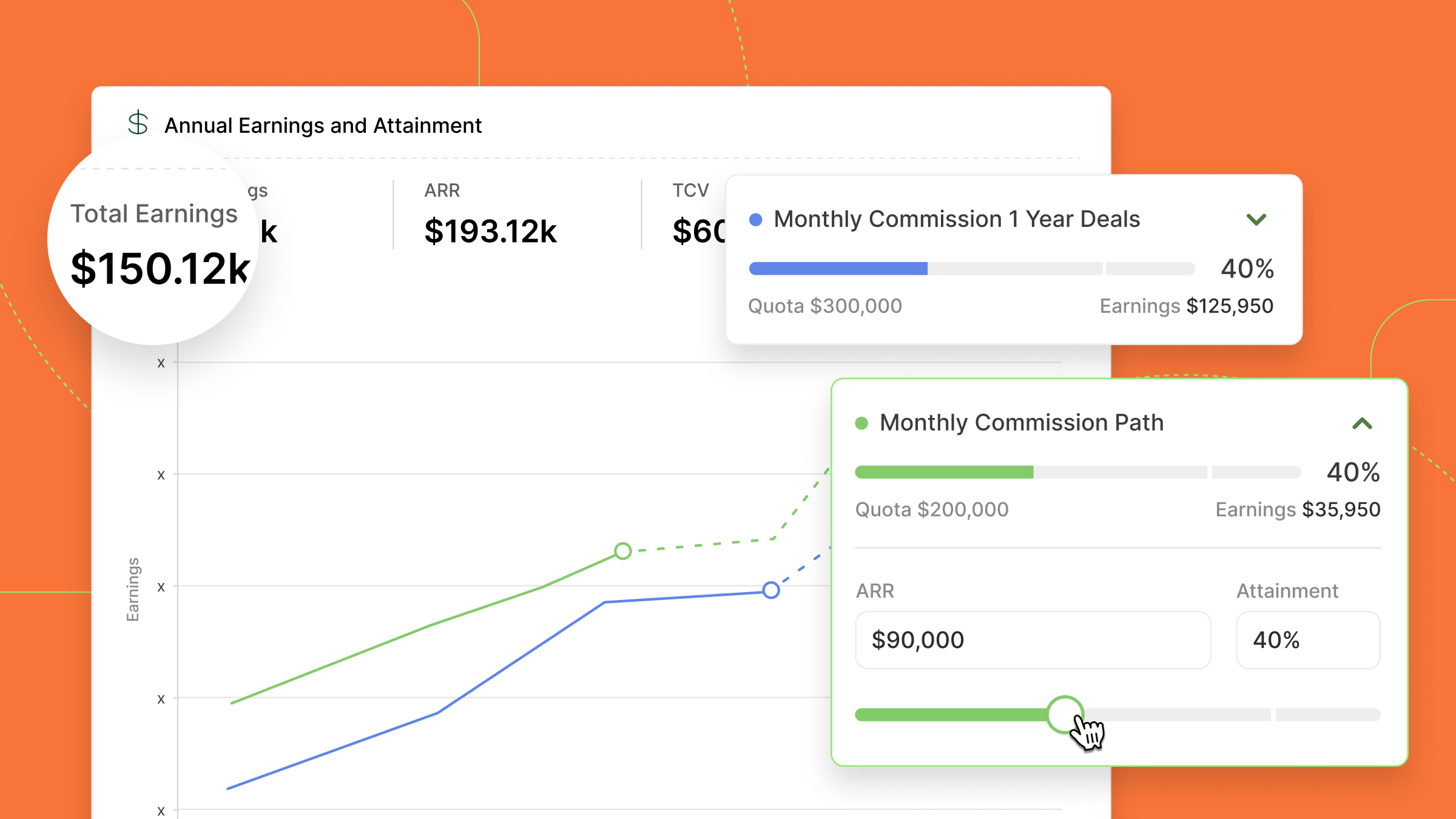

Using a tool like QuotaPath, you can sync your deals live from your customer relationship management (CRM) software to give reps real-time visibility into commissions calculations. Reps can also forecast what they will earn if they close other deals in their pipeline. The team can proactively flag payroll discrepancies before you pay them, leading to fewer hassles when it’s time to run payroll.

The signing of the deal marks the start of the customer relationship in sales. Similarly, rolling out a compensation plan sets the beginning of your financial relationship with your employees. Stay plugged in so you can make adjustments should any problems arise and adapt to changes in your market.