More than 40% of reps aren’t motivated by their comp plans.

An easy fix? Consider SPIFs.

There are various ways to motivate specific sales rep behaviors and drive performance. Although properly prepared sales compensation plans address most overarching business goals, there are times when short-term rewards like SPIFs are necessary.

What is a SPIF?

A SPIF, also known as a SPIFF or SPIV, is a short-term element of the overallincentive compensation management plan. What does SPIF stand for? SPIF stands for sales performance incentive fund or special performance incentive fund. It is designed to motivate specific behaviors of quota-carrying teams, such as salespeople, customer service agents, lead qualifiers, and sales engineers.

Try the most collaborative solution to manage, track and payout variable compensation. Calculate commissions and pay your team accurately, and on time.

Start TrialWhat is a SPIF in sales?

SPIFs can be used across departments within an organization to improve performance or to encourage and reward specific behaviors. In sales specifically, leaders run SPIFs to inspire revenue-generating behaviors.

When and how are SPIFs used?

Sales teams often add SPIF programs to meet short-term goals like:

- Closing a pipeline gap

- Improving specific behaviors or metrics

- Motivating reps to sell new customers or product types

To drive participation and reward attainment, employers offer various types of incentives or rewards to team members based on the rules set forth at the beginning of each SPIF program.

SPIF challenges

Well-executed SPIFs can be very effective. However, long-term or repetitive use can reduce their impact and diminish returns. Keep the following challenges in mind to increase the odds your SPIF program is a success.

SPIFs are often planned hastily

First and foremost, it’s common for teams to add SPIFs in response to unanticipated marketplace or organizational changes. As a result of this reactionary nature, SPIFs usually lack organization, planning, and strategy. Rushing into a poorly executed sales incentive rewards program can cause more harm than good by driving the wrong outcomes, distracting reps, or creating goals that conflict with those of your overall sales incentive program.

That’s why it’s best to plan SPIFs while building out your compensation plan design proactively. Create a step-by-step process for adding unexpected SPIFs to minimize the risks of reactively introducing poorly executed programs.

Poorly executed SPIFs are common

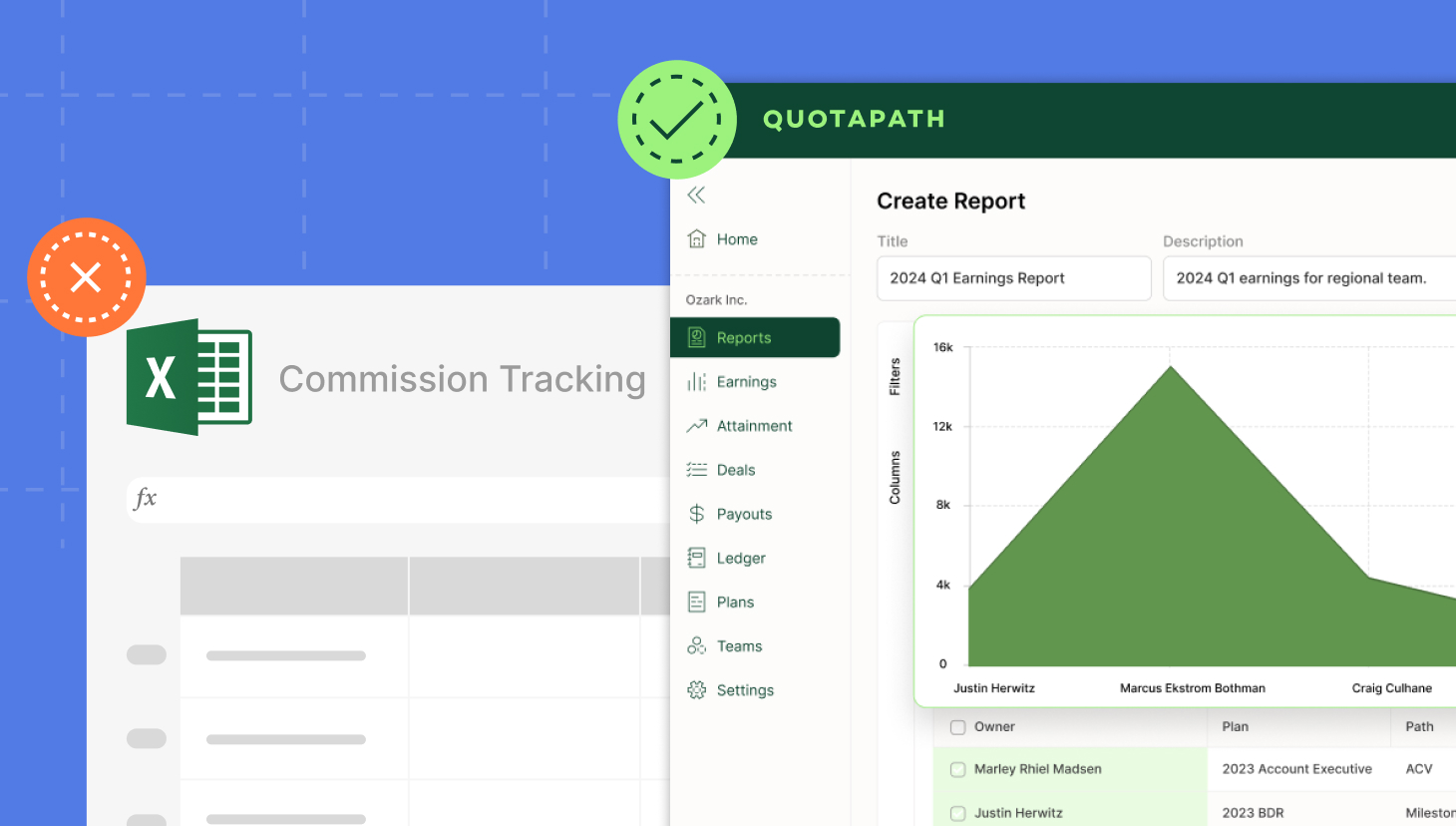

Additionally, leaders usually calculate their SPIF program outside of their main compensation management services. In doing so, this increases the associated financial risk and makes it more difficult to track or analyze. So, it’s best to leverage a commission tracker that allows you to quickly add customized SPIF plans to facilitate compliance and control monitoring.

Sales reps can’t keep their eye on the prize

Plus, most sales organizations encourage reps to track their SPIFs independently, using a manual commission tracking spreadsheet or the likes. This is both time-consuming and error-prone. And, reps can’t easily monitor their progress toward their overall attainment goals. This reduces the motivational impact of the program as they approach the end of the designated period.

It’s difficult to prevent cheating

Along with difficult tracking processes, SPIFs may lead to reps holding deals until they can benefit from the SPIF. When reps know a SPIF program is about to begin, they may delay closing deals to count them toward the desired program goal. To avoid this, wait to announce the upcoming SPIF until it’s time for the SPIF to begin.

ROI measurement isn’t easy

Measuring the success of a SPIF program after its completion entails a complex process further complicated by manual tracking. Sales compensation platforms facilitate post-SPIF analysis, so you can determine which SPIFs are worth repeating.

Too many SPIFs are counterproductive

Last but not least, offering SPIFs too often reduces the motivational impact they have, leading to diminishing returns. If you feel the need to offer SPIFs frequently, you should revisit and revise your overall sales compensation plan. Ensure it’s driving the right behaviors and types of sales.

How to execute successful SPIFs

Take the time to properly plan SPIF programs to increase your odds of success and ROI. Below we share how to plan for your first SPIF.

- Start with clean accurate historical sales data. This makes it easy to identify times and product lines best suited for SPIFs.

- Plan SPIFs when you design your sales commission plans. These programs can be easily integrated into the overarching comp plan, so they are implemented when they’re most needed to balance seasonal variability and key milestones throughout the year.

- Use SPIFs to support established sales initiatives. These include planned promotional offers for new products or a new market segment to pursue.

- Determine the overall compensation budget and what percentage to allocate for SPIFs. Then carefully track SPIF spending throughout the year to stay on budget.

- Always measure SPIF performance against objectives. This prevents repeating expensive mistakes and increases future successes.

- Use past SPIF performance insights to help guide future SPIF planning and adjustments.

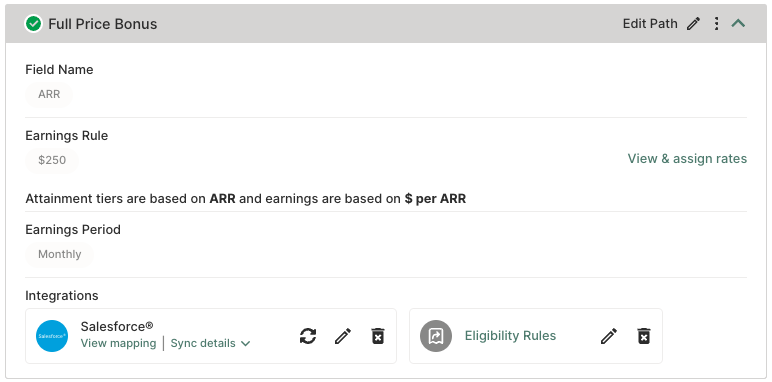

The key to completing this process successfully is clean accurate data. An integrated sales compensation platform, like QuotaPath, makes this possible.

RevOps, sales leaders, and finance teams use our free tool to ensure reps’ on-target earnings and quotas line up with industry standards. Customize plans with accelerators, bonuses, and more, by adjusting 9 variables.

Build a Comp PlanIntegrating SPIFs with Your Overall Compensation Plan

Keep in mind, that you’ll want to integrate your SPIF with your overall compensation plan.

To do so, follow these seven guidelines.

| Alignment with Business Goals | Ensure your SPIFs directly align with your overall business objectives. Don’t create a SPIF in isolation. Analyze your current sales performance and identify areas where a targeted incentive can provide a boost. Is it acquiring new customers, increasing sales of a specific product line, or shortening the sales cycle? Structure your SPIF to incentivize behaviors that contribute to achieving these goals. |

| Complement, Don’t Compete | SPIFs should complement your base salary and commission structure, not replace them. Ideally, the SPIF acts as a motivator for exceeding expectations or achieving specific milestones. A well-designed SPIF shouldn’t cannibalize existing commissions or create a situation where reps prioritize SPIF goals over core sales objectives. |

| Transparency and Communication | Clear communication is crucial. Communicate the SPIF’s goals, eligibility criteria, earning potential, and timeframe clearly to your sales team. Everyone should understand how the SPIF works and how it integrates with their overall compensation plan. |

| Budget Considerations | Allocate a realistic budget for your SPIF program. Consider the potential cost of the incentives and factor that into your overall sales compensation budget. Track the program’s effectiveness and ROI (Return on Investment) to ensure you’re getting a good return on the financial investment in the SPIF. |

| Avoid Overuse | While SPIFs can be a powerful tool, overuse can dilute their effectiveness. Reserve them for strategic initiatives and avoid bombarding your team with constant SPIFs. This can lead to confusion and make it difficult for reps to focus on core sales activities. |

| Integrating with Tracking Tools | Utilize your sales performance management software or CRM system to track SPIF progress. This allows reps to monitor their performance toward earning the incentive and provides insightful data for future program optimization. |

| Regular Review and Refinement | Don’t set it and forget it. Regularly review the effectiveness of your SPIF programs. Analyze data, gather feedback from your sales team, and make adjustments as needed. Over time, you can refine your SPIFs to become even more impactful in driving desired sales behaviors and achieving your business goals. |

By following these strategies, you can integrate SPIFs strategically into your overall compensation plan. This ensures they act as a valuable tool for motivating top performance, achieving sales objectives, and ultimately contributing to your company’s success.

SPIF Best Practices

We’ve gathered some tips on how to get SPIFs right to further boost your success.

Set well-defined goals for each SPIF. Knowing what you want to accomplish at the outset makes it easier to communicate to your team and to gauge success at the completion of the program.

Provide clear direction to your reps. They need to understand what they need to do to earn the incentive and what target, such as X leads or Y deals at $Z, equals success.

Designate who is eligible for the SPIF. This prevents confusion and prevents disappointment.

Specify a clearly defined start and end date for the SPIF.

Consider all SPIF-related costs to prevent going over budget.

Avoid SPIFs that contradict your main sales compensation plan.

Keep it simple. Complicated rules only lead to frustration, disappointment, and less participation.

Don’t use SPIFs too often. They become less effective at motivating and exciting the team if they become the norm.

They should be unexpected. Otherwise, reps will sandbag deals if they know when SPIFs are scheduled.

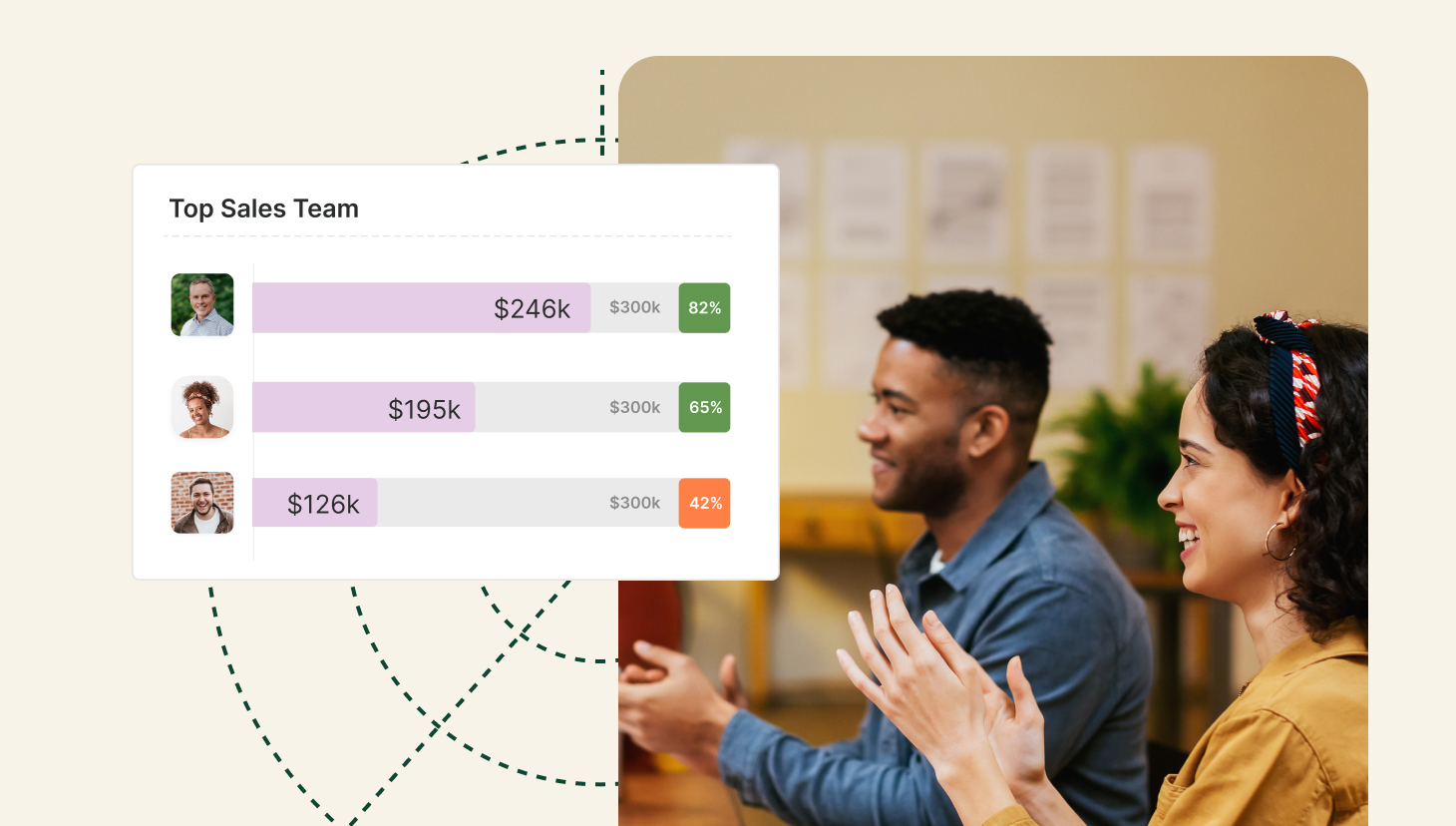

Make them possible for everyone. So, instead of offering a reward for the top X reps, set a SPIF target all team members can reach, like anyone who hits 100% of quota.

Tie success to things reps can control. For example, complete X dials per day for so many days versus speaking to X prospects per day.

How to use SPIFs to drive key business metrics

You can use SPIFs to drive specific business metrics, such as NPS scores, gross profit margin, and more.

For example, you could reward SPIFs or kickers for products that generate higher gross margins. To motivate your team to sell and upsell your most profitable products, pay your team higher rates on new business or renewals that include the products that yield higher gross margins.

You could also give a SPIF on non-discounted deals to promote full-priced deals. Maybe it’s $100 for each one on top of the commission they earn from closing the deal.

Another SPIF might entail $250 every time the rep closes a multi-year deal to drive gross revenue retention.

Key Metrics to Track During a SPIF

So, which metrics should you track? Consider starting with these five:

- SPIF Achievement Rate: This metric measures the percentage of sales reps who successfully achieve the specific goal or behavior required to earn the SPIFF incentive. It helps measure the program’s overall effectiveness in motivating desired actions.

- Sales Velocity: Track the average time it takes to close a deal during the SPIF period. Ideally, the SPIFF should incentivize faster deal closure, leading to a potential increase in sales velocity.

- Revenue Generated: Monitor the total revenue generated as a direct result of the SPIF program. This helps determine the return on investment (ROI) of the SPIF by comparing the cost of the incentives to the additional revenue generated.

- Product/Service Mix: If the SPIFF targets specific products or services, track the sales mix during the program. This reveals if the SPIFF is successfully driving sales towards the desired products/services.

- Rep Engagement: While not one of the direct sales metrics, monitor rep engagement throughout the SPIF. This could involve tracking participation rates in training sessions or surveys to gauge their enthusiasm and overall satisfaction with the program.

Bonus Metric:

- Cost per Acquisition (CPA) of New Customers: If the SPIF aims to acquire new customers, track the CPA during the program. This helps assess the cost-effectiveness of the SPIFF in acquiring new business.

By tracking these key metrics, you can gain valuable insights into the effectiveness of your SPIF program. This allows you to refine future programs for optimal results and ensure they align with your overall sales goals.

Do SPIFs work? Why and when to use SPIFs.

Nearly every sales organization runs sales performance incentive funds (SPIFs) throughout the year. But do they work? Learn when and how to use them effectively.

Take Me to Article

Communicating SPIF Programs to Your Team

Effective communication is paramount when introducing a Sales Performance Incentive Fund (SPIF) program to your sales team. Here’s how to ensure your team is clear, motivated, and ready to succeed:

Transparency and Clarity: Start by clearly outlining the program’s goals and objectives. What specific behaviors or achievements does the SPIF incentivize? What are the desired outcomes the program aims to achieve? Be transparent about the criteria for earning the SPIF and the program’s timeframe. This clarity ensures everyone understands how to participate and what to do to win.

Highlight the Benefits: Don’t just explain the mechanics; emphasize the benefits. Frame the SPIF as an opportunity for reps to earn additional rewards and recognition for their hard work. Showcase how the program aligns with their personal career goals and contributes to achieving team objectives. By highlighting the potential rewards, you can generate excitement and motivate reps to participate actively.

Provide Resources and Support: Equip your team with the resources they need to succeed. Develop training materials or conduct coaching sessions to ensure everyone understands the SPIF details and the specific actions required to earn the incentive. Make ongoing support available to answer questions and address any roadblocks reps might encounter.

Communicate Regularly: Don’t just announce the program and expect magic to happen. Maintain open communication channels throughout the SPIF period. Provide regular updates on progress towards goals, celebrate individual and team achievements, and address any concerns that may arise. This ongoing communication fosters a sense of engagement and keeps reps focused on maximizing their earning potential.

Consider Feedback: After the SPIF concludes, gather feedback from your team. What worked well? What could be improved? This feedback loop allows you to refine future SPIF programs to better align with your team’s needs and preferences. By incorporating their insights, you can create even more effective incentive programs that drive exceptional sales performance.

By following these communication strategies, you can ensure your SPIF program is a well-understood motivating force that propels your sales team toward achieving outstanding results.

Spiff vs CaptivateIQ vs Xactly vs QuotaPath

Read this full comparison to identify the most adaptable commission software.

Take Me to BlogSPIF examples

Companies with the best SPIF incentives tailored them to their teams. What motivates some sales reps may not appeal to others. Hence, it’s best to know your team and their preferences before selecting a reward for your SPIF program. Otherwise, you risk reduced participation and results. We find that successful SPIFs fall into seven categories:

Money – This is a popular choice, but not everyone is motivated by more dollars.

Praise & Recognition – Some people enjoy being in the limelight and see rewards in this category as potentially positioning them for promotion or advancement based on performance. These include:

- Feature of top performer’s name on the leaderboard

- Inclusion in the President’s Club

- Receipt of a displayable award/trophy

Access – These types of SPIFs provide access to special information, support, and resources not available to everyone. These incentives offer professional advantages. But some reps may not value them because they don’t cost the company any or much money. These include:

- The ability to select which sales engineer they’re paired with

- A private calling booth solely for the individual’s use

- First dibs on new accounts or the ability to pick a handful of target accounts

- A one-on-one dinner with the executive team providing access to exclusive information

- Opportunities to attend trade shows, trainings, or certifications to help advance their career

Power – This rewards individuals with the ability to participate in a change or process impacting the sales team. These include:

- Working with the creative team to build the next sales deck

- Inclusion in discussions about sales compensation structure

- Influence over the terms and location of the next President’s Club

Gifts – Like money, gifts are quite commonly used as SPIF incentives. These include:

- Basic gift cards

- Books

- Items to make work life better, like noise-canceling headphones or an extra-wide computer monitor

- A subscription to a platform like Headspace or a music streaming service

Consider these examples to get your creative juices started once you figure out what is attractive to your reps.

Design, track, and manage variable incentives with QuotaPath. Give your RevOps, finance, and sales teams transparency into sales compensation.

Talk to SalesUnsuccessful SPIFs and solutions

Regardless of how hard you try, there’s always a chance you’ll fail the first time you use a specific incentive. If you can determine why it was a flop, make adjustments and try a variation in the future.

Some reasons a SPIF might fail include:

Incentives didn’t match the audience.

Although you can’t please everyone, the incentive needs to motivate most reps included in the program. Without this consideration, you’ll have poor participation and weak results. For a team consisting of diverse demographics, no single incentive will appeal to everyone.

That’s when it’s beneficial to offer reward points where X points are awarded for each unit achieved. Then at the end of the SPIF period, recipients can redeem their points for gifts of their choosing from a selection you offer. And, remember to reveal the gift options at the beginning of the program so reps know what they are working toward.

Promoting a team SPIF

Rewarding the entire sales team for hitting a team goal can negatively impact your team’s culture. This holds especially true if the team falls a few dollars short of a multimillion-dollar goal. Top performers end up feeling short-changed and weaker reps face backlash. Instead of team SPIFs, consider an incentive that applies to everyone who exceeds quota or another target.

Why 91% of sales teams missed quota this year

Take Me to BlogLeveraging Technology for SPIF Management

If you’ve made it all the way here, you should feel fully prepared to implement a SPIF that motivates and rewards your reps. Thank you for joining us!

Our last recommendation is to partner with a tool like QuotaPath to make SPIF management seamless and adaptable to your process.

In doing so, you’ll take advantage of:

| Streamlined Administration and Reduced Errors | Manual SPIF administration can be time-consuming and prone to errors. Technology automates many of the administrative tasks associated with SPIF programs. This includes calculating incentive payouts based on pre-defined criteria, tracking individual and team progress, and generating reports. By automating these tasks, you free up valuable time for your sales team and managers, while minimizing the risk of errors in calculations or payouts. |

| Enhanced Visibility and Motivation | Technology can provide real-time data and insights into SPIF performance. Sales reps can easily access dashboards that show their progress towards earning the incentive, fostering a sense of transparency and encouraging them to stay focused on achieving goals. This real-time visibility motivates reps to push harder and maximize their earning potential throughout the SPIF period. |

| Improved Data-Driven Decision Making | Technology allows for easy data collection and analysis of SPIF programs. You can track key metrics like cost per acquisition of new customers, revenue generated through the SPIF program, and overall return on investment (ROI). These data insights allow you to measure the effectiveness of your SPIFs and make informed decisions about future programs. By leveraging data, you can refine your SPIF strategy to maximize their impact on sales performance and overall business objectives. |

Try QuotaPath’s free commission tracking software in a trial experience. Or, schedule time with a member of our team to learn how to optimize your entire compensation process.