Sales comp isn’t just a sales issue… It’s a margin, forecasting, and behavior issue.

Most CFOs know how much they spend on commissions.

However, the best CFOs understand why they spend it and whether that expenditure is actually driving the desired outcomes. Because the way we see it (and use it), sales compensation is a strategic lever to influence revenue efficiency, margin performance, and sales behavior.

Smart CFOs don’t treat comp as a black box or a cost center.

“The only thing worse than overpaying is having an overly generous incentive structure where the commissionable team is not actually seeing the incentives right in front of their noses,” said Thomas Egbert, Head of Finance at Prefect.

Leading finance teams are rethinking comp beyond a payroll line item in favor of viewing it as a direct input into CAC, LTV, gross margin, and retention. Especially in a market where the cost of capital has shifted, the most astute CFOs are trading the “grow at all costs” mindset for compensation plans that reward efficient, profitable growth.

As Ryan Macia, CFO at Osana, said, “Growing at 20% profitably is better than 100% with burn. Investors want growth and efficiency now.”

Design, track, and manage variable incentives with QuotaPath. Give your RevOps, finance, and sales teams transparency into sales compensation.

Talk to SalesThe Challenge With Comp

Still, despite more finance leaders recognizing sales comp as a powerful tool, 30% of finance and RevOps leaders say their comp plans fail to motivate reps, according to our 2024 report.

This is often due to a lack of clarity and visibility, resulting in a missed opportunity for strategic influence and predictability in planning. When plans are buried in spreadsheets or divorced from actual outcomes, companies not only lose confidence in forecasts they also lose control of margin and motivation.

This blog will explore the lesser-known truths of sales compensation through the lens of high-performing finance teams.

We’ll unpack:

- The hidden margin risks in bloated commission structures

- How behavioral economics and visibility influence rep performance

- The CFO’s role in aligning comp plans to strategic business metrics

- Why automation and data-backed planning are no longer optional

- And the common pitfalls experienced finance leaders still make

Whether you’re building a comp plan from scratch or scaling one across a 300-person team, this blog will give you the framework and financial lens you need to treat comp like the growth lever it is.

The Hidden Costs of Sales Compensation Most CFOs Miss

While more CFOs are waking up to the strategic potential of sales compensation, many still overlook how compensation structures silently erode profitability and predictability.

It’s not just about how much you’re paying, it’s where and why that spend accrues.

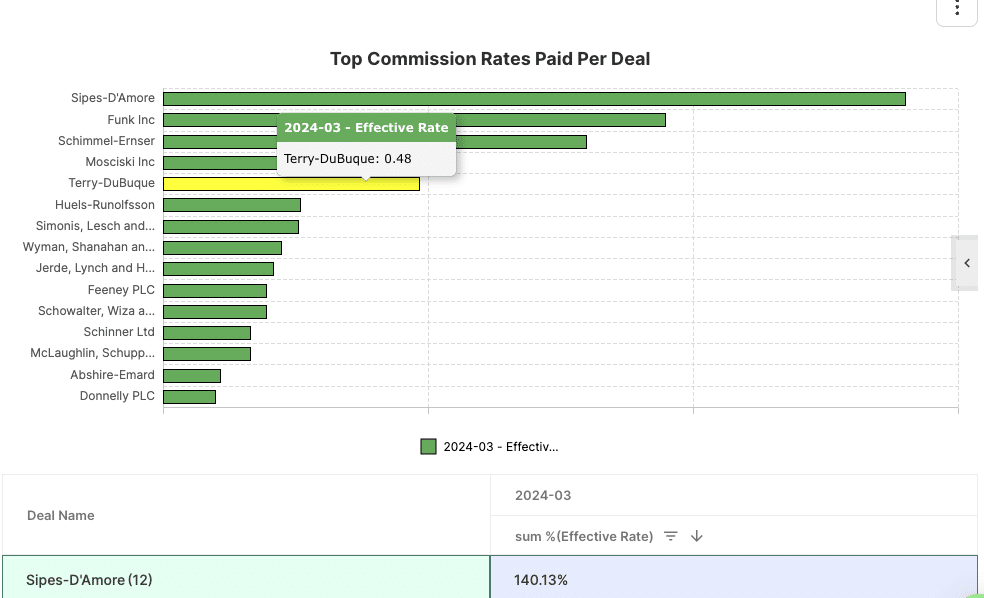

Take what we call the “35% Commission Rate Trap.”

It happens when multiple roles, like BDRs, AEs, SEs, frontline managers, and directors, are all paid on a single deal. On paper, each rate looks reasonable. However, without deal-level visibility, these layered payouts can accumulate quickly, resulting in a margin bleed that most CFOs don’t detect until it’s too late.

“You blink and you’re paying five commission rates … 5%, 10%, 3%, 1%, and it turns out you’re paying a 35% commission rate across all these people. That’s a hidden cost of commissions,” said our VP of RevOps, Sales, and Marketing, Ryan Milligan.

This lack of visibility makes it almost impossible to assess true deal profitability, especially in team-based or multi-stage sales processes. And without centralized reporting, you can’t identify these inefficiencies until they’ve already impacted your margin.

Behavioral Economics and Sales Comp: Incentives Are Only as Good as Their Visibility

If hidden costs eat at your margin, then hidden incentives quietly erode motivation.

Following the logic of behavioral economics, an incentive only works if the person on the receiving end understands it, believes it’s achievable, and can track their progress in real time. Unfortunately, many comp plans fail at that last one.

The stat we referenced above from our 2024 Sales Compensation Trends report (30% of finance and RevOps leaders say their comp plans fail to motivate reps) is largely tied to a lack of visibility.

If sellers can’t see how their efforts connect to earnings, compensation ceases to influence behavior.

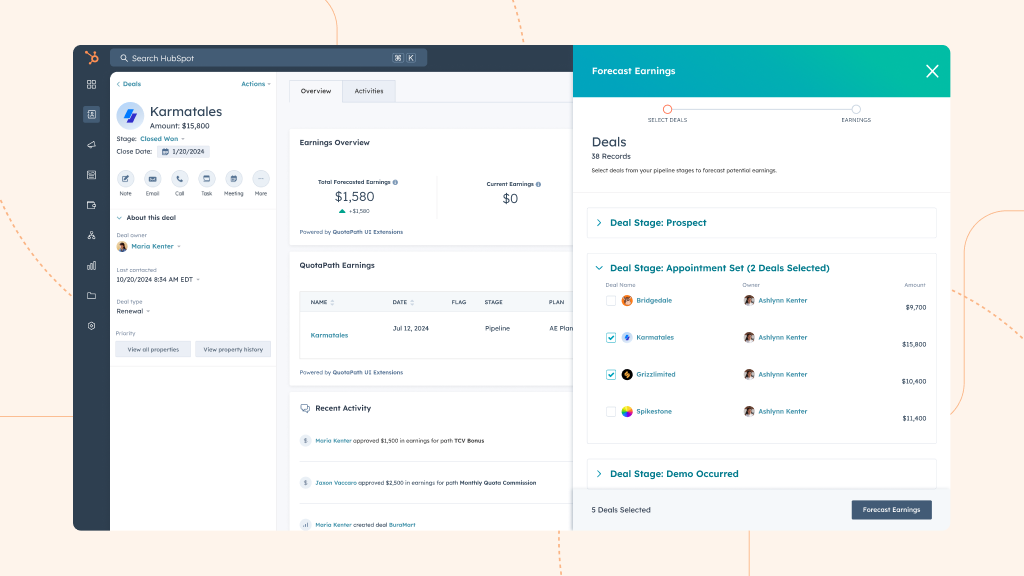

Genevieve Moss-Hawkins , who introduced QuotaPath at NeuroFlow, saw a positive change with her team shortly after.

“The sales team loves having the ability to see their pipeline, forecast potential commissions, and understand exactly how payouts are calculated and when they’ll receive them,” said Genevieve.

Genevieve’s experience is a perfect example of how visibility reduces admin burden and how reps engage with their goals.

By giving sellers line of sight into their pipeline, forecasted earnings, and payout timing, NeuroFlow unlocked more accountability and energy without needing to touch the comp structure itself.

The CFO’s North Star: Aligning Sales Compensation to Strategic Metrics

Visibility motivates. But alignment is what drives real business outcomes.

Once reps understand how they’re paid, the next critical question for finance leaders becomes: “Are we rewarding the right outcomes?” That’s where many comp plans fall short, especially those still locked into a “new business only” mindset.

The most strategic CFOs take it further. They use sales compensation to steer the business toward healthier metrics. Ie: gross margin, CAC efficiency, customer retention, cash flow.

“Growing at 20% profitably is better than 100% with burn,” said Ryan Macia. “Investors want growth and efficiency now.”

That’s the North Star for finance leaders today. Rewarding top-line growth and designing comp plans that optimize how that growth is achieved.

Results of Sales Compensation Report

Watch the webinar to uncover the biggest gaps in comp planning and commission management, and get expert guidance to align Finance, RevOps, and Sales Leadership for 2024 success.

Watch WebinarTurning Metrics Into Incentives

So what does alignment actually look like?

Here are some examples of strategic sales behaviors smart CFOs are incentivizing — and the business outcomes they support:

| Incentivized Behavior | Business Metric Impacted |

| Multi-year contracts | Improves revenue predictability, GRR, LTV |

| Selling to ICP (Ideal Customer Profile) | Lowers CAC, boosts NRR |

| Lower-discount deals | Increases gross margin |

| Faster payment terms / upfront billing | Improves cash flow |

| Expansion or upsell of existing customers | Increases LTV, improves NRR |

By shifting incentives to support these behaviors, even modestly, CFOs can significantly impact the quality of revenue, not just its quantity.

Design With the End Metric in Mind

Comp plans are often built with only the seller’s perspective in mind. But when finance leads the design, the question changes from “What will reps respond to?” to “What metrics do we need to move?”

That subtle shift makes a major difference. You start to:

- Pay more for the deals that deliver long-term value

- Avoid overpaying for revenue that hurts margins

- Design accelerators that reinforce retention, not just acquisition

This approach turns comp into a strategic engine.

And it’s not limited to AEs. These principles can apply to SDRs, CS teams, and even full-company variable pay when aligned to top-level goals.

The Operational Payoff: Automation, Forecasting & Audit-Readiness

Strategic alignment is powerful, but without automation, it’s hard to scale.

Once compensation plans are designed to influence the right outcomes, finance leaders face the next challenge: executing those plans accurately, repeatedly, and at scale. This is where automation becomes not just a convenience, but a necessity.

Take James Hall, EVP of Revenue at Gappify for example. As they scaled, the errors mounted up.

“I would sometimes make mistakes… There are multiple times I would go back to a rep and let them know they had actually been overpaid or underpaid,” said James.

Manual comp processes buried in spreadsheets create friction at every level. They slow down payout cycles, increase the risk of error, block visibility, and make forecasting a painful, unreliable task. In a world where forecast accuracy and audit readiness are non-negotiables, that’s a risk most CFOs can’t afford.

That peace of mind comes from knowing comp calculations are correct, approvals are streamlined, and payment data flows directly into payroll and accounting systems, eliminating double entry, cutting time, and reducing audit exposure.

Now, James can trust automation to reduce those errors and more…

“One of the things that has been really valuable for Gappify since we implemented QuotaPath is not just the time savings for me, but the positive impact on motivation for our sales team,” said James. “They love being able to log in and see how they’re tracking and model out, ‘Hey, if I book X amount of dollars, how much can I earn this month or this quarter?’”

Forecasting: From Luxury to Table Stakes

Once automation is in place, forecasting becomes a built-in benefit. The best comp platforms allow finance to:

- Model plan changes before rollout

- Forecast payout liability by pipeline, role, or plan

- Track attainment and commission cost in real time

- Produce audit-ready reports across periods and entities

“I loved that you could model out the pipeline… I would consider it [forecasting] a requirement because it’s really powerful to look at forecasted deals,” said Thomas from Prefect, who implemented Quotapath 3+ years ago.

What Most CFOs Still Get Wrong

This is where we see Finance leaders make the biggest missteps when it comes to comp:

- Overly complex plans = underperformance: 78% of leaders say reps don’t understand their comp plans.

- Underestimating sales comp’s strategic weight: CFOs who view it purely as a cost center miss opportunities to influence margin, retention, and growth quality.

- Lack of real-time reporting: Chris Wasik (Honeycomb) notes the importance of seeing “how much we pay per dollar of revenue sold” — a critical metric many tools overlook.

What Smart CFOs Do Differently

So, to avoid these downfalls, focus on the following.

The most forward-thinking CFOs don’t treat compensation as a static line item — they treat it as a strategic lever for growth. Rather than focusing solely on cost containment, they design comp plans to influence deal quality, drive desired sales behaviors, and improve overall business performance.

They obsess over visibility for finance and reps. When sellers understand exactly how they get paid, they’re more engaged, more motivated, and more likely to deliver consistent results. That’s why smart CFOs prioritize tools and processes that make earnings transparent and easy to model.

They also design comp plans with the end metric in mind. Whether the goal is to improve gross margin, increase multi-year deals, or incentivize upsells, top CFOs work backwards from the business outcome they want to achieve, then model plans to support that outcome.

Finally, they invest in automation early. Rather than waiting until the comp process becomes unmanageable, they implement systems that can scale with the business, reducing manual work, eliminating errors, and freeing up time for strategic finance.

Turn Sales Compensation into a Strategic Advantage

Join the ranks of CFOs using comp to drive better business outcomes. Talk to QuotaPath to learn how you can model, automate, and scale smarter compensation plans.