The sales commission platform market is experiencing rapid growth, driven by increasing demand for automation and performance-driven compensation strategies.

Valued at USD 16.92 billion in 2024, the market hit USD 17.69 billion in 2025 and is projected to soar to USD 41.63 billion by 2034, reflecting a 9.97% compound annual growth rate (CAGR) from 2025 to 2034 (Source). This growth underscores the rising importance of commission management solutions in optimizing sales performance and operational efficiency.

As competition is tight regarding the best commission software, we’ve curated a list, plus pros, cons, and ratings, to inform you as a buyer.

Top 5 Sales Commission Software Companies as of 2025

| Company | G2 Score | Description |

| QuotaPath | 4.7 out of 5 | Sales commission platform that helps businesses design, track, and automate compensation calculations with AI-powered plan builder and native integrations |

| Performio | 4.4 out of 5 | Sales commission platform for building and automating compensation calculations |

| ElevateHQ | 4.7 out of 5 | Sales commission platform that simplifies and automates sales compensation calculations |

| Everstage | 4.9 out of 5 | Sales commission platform to design and automate compensation calculations |

| Spiff | 4.7 out of 5 | Sales commission platform to automate compensation calculations. |

Design, track, and manage variable incentives with QuotaPath. Give your RevOps, finance, and sales teams transparency into sales compensation.

Talk to SalesWhat is Sales Commission Software

Finance, sales and RevOps management, and sales reps use sales commission software to plan, manage, and administer employee compensation packages. These platforms help organizations save time, reduce errors, and simplify compensation plan management. Sales commission tools also help improve transparency and trust while increasing sales motivation and performance.

Features To Look For In Commission Software

Seeking the following key features when evaluating software for commission sales will enable you to select the best commission software.

- Automated Commission Calculations – Eliminates manual errors and reduces administrative work.

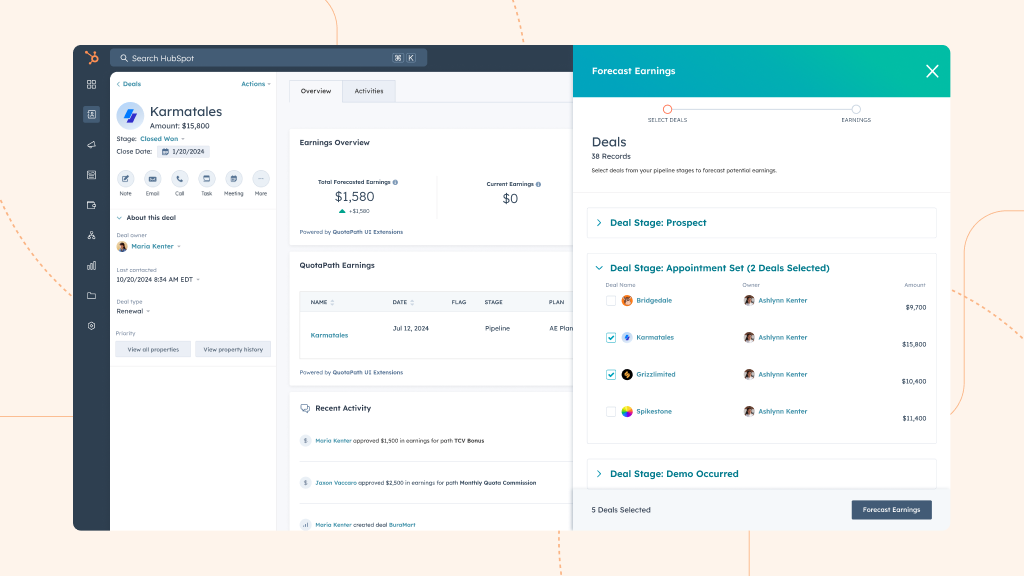

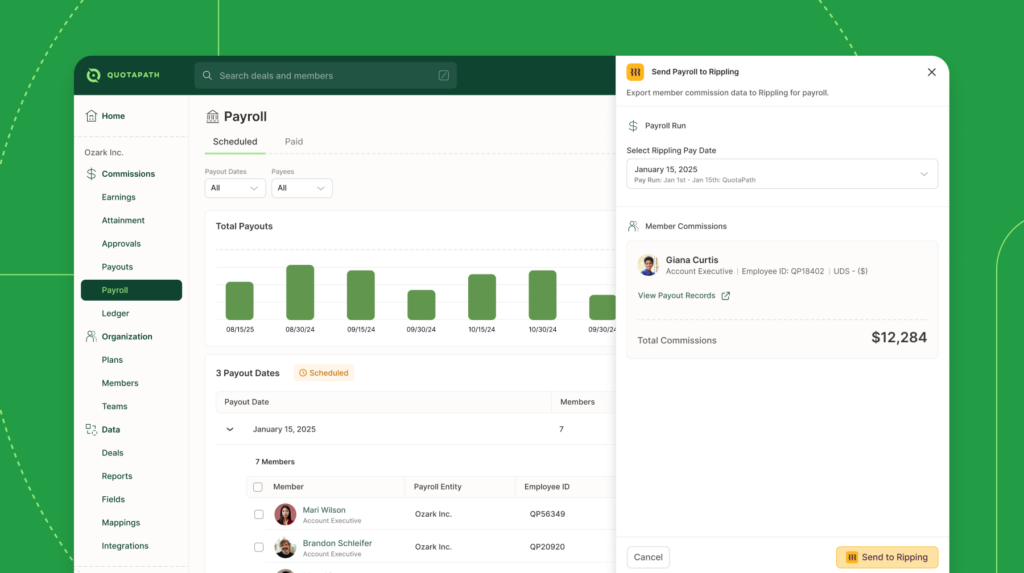

- Seamless CRM & Payroll Integrations – Syncs directly with Salesforce, HubSpot, Rippling, and other platforms.

- Real-Time Rep Visibility – Gives sales teams instant access to earnings, quotas, and payout forecasts.

- Flexible Plan Customization – Easily adjust comp structures, accelerators, and bonuses as business needs evolve.

- Multi-Level Payout Approvals – Ensures accuracy by enabling finance and leadership to review commissions before payout.

- ASC-606 Compliance & Audit Readiness – Keeps commission tracking accurate and compliant.

- AI-Powered Plan Builder – Streamlines plan creation and modifications with intelligent recommendations.

- Ease of Use – Confidence to run the platform independently.

- Pricing – No minimums, transparent pricing.

- Support Access – A reliable team to address support needs in a timely manner.

- Performance Analytics & Reporting – Provides insights into sales compensation impact and ROI.

Benefits Of Using Commission Software

The right commission platform offers significant advantages beyond automation. Here’s a closer look at the benefits of using software for commission sales.

Saves Time and Reduces Errors

- Eliminates manual calculations – Automates commission tracking, reducing spreadsheet errors.

- Seamless CRM and payroll integration – Ensures real-time data sync, eliminating the need for manual exports.

- ASC-606 compliance and audit readiness – Keeps finance teams confident in accuracy and reporting.

Improves Transparency and Trust

- Real-time earnings visibility – Reps can see their commissions as deals close, reducing payout disputes.

- Multi-level approvals – Ensures leadership oversight, preventing incorrect payouts.

- Clear payout timelines – Keeps reps and finance aligned on commission schedules.

Increases Sales Motivation and Performance

- Instant commission tracking – Helps reps understand how their deals impact earnings.

- Accelerator and bonus visibility – Encourages reps to push for higher performance.

- Better alignment with business goals – Incentivizes the right deals, improving revenue growth.

Simplifies Compensation Plan Management

- AI-powered plan builder – Enables quick adjustments to evolving comp structures.

- Customizable commission rules – Supports multiple payout structures, quotas, and accelerators.

- Scenario modeling and forecasting – Helps leadership predict costs and adjust strategies.

Best Sales Commission Software as of 2025

With numerous options, selecting the best sales commission software for your organization can be challenging. We’ve compiled a list of top-rated platforms based on G2 rankings, highlighting their standout features to help you choose.

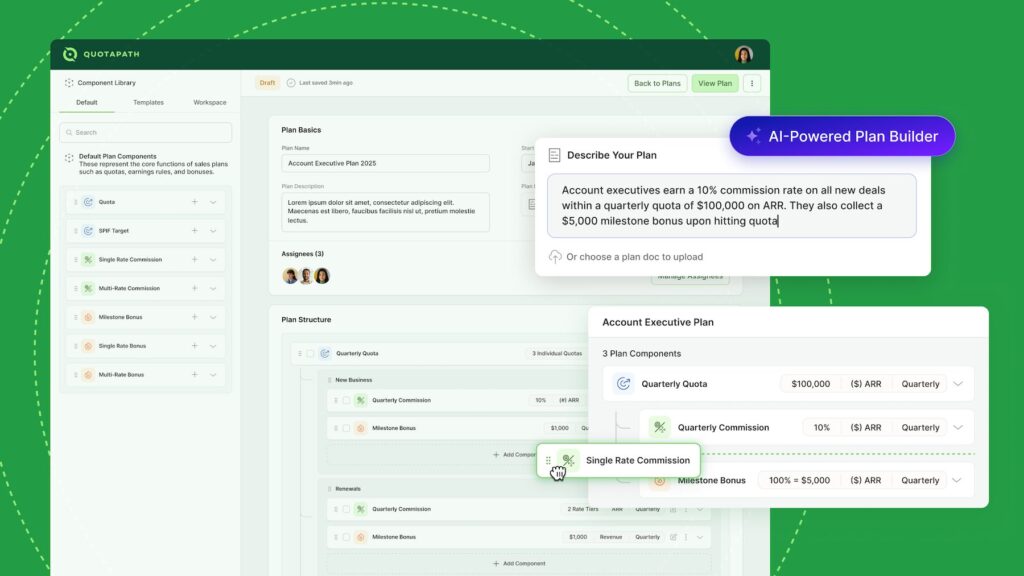

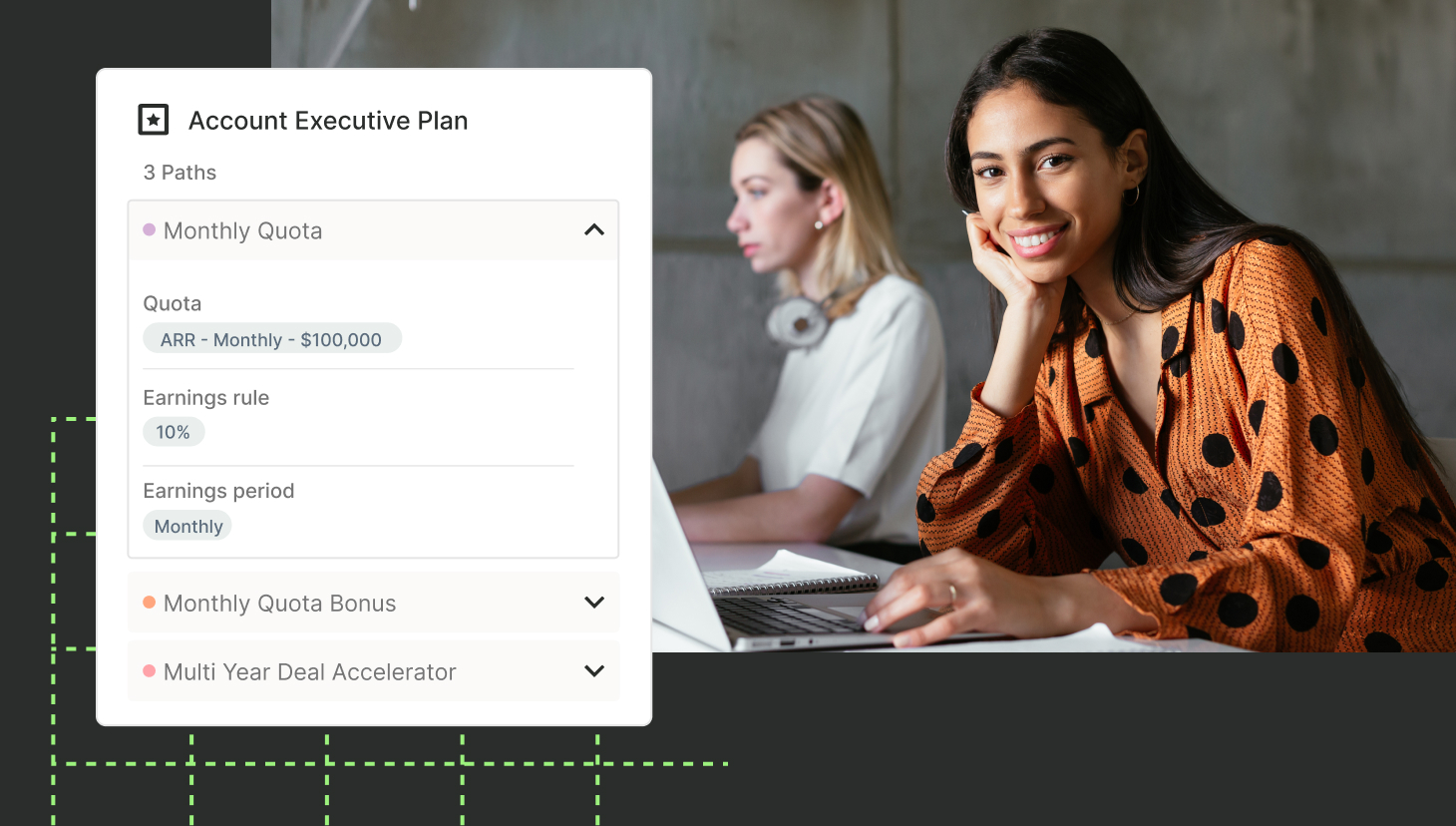

QuotaPath

Features:

- AI-Powered Plan Builder

- Free Trial experience

- Only push integration to Rippling

- Performance Analytics & Reporting

- Award-Winning Support Access

- Native CRM & Payroll Integrations

- Fast Onboarding and Time to Value

- Automated Commission Calculations

Rankings: 4.7 out of 5

Performio

Features:

- Performance Analytics & Reporting

- Automated Commission Calculations

- Support Access

- Flexible Plan Customization

- Seamless CRM & Payroll Integrations

Rankings: 4.4 out of 5

ElevateHQ

Features:

- Automated Commission Calculations

- Support Access

- Multi-Level Payout Approvals

- Performance Analytics & Reporting

- Ease of Use

Rankings: 4.7 out of 5

Everstage

Features:

- Automated Commission Tracking

- Seamless CRM & Payroll Integrations

- Real-Time Rep Visibility

- Flexible Plan Customization

- Performance Analytics & Reporting

Rankings: 4.9 out of 5

Spiff

Features:

- Performance Analytics & Reporting

- Automated Commission Calculations

- Multi-Level Payout Approvals

- Flexible Plan Customization

- Real-Time Rep Visibility

Rankings: 4.7 out of 5

Xactly

Features:

- Automated Commission Calculations

- CRM Integrations

- Real-Time Rep Visibility

- Support Access

- Flexible Plan Customization

Rankings: 4.3 out of 5

Sales Cookie

Features:

- Automated Commission Calculations

- Flexible Plan Customization

- Multi-Level Payout Approvals

- Ease of Use

- Performance Analytics & Reporting

Rankings: 4.6 out of 5

CaptivateIQ

Features:

- Automated Commission Calculations

- Flexible Plan Customization

- Performance Analytics & Reporting

- Multi-Level Payout Approvals

- Support Access

Rankings: 4.7 out of 5

Commissionly

Features:

- Automated Commission Calculations

- Seamless CRM & Payroll Integrations

- Flexible Plan Customization

- Performance Analytics & Reporting

Rankings: 4.8 out of 5

Varicent

Features:

- Automated Commission Calculations

- Seamless CRM & Payroll Integrations

- Flexible Plan Customization

- Ease of Use

- Performance Analytics & Reporting

Rankings: 4.5 out of 5

Try the most collaborative solution to manage, track and payout variable compensation. Calculate commissions and pay your team accurately, and on time.

Start TrialHow to Choose the Right Commission Software for Your Business

The best commission software does more than automate commission calculations. It enhances efficiency, transparency, and sales performance while simplifying compensation management. The ideal commission platform seamlessly integrates with CRM and payroll systems and gives sales teams real-time visibility into earnings, quotas, and payout forecasts. It should also allow for flexible compensation plan customization and multi-level payout approvals.

ASC-606 compliance and audit readiness features are essential to ensure commission tracking accuracy. An AI-powered plan builder, performance analytics, and reporting streamline compensation plan creation and optimization. Additionally, ease of use, transparent pricing with no minimums, and a reliable, accessible support team are key to a trusted and successful partnership.

Schedule a demo to see how QuotaPath fulfills all these requirements and more.

Recent Comments