Your sales compensation plan is all set up, you have balanced a plan that is attainable yet challenging. It’s lucrative for the reps and profitable for the company. It has some accelerators, it encourages consistency; it’s your magnum opus. And then the unthinkable happens: one of your middle-of-the-road reps closes a bluebird sales deal.

Wait, this is an article about sales compensation, not birdwatching. What do you mean, a bluebird deal?

What is a bluebird in sales? A bluebird is a deal that is substantially larger than your average deal or one that closes much quicker than your standard deal. Many organizations consider a bluebird deal as one opportunity when the contract value is greater than a rep’s quota.

What do you do? Your first instinct might be to panic. You have never written a commission check this big in your entire sales career! What happens if this bluebird deal isn’t all it’s cracked up to be? Where is that large automobile? Wait, no, that’s Talking Heads. Anyway, here’s what you should do.

Try the most collaborative solution to manage, track and payout variable compensation. Calculate commissions and pay your team accurately, and on time.

Start TrialStep 1: Celebrate the bluebird deal

Your rep sold the biggest deal in company history. The very first thing you do? Scream it from the rooftops. Celebrate your rep. Send out an organization-wide email about how this is an incredible achievement for your rep, their manager, the sales engineer who helped close it, and the SDR who sourced the deal. Your VP of Finance might be wringing their hands, but now is not the time. If you want to close more of these gigantic deals (hint: you do), then you need to signal to your team that this is a good thing.

Step 2: Pay your rep on the bluebird sales deal (with a smile on your face)

Okay, now is when the rubber hits the road for you. Pay your rep. Pay them accordingly to their commission plan. If you try anything funny, you’re going to have issues. Don’t try to reduce their sales commission rates. Don’t try to cap their commission. If you ask a room full of salespeople if they’ve ever had someone mess with their commission, you’re likely to have at least a dozen hands go up. And if you ask them about that experience, at least one of them will probably say they quit because of it. They probably posted a scathing LinkedIn post about it, too. Losing a top rep purely because you didn’t want to pay a commission that they earned is a very expensive (and unethical) mistake. Pay them on the bluebird sales deal.

Step 3: Modify commission payment terms if needed

There is one nuance to bluebird deals: timing of commission payouts. If you normally pay your reps after the customer has been fully onboarded, then this probably won’t be an issue for you. However, if you’re like most companies and don’t wait until onboarding is complete, it can get a little more complicated. Essentially, you don’t want to pay out on this bluebird sales deal only for the deal to evaporate. Then you’d be stuck trying to clawback a gigantic commission check, or worse your rep quits and you have to kiss that commission check goodbye.

So, explain the extenuating circumstances to your rep. Consider giving them a portion of the commission at the typical cadence and pay the rest out on a set schedule. If you typically pay out after the deal is closed, you pay out 25% of the commission on the next pay period and the other 75% once the customer has paid their invoice. Or, if you usually pay commissions after the first month’s invoice is paid, pay out equal installments over the first 3 invoices.

RevOps, sales leaders, and finance teams use our free tool to ensure reps’ on-target earnings and quotas line up with industry standards. Customize plans with accelerators, bonuses, and more, by adjusting 9 variables.

Build a Comp PlanStep 4: Evaluate your comp plan for next time

You might think this was a black swan event. And, it very well might be. But that’s not a good reason to skip planning for the next time it happens. You want to avoid discouraging people from closing these bluebird deals. After all, they can affect an entire sales team quota. We don’t recommend limiting the commission they earn on these deals. However, you might want to consider reducing the accelerators once someone hits above 300% of quota. Maybe you actually write the modified commission payment terms into the compensation document.

There you have it! Congratulations on your bluebird deal. Now you know how to handle it in a professional and expert way.

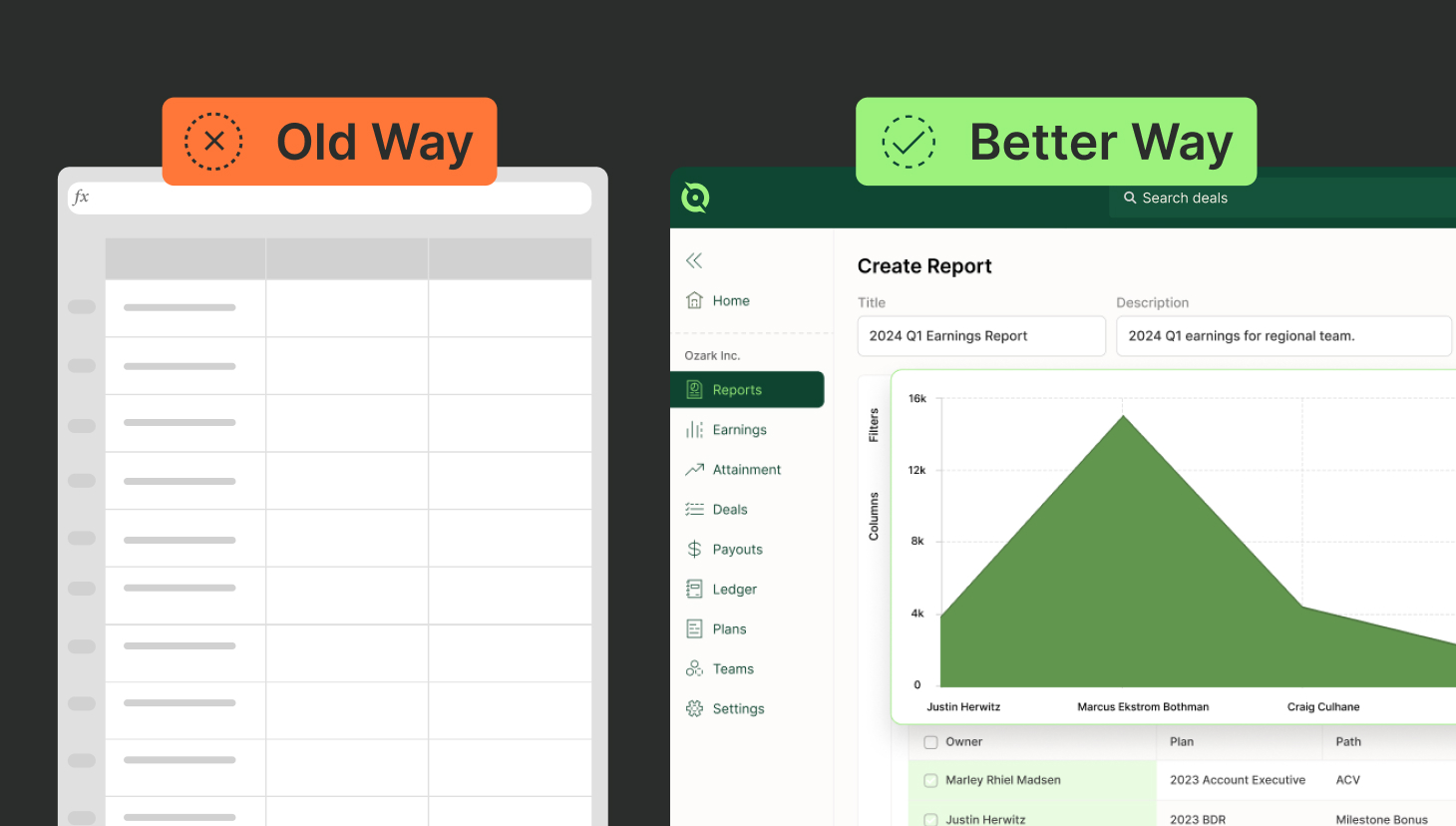

Also, if you are looking to calculate commission on this bluebird deal – or any deal for that matter – you should be using QuotaPath. QuotaPath is a tool designed to help automate the commission tracking process for you, your finance team, and (maybe most importantly) your sales reps.