Hi there! I’m Graham Collins, Head of Partnerships here at QuotaPath. I’ve spent pretty much my whole career in sales—from leading 40-person sales development teams to heading both Sales and Marketing at QuotaPath—and I can tell you that you need to think about discount strategies as both an art and a science.

Discounting is an integral part of winning deals today especially in software.

But remember that doing so can undermine the value of your product or service.

To do so effectively, you must strike a balance and find innovative ways to “discount” that don’t risk your organization’s revenue (and the value you’ve worked to build with the customer).

In this post, I’ll cover discount strategies so you can close deals without giving away too much or losing control over future revenue opportunities.

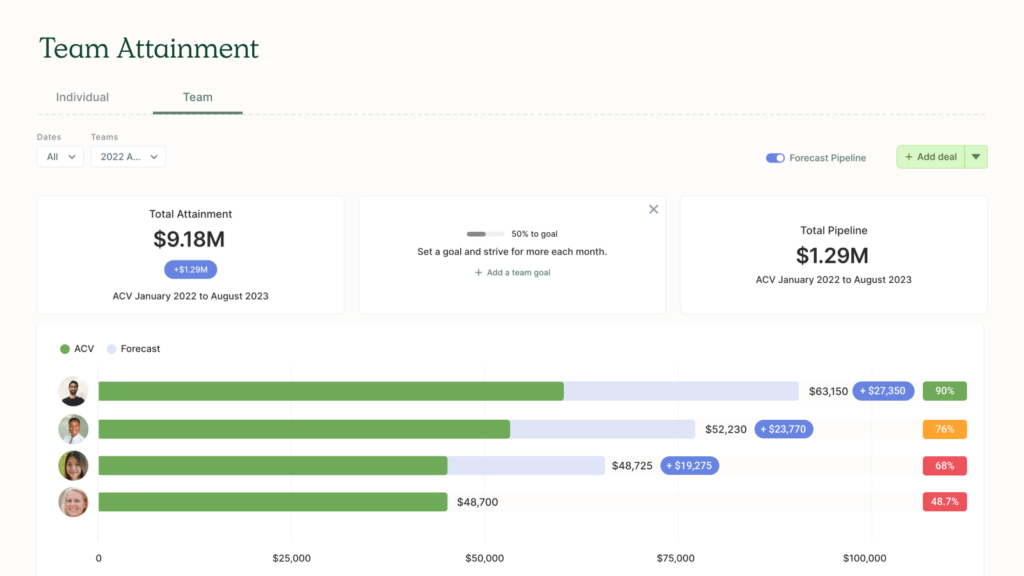

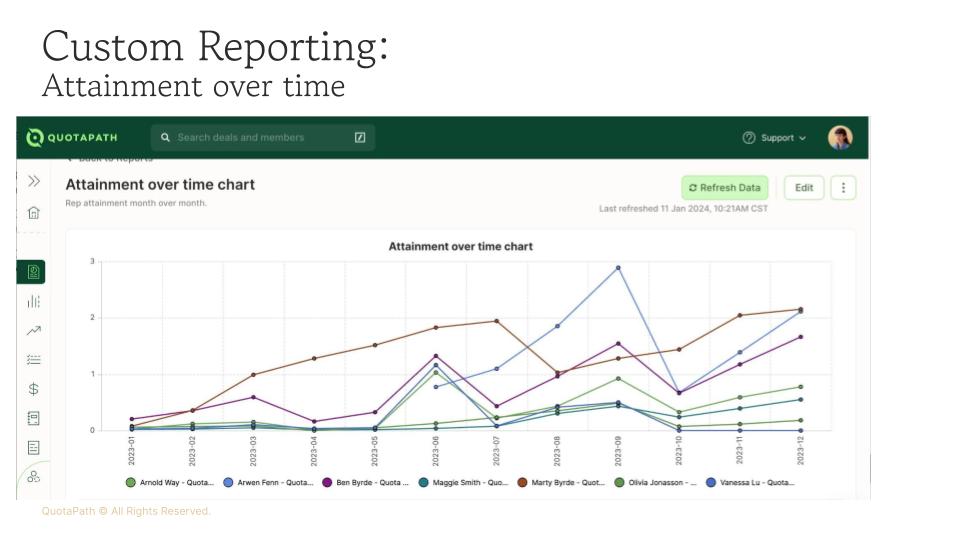

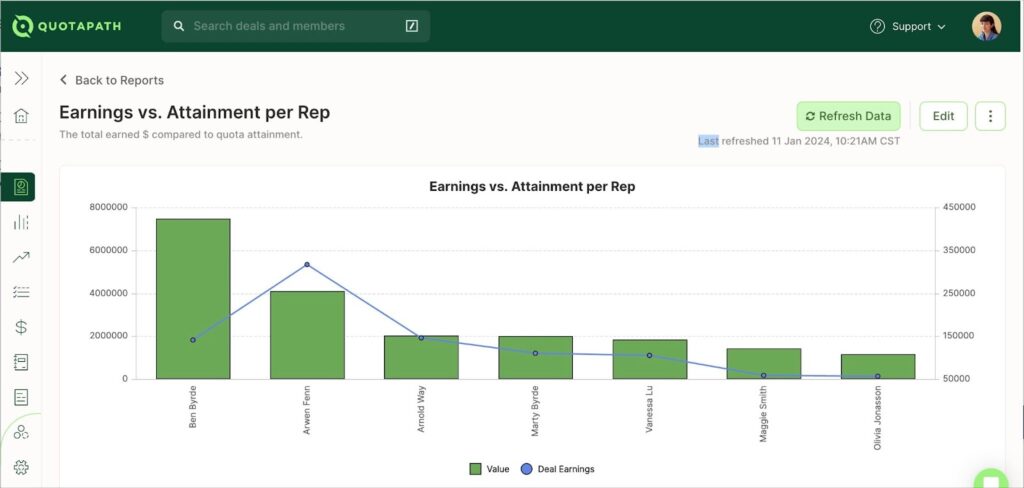

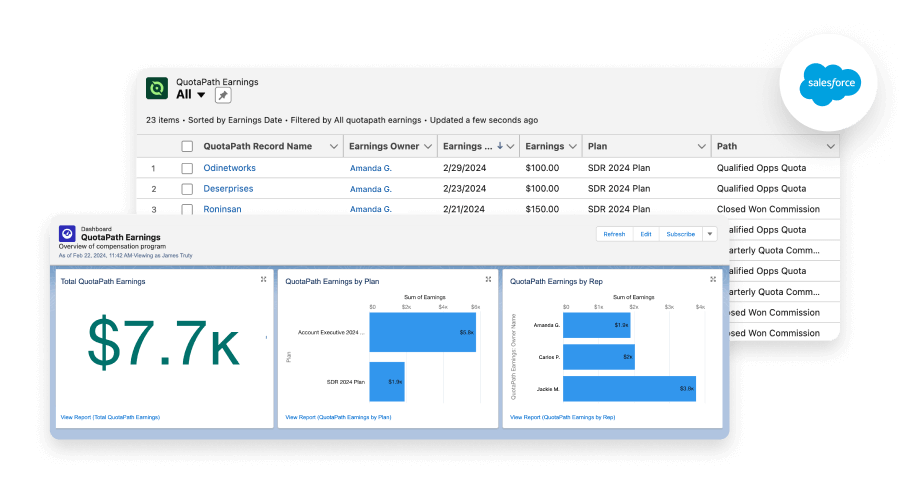

Design, track, and manage variable incentives with QuotaPath. Give your RevOps, finance, and sales teams transparency into sales compensation.

Talk to SalesWhy Discount at All?

First, let’s consider why we offer discounts.

It’s more common than many realize—unless you’re Chili Piper, almost every SaaS business offers strategic, process-driven, or ad hoc discounts.

This can happen for several reasons (some better than others):

- Timing Alignment: A client might want to wait on signing, and as reps, we want to hit our targets by EOQ. Discounting can help align timelines.

- Competitive Pricing: Occasionally, discounts will match a competitive offer, but ideally, this isn’t the main driver.

- Budget Mismatches: Sometimes, the prospect’s budget falls short. Offering a discount helps bridge that gap without drastically altering the scope of the project.

Discounting as a Tool, Not a Crutch

Still, discounting should be seen as a strategic tool rather than a default move.

If you start relying on discounts as the primary lever for closing every deal, value and positioning will quickly diminish.

If your team discounts consistently, it may signal a misalignment between your product’s perceived value and pricing.

When discounts are routine, customers might start viewing them as an expectation rather than an exception, which can dilute your brand’s value proposition.

This situation offers a crucial opportunity to reassess your pricing model and value positioning.

For instance, it may be time to refine your messaging to emphasize unique value drivers that set your solution apart. Or, if your product regularly competes in pricing discussions, consider adjusting features at various pricing tiers to more clearly reflect the value delivered at each level.

Ultimately, a well-positioned product should have a price point that feels justified to the buyer, making discounting a helpful but rarely needed tool rather than a requirement.

Then, when it’s time to offer a discount, you can get strategic about how to do so.

6 Types of Strategic Discounts

Discounts aren’t one-size-fits-all.

Here are a few ways to use them that keep long-term value and flexibility intact.

1. Flat Discounts

The flat discount is straightforward and easiest to offer—simply reduce the cost by a set percentage.

While flat discounts are what customers typically expect, they also pose risks.

For example, if you reduce the per-user price, it can be challenging to upsell at a higher rate in the future. Customers may also expect that lower price to apply for any new users or add-ons.

My recommendation? Keep flat discounts as low as possible and ensure your renewal terms clearly state that any additional users will be charged at the original rate.

2. Extended Contract Terms

Offering 3 months free as part of a 15-month contract (for the price of 12) is a great way to keep ARR steady while incentivizing the client to lock in sooner.

This approach gives the buyer a tangible benefit without impacting the renewal cost. When renewal time comes around, the client pays full price, making it easier to raise prices in the future if needed. Remember to include in the terms that the renewal will return to the standard 12 months.

Alternatively, you can reduce the cost by two or three months but retain the 12-month structure.

This clearly states that the customer receives a discount now, but future contracts will revert to the standard price.

3. Adding Free Users

If your client’s team is expanding, offering a “pay for 15, get five free” user package can help them onboard additional users while preparing for growth.

This approach is especially beneficial if the customer is in a growth phase and may add more seats later. While this may limit upsell opportunities during the contract period, it can effectively secure a multi-year commitment or create goodwill with the client.

4. Discounted or Free Implementation

You could also offer discounted implementation fees to reduce the customer’s upfront costs while preserving annual recurring revenue (ARR).

However, implementation can be costly if you’re not careful, especially if you outsource this work.

If you choose this route, be strategic—consider offering partial discounts or reducing the upfront fee rather than waiving it completely. This way, you maintain margin while helping the customer get started without high initial expenses.

5. Multi-Year Contracts

One of our favorites is the multi-year contract.

Encouraging a client to sign a two- or three-year deal can be a win-win for everyone involved.

However, since it locks in revenue and provides the client with a fixed rate, you might miss out on potential price increases over time.

The decision to offer a multi-year discount depends on retention rates. If your churn is high, it might be more valuable to lock in longer terms, even if it means fewer opportunities for price increases.

6. Flexible Billing Terms

Lastly, offer flexible billing terms.

Offering quarterly (even monthly) or delayed billing can be a good alternative to traditional discounting, especially if budget constraints are the issue. With flexible billing, you can accommodate the client’s financial flow without cutting into your ARR.

Give-and-Take Approach

One of the best discount strategies I recommend is adopting a “give and get” mindset when discounting.

Rather than offering a discount with no strings attached, ask for something in return, such as a case study agreement, logo placement on your site, or favorable contract terms (like no price increase cap).

When you clarify that discounts come with specific requirements, you create a mutually beneficial relationship rather than simply giving away value.

Navigating Renewal Conversations

Finally, always keep the renewal stage in mind (yes, even if you’re a new biz rep!).

Whatever discount you offer now will impact future conversations.

Be upfront with clients about the temporary nature of discounts and how standard pricing will apply at renewal. Building this into the contract terms is essential for setting expectations early and avoiding surprises later.

Try the most collaborative solution to manage, track and payout variable compensation. Calculate commissions and pay your team accurately, and on time.

Start TrialDrive Value without Compromise

Discounting can be an effective way to close deals, but it should be used strategically.

The goal is to leverage discount strategies without eroding your product’s perceived value or losing out on upsell potential.

Remember that discounting is a tool to help you achieve your revenue goals, not a crutch to close every deal. With a thoughtful, strategic approach to discounting, you can close deals that support your long-term business goals and strengthen your client relationships.

As always, if you’re looking to simplify your sales compensation management, QuotaPath can help. We offer tools to track and manage deals, ensuring your reps understand how each contract term impacts their earnings. With better visibility and smarter discounting strategies, you’ll drive sustainable growth and close deals that benefit both you and your clients.

Recent Comments