In the last few years, RevOps careers exploded across the tech industry.

According to Clari, RevOps jobs increased by 300% in the last 18 months on LinkedIn.

This growth follows the rising changes in how companies think about their revenue philosophy.

Forbes said, “RevOps treats revenue not as a fortunate outcome of a quality product, but like a mirror of the supply chain — a pipeline that needs to be powered by optimized business processes.”

These optimized business processes must also reflect how buyers buy now.

For instance, in today’s market, tech buyers have already done plenty of research before connecting with a sales rep.

Some even expect to be able to trial a product ahead of that introduction.

That means all internal teams, Sales, Marketing, Account Management, Customer Success, and even Product, must align on what matters most to the buyer and the customer, and then work together to deliver those experiences.

And the role that connects them, with data-backed recommendations to optimize business efficiencies and revenue, is RevOps.

Try the most collaborative solution to manage, track and payout variable compensation. Calculate commissions and pay your team accurately, and on time.

Start TrialWhat is RevOps?

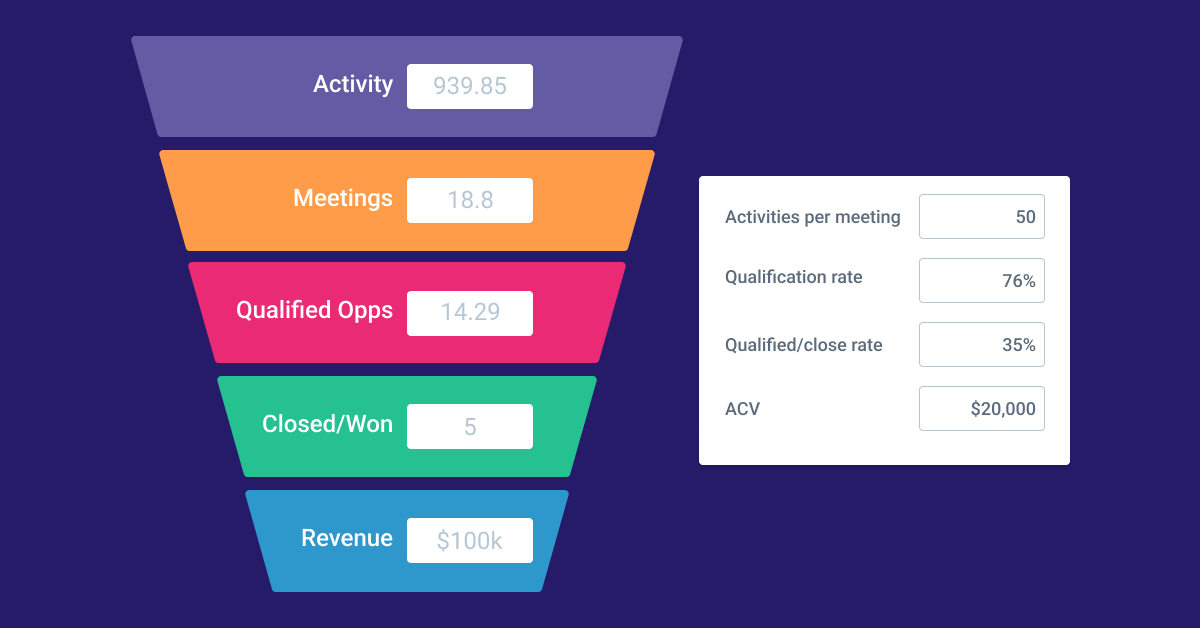

Revenue Operations (RevOps) aims to bring data transparency across Sales and Marketing, improve process efficiencies, drive revenue predictability, and achieve revenue growth.

The goal of RevOps is to streamline the customer journey and remove any obstacles or inefficiencies that may prevent a customer from making a purchase or reaching their desired outcome.

This is achieved by combining data, processes, and technology to create a unified revenue team that works toward a common goal. By focusing on revenue-related metrics, such as customer acquisition cost (CAC), customer lifetime value (CLV), and net promoter score (NPS), they work to improve the customer experience and promote growth.

Essentially, RevOps helps businesses maximize their revenue potential.

When is it time to hire for RevOps?

There is no “perfect time” for an organization to bring in a RevOps hire. However, RevOps should be able to address these challenges:

* Streamline revenue processes

* Act as a liaison to Sales and Marketing

* Eliminate data silos

* Remove unnecessary resources, or “app bloat”

At QuotaPath, for example, our CEO and Co-Founder AJ Bruno hired our Sr. Director of RevOps, Ryan Milligan, with only 40 employees at the time. We hired Ryan initially in a SalesOps role, but after AJ recognized Ryan’s vast skillsets in Sales and Marketing, we pivoted the role to RevOps. So, it was an easy decision to move Ryan into RevOps.

Stage 2 Capital has some great advice about when and how to hire for RevOps. Specifically, they call out the need for RevOps once you’ve hired your first Sales Leader.

90-Day Plan for RevOps

Your first Revops hire should come into the role with a 90-day plan. To learn what to expect and to help shape your new RevOps leader’s plan, we borrowed advice from RevOps Leader Jeff Ignacio.

Jeff recently started a new role and outlined his plan.

He said it usually takes six months to establish a RevOps framework, but there’s a way to cut that in half with a practical 90-day plan.

First 30 days:

- Learn as much as possible

- Understand the company’s values, culture, goals, and processes

- Meet with key stakeholders and leaders across the organization

- Understand the current revenue landscape and challengers

- Identify quick areas to win

- Set goals for the first 90 days that align with the company strategy

After the first 30 days, RevOps can start executing and implementing some changes.

60 days in:

- Establish a RevOps plan to achieve the goals set in the first 30 days

- Implement new tools to get rid of silos and will generate revenue

- Collaborate with sales, marketing, customer success, and other teams to create seamless communication and execution of RevOps strategies

- Analyze data to improve processes and close gaps

For those last 30 days, RevOps leaders should start growing the business and showing profitable contributions.

90 days (last 30 days):

- Continue to optimize processes and tools to create generational revenue

- Measure RevOps initiatives that you implemented in the first 60 days

- Continue to develop relationships with key stakeholders to deepen alignment and collaboration

- Present reports to leadership and seek feedback for improvement

Design, track, and manage variable incentives with QuotaPath. Give your RevOps, finance, and sales teams transparency into sales compensation.

Talk to SalesRevOps Best Practices

Whether you’re a growing company looking to start a RevOps team from the ground up or adding more experienced leaders to your team, we have a few best practices that we’ve gathered from our RevOps pro, Ryan. We touched on some of these practices above via Jeff’s framework, but let’s get more granular.

- Understand Company Goals: the knowledge gained in your last role will only get you so far. Educate yourself on this business’s current industry and needs, which will help you understand how to bring in more revenue.

- Align company leaders: all heads of the business should be on the same page about business goals. If you create transparency then everyone will trust your practices.

- Verify data: Correct data ensures you pay your sales teams accurately. Plus, accurate data allows the finance department to make better projections. Your work reflects your department and your boss, and that data will determine the next steps for multiple departments within the company.

- Revenue increases then salary increases: RevOps leaders understand company goals and they can set strategic expectations for the sales team. These should be attainable and realistic. If the sales team believes they can reach quota, they will perform better to meet their goals as well as the company’s.

RevOps leaders carry a heavy load managing the sales funnel, financial projections, and company growth.

“Sometimes RevOps leaders make the mistake of not asking the sales team what they need, what they see in the market, and how they want to be measured,” said Ryan. “By gathering this feedback from the sales team, I can incentivize the team through compensation plans that drive results and keep the team motivated and happy.”

About QuotaPath

QuotaPath’s commission tracking software supports RevOps professionals responsible for sales compensation design, calculations, and payments.

Try out QuotaPath for free by integrating with your CRM, like HubSpot or Salesforce, with a free 30-day trial.

Recent Comments