At QuotaPath, we believe in building fair and logical compensation plans that drive growth for the organization and increase earnings for reps.

Fair plans give reps a true shot at hitting on-target earnings (OTEs).

So, what happens when reps go out on parental leave? Are they earning any incentive pay while they’re out with their new baby, like a percentage or an average? Is anyone keeping their pipeline warm, so it’s not empty upon their return? Are they coming back to a full quota while staring up at their team’s leaderboard from the very bottom?

Unfortunately, we found that the answers are often “No.”

That is why QuotaPath recently hosted the webinar, “Creating Fair Sales Leave Policies,” in collaboration with Women in Sales, so that every organization will eventually say “Yes” to all of those questions.

Our panelists included Kelly O’Halloran, Director of Content at QuotaPath, Allison Whalen, CEO and co-founder of Parentaly, Jessi Johanson, VP of Sales at Tilt, and Ryan Milligan, VP of RevOps, QuotaPath.

The panel discussed topics like best practices for sales leave policies, creating an effective return process, managing time off, and the importance of establishing clear and transparent policies.

(Webinar) Creating Fair Sales Leave Policies

Register and watch the full recording.

Take Me to WebinarBest Practices for Sales Leave Policies

The conversation began with the panelists discussing tips on developing effective sales parental leave policies and how to navigate related challenges.

How to Determine Incentive Pay During Leave

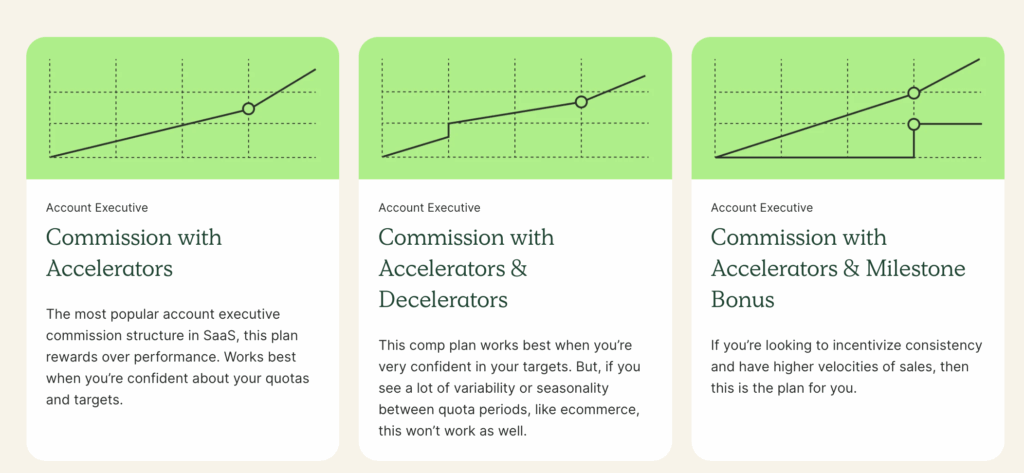

Ryan outlined best practices for determining incentive pay during leave, emphasizing the importance of clear policies and documentation.

“You want to have a completely clear policy for what is going to happen to pipeline based on stage, depth, and time to close. You have two types of pipeline: pipeline you expect to close while you’re on leave and pipeline you don’t expect to close but need to continue nurturing,” Ryan said.

“Typically, you want to give the bulk of the credit to the rep who did the work to prepare the pipeline to close. I advise senior leaders such as sales managers, directors, and CROs to step in and support the closing of that handful of ops. Then give your rep full credit for the work that they did to prepare those opportunities to close while they are on leave.”

Ryan continued, “For upstage pipeline, use a split policy where the rep going on leave gets a clear and determined amount of credit based on the depth of that pipeline before they go on leave.”

Conduct a review with the rep a month before they plan to go on leave, where you clearly document the open ops, their stage, and how compensation for each will be handled during leave, as well as what will happen when they return from leave.

Ryan also explained, “You should have a clear existing pipeline policy as well as a guaranteed variable component. Typically, orgs pay anywhere from a third to half of the variable guaranteed while a seller is on leave. That pairs with the commission the seller expects to receive on the deals forecasted to close while they’re on leave. This should get them as close as possible to full OTE based on the work they did prior to going on leave.”

According to Ryan, your leave policy is “a ramping plan in reverse. It’s a very clear, documented, and mutually agreed upon policy that both protects the cash needs of the business while protecting the relationship with the seller and preparing them to be successful when they return.”

Jessi shared her innovative approach of opening up a stretch assignment for her team to cover for an employee on leave, which worked well for her team.

“My Account Manager took a leave of absence for a full quarter. Gone are the days when Jessi is everyone’s backfill. We’re too big now, and I have too much going on. Things will fall through the cracks. So, we decided to try opening up a stretch assignment for anyone in the organization who wanted to apply.”

Jessi continued, “They were essentially her backfill, and we took away most of her other duties, except getting contracts renewed. We estimated it was half a day to a full day a week, and we would do a commission split. We posted the job internally, and I received six applications. I interviewed everyone and hired someone from my marketing team. It was super unexpected. He absolutely crushed it, and we have all on time renewals so far this quarter.”

Source Data/Examples from Like Companies

Allison discussed the importance of having a clear policy and using data from other companies to advocate for better leave policies.

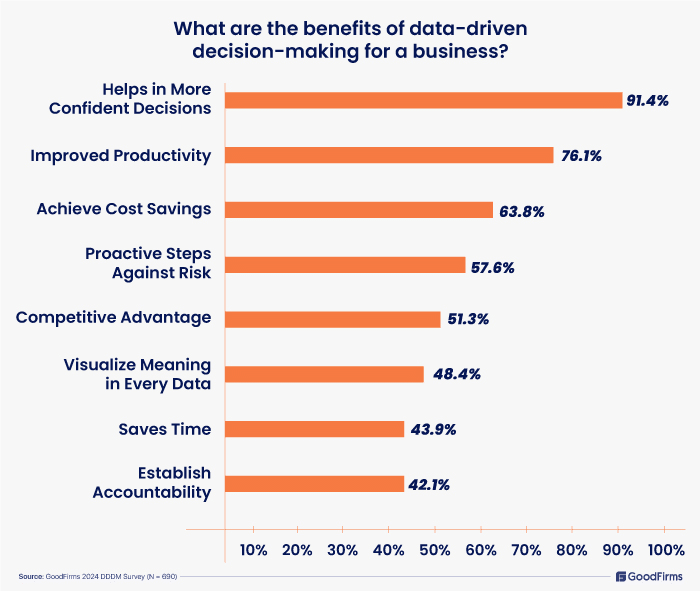

“If you’re advocating that your company needs an explicit policy, try using information about what other companies are doing. Then you can say, Hey, this is something that we need to have as an organization,” Allison said. “There are enough examples from other companies that you can bring forward to say, which one do we think we want here? Although leadership at companies may want to do the right thing, it seems too difficult. So, using data and showing what other companies are doing is powerful.”

Jessi emphasized the need for managers to be educated on leave laws and to support their teams effectively during and after leave.

“Managers tend not to say anything if they don’t know what to say. And the worst way for your manager to show up is not to say anything to you. The worst-case scenario is they actually say something that they shouldn’t,” Jessi said.

“Consequently, some education on what they can and can’t say, some leave laws, what job protection means, and if they can communicate with an employee while they’re on leave. Things like that will help a manager know what the guardrails are and what they can and can’t do, so they can have these conversations with the employee, know they’re saying the right thing, or at least doing their best and not saying anything they shouldn’t.”

Returning to Work After Leave

After a thorough discussion about creating fair sales leave policies, the panelists’ conversation turned to best practices for successful return-to-work experiences that boost retention.

Jessi and Ryan discussed the importance of a clear ramp-up period for employees returning from leave, including the emotional support needed.

“You treat a person returning from leave in the same way you would when ramping a new hire,” Ryan said. And that needs to include the same quota credit, quota relief, training, and enablement for those returning from leave.

“We have a four-week ramp-up period for all employees that’s full-time pay for a part-time schedule,” according to Jessi, to ease the transition after parental leave. She continued, “One of the hardest things is emotionally supporting the employee when they’re back. The return isn’t hard because they’re returning, it’s hard because they’re scared that they’re not going to be able to get their pipeline back where it needs to be, close deals, and make money again.”

“I have not had a single person who couldn’t do it, but it’s so scary, especially when you’re great at your job, you’ve taken a break for the first time, and now you’re back. So, I spend a lot of my one-on-ones reassuring, supporting, talking through it, and really advocating for that person,” Jessi shared.

The Manager’s Role

Allison highlighted the role of managers in ensuring a smooth return to work, including setting up opportunities to maintain momentum and confidence.

The return-to-work experience is the most important thing for any manager. The worst feeling when you return to work in sales is that you’ve got this stale pipeline, like starting over.

At Parentally, we start preparing a month before a rep’s return from leave. “They’ll be so stressed if they have nothing. However, there are some great ways for sales managers to tee up opportunities, depending on the context and your sales cycle,” said Allison.

“For example, we just had someone return from leave,” Allison continued, “We had prepared by having our Head of Marketing set a bunch of meetings and conduct early-stage meetings so that when she came back, we were able to give her some new opportunities.”

Every manager should consider how they handle the return-to-work experience to help the rep get excited, feel like there’s momentum, and have something to work on. “It doesn’t need to be, here’s an entire beautiful pipeline for you to come back to,” Allison said. “But it should be here are a few exciting deals that we started that I’m giving to you as a confidence builder, an exciting thing. I think that goes a long way in helping people get their groove back.”

Ryan added, “If you have a faster sales cycle, like we tend to, and you have a mid-market or enterprise rep who’s coming back, give them a couple of quick SMB wins to get their confidence back.”

Transparency is Key

The panelists discuss the challenges of managing time off and the importance of transparency and flexibility in policies.

According to Allison, “Oftentimes, non-birth parents will game the system. For example, a rep knows a huge deal will hit while they’re on leave. If based on the numbers, they’d earn more by being in the seat when that deal hits, non-birth parents often come back for a week, so they are in the seat when the deal closes, so they get full credit. Then they go back out on leave, which creates cultural issues.”

Since non-birth parents aren’t usually able to do that because they’re on short-term disability,” Allison continued, “I still see it happen more often than you would expect.”

To avoid having this happen, Allison shares, “We see a lot of companies say you can’t split your leave, or you can split your leave, but it needs to be in chunks of four weeks at a time to limit its occurrence.” This prevents people from coming back for one week when the deal is going to close. However, it becomes a judgment call of whether it’s worth optimizing for that.

“The clear split policy is the best way to approach it as long as you, as the leader, and the employees are on the same page about when the splits are going to happen, how long they’re going to happen, and why. A lot of families use split leave to extend leave policies naturally until they have other paths to childcare,” Ryan added. “The rep must be back for long enough to get fully back in the seat before going back on leave again, due to ramp-up and ramp-down time. You must be clear about maximum splits or designated length of chunks.”

This is a Retention strategy

Additionally, Kelly and Ryan emphasized the need for organizations to prioritize leave policies as a way to retain top performers and ensure long-term success.

Sales teams are being asked to do more with fewer team members. For instance, the team that used to be 40 reps might now be 10, trying to drive as much revenue as possible. This is a reason why leaders should prioritize leave policies. Ryan suggests that they consider, “What if your top performing seller left tomorrow? It’s so much more painful for a 10-person team than a 40-person team.”

“That moment of returning from leave is a massive point of reflection for a person as to whether they think this company is the right fit for them in the long term, Ryan explained. “There’s a lot of emotion in that process since you’re potentially leaving your child, who you’ve been with for a while, in a different body of care. Plus, you’re staring at that leaderboard that you’re at the bottom of while you might have major confidence issues.”

That’s why it’s essential that you communicate to the seller that you have confidence in their ability to be very successful upon their return, and that you have a clear process in place to get them back up and running.

On the other hand, “if you want to be super pragmatic about it, it’s a math equation,” Ryan explained, “If you just stripped out half of your top performing sellers who all, went on leave in the next three or four years, what would that mean if you lost all of them because of a terrible leave policy? What would that mean for revenue, for performance, for Board reporting?”

Ryan added, “This makes it a smart, quantitative business decision to have a good leave policy for strong rep retention, long-term success of the business, and predictability of revenue.”

Kelly shared that she loved the mindset shift that occurred during the conversation, from less focus on let’s not have the sales rep be scared. The focus shifted to “Let’s have the sales leader be scared that they’re going to lose that sales rep for having a poor policy in place,” as Kelly described, “versus someone being scared to come back or to have a child, while being a sales professional.”

Q&A with Attendees

Next, the panelists responded to questions from attendees and wrapped up with additional comments.

The panelists addressed questions from the audience, including best practices for early-stage companies and ways to empower managers.

“Best practices across industries right now are typically 12 weeks and giving non-birthing parents as much time as well,” Jessi shared in reference to early-stage companies. “Then consider how the policy applies to OTE compared to base, and if you plan to have any guaranteed commission or variable comp.”

“I would be more focused on what to do, especially if they’re the only salesperson. Don’t put so much pressure on yourself to define a policy forever,” Allison added. “You are small, and you need to consider what’s best for the business, for this person, and what’s realistic.”

According to Ryan, you can empower managers with messaging about supporting new parents with a strong leave policy for their benefit and for retention to protect the business, which trickles all the way down to the person going on leave.

The panelists discussed the importance of top-down support for leave policies and the need for clear communication and education for managers.

“Your thoughts on parental leave must be top down from a CRO or management level to be successful and supported in terms of how a VP of sales, for example, could support her manager who has a team member going on leave,” Ryan said. “The conversation should come from a VP of sales or CRO to say we have these policies in place, because I know that if I don’t have a policy, I run the risk of losing a top performer tomorrow. This is especially true at an incredibly lean growth startup and hyper hyper-damaging to revenue predictability.”

“Managers also need help with things like, what am I supposed to do if I’m a person down? Sometimes we forget that most managers want to support people, but wonder, ‘Am I being held accountable to a team goal when my headcount is being cut?’ That’s when they need their manager to help with this,” according to Allison.

“For instance, they need more budget to bring in a backfill or spend more money on marketing. So, managers are also scared. They want to know, ‘How am I supposed to deliver business results?’”

Jessi added that support for managers includes “any kind of education, on leave, laws, things like FMLA, so they know how to effectively communicate with and support their teams before, during, and after leave.”

Importance of Flexibility & Support Upon Return

Lastly, the panelists share final thoughts on the importance of flexibility and support for new parents in sales roles.

Jessi talked about both flexibility and support for new parents as they return from leave. She explained, “The reasons you need time off as a parent are changing. It’s probably going to be because daycare is closed, your kid’s sick, or you have a doctor’s appointment.”

Reps get anxious because they’re new parents and didn’t know they would need all this random time off. “I tell my team, you are going to have days where you’re going to call me and say, I have to go pick up my kid from school, or they were up all night and have a fever, so they can’t work today,” Jessi said. “That’s okay. I know this is going to happen. I’m here for you. We’ll figure out coverage. I can jump on a call for you if I need to or somebody else can.”

“We got it,” Jessi continued, “but I don’t want them to suffer with that in silence and not be open with me about what they’re going through. So, I have those conversations early and often in the beginning, until they get comfortable with being super transparent with what’s going on and how I can help.”

Ryan explained that there are two ways to look at support in terms of parental leave. “I am supporting you because I care about you as a person and want you to have a great and fruitful pregnancy relationship with your child. I also think you are key to the success of this business quantitatively, so I’m investing in your leave and your return from leave, because it makes financial sense for this business.”

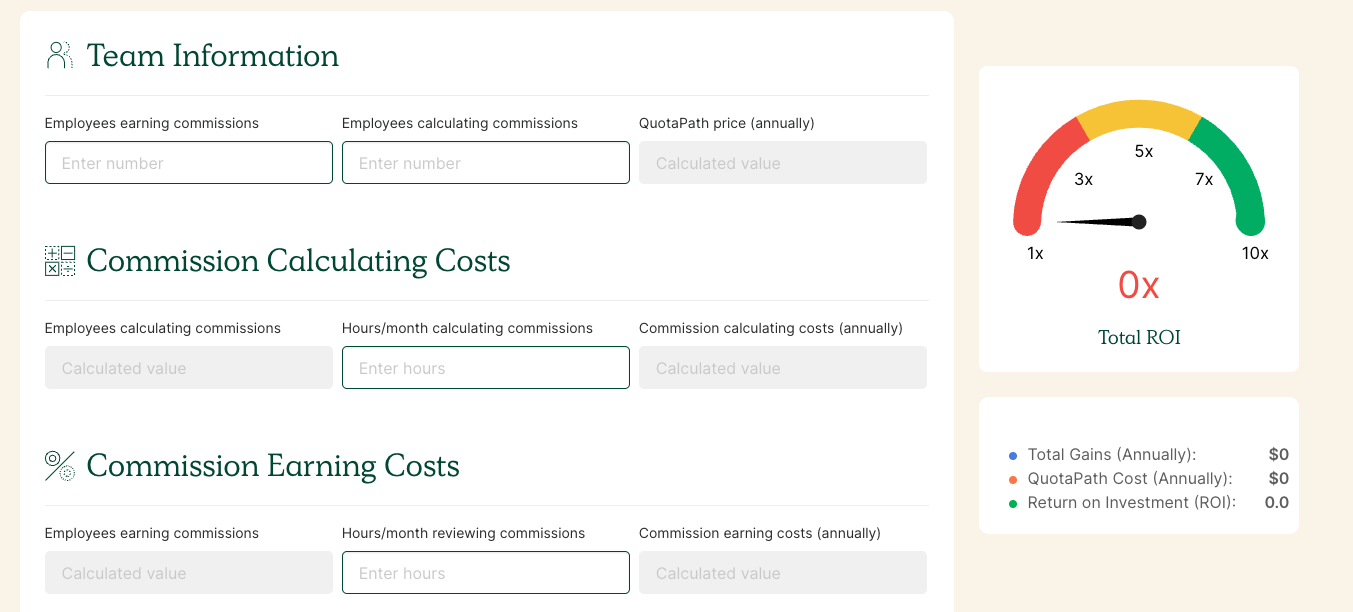

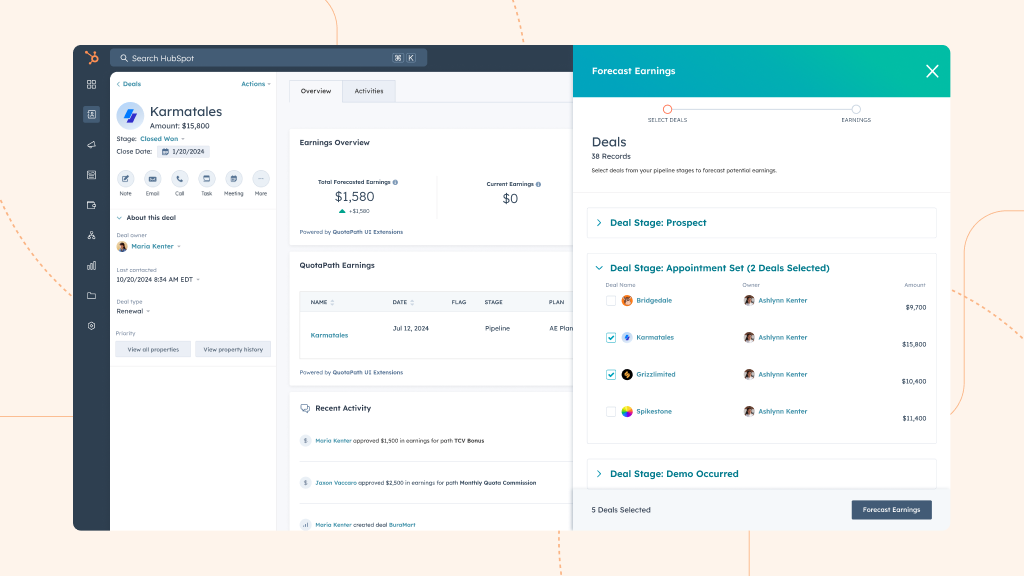

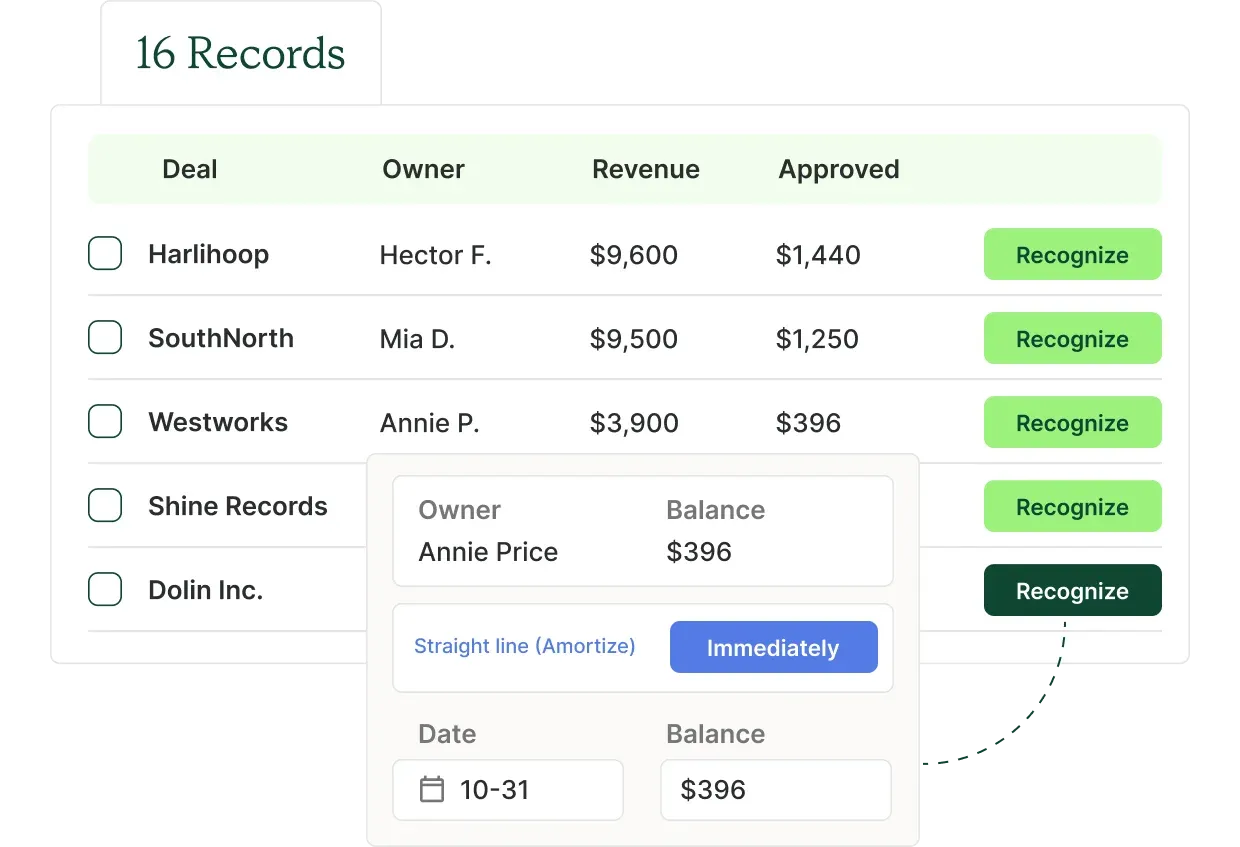

Design, track, and manage variable incentives with QuotaPath. Give your RevOps, finance, and sales teams transparency into sales compensation.

Talk to SalesFor support in building fair compensation plans, book a time with Ryan for a compensation plan consultation. To learn more about how QuotaPath automates commission tracking and payouts, schedule a demo.

Recent Comments