Learning how to motivate your sales team is one of the most important things you can learn as a leader. Some employees respond to gentle encouragement, while others need more direct feedback to get revved up. But there’s one type of motivation that’s almost universally effective: money. That’s where incentive compensation shines.

Learn all about incentive comp and how this fluid approach to payday could inspire your team to work harder and scale quickly.

RevOps, sales leaders, and finance teams use our free tool to ensure reps’ on-target earnings and quotas line up with industry standards. Customize plans with accelerators, bonuses, and more, by adjusting 9 variables.

Build a Comp PlanWhat is incentive compensation?

Many non-sales jobs come with a fixed income, meaning you get paid the same amount every paycheck no matter what. That’s ideal for anyone who thrives on stability, but that guaranteed biweekly deposit doesn’t do much to encourage an extra dose of hustle.

Sales incentive compensation is a type of variable compensation that awards earnings depending on how the team member performed. In other words, the more someone sells, the more money they get to take home.

Incentive compensation is commonly structured as base pay plus commission to help keep salespeople afloat in between deals. It’s also not unusual to see non-monetary incentives on offer. Prizes, free vacations, stock options and at-work perks can also inspire.

Who gets incentive compensation?

Incentive compensation is an option for anyone who has a quota. That includes SDRs, account managers, account executives, some customer success roles, etc.

For an incentive compensation plan to work, candidates must fit two criteria:

- They must be given a number to hit so it’s possible to gauge performance in a quantifiable, objective way.

- They must have opportunities to sell and a chance to showcase their unique brand of hustle.

Incentive based compensation can be a valuable tool both during recruitment and after your hires are hard at work. Do your part to create an effective system by being totally transparent. Every employee should know what types of compensation are on the table and how they can exponentially higher earnings.

Why hand out incentive compensation?

Being a salesperson is wonderfully liberating because you finally have at least some authority over your income. What you do informs how much you make. In other words, a career in sales means that the better you do, the more you get paid. That’s an attractive upside for job seekers interested in moving away from set salaries and pursuing professional growth.

For employers, handing out incentive compensation is like issuing a challenge to their entire team. It’s like you’re saying “Meet this objective and you win a big prize.”

Tips for creating an Incentive Compensation Program

1. Outline clear, realistic objectives

Give your employees goals to hit. These personal objectives should align with larger business objectives. They should also be attainable to keep employees motivated and generating revenue.

2. Emphasize the importance of organizational results

It’s great for salespeople to feel motivated by their own desire for success, but what the company needs matters too. Sales incentive programs can drive competitiveness, sometimes to the extreme. By splitting focus between individual quotas and organizational goals, you empower the entire team without capping individual results.

3. Create a pay structure

The obvious play is to compensate salespeople for hitting an overall goal, such as a quarterly sales quota. But there are other ways to structure financial incentives.

A SPIF, or sales performance incentive fund, encourages reps to push a particular item or portfolio. SPIFs are often used to promote a new feature launch or boost sales of a product line. The opportunity for immediate results is tempting, but there are downsides to offering a SPIF (also called a SPIFF or SPIV) too.

Some insiders believe that SPIFs encourage salespeople to push for sales at all costs when they should be giving clients what they need. Instead, they’re tempted to compel the buyer to go with the option that results in the best commission or bonus. The trick is to use short-term incentives programs such as SPIFs as a complement to a more long-term sales incentive program. One is exciting due to the speedy return. The other helps develop salesperson-client relationships and drive continued success.

Single-rate and multiple-rate bonuses as well as milestone bonuses are also worth exploring. If you need a hand creating your sales incentive compensation plan, I’m here to help!

4. Communicate expectations

Nobody can hit a target unless they know where and what it is. Outline your compensation program, and make sure everyone has a copy. Transparency is key, as is a plan that accounts for every position and reasonable circumstance.

Additionally, ensure your employees all have solid employee development plans in place. That way there is no ambiguity on how to progress and be promoted.

5. Incorporate supporting sales roles

It’s not just your salespeople making the magic happen. Customer service agents, lead qualifiers, techs, administrative support — they all deserve to have their contributions acknowledged, too. Include them in your sales compensation plan, even if the rewards aren’t as big and flashy.

6. Think beyond money

Surprise! Not all salespeople are motivated most by money. Financial rewards are wonderful, but there are other options worth exploring. Incentive programs can include:

- Gift cards

- Tickets to a show or sporting event

- An invitation to a corporate retreat

- Special merchandise

- Travel rewards

- About a hundred other things

Research what your team would want and make that the pot of gold at the end of the sales rainbow.

7. Budget for bonuses

Leave room in your budget to go above and beyond if team performance warrants it. Say you’ve decided to give out one big prize to the top seller. Then the entire term delivers way past expectations. Sure, they’re getting their normal commission. But wouldn’t it be nice to come up with a second and third prize last minute?

It’s entirely possible to plan secretly for tiered prizes for runners-up without announcing it first. In fact, the surprise factor could be an additional motivator the next time you’re running a sales contest.

8. Be prepared to pivot

When COVID-19 hit, business were forced to revisit their compensation plans. The goal was to help reps cope with the new normal and adapt to economic stress. Lowering quotas and removing decelerators and commission cliffs can prevent demotivation. You can also add in new more feasible incentives and reward other performance factors aside from total revenue. These measures may be temporary, but the goodwill and morale boost lasts a long time.

Types of Incentive Compensation

Incentive compensation can take many forms, and understanding which structure to use can be the key to motivating different segments of your sales team. From straightforward commissions to more complex SPIFs and multi-tier bonuses, the right compensation type will align with both your team’s roles and your business goals. Here’s a look at the main incentive options to consider:

- Base + Commission: Most commonly used for sales reps, this is the classic structure where earnings grow in direct relation to sales achievements.

- Bonuses and SPIFs: Targeted bonuses, like SPIFs (Sales Performance Incentive Funds), provide short-term motivation, often to drive specific behaviors, like pushing a new product.

- Milestone and Performance Bonuses: For goals beyond mere revenue, milestone bonuses can reward reps for hitting metrics like customer satisfaction or retention rates.

- Non-Monetary Rewards: Gift cards, trips, or public recognition can be a huge motivator for reps who value unique experiences or prestige.

When should you be using team incentives vs individual incentives?

Choosing between team-based and individual incentives depends on your organization’s goals and team dynamics. Team incentives are effective when you want to foster collaboration, like in complex sales cycles where support and customer success play significant roles. This approach builds camaraderie and rewards everyone involved in a successful outcome, from the account executive to support and implementation teams.

On the other hand, individual incentives work well when rewarding personal initiative or competition is likely to drive performance. Individual incentives are often best suited to roles where personal contribution is more measurable, like account executives or SDRs with specific targets. Balancing both types can reinforce a culture where individuals contribute to the team’s success while still being recognized for their unique achievements.

Key features of an incentive compensation tracking tool

An effective incentive compensation tracking tool helps both leaders and sales teams by providing transparency, real-time updates, and streamlined calculation processes. Here’s what to look for:

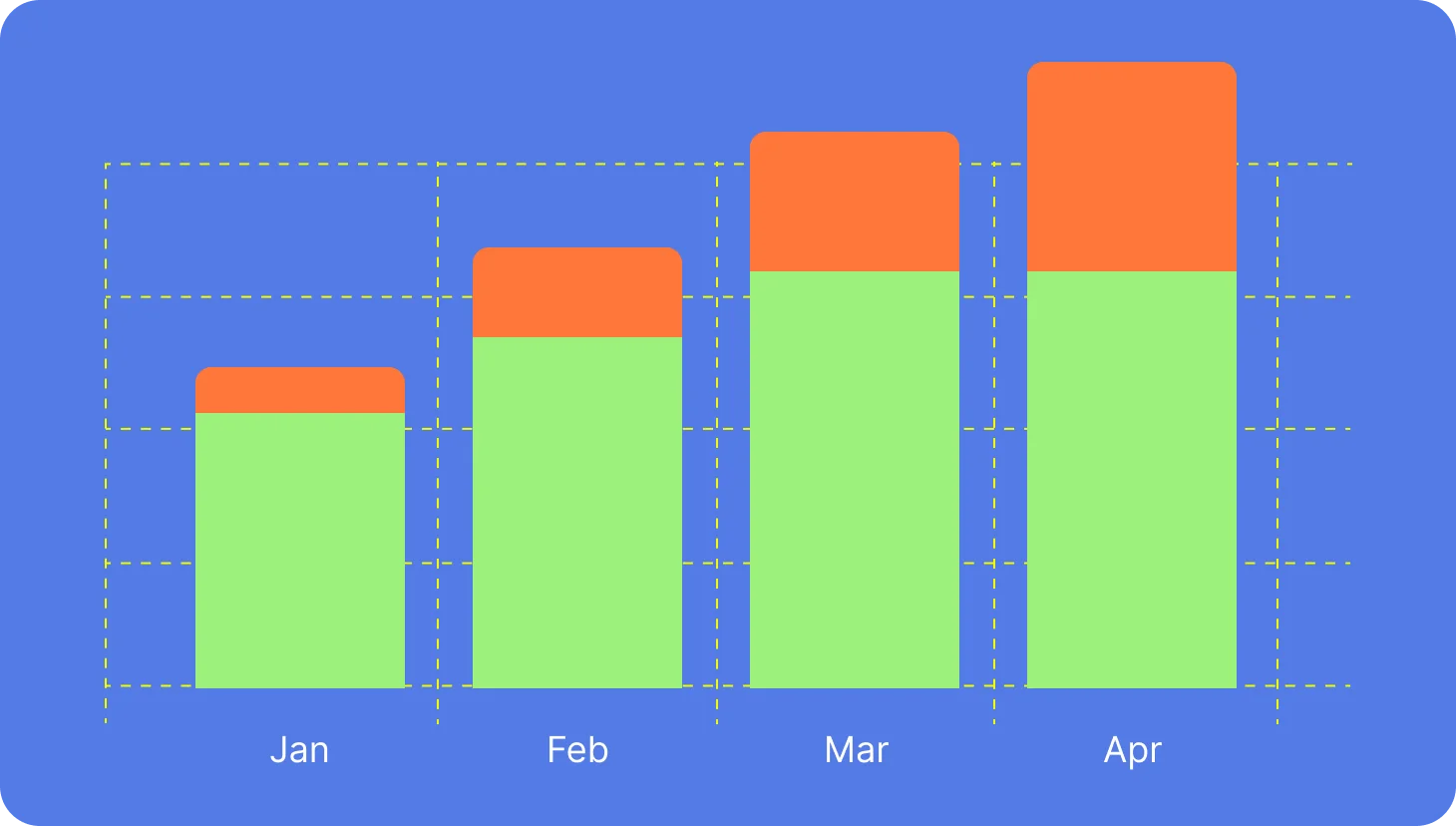

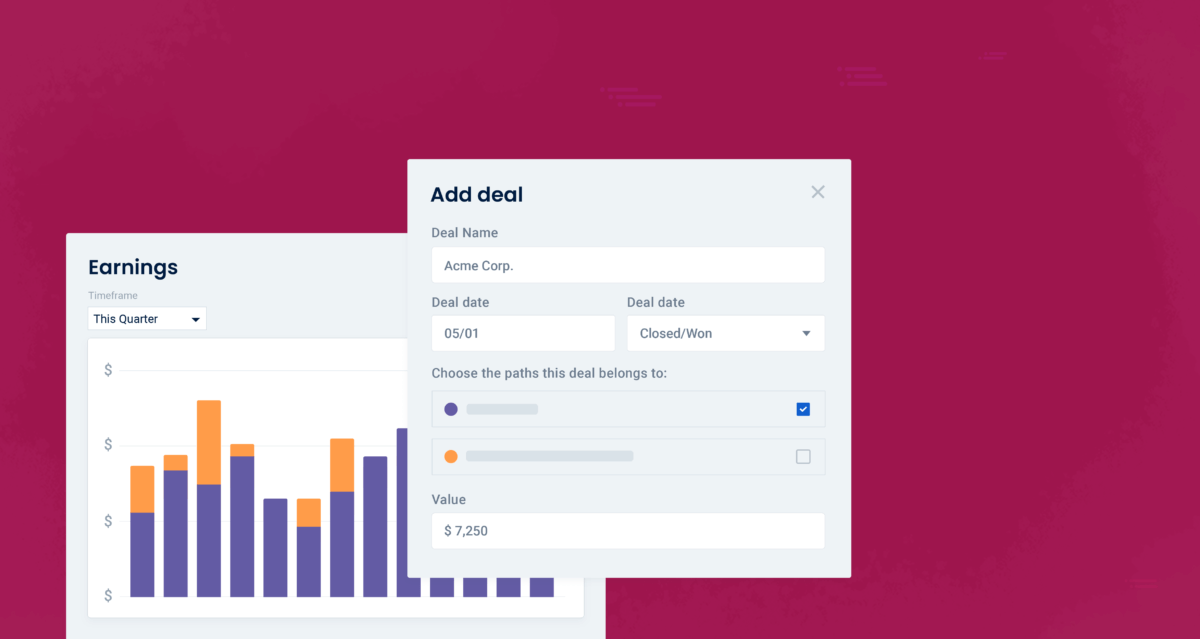

- Automated Calculations: Manual commission tracking is prone to errors, especially as teams scale. Automated tools eliminate calculation errors and save time by quickly adapting to different compensation structures, tiers, and bonuses.

- Real-Time Tracking: A dashboard that updates as deals close keeps reps informed about their earnings and motivates them as they approach targets.

- Customizable Reports: Leaders benefit from flexible reporting features that allow them to analyze trends, measure team performance, and make data-driven decisions.

- Visibility into Earnings: Salespeople thrive when they can see how their actions translate into compensation. A tool that shows progress toward goals and earnings potential helps boost motivation and transparency.

- Goal Management and Alerts: Tools that track quotas and notify reps as they hit milestones help reinforce goals and drive performance.

With the right tool, tracking incentive compensation becomes a seamless part of operations, motivating reps and helping leadership keep compensation aligned with business objectives. QuotaPath provides just that: visibility, automation, and actionable insights for sales teams to stay focused on their goals.

Tracking incentive compensation

The more salespeople you have, the harder it is to keep an eye on everyone’s numbers. Figuring out who is meeting or exceeding quotas can feel like trying to juggle a dozen balls coated in something desperately slippery. Luckily, QuotaPath can help. Our proprietary sales commission software can help your team understand earnings, track incentive compensation and so much more.

Interested in having more flexibility and control? Sign up for free today and see why people love QuotaPath.

Recent Comments