Congress passed the Sarbanes-Oxley Act in 2002 to mitigate fraudulent financial reporting, requiring public companies to run audits with an independent auditor every year.

But what about startups? Are they required to hold audits?

While not mandated by law, a few situations may call for it. It’s a pretty standard procedure between startups and investors, and a good one at that.

Take, for instance, QuotaPath — one of our lead investors calls for an annual audit as part of our funding agreement.

Potential investors and creditors alike may require an audit to ensure the company’s financial statements are reasonably accurate and reliable. They can also identify risks or problems and verify that the company uses its funds responsibly and ethically. The goal of any public or private audit is to assess the risk of material misstatement in a company’s financials.

Audit more efficiently with QuotaPath

Expedite your audit processes and keep ASC 606 and 340-60 compliant. Approve sales deals, schedule payments, create audit-ready reports, and amortize commissions in one workspace to ensure a smooth and aligned month-end process.

Learn moreAnother instance when startups subject themselves to an audit occurs when a business wants to sell. If so, potential buyers may request it to check if they’re getting a fair price.

So, while not required by law, it is in a startup’s best interest to be audit-ready if an investor requires it down the road or a sale is on the horizon. Plus, it’s a good business practice.

Why startups should embrace audits

Beyond an investor’s request, additional benefits come from completing an audit.

First, an audit can help you identify potential problems with your business. This includes accounting errors, financial mismanagement, and compliance issues. By identifying these problems early on, you can address them before they become more significant.

Second, your findings and recommendations from the auditor can improve your business operations. They can help you identify areas with room for improvement, like process inefficiencies, potential risks, and vulnerabilities, and offer solutions to address each.

And third, an audit can build trust with investors and partners. If you want to raise money or partner with other businesses, an audit can show that your business is well-run and you are serious about your business.

But one does not simply run an audit. Gathering documents and addressing auditor questions takes tremendous time, organization, and preparation.

Tips for Your Startup Audit

Sound daunting? It doesn’t have to be.

While not many people get excited about “auditing season,” they are a necessary part of running a successful business. They can act as a valuable tool for identifying and addressing potential problems.

To help prepare for audit season, whether your first or your 10th, follow these best practices and tips from QuotaPath’s Finance team, our VP of Finance Ryan Macia, and Finance Manager Jonathan Mann.

5. Be preemptive.

Anticipate where the auditors’ questions will come from and shore up as much as you can leading up to it. You’ll have adjustments to make, but by getting ahead of them, you can minimize the adjustments the auditor will request.

4. Prioritize what to focus time on.

Audits require a considerable time commitment from your Finance team. And that’s in addition to their day-to-day responsibilities serving the company.

To help with time management, choose what you want to focus more heavily on.

You want to make sure to complete all of the documentation. But if you identify areas to hold off on until the auditor’s recommendations, you can save time and direct your attention to more time-consuming but straightforward tasks.

3. Be collaborative with your auditing team (not adversarial)

“Think of your relationship with your auditor as a partnership,” Ryan said.

It’s not a you vs. them.

When you work in lockstep with them, they can help you identify and correct errors, improve internal controls, and keep you compliant with laws and regulations while providing assurance.

2. Ongoing financial hygiene

Ryan and Jonathan also offered some advice on how to stay abreast of audit tasks outside of auditing season.

“Make the audit requirements part of your month’s end process,” said Ryan.

1. Score yourself

Lastly, Jonathan suggested popping open financial statements and scoring yourself line by line.

“Ask yourself, ‘How comfortable am I with this getting audited?’” Jonathan said.

Check for adequate supporting documentation and ensure any assumptions are clear and grounded. If it’s not, get that documentation.

Design, track, and manage variable incentives with QuotaPath. Give your RevOps, finance, and sales teams transparency into sales compensation.

Talk to SalesHow QuotaPath can help with auditing of commissions

We appreciate Ryan and Jonathan sharing their advice and experience regarding startup audits.

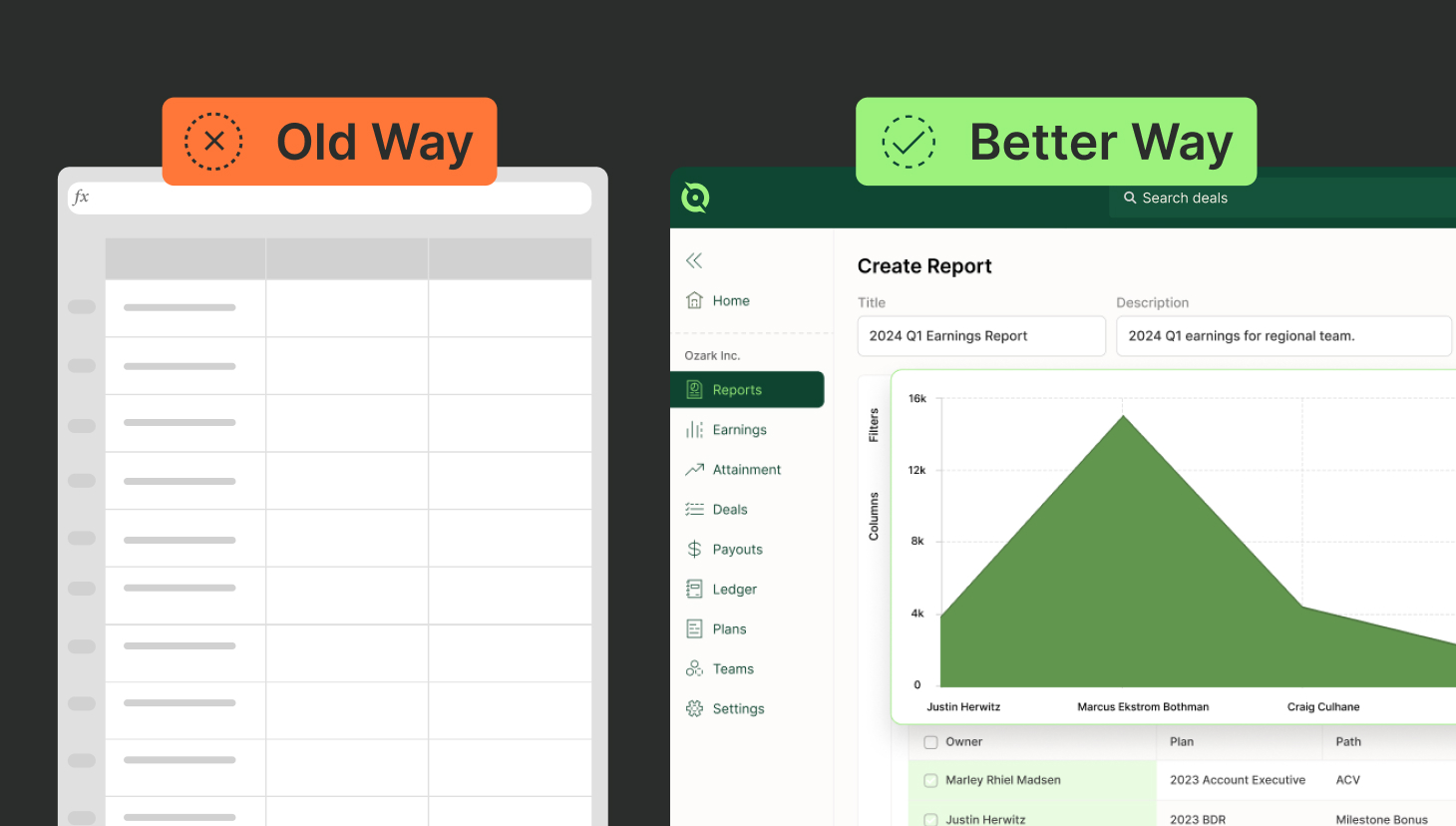

Now, when it comes to sales commissions, QuotaPath can help prepare commissions for auditing.

Our commission tracking software provides a centralized platform for tracking, managing, and amortizing commission payments.

Let QuotaPath house your commission data so that when you need to run a report that shows commissions, payouts, and clawbacks, you can quickly populate one over any period.

Plus, use granular audit trails to reconcile payouts with accruals and minimize the need for true-up entries. Close the books faster, define eligibility rules for when commissions payout, and feed your financial model from live forecasts in QuotaPath.

Talk to one of our reps today to learn more, or sign up for a 30-day trial and see for yourself.