This is a guest blog written by Tanhaz Kamaly, a Partnership Executive at Dialpad.

To survive and thrive in today’s business world, businesses must have a tried-and-true sales process or structure in place. This process is a required pathway that every salesman goes through before closing a deal.

A single-minded focus on success is essential for every sales endeavor, from designing a sales compensation plan to prospecting and eventually closing prospects. A company’s ability to close deals and keep its clients is severely hampered without a simplified sales process. When the business strategy isn’t supported by a thorough sales procedure, data loss, misunderstanding, and poor sales insights are the inevitable results.

This is where customer relationship management (CRM) software can transform your business.

Customer relationship management is more than just CRM; it also handles sales processes and yields much higher sales volumes. It’s obvious that CRM software functions have expanded beyond that of a simple tool used for contact management. Business leaders can better manage customer service and relationships with the help of modern CRM software, which provides everyone on the team with a unified view of data.

The success of your company depends on the effectiveness of your customer service. It’s clear that customers will only remain loyal to companies that can satisfy their increasingly high delivery requirements.

Your business needs the capacity to leverage personalized customer interactions and produce consistent user experiences across the board.

You need to think of your CRM software as a tool to increase productivity, enhance sales, and convert leads into customers. Effective use of customer relationship management software has been shown to boost revenue, productivity, and customer satisfaction scores.

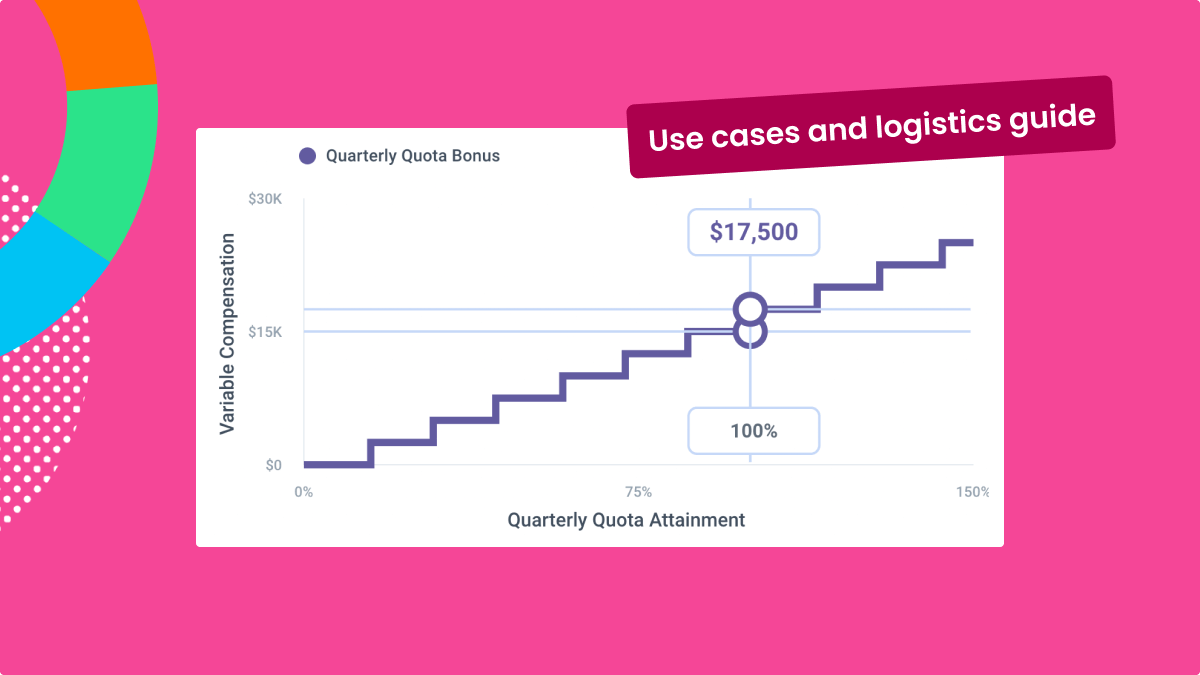

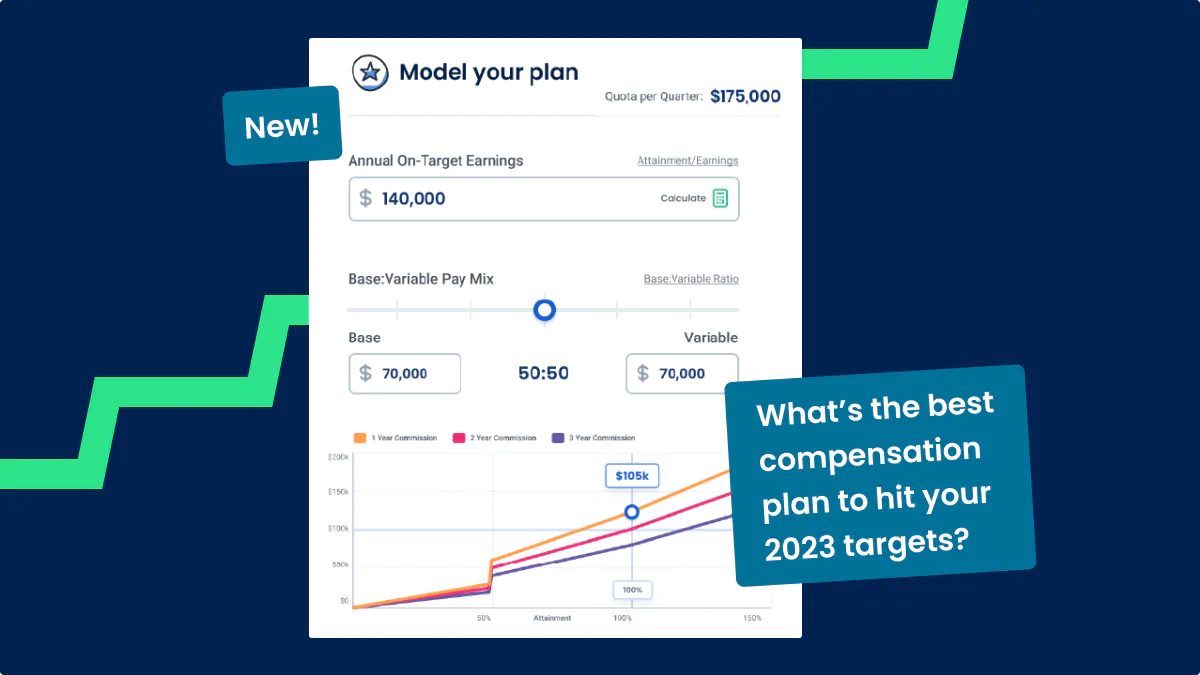

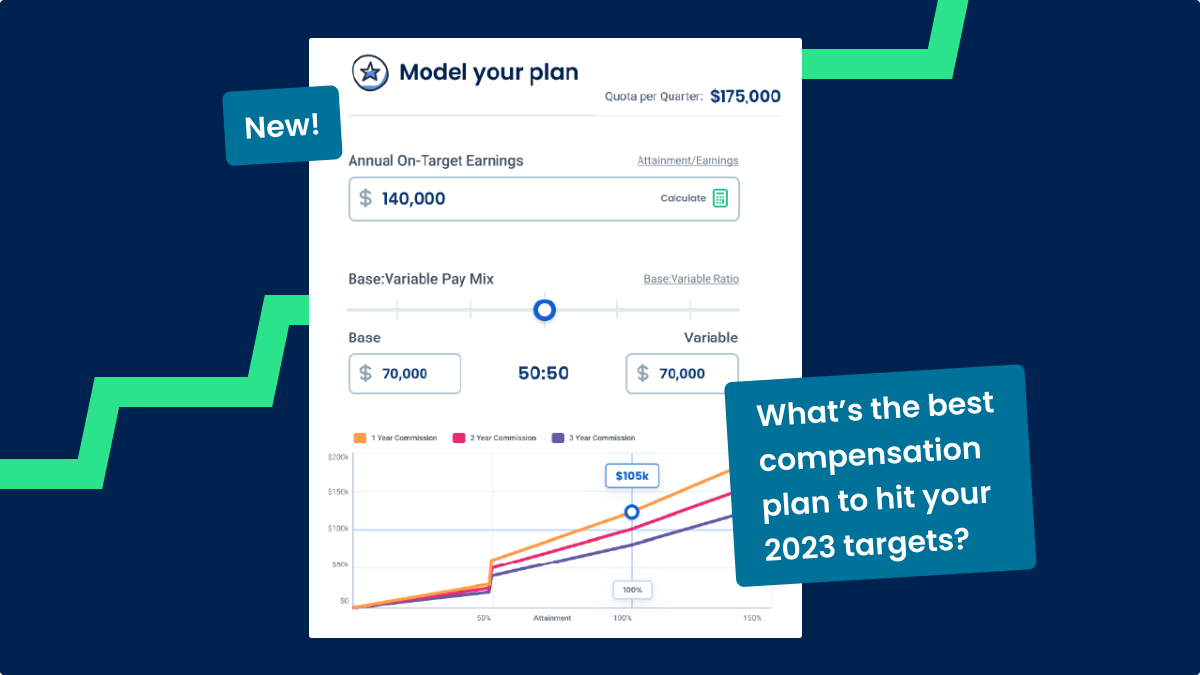

Compensation Hub

Discover, compare, and build compensation plans. Customize compensation models using 9 variables.

Find Compensation PlansHow can sales CRM software help your business?

Improving customer data accuracy

It’s easy for mistakes to creep in when entering data manually. Consider a scenario in which a virtual call center agent must manually jot down a lead’s details. It’s possible that they’ll enter the wrong information or neglect to include the lead’s contact details.

To reduce the likelihood of these mistakes, customer relationship management systems for sales teams keep track of every interaction a salesperson has within the software, including making contact, making a sale, and following up. Activity feeds and contact profiles displayed in real time show these interactions. Filtering the feed by user or activity makes it easy to get the precise piece of information you need about a lead or an event.

There are also data enrichment tools and data enrichment API available in several sales CRMs that can pull information from other databases and add it to a prospect’s contact card in a matter of seconds. This not only lessens the possibility of representatives acquiring erroneous data but also significantly reduces the time spent exploring leads.

In addition to improving access to reliable and thorough prospect information, CRM software can help you spot performance or operational concerns that may be impeding your company’s expansion.

Connecting with your target customers

Any company that invests in customer relationship management software will see a substantial return on investment because of its ability to connect you with leads.

Without it, your team would have a difficult time prioritizing prospects and reaping the rewards of the effort invested in producing and recruiting new leads.

It’s crucial to have a plan in place for cultivating business opportunities of varying importance. Integrated CRM systems aid in providing a comprehensive picture of leads to relevant departments, allowing them to tailor engagements and swiftly reach important decision-makers.

Consolidating sales operations

Salespeople spend time doing anything from research and cold calling to deal management and going out into the field to close deals. Managers have a lot on their plates between keeping tabs on salespeople’s numbers, scheduling ride-alongs, and educating their staff. Things in your department are likely to become jampacked without a centralized framework for organizing these regular tasks.

Sales CRMs are built to streamline every step of the daily workflow. They can synchronize with your current set of channels and tools, such as your phone system’s automatic call distribution, to make it simple to handle everything in one place.

When information is gathered in one place, it becomes the most reliable source for the entire company. Salespeople get quick access to current data that they need to effectively pursue leads and complete deals. In addition, they don’t have to switch between applications or tabs to interact with leads via all available channels of contact (phone, email, or website chat box).

Boost efficiency in the workplace

Employing the right technology releases your staff from tedious processes and gives salespeople opportunities to advance. In customer service, manual tasks like data entry and locating contact information can be automated or removed. By automating various aspects of the sales, service, and marketing processes, you can free up your staff to focus on developing new leads and nurturing existing ones.

Improving customer service consistency

Consistency continues to be a defining factor in the efficiency of your customer service.

Even great sales reps and goods are only as valuable as the service they come with, and consistency has become the new gold standard. When all relevant teams have real-time access to a customer’s history, they can work together to swiftly deliver individualized communications and solutions. In a nutshell, consistency across communication channels fosters trust and increases the likelihood of future business.

Providing a great customer experience is as important as having an excellent landing page for your website.

Finding weak spots in the sales process

It might be difficult for businesses that don’t employ a sales CRM to analyze performance difficulties. To identify bottlenecks, they have to collect vast volumes of data into spreadsheets and fight with Excel formulae.

One of the best things about CRM software is that it automatically carries out data analysis. Data from your customers is combined into “smart reports” in real time, giving you a glimpse into the overall efficiency of your sales team.

To maximize efficiency, you can use CRM software to plan and prioritize your sales activities and tasks.

Decrease in sales caused by poor sales forecasting

With CRM sales systems, you can track and analyze your deals in real time. Representatives can see which opportunities are more likely to result in a sale and which ones are closers. Managers can more easily coordinate plans and construct effective deals with a clear picture of the pipeline.

Poor insight into sales performance.

Today’s customer relationship management (CRM) software allows users to create custom dashboards from which they can keep tabs on key metrics, assess progress against key performance indicators, and dig deeper into sales reports.

Poor decision-making due to inadequate data access

To streamline procedures and make educated, well-informed decisions, businesses are increasingly turning to CRM software solutions.

Points to consider when choosing sales CRM software

By now, you are well aware of the benefits of sales CRM and its potential for your business.

Now, let’s look at some of the most vital considerations for choosing CRM software.

Choosing CRM software can be difficult if you don’t know what features you need. Is it best to go with the most popular CRM for making sales? The most economical one, perhaps?

However, there are other factors to consider besides cost and reputation when selecting CRM software. Here are some things to think about when you evaluate the potential options for your company’s sales department.

Mobile-friendly application

People are spending less time at their desks these days since they are so frequently on the go for many reasons, including travel and fieldwork. You need access to your sales CRM wherever you go.

Modern sales CRM systems allow you to access your most vital information, reports, and even something as random as a release of liability template from any mobile device, at any time. Those companies that have implemented the change are more likely to meet or exceed their sales targets.

Security

Using a CRM system means storing sensitive client data on the cloud, where it can be accessed by hackers. There are ways to find out how safe the sales CRM that you’re considering is. For instance, you can assess whether the system has been updated to meet the requirements of data privacy regulations such as the General Data Protection Regulation (GDPR).

Integration

A CRM system can help you simplify your business in the same way that optimization tools like Process Bliss business processes do. As a result, you can tell you’ve found the right choice when the sales CRM platform you’re considering has integration capabilities.

Add-ons allow you to automate a large part of your sales process, including the addition of contacts, the scheduling of meetings, the creation and sending of invoices, the exchange of e-signed documents, and the creation of forms.

Improve operational efficiency with a sales CRM

Creating genuine connections with customers is the key to maintaining a steady flow of repeat business. By streamlining and automating routine administrative and data analysis activities, a sales CRM frees up time for reps to focus on developing relationships with prospects. Reps can move leads faster through the sales pipeline since they can build meaningful relationships with more prospects in less time.

About Tanhaz Kamaly – Partnership Executive, UK, Dialpad UK

Tanhaz Kamaly is a Partnership Executive at Dialpad, a modern cloud-hosted business communications platform that turns conversations into the best opportunities, both for businesses and clients with features like the auto attendant by Dialpad. He is well-versed and passionate about helping companies work in constantly evolving contexts, anywhere, anytime. Tanhaz has also written for other domains such as Not Going To Uni and Corporate Vision Magazine.

Check out his LinkedIn profile.

QuotaPath CRM integrations

QuotaPath sales compensation management software provides real-time commission tracking by integrating with any CRM.

Recent Comments