Since we launched QuotaPath in August of 2019, I’ve heard a lot of reasons why people don’t use sales commission software. These are the three most common reasons I hear:

- We can calculate our commission in a spreadsheet

- Our commissions are too simple/complex for software

- Commission software too expensive

We built QuotaPath from our first-hand experience with a big problem in the sales industry: sales commission calculation sucks. Here are the 6 reasons we believe it’s important to automate your commission process.

Try the most collaborative solution to manage, track and payout variable compensation. Calculate commissions and pay your team accurately, and on time.

Start TrialBenefits of adopting a sales commission software

Time efficiency

Most organizations spend hours (if not days) calculating, verifying, and recalculating commission checks for their sales reps. Especially if the b2b sales team has one spiff, the SDR has another spiff. It can get incredibly confusing to keep it all straight. By automating commissions with software, the process can take just a few minutes every month/quarter.

With QuotaPath, you don’t need any complex formulas or an outside consultant to get accurate commissions. If you have an especially complex comp plan, we’re here to help — no implementation fees. If you use CRM software, our Salesforce integration pulls in all of your company’s data and updates in real-time. This makes it easy to get your team up and running and data is exportable for you to upload to your payroll providers.

Reduction of mistakes

The term ‘fat-fingering’ can strike fear into the hearts of data-centric people. Take it from UBS, whose fat-finger mistake cost them $100 million. While your numbers might not be as large as USB, a simple spreadsheet error can be a headache to unwind.

If you’ve ever had a conversation with a rep that starts with “my commission check is wrong…” then you know the pain. Oftentimes, it requires you to write a check out of your payroll cycle or hold off until the next paycheck. Either way, the sales rep is annoyed that their compensation is wrong. Plus it causes a disruption to your week. By automating your commission process, you can reduce the number of costly human errors.

QuotaPath allows users to relax knowing that their commissions are correct the first time. And if you need to make a change in the compensation plan? It takes just a few minutes to tweak (or entirely remake) compensation plans.

Money savings

Save money by spending money on sales commission software? That sounds counter-intuitive. If you’ve ever done a search on Google, you may have gotten turned off by expensive enterprise solutions. These legacy tools are clunky, unintuitive, and take forever to set up. I don’t recommend them — I know from experience! Many of our customers have migrated to QuotaPath after poor experiences with these tools. Commission managers are looking for a modern and affordable sales incentive compensation solution for their team.

And spending money on a compensation management tool, you’ll likely save money in the long run. Between time spent to calculate commissions, the numerous back-and-forth exchanges with reps, and reps’ time away from selling there are countless wasted hours. These hours could be spent doing core tasks that generate revenue for the company while finding ways to cut costs where appropriate. For instance, Finance teams could consider exploring high-interest savings accounts reviewed to make informed decisions about optimizing their company’s financial management strategies.

Improved sales

When people track their progress towards goals, they are more likely to achieve them. This applies to goals from weight loss and quitting smoking to growth targets. With quota attainment tracking tools, reps are reminded of their goals regularly and are more likely to hit their quotas.

Within QuotaPath, there are two ways for reps to track progress toward a goal. With the Attainment module, they can see their quota prorated over time to see how their deals are helping toward hitting quota. They also have the ability to forecast deals in their pipeline so that they can maximize earnings potential. With MyPath, reps can create their own goals based on personal events. If they are saving for a house down payment or a fancy vacation, they can set an earnings goal and track toward it. It’s also a great way to keep their busy days organized and stay on track and motivated to hit their targets.

Transparency

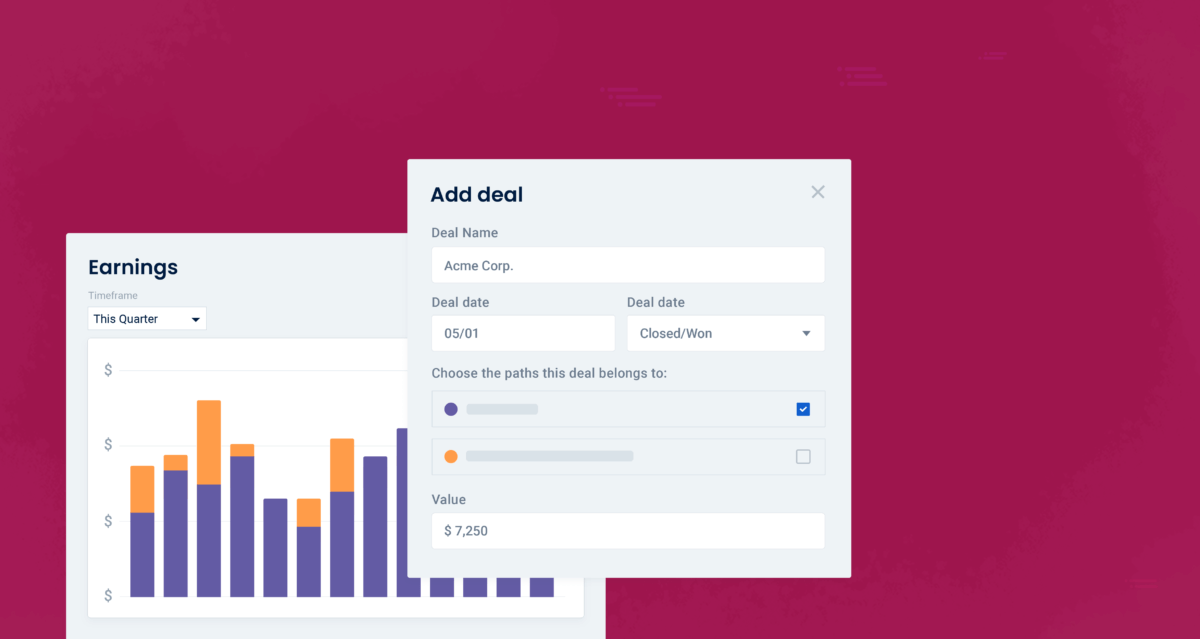

This is the reason that I’m most passionate about. With sales commission software, there is no “shadow accounting”. Reps know — in real-time — how much compensation they have earned on deals. ‘Forecast Pipeline’ allows the ability to see how much compensation they could earn on deals in their pipeline. With QuotaPath, reps can log in and see real-time views of their earnings and what they’ve closed in a quarter. With the Earnings Detail View, they can drill into deals and understand why they made what they did on a specific deal. They have visibility into which deals pushed them into the accelerator bracket, and which ones pushed them over their monthly quota.

For commission managers and sales managers, sales commission software provides more visibility into individual and team sales performance. They can view deal data on both a macro and micro level. They have access to the same information as the reps. Finance teams don’t have to send out end-of-the-month commission statements because reps are aware of how much they have earned.

Source of truth

I’m sure you’ve heard software companies tout that they are the “source of truth” for organizations. While the term might be overused, QuotaPath helps align teams. Our commission tools offer a dedicated place where teams can look at the same set of data, instead of disparate spreadsheets. Juan Torres, Head of Global Sales at Prism.fm said it best, “With QuotaPath I know exactly how much to pay my reps. They can easily see how much they earn.”

Not only are earnings aligned, so are compensation plans. Using our sales commission tool, admins can distribute new compensation plans to all relevant reps instantly. Need to add in a quick spiff (or is it spif? Spiv?) or alter quota due to, say, a pandemic? QuotaPath’s Plans module has that functionality. Plus you can integrate your CRM to ensure all the data is accurate.

In uncertain times, investing in sales software can be tricky. Adding a sales commission software might seem like an unneeded expense. However, as you can see, it pays off very quickly for you and your team. Your reps will have a greater understanding of their earnings which means they will have more time to focus on closing more business. Managers will have more visibility and insight into team performance. Plus, you can use QuotaPath for free for your whole organization.

Originally published on March 27, 2020, updated on November 12, 2020.

Recent Comments