Sales commissions are one of the largest expenses on your GTM budget, and one of the hardest to forecast accurately. Too often, finance and RevOps teams don’t model commission costs until after deals close, and reps are already paid.

By that point, it’s too late.

Without a forward-looking approach to commission modeling, you risk overpaying on low-margin deals, misaligning incentive costs with strategic goals, and setting 2026 budgets on guesswork.

Key Takeaways

In this blog, we’ll walk through five ways to model the cost of commissions, so you can:

- Forecast commissions cost accurately

- Avoid surprises

- Drive smarter outcomes with your comp plans

1. Model Your Effective Commission Rate Per Deal

First, let’s start by modeling your effective commission rate.

Your effective commission rate (ECR) is the percentage of revenue paid out on a deal across all earners (AEs, BDRs, SEs, managers), and any SPIFs or accelerators.

Most teams only track individual rates. But finance leaders need to understand the total cost per deal.

How to calculate it:

- Total Commission Paid ÷ Deal Revenue = Effective Commission Rate (%)

Example:

- $100K deal

- AE earns $8K

- SDR earns $3K

- Manager earns $2K

- Accelerator adds $5K

- Total Commission: $18K → ECR = 18%

We recommend flagging any deal with an ECR above 25–30%. That’s often where profitability starts to erode.

“You blink, and you’re paying 35% of a deal in total commissions once you add up everyone involved. That’s a hidden cost finance leaders need to track,” said Ryan Milligan, GTM Leader at QuotaPath

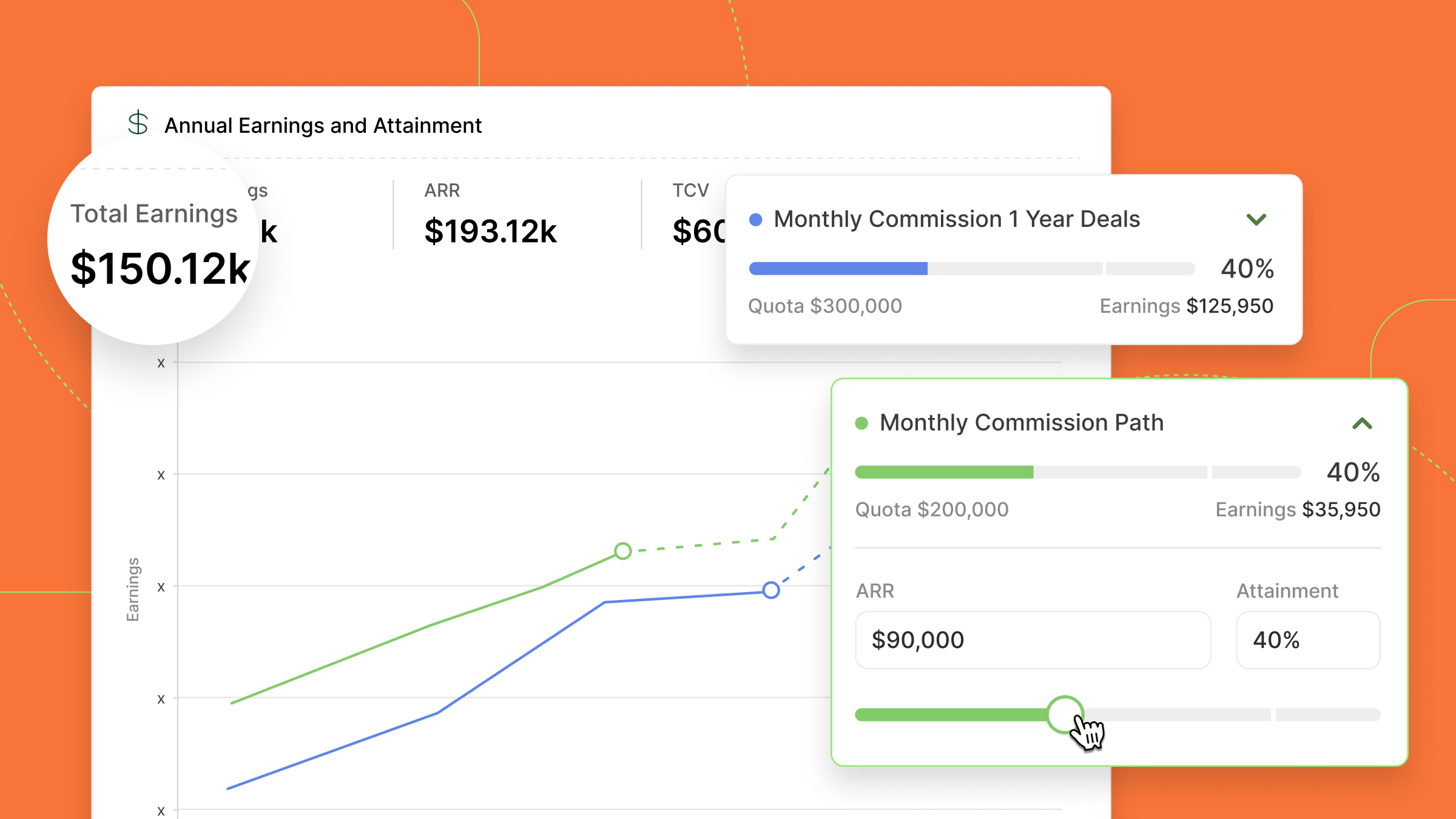

2. Forecast Across Attainment Bands

Next, pay attention to attainment bands.

Want to know what your commission cost will be if reps crush quota…or fall short? That’s where attainment scenario modeling comes in.

It helps you understand how commission costs scale under different rep performance scenarios.

Try modeling:

- What happens if 80% of reps hit 75% of quota?

- Or if 30% of reps hit their accelerators?

- Or if you hire 20 new sellers mid-year?

QuotaPath’s Draft Plans make it easy to run these “what-if” models before you launch anything live.

Pro tip: Use your own historical attainment data to project future commission costs across different rep cohorts.

Recommended Reading: Aligning 2026 Comp Plans with Your Board’s North Star Metrics

3. Reverse Engineer From a Top-Line Budget

Instead of starting with your comp plan and crossing your fingers it stays within budget, try this:

Start with your target commission expense, and build your plan backwards.

For example:

- You decide you can afford to spend 11% of revenue on commissions.

- Based on your forecasted revenue, that gives you a $3M commission budget.

- Now you model quotas, rates, and tiers that fit within that constraint.

This approach forces intentional tradeoffs:

- Do we overpay top performers?

- Should we flatten tiers to boost quota coverage?

- Where can we reward smart selling without hurting CAC?

Like our Finance team always says, “Designing a comp plan isn’t just about setting attractive rates. It’s about understanding the ripple effects each decision has on profitability, performance, and morale.”

Design, track, and manage variable incentives with QuotaPath. Give your RevOps, finance, and sales teams transparency into sales compensation.

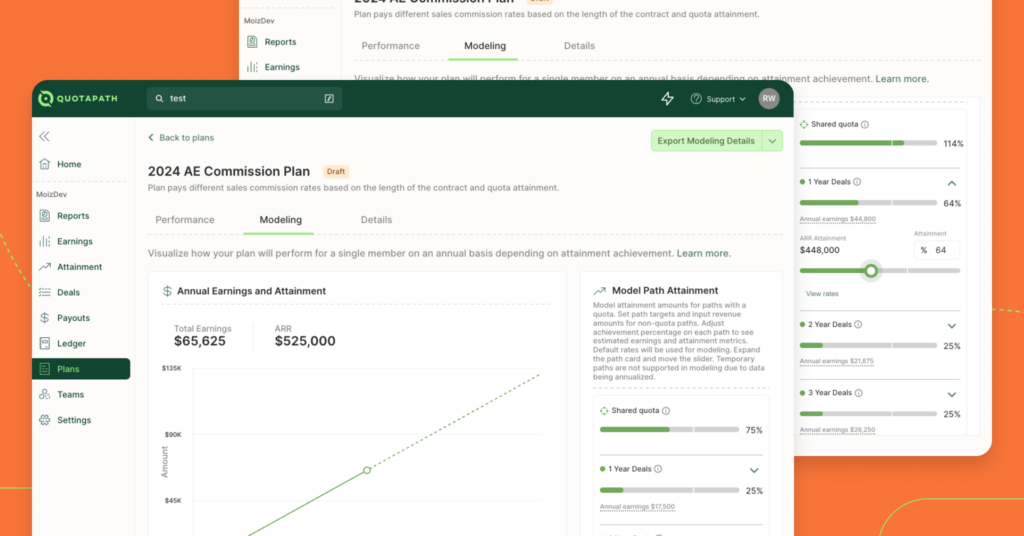

Talk to Sales4. Compare Comp Plans Side by Side

And, don’t forget to compare comp plans.

The structure of your plan (flat rate vs. tiered, monthly vs. quarterly quotas, SPIFF-heavy vs. bonus-heavy) can drastically change how much you spend in commissions.

That’s why comparing multiple plans side by side is a critical step.

Build and compare multiple versions:

- Version A: Flat 10% on all deals

- Version B: 8% base + tiered accelerators

- Version C: Bonus tied to renewal probability

Model each one with the same revenue and attainment assumptions, then compare:

- Total payout cost

- Distribution of earnings (top vs. mid vs. low performers)

- Alignment with business goals

(Remember Draft Modes mentioned above? With QuotaPath, you can duplicate and modify plans in Draft Mode, making it easy to test multiple paths before rollout. ♥️)

5. Forecast Commission Liabilities in Real Time

Lastly, it’s not enough to know what you’ve paid…you need to know what you owe.

Accrued commission liabilities often get misaligned with payouts. When that happens, your financial reports are off, and cash flow planning takes a hit.

To forecast commission liabilities properly, model:

- Payout schedules across periods

- Multi-month installments or clawbacks

- SPIFs and threshold bonuses

- Pipeline earnings based on close probability

By forecasting liabilities in real time, you protect your balance sheet, skip the guessing game, and reduce surprises when payroll hits.

When Should You Model Your Cost of Commissions?

Short answer: yesterday.

Longer answer: Whenever you’re…

- Building a new comp plan

- Finalizing a new year budget

- Changing team headcount

- Rolling out new products

- Trying to avoid a panic audit at the end of the year

The Strategic Value of Modeling Commissions

At QuotaPath, we’ve worked with hundreds of Finance, RevOps, and Sales leaders. The best ones don’t wait until year-end to analyze commission spend. They use modeling to guide strategy. Not clean up after it.

When done right, commission modeling helps you:

- Stay within budget

- Align incentives with high-quality revenue

- Boost trust across Finance and Sales

- Spot overpayments before they compound

Because the worst time to realize your comp plan is broken is after the payouts hit.

Try the most collaborative solution to manage, track and payout variable compensation. Calculate commissions and pay your team accurately, and on time.

Start TrialReady to model smarter?

Book a demo to see how QuotaPath helps finance and RevOps teams model commission costs in real-time.