In this blog, QuotaPath‘s Chief of Staff and host of Sales Nerds Live! Graham Collins shares 5 sales compensation plan examples. Read on for a sales manager compensation plan sample, SDR compensation plan, VP of Sales compensation package, sales rep commission, and recruiter commission plan sample.

Designing compensation plans is not an easy task. You have to balance fairly paying your sales rep commission. However, you don’t want to overpay them. You also have to consider the goals laid out by the finance team. Not to mention trying to build a compelling VP of Sales compensation package! It can feel like you’re being pulled in 10 different directions.

Automate Commission Tracking

Manage, track and payout your GTM team’s variable compensation. Calculate commissions and pay your team accurately, and on time.

Learn More

I wish there was a universal perfect sample compensation plan, I really do. However, with all the different sales roles, business models, industries, and locations, that one perfect plan is impossible. There is no SDR compensation plan that works for everyone. The tiered commission structure that works for one company, may be horrible for another. So, instead of trying to solve all compensation plans for everyone, I thought I’d give you a leg up when designing compensation plans for your company by showing you a few sales compensation plan examples that have worked for companies in the past.

Below you’ll find an example sales rep compensation plan, an example SDR compensation plan, an example sales manager compensation plan, an example VP of Sales compensation plan, and an example recruiter compensation plan. Don’t forget to check out Compensation Hub, a free resource we created that includes more than 20 adjustable comp plan templates to support comp plan design.

First, I’ll explain what a comp plan entails to be successful. Then, we’ll take into consideration each of the examples of variable compensation plans. Lastly, I provide a list of comp plan examples for inspiration.

What Does a Sales Compensation Plan Need to Achieve?

A well-structured sales compensation plan is the backbone of a motivated, high-performing sales team while ensuring alignment with your company’s business goals.

Sales roles are notoriously high-stress and prone to high turnover; in fact, the median tenure for sales representatives is just over three years, according to the Bureau of Labor Statistics. With hiring costs ranging from $10,000 to $15,000 per sales rep, turnover quickly becomes an expensive challenge for businesses.

A strong sales compensation plan can reduce turnover by providing clear incentives for sales reps to stay and perform at their best. It motivates them with a balanced mix of salary, commissions, and bonuses while offering the clarity and fairness necessary to build trust. Notably, over half of employees consider leaving their jobs if compensation doesn’t meet their expectations, underscoring the critical role of a thoughtful comp plan.

Here are the core goals a sales compensation plan should achieve:

Align with Business Objectives

Your compensation plan must support your company’s overarching goals and sales strategy. For example:

- Increasing market share? Incentivize reps to acquire new customers.

- Boosting customer loyalty? Offer rewards for upselling and cross-selling to existing clients.

- Building strong leadership? Use manager-focused compensation plans to encourage team-building and development.

You directly link rewards to business outcomes to ensure sales reps’ efforts drive the desired results.

The right plan creates a clear connection between effort and reward. Fundamental mechanisms to consider include:

- Sales Quota: The minimum sales target reps must meet to earn commissions.

- Accelerators: Additional bonuses for exceeding sales quotas, motivating reps to go above and beyond.

- SPIFFs (Sales Performance Incentive Funds): One-time bonuses for achieving specific objectives, such as closing deals in a priority category or within a short timeframe.

Incentives like these boost individual performance and contribute to overall team success.

Provide Transparency and Security

Sales teams thrive when they understand how their efforts translate to earnings. Detailed communication about on-target earnings (OTE)—the expected annual income if targets are met—and clear documentation of commission structures help ensure transparency.

Security measures, like ensuring fair base salaries for sales reps and managers, also reduce turnover risk while fostering trust.

Enforce Accountability

While motivating your team is crucial, your plan should include mechanisms to address underperformance or mitigate financial risks.

Common elements include:

- Decelerators: Reduced commission rates for underperforming reps.

- Clawbacks: Provisions for reclaiming commissions in cases of canceled sales or misconduct.

Accountability measures maintain fairness and protect the organization’s financial interests.

5 sales compensation plan examples

1. Sales manager compensation plan sample

Sales managers are responsible for, well, managing salespeople. There are times when the title “sales manager” applies to someone who doesn’t actually have a team of salespeople reporting to them. For this example, I’m talking specifically about managers who do not focus on closing their own deals but instead have several sales reps who report in.

Unlike sales reps whose quotas are unique to themselves, sales managers’ quotas are typically based on the collective quotas of the people reporting to them. Their quota is not always a sum of their team’s quota. They are sometimes given a “buffer” of 10-20%. This means that if a sales manager has 5 reps reporting to them, each with a $150k quota, the manager’s quota is 90% of that sum. So, instead of $750k (5*$150k) it is $675k ($750k*90%).

Because the sales manager compensation plan sample is built around the deals their reps close, it allows them to spend their time coaching their sales team to close more deals.

Sample Sales Manager Compensation Plan:

Quota: $945k per quarter (based on a team of 6 reps at a $175k/quarter quota, held to 90%)

On-Target Earnings: $200k per year

Base Salary: $100k per year

On-Target Variable: $100k per year

Commission Structure: 2.65% of all deals their reps close

Notes: This plan is a very straightforward plan, utilizing a single rate commission. That means that the manager earns the same amount on all deals their team closes, regardless of their team quota attainment. This type of plan is somewhat common because it is easy to understand, very simple to roll out, and allows additional complexity to be added in at a later date.

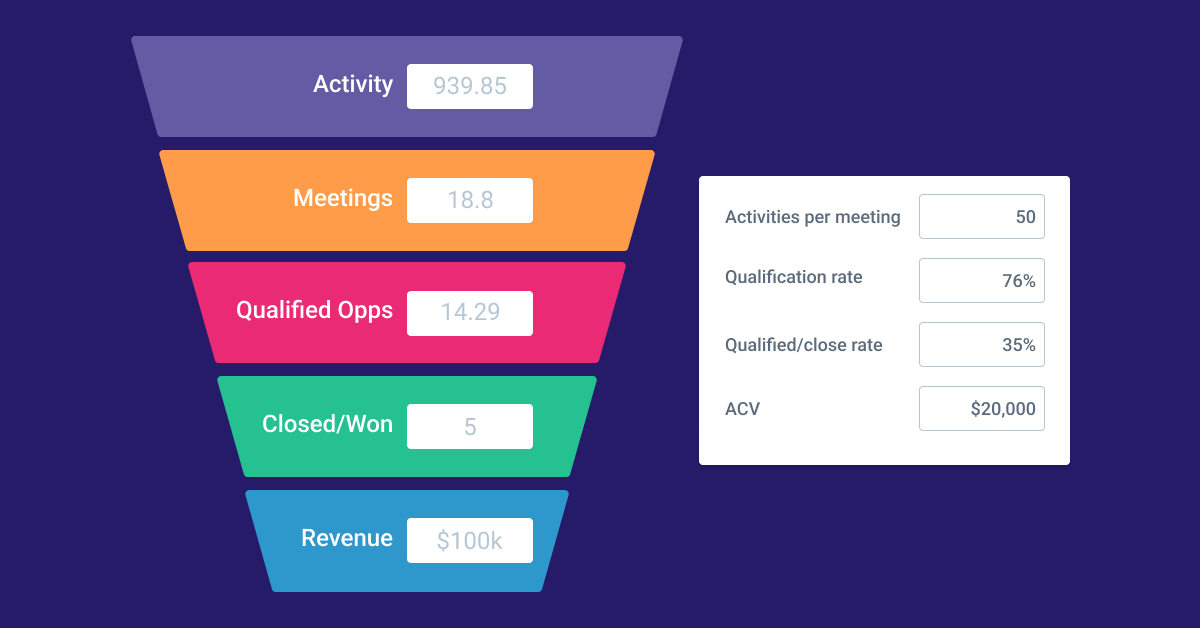

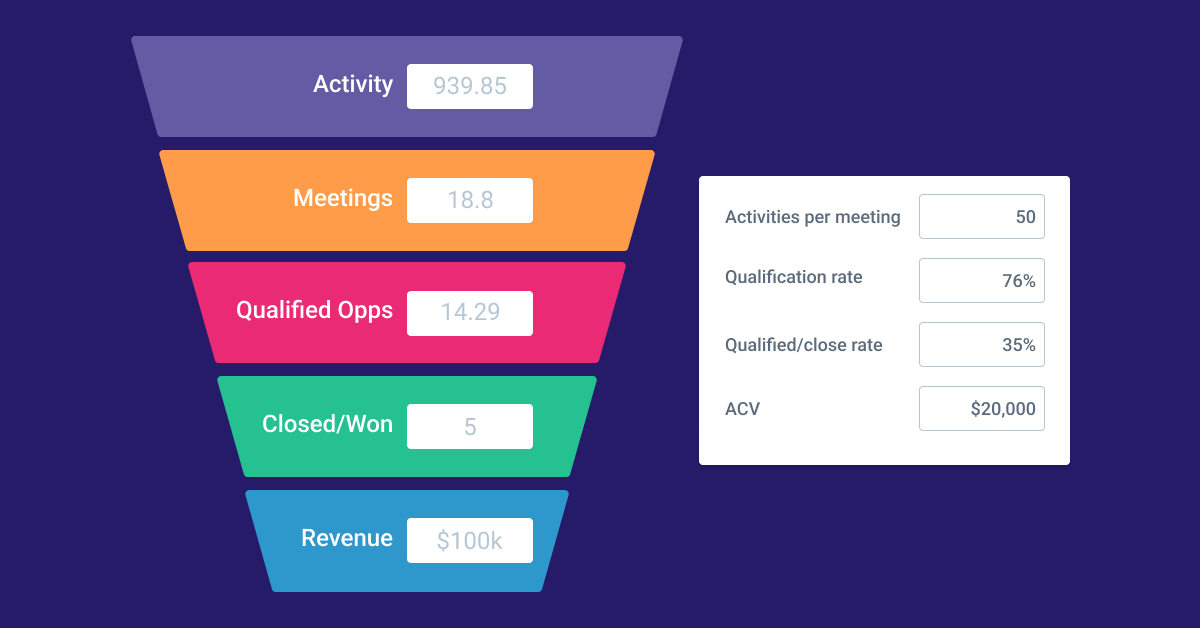

Build a Sales Funnel

Use our free sales funnel resource to see how many meetings your team needs to book to hit quota.

Calculate Now

2. SDR compensation plan

An SDR, or sales development rep, is typically responsible for scheduling meetings for the sales team. Sometimes businesses refer to this role as an MDR (market development rep), BDR (business development rep), or LDR (lead development rep). Regardless of their title, they handle the top of the funnel for a sales team. This could be qualifying marketing leads, running outbound calls and emails, and even holding discovery calls. As for compensation, the three plans below are the most widely implemented SDR comp plans.

- Number of meetings: This SDR compensation plan is the most common for early organizations that want to fill their sales reps’ calendars. For every meeting the SDR sets (that actually happens!) they receive a bonus. This bonus varies wildly based on the company’s ASP (average sales price) and demo-to-close rate. Generally, the bonus falls anywhere between $20 and $300.

- Number of qualified opportunities: This SDR comp plan is better once an organization has a clearly defined ICP (ideal customer profile) and only wants sales reps on the phone with qualified prospects. It’s important to create very clear and concise rules as to what a qualified opportunity is so there is no ambiguity. Once again, this bonus is highly dependent on the company but generally a higher dollar figure than simply paying for demos.

- Percentage of revenue generated: While many organizations think this is the ideal SDR compensation plan, it is only the right option for specific companies. Essentially, in this example comp plan, SDRs get paid a commission on all closed won deals that originated from the opportunity they created. This only works if you have a shorter sales cycle (ideally sub-60 days) because the SDR needs to have control over their income. The SDR commission percentage typically ranges from .5% to 4%.

With all that being said, the most common SDR compensation plan is actually a combination of 2 or more of these components. See below for an example of this.

Sample SDR Compensation Plan:

Quota: 10 qualified opportunities per month and $60,000 of revenue per month

On-Target Earnings: $70k per year

Base Salary: $46k per year

On-Target Variable: $24k per year

Commission Structure: $100 per qualified opportunity and 1.66% of all deals they generate

Notes: There are two different quotas and therefore two different commission rules for this sample SDR plan. They are paid a flat $100 bonus for every qualified opportunity they generate and are expected to create 10 qualified opportunities per month. Their second target is to generate $60,000 of revenue per month and they are paid 1.66% of all revenue generated.

3. VP of Sales compensation package

When thinking about a sample VP of Sales plan, you have to factor in the entire VP of Sales compensation package. If a VP of Sales is looking purely for a high base salary, most organizations would consider that a red flag. That’s because a VP of Sales compensation package consists of base salary, bonus/variable, and likely a hefty equity component. If the VP of Sales doesn’t have an equity component of their comp package, they may have milestone bonuses for certain achievements or an alternative way to ensure they have a competitive sales compensation plan model.

A VP of Sales compensation package varies from a standard compensation plan in a few other key ways. For example, organizations generally hold VPs to a financial target number set by the CFO and Board of Directors. It is their responsibility to hire, ramp, and train reps to be able to hit that number. So, instead of having a quota that aligns with the number of reps they have, it’s the other way around.

Secondly, their quota tends to change over time as the company grows. That implies that their target might double in Q4 from where it stood in Q1. Because of this, they might earn incentive pay on a “per attainment point” model. This means that they have a set bonus amount and they multiply that bonus number by their quota attainment. See below for an example.

Sample VP of Sales Compensation Package:

Quota: $2 million of new business ARR broken down quarterly based on financial model

Q1: $310k | Q2: $420k | Q3: $580k | Q4: $690k

On-Target Earnings: $400k per year

Base Salary: $240k per year

On-Target Variable: $160k per year

Commission Structure:

$300 per attainment point of quota

$10k quarterly bonus for hitting financial target

1% equity vested over 4 years

Notes: As discussed above, this VP of Sales compensation package has a quota that increases quarter over quarter and utilizes a “per attainment point” bonus. In this example, the VP of Sales earns $300 per attainment point. So, if they ended the quarter at 94% of target, they would be paid 94 times $300 or $28,200. If they ended the quarter at 107% of quota, they would earn 107 times $300 or $32,100. They also have a $10k milestone bonus for achieving quarterly financial target. This means that if they hit that financial target, they get a flat $10k bonus that is not prorated if they miss and doesn’t increase if they over attain.

Create Compensation Plans with confidence

RevOps, sales leaders, and finance teams use our free tool to ensure reps’ on-target earnings and quotas line up with industry standards. Customize plans with accelerators, bonuses, and more, by adjusting 9 variables.

Build a Comp Plan

4. Sales rep commission

Because most people who work in sales identify as sales reps, thousands of different sales rep commission plans and commission structures exist.

Where do you start? Well, the easiest thing to do is to start simple and add complexity later as needed. A simple comp plan doesn’t always entail paying a flat rate commission. You might want to add in accelerators/decelerators or you might want to have a bonus. Maybe you want to change the commission rate based on the length of the contract. It will all depend on the specifics of your company and what you’re hoping to accomplish.

Below, we’ve provided a sample sales rep commission plan that has worked well for organizations we’ve seen in the past.

Sample Sales Rep Commission Plan:

Quota: $160,000 of ARR per quarter

On-Target Earnings: $140k per year

Base Salary: $70k per year

On-Target Variable: $70k per year

Commission Structure: 11% commission on all ARR sold until quota is reached then 17% commission on all ARR above quota

Notes: This plan features a simple accelerator to encourage over performance. The sales rep commission is flat until they achieve their quota. Once that quota is reached, the commission rate increases for all subsequent revenue. Because this commission rate doesn’t apply to the previous tier, they only get the higher rate on the revenue above their quota, not everything they sold that quarter.

5. Recruiter commission plan sample

The first thing to remember about recruiter commission plans is that there are two types of recruiters, internal and external. The difference is that an internal recruiter works entirely within one company. They are an employee of that company. Whereas an external recruiter might work for several companies and is either an independent contractor or an employee of a recruiting firm. Typically internal recruiters do not have a variable pay component of their compensation and receive just a base salary.

On the other hand, external recruiters generally do have commission plans. Those plans can vary quite a bit. But they often share one thing in common: the recruiters earn compensation based on someone getting hired. Now, how much they earn varies widely, but it is typically a percentage of the revenue that the recruiter generates.

For easier-to-fill roles, a recruiting firm might earn only 10% of the candidate’s salary as a recruiting fee. Whereas for more difficult-to-find hires, the recruiting firm might make 50% of that person’s salary. So from there, the recruiter earns a percentage of that revenue based on their revenue target. These commission rates might be as low as 5% and as high as 20%.

Recruiter commission plan

Quota: $650,000 of revenue per year

On-Target Earnings: $100k per year

Base Salary: $50k per year

On-Target Variable: $50k per year

Commission Structure: 0% commission until recruiter has generated $50k in revenue then 8.33% commission on all revenue sold thereafter

Notes: The reason that this plan doesn’t pay commission until the recruiter has generated $50k of revenue is because they are expected to at least generate the amount of revenue equal to their base salary before they are paid commission. This plan also includes a recoverable draw on the expected commission on a monthly basis.

Building Your Own Custom Compensation Plan

Designing a sales compensation plan that aligns with your company’s goals and motivates your team requires a thoughtful, structured approach.

Here’s four steps to get started:

Step 1: Establish What Goals You Want to Achieve

Before diving into the numbers, identify the specific business outcomes your compensation plan should support.

Are you aiming to:

- Drive new customer acquisition?

- Increase upselling and cross-selling among existing clients?

- Foster a collaborative sales culture?

- Incentivize long-term retention and leadership development?

Defining these goals will provide a clear roadmap for the plan’s structure.

Step 2: Determine the Market Rate and Target Compensation

Understand the market benchmarks for sales roles in your industry and region. Resources like salary surveys or compensation platforms can help identify competitive pay rates. Next, decide on your target compensation for each role, focusing on on-target earnings (OTE)—the total expected income for meeting performance expectations.

Step 3: Pick the Right Metrics and Targets

Select metrics that directly support your business objectives. For example:

- Revenue-based metrics for driving sales volume.

- Customer acquisition metrics for market expansion.

- Retention or upsell metrics to increase customer lifetime value.

Pair these metrics with realistic, yet ambitious, sales quotas or targets. Be sure your reps have the tools and support to achieve them.

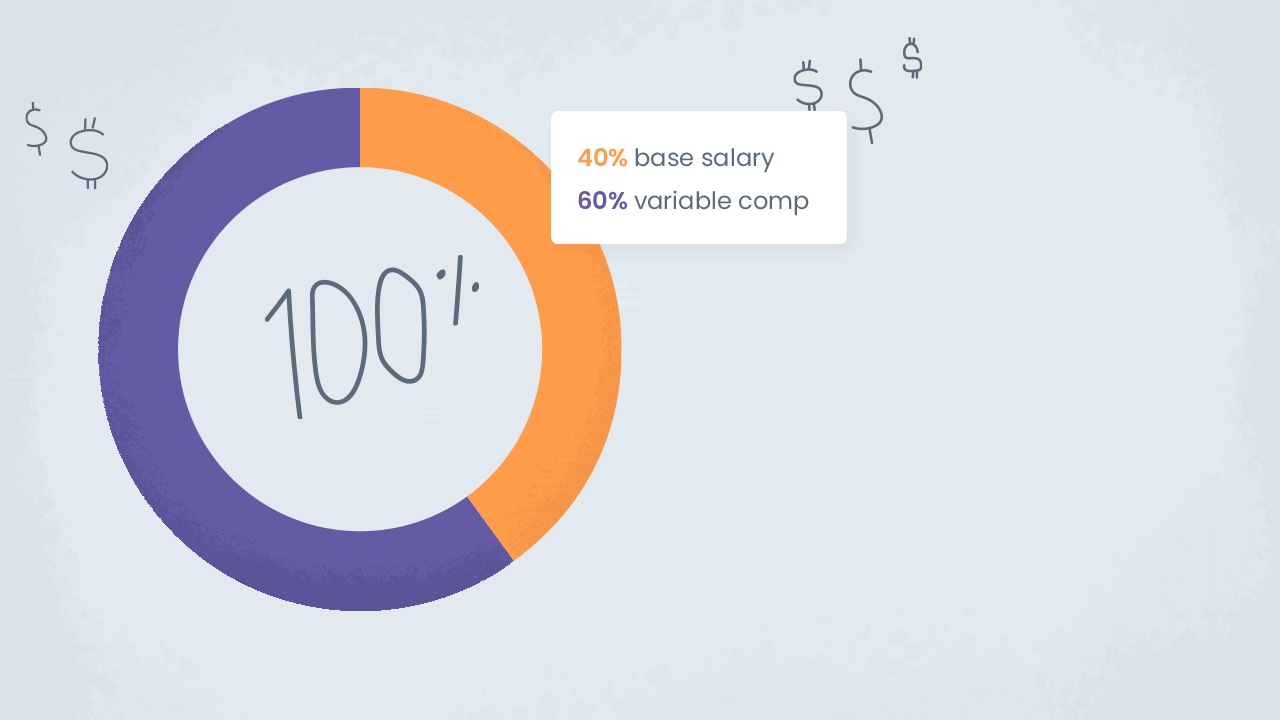

Step 4. Choose a Compensation Breakdown

Determine the balance between fixed and variable pay, such as:

- Base salary: Provides security and reduces turnover risk.

- Commission: Rewards performance and motivates effort.

- Bonuses or SPIFFs: Drives short-term goals or strategic priorities.

Your breakdown should reflect the role’s focus—heavily commission-based plans often suit individual contributors, while managers might prefer a steadier income mix.

Following these steps, you can craft a compensation plan tailored to your company’s unique needs, ensuring alignment with both business goals and your sales team’s motivation.

Final thoughts

As you’re building out compensation plans, remember that you always want your plans to fill three core requirements:

- Simple. The plan has to be easy to understand, otherwise, you won’t get the behavior you’re trying to encourage.

- Logical. Comp plans should follow your company’s strategy, not the other way around.

- Fair. It has to be attainable and people have to feel like they can make money off it.

As long as your plans meet all those requirements, you’re already ahead of the game. If you need more advice or sales compensation plan examples, visit Compensation Hub for free, customizable comp plan templates, and QuotaPath’s blog is also a great resource for helpful tips and resources.

Once you’ve built out your compensation plan, find an easy commission tracker. That’s where QuotaPath comes in. QuotaPath is a commission tracking tool built for transparency, simplicity, and accuracy. If that’s appealing, schedule a full overview today.

Recent Comments