The process of commission accuracy involves several vital steps to ensure that sales representatives are compensated fairly and accurately for their efforts, including clean data, clear commission structures, and regular auditing and review.

Getting commissions right is crucial in any business that relies on sales incentives to motivate and reward its sales teams — which, according to this study, 80% of the top-performing companies do.

Not only does commission accuracy ensure fairness and transparency, but it also drives sales performance, promotes a healthy company culture, and establishes trust between reps and their organizations.

However, achieving commission accuracy has its challenges.

Many organizations need help with commission management, including setting clear commission structures and sales performance metrics, integrating and maintaining accurate data, and aligning sales and finance teams.

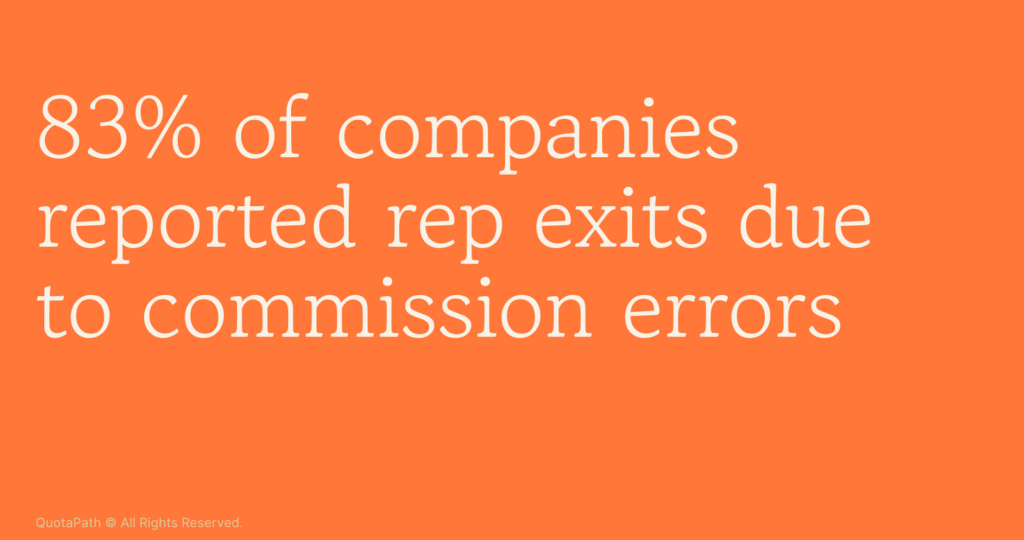

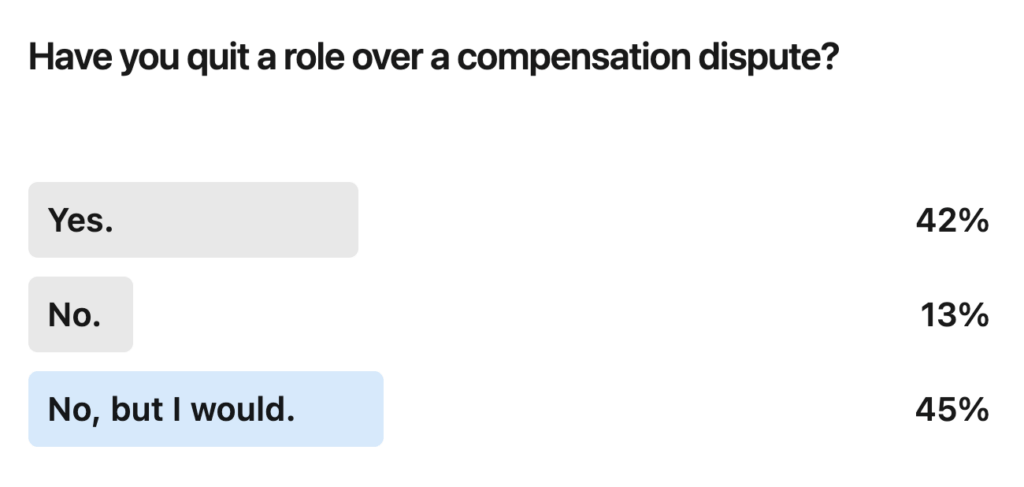

In fact, our 2024 Compensation Report found that 83% of companies reported sales rep exits due to inaccurate commission calculation. A quick LinkedIn survey also uncovered that 42% of people had quit their roles over compensation disputes, and another 45% would if significant commission errors unfolded.

Fortunately, technology solutions can help streamline the commission process, provide more visibility with sales compensation reporting, and minimize mistakes. Regular auditing, review, effective communication, and training are also essential for maintaining accuracy.

This blog will explore these challenges in detail and provide practical strategies and case studies to help businesses increase commission accuracy.

Furthermore, we will discuss the future of commission accuracy and how advancements in technology and data analytics will continue to revolutionize accuracy in sales compensation.

The importance of accurate commissions

Paying accurate commissions is critically essential for various reasons, as it benefits the organization and significantly impacts employee motivation and the overall business environment.

Here are several vital reasons to invest in accurate commissions:

Motivation and Performance: The core goal of variable pay is to incentivize, motivate, and reward performance. When employees see a direct correlation between their efforts and earnings, they are more likely to stay motivated and consistently perform at their best. But every error you make de-legitimizes (and de-motivates) your team.

Fairness and Trust: Accurate commissions ensure fairness and transparency within the organization. When employees perceive that their commissions are calculated accurately and consistently, it fosters trust among team members and management. This trust is vital for a positive work environment and employee satisfaction.

Retention and Loyalty: High employee turnover can be costly and disrupt the sales team’s continuity. Accurate commissions help retain valuable talent.

Cost Control: Paying commissions accurately helps organizations manage their costs effectively. Overpayments due to errors can be costly for the company, while underpayments can lead to demotivation and attrition among sales representatives.

Compliance and Legal Issues: Inaccurate commission payments can lead to compliance and legal problems. Failure to adhere to agreed-upon commission structures or disputes arising from inaccurate payouts can result in legal action and damage the company’s reputation.

Improved Financial Planning: When commissions are calculated correctly, financial projections become more reliable, helping the company allocate resources effectively.

Reduced Disputes: Commission errors often lead to disputes and conflicts among sales representatives and between sales and management. Commission reconciliation consumes valuable time and resources that could be better invested in revenue-generating activities.

Transparency and Communication: Employees appreciate knowing how their commissions are calculated, and this transparency fosters a sense of unity and cooperation within the organization.

Enhanced Employee Morale: When employees feel they are being compensated fairly for their efforts, they are more likely to be engaged and enthusiastic about their work.

Customer Satisfaction: Accurate commissions can indirectly impact customer satisfaction. Satisfied and motivated sales teams are likelier to provide better customer service, resulting in higher customer satisfaction and loyalty.

Common challenges in commission accuracy

Despite all of the positives that come with striving for commission payment accuracies, as our data shows, many leaders need help implementing processes to mitigate errors.

That’s because ensuring sales commission accuracy can be complex, and various challenges can arise in the process, such as the following:

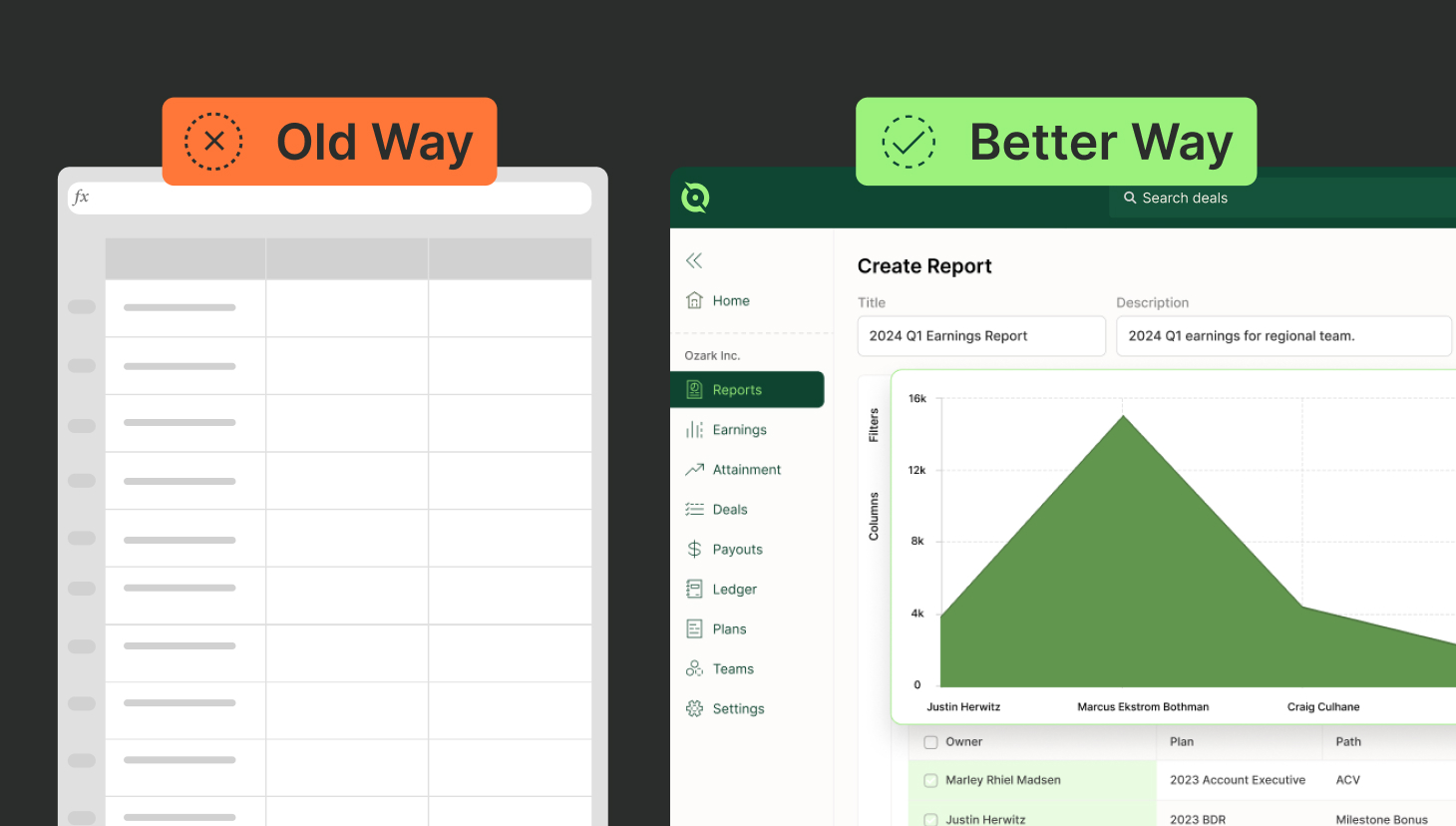

| Complex Commission Structures | Many organizations have intricate commission structures with multiple tiers, rules, and criteria. Plus, if they aren’t using an automated tool, they’re likely using a spreadsheet to calculate commissions, which are error-prone. |

| Manual Calculations | Relying on manual calculations and spreadsheets increases the likelihood of human-inputted errors, leading to payout discrepancies. Additionally, manual processes are time-consuming and can lead to delays in commission payments. |

| Lack of Regular Auditing | Failing to conduct regular audits and review commission calculations can allow errors to persist and go unnoticed. Without a system to catch and rectify inaccuracies, they can accumulate over time, causing frustration and demotivation among sales teams. |

| Technology Limitations | While technology can significantly aid commission calculations, it can also lead to errors. Programming or configuration errors in commission management software can lead to miscalculations. Additionally, technical issues, such as server outages or software glitches, can disrupt the commission calculation process. |

| Data Integration and Accuracy | Accurate commission calculations rely on correct and up-to-date data. Data integration can be problematic when organizations use disparate systems, leading to discrepancies between sales data, order information, pricing, and customer details. See how QuotaPath integrates with your CRM. |

Addressing these common challenges requires organizations to simplify commission structures, invest in technology solutions, improve data integration and accuracy, conduct regular audits, and provide training and education to sales teams and commission administrators.

Below, we dive into each one.

Establishing clear commission structures

Establishing a transparent commission structure that makes sense for the business and that reps understand is vital to ensuring accurate commissions.

When the commission structure is well-defined and transparent, it promotes fairness and transparency, motivating and rewarding sales teams effectively.

However, many organizations face challenges in creating and maintaining clear commission structures, which can lead to errors and misalignment between sales and finance teams.

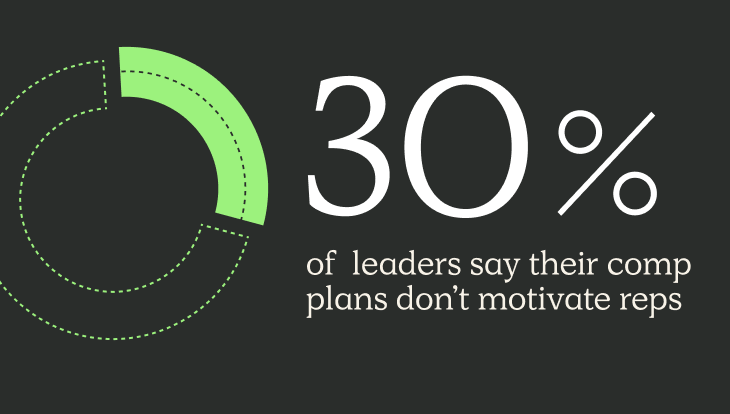

For instance, our report found that 97% of leaders struggled to design comp plans and cited doesn’t motivate reps, unrealistic expectations, too hard to execute, and too complicated to understand as their top challenges.

To help, here are 10 best practices to establish clear commission structures.

- Define Your Commission Objectives: Clearly define your commission plan’s objectives. Determine what you want to achieve with your commission structure, whether driving sales, incentivizing specific products, or rewarding specific behaviors.

- Set Clear Goals and Targets: Outline your sales goals and targets. Ensure that your sales representatives clearly understand what they need to achieve to earn commissions. Show the math behind the targets in how they achieve X goals for the company and how they are paid when they hit those goals.

- Document your Compensation Plan: Produce documentation of the commission plan in a comprehensive and easily accessible manner in a commission agreement.

This document should include commission rates, commission eligibility, payout periods, performance metrics, rules or exceptions, clawback clauses, on-target earnings, quotas, and more. Then, collect rep signature to protect your organization and the rep against potential disputes.

- Make the Plan Accessible: Ensure that everyone on variable compensation has access to the commission plan document. This will help prevent misunderstandings and disputes as it offers a place of reference.

- Simplify Rules and Criteria: Keep the commission structure as simple as possible. Avoid overly complex rules and criteria that can confuse sales representatives. We recommend keeping it to 3 compensation components or less, meaning that there are three rules or paths for the rep to earn compensation.

- Provide Training and Education: Offer compensation-focused workshops to your sales teams to help them understand the commission structure. Ensure that all team members know how commissions are calculated and what they need to do to maximize their earnings.

- Address Questions and Concerns: Create an open channel for sales representatives to ask questions and seek clarification regarding the commission structure. Encourage communication and promptly address any concerns or disputes.

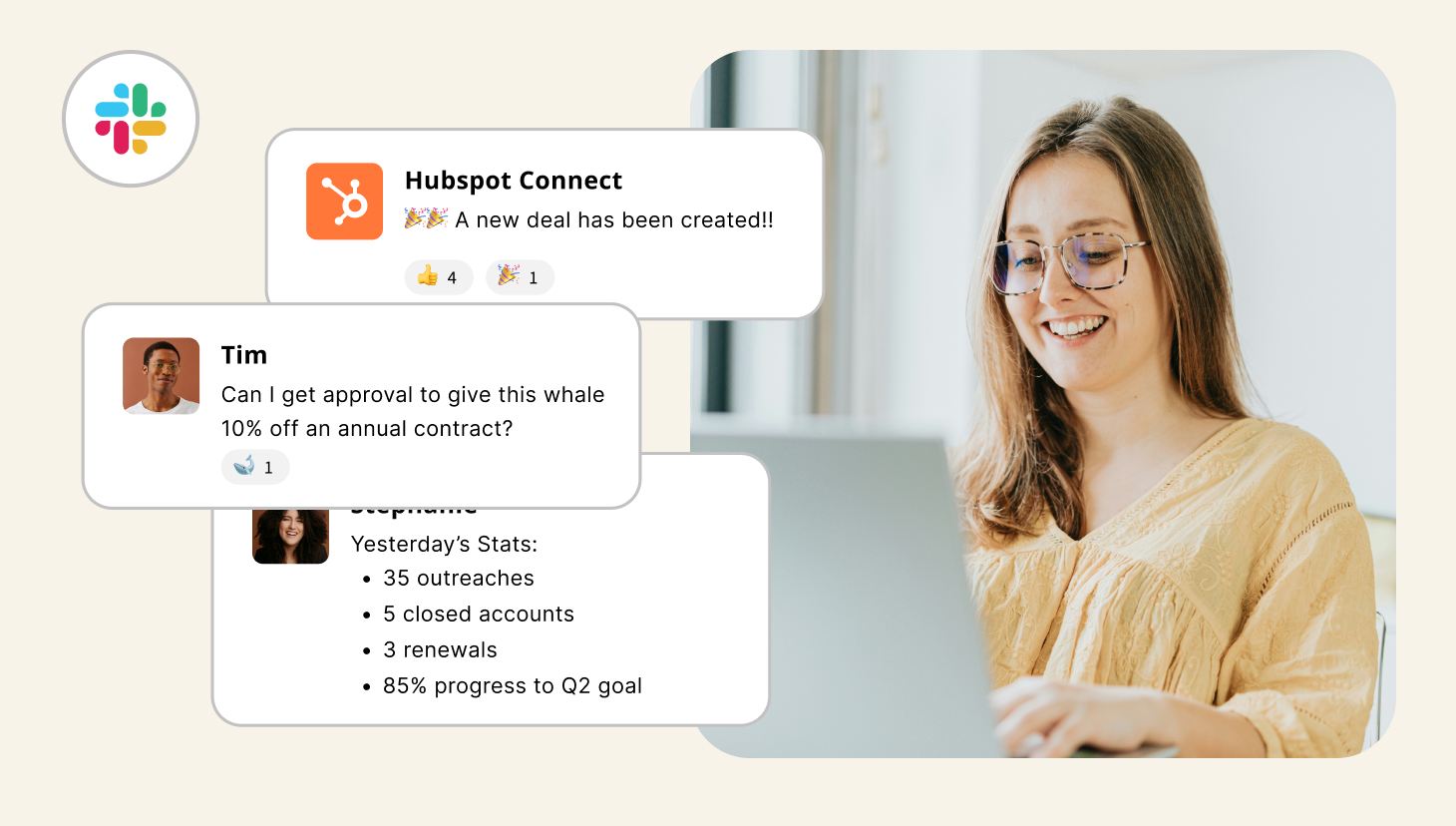

For instance, QuotaPath enables reps to ask questions and “raise flags” directly on specific deals or payouts where admins are notified and can respond in-app. - Regularly Review and Update: Commission structures may need adjustments over time to align with changing business goals and market conditions. Conduct periodic reviews to ensure that the plan remains relevant and effective. If it’s not, be ready to implement changes.

- Maintain Transparency: Give your team visibility into their past, existing, and forecasted earnings. Include a breakdown of their comp plan and progress of attainment. Bonus points if you use QuotaPath.

- Seek Feedback: Solicit feedback from sales teams about their comp plan’s effectiveness. Their insights can help identify areas for improvement and ensure that the plan remains fair and motivating.

How to motivate your sales team

More than 450 RevOps, Finance, and Sales leaders said their biggest challenge with their sales compensation plans is that they don’t motivate their reps. Here’s how to change that.

Read MoreData integration and accuracy

Another way to increase incentive pay accuracy — and one of the best ways, in our opinion — is to integrate your deal source of truth with sales quota management and compensation software.

When data from various sources is integrated seamlessly, it reduces the risk of errors and discrepancies, leading to more precise commission calculations. It also eliminates data silos.

Some things to pay attention to when connecting two platforms:

- Data hygiene: You should have processes in place to ensure your deal data is accurate and clean because if that’s incorrect or out-of-date, so will the commissions.

- Real-time updates: Look for integrations that provide real-time updates. This will ensure that calculations are based on the most recent data.

- Regular data audits: Conduct regular data audits to identify discrepancies, anomalies, or inaccuracies in the integrated data.

- Data security: Implement robust data security measures to protect sensitive data during the passing to and forth between platforms.

Regular auditing and review

You should also conduct regular auditing and review of sales commission calculations, even if this process is automated. These processes help ensure accuracy, fairness, and transparency in commission payouts, benefiting the organization and its sales teams.

Doing so will help you identify and rectify errors, reducing conflicts and fostering trust between you and your sales team. Plus, the whole regulatory requirements around company policies and legal requirements. Moreover, it acts as a cost control because you won’t have to allocate time and resources to address inefficiencies.

Auditing best practices include:

| Scheduling routine audits | Creating a cross-functional audit team |

| Creating an audit checklist | Using technology |

| Verifying data | Maintaining audit trails |

| Reviewing & validating commission rules | Benchmarking your data |

Technology solutions for commission accuracy

You’re here, so you’ve heard of QuotaPath (at least, we hope!). Yet we are not the only ones who can provide commission accuracy. In fact, there’s quite a growing list of competitors. Spiff, CaptivateIQ, Xactly, to name a few, have co-existed in our space for a while. Learn about the nuances between the platforms here.

When evaluating solutions, keep in mind

- Accessibility and Usability: How easily the platform allows for plan creation and adjustments as your business grows.

- Forecasted Earnings: Providing detailed revenue and earning potential reports for executives and sales reps linked to pipeline and quota achievement.

- ASC-606 Compliance: Ensuring commission expenses are scheduled, recognized, and reported by ASC 606 regulations.

- Time-to-Value: The speed at which customers can realize the platform’s value after purchase.

- Accuracy: Confidence in the accuracy of calculations.

- Plan building: Ability to build, test, and validate new compensation plans using past deal data before finalizing plans

- Integrations: Direct, real-time data flow from the source of commission information.

- Rep Accountability: Clear views of sales compensation, goal progress, and commission payment details.

- In-App Communication: Tools for resolving commission discrepancies and maintaining records within the tracking app.

- Support: Reliable and accessible vendor support.

- Pricing: Transparent upfront pricing with no minimum user requirements

Design, track, and manage variable incentives with QuotaPath. Give your RevOps, finance, and sales teams transparency into sales compensation.

Talk to SalesAligning Sales and Finance teams

There shouldn’t be a “versus” mentality unfolding at your organization between Sales and Finance. Instead, the two teams should work together during the sales compensation plan design process to create compensation structures that drive the right business behaviors and metrics and reward and motivate the sales team.

You’ll establish transparency and trust between the two departments, which will only increase once you have consistent, accurate commission payout processes.

Align Sales and Finance teams via commission accuracy

Aligning sales and finance teams using these strategies promotes transparency, accuracy, and cooperation in commission processes.

- Clear Communication: Establish open and regular communication channels between both teams to keep them informed and aligned.

- Shared Objectives: Define common goals and overarching objectives that both teams can work towards, ensuring they have a shared vision for commission accuracy.

- Collaborative Roles: Clearly define and delegate roles and responsibilities for commission-related tasks, preventing overlap and miscommunication.

- Data Integration: Ensure both teams work with the same, high-quality data and implement data quality assurance processes together.

- Automate Calculations: Invest in commission management software and involve both teams in its selection and implementation to automate calculations and reduce errors.

The future of commission accuracy

So, what’s ahead for us? The future of commission accuracy will undergo significant transformations in the coming years.

Technological advancements, increased data integration, and a growing emphasis on transparency and fairness will continue to shape this future landscape.

Artificial intelligence and machine learning will play a central role, allowing organizations to predict commission trends, detect anomalies, and automatically correct errors in real time. This will enhance accuracy, reduce disputes, and improve efficiency in commission management.

Blockchain technology may become more prevalent, providing an immutable ledger of commission transactions, ensuring tamper-proof records, and boosting stakeholder trust.

Data integration and analytics will remain paramount, with organizations streamlining data sources and validating information to ensure precision in calculations. Real-time data flow and instant updates will further cement accuracy.

Focusing on fairness and transparency will remain a top priority. Companies will strongly emphasize collaborative processes that align sales and finance departments. Regular audits, reviews, and dispute-resolution mechanisms will become standard practice.

In summary, the future of commission accuracy will be characterized by advanced technology, data integration, transparency, and fairness. Organizations that embrace these trends will achieve more accurate commission calculations and foster trust. This ultimately drives higher sales performance and satisfaction.

About QuotaPath

Is QuotaPath in your future of commission accuracy? Schedule time with our team to see how our system can increase productivity, payment efficiencies, and compensation optimization.