Explore the latest review of the best revenue operations and intelligence software providers for commissions.

| # | Name | Score (Capterra/G2/TR) | Description |

| 1 | QuotaPath | 4.5+4.7+8.6 | Commission tracking and sales compensation management software |

| 2 | Spiff | 4.7+4.7+8.8 | Commission software |

| 3 | Everstage | 4.9+4.8+9.4 | Commissions automation platform |

| 4 | Palette | no reviews +4.9+no reviews | Sales compensation software |

| 5 | Qobra | 4.8+4.7+no reviews | Sales compensation management platform |

Design, track, and manage variable incentives with QuotaPath. Give your RevOps, finance, and sales teams transparency into sales compensation.

Talk to SalesCriteria for Comparing Revenue Operations Software Providers

Consider the following criteria when selecting Revenue Operations and Intelligence commission automation software tools.

Commission Management Features

- Commission Structure Configuration: Can the software handle complex commission structures with tiers, bonuses, and territory rules?

- Adaptability: How does the platform support changes as your team scales?

- Automated Commission Calculations: Does the software automate commission calculations based on pre-defined rules and sales data?

- Real-Time Commission Tracking: Can salespeople track their commission potential and progress in real time?

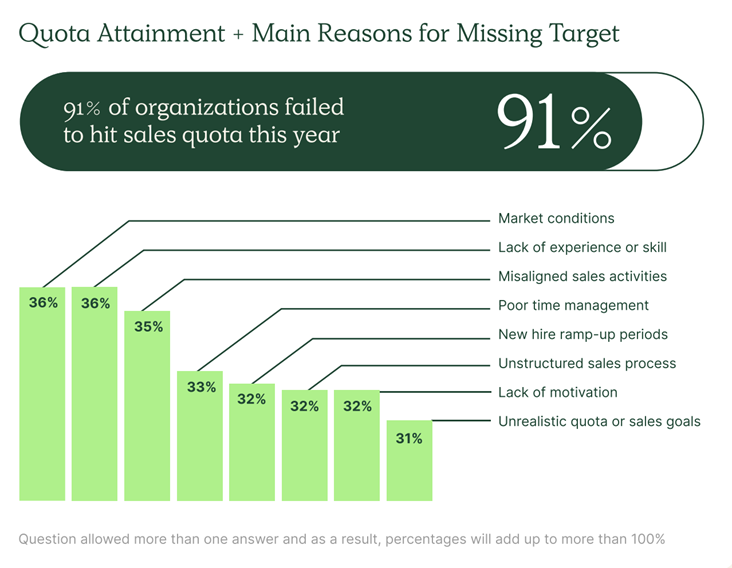

- Reporting and Analytics: Does the platform offer reports and analytics on commission payouts, team performance, and quota attainment?

- Integration with CRM & Payroll Systems: Does the software seamlessly integrate with your existing CRM and payroll systems, streamlining data flow?

Revenue Operations Integration

- Data Integration: Can the software integrate with other RO&I tools like forecasting, pipeline management, and deal tracking solutions?

- Unified Sales Performance Management: Does the platform offer a unified view of sales performance, combining commission data with other key metrics?

- Improved Sales Visibility: Does the solution enhance sales leadership’s visibility into team performance and commission payouts for informed decision-making?

- Workflow Automation: Can the software automate tasks related to commission calculations and approvals, improving efficiency?

- Scalability for Growth: Is the solution scalable to accommodate your growing sales team and evolving commission structures?

Additional Considerations

- Ease of Use: How user-friendly is the commission software for both salespeople and sales management?

- Security and Compliance: Does the platform meet your security and data compliance requirements?

- Customer Support: What level of customer support does the software provider offer for implementation, training, and ongoing issues?

- Pricing Model: Does the software offer transparent pricing that aligns with your budget and sales team size?

- Free Trial or Demo Availability: Does the provider offer a free trial or demo to allow you to test the software’s capabilities before committing?

Next, let’s compare each vendor based on the above considerations.

QuotaPath

Capterra 4.5 / G2 4.7 / TrustRadius 8.6

QuotaPath’s commission tracking and sales compensation management software creates ownership and accountability across RevOps, Finance, and Sales while managing and tracking variable pay. Described by customers as “easy to set up and use,” QuotaPath’s smart UX ensures admins can quickly adjust sales comp as business needs change. This also empowers reps to reference deals for commission, forecast potential earnings, and see quota attainment progress, motivating them to close that next deal.

Fit for sales compensation plans of all complexities and companies of all sizes, QuotaPath has no minimum user requirements.

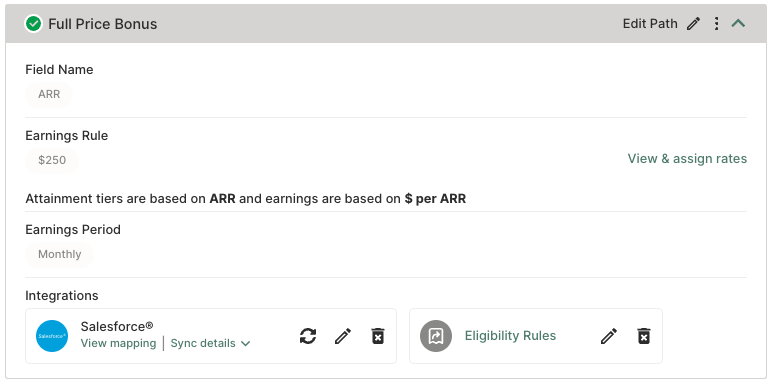

Commission Features (reporting, modeling, and testing)

QuotaPath’s compensation reporting and modeling tools enable leaders to measure and model the business value and performance of their revenue teams’ comp plans.

See real-time attainment health, identify performance anomalies, and predict new plan costs in one place to optimize your team’s success and gain confidence in your compensation structures.

Custom reporting provides analytics and insights that facilitate data-driven decisions while plan performance modeling simplifies sales optimization to improve outcomes.

Integrations

QuotaPath’s self-serve integrations enable you to add and edit technology connections essential to your commission process, including data warehouses, spreadsheets, business intelligence, and payment and ERP systems.

For instance, CRM integration can be established with platforms like HubSpot and Salesforce as well as data sources such as Excel, Google Sheets, Stripe, and Chargebee.

Onboarding and Ease of Use

QuotaPath is known for fast and easy onboarding plus ease of use. Implementation timeframe estimates are listed on QuotaPath’s website along with transparent pricing.

Reviewers on sites like G2 stated that “Deployment was so easy that I was able to get around 99% complete with minimal support. The integration with Salesforce is extremely easy to understand and complete we were up and running within just a couple of hours of work from myself.” And, another reviewer stated, “The product team has made onboarding simple.”

Plus, “The ease of use of the platform is excellent…Their customer support is top-notch. I know I will always get my questions answered. They also have great resources available to help guide our comp strategy and decision making.”

Workflow Automation

QuotaPath’s workflow automation tools facilitate incentive payment calculations on multi-year deals, renewals, demos, specific products, and users. Sales commission automation in QuotaPath tags sales reps involved in each sale, tracks commission earnings, provides transparent sales commission reporting to sales reps and allows them to forecast their future earnings.

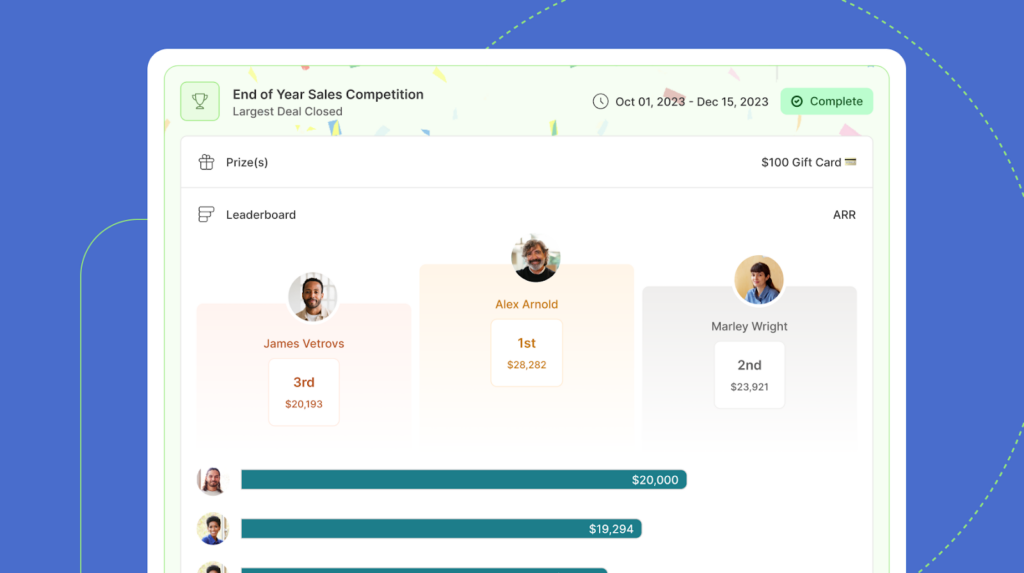

Additional QuotaPath automation tools include in-app compensation question and dispute resolution, deal approval, scheduled payments, and payout eligibility rules. And commissions amortization, pipeline and earnings forecasts, real-time attainment and effectiveness rates, and team leaderboards.

Support

QuotaPath’s support staff consists of Customer Success and Account Management agents available to guide implementation and provide best practices at key milestones. Live chat, an in-depth knowledge center, and monthly training webinars are available as part of QuotaPath’s highly-rated customer support model that continues throughout the customer’s entire engagement.

Help designing commission structures for a new team or compensation plan is easily accessible through QuotaPath’s ungated resource Compensation Hub, featuring a library of adjustable sales compensation plan examples.

Reviewers on sites like Capterra, G2, and TrustRadius reported, “When I needed customer support, their chat feature within the application with one of their reps was incredibly helpful.”

Pricing Model & Free Trial

QuotaPath lists transparent tiered pricing for a range of business sizes from startup to enterprise on its website, clearly stating what is included. Plus, QuotaPath offers a 14-day free trial is available enabling organizations to try the platform before becoming a customer with no credit card required.

Spiff

Capterra 4.7 / G2 4.7 / TrustRadius 8.8

Spiff commission software enables finance and sales operations teams to self-manage complex incentive compensation plans with ease. The Spiff platform is designed to build trust across organizations, motivate sales teams, increase visibility into performance and earnings, and ultimately drive top-line growth.

Commission Features (reporting, modeling, and testing)

Spiff enables organizations to generate custom reports incorporating metrics imported from business intelligence platforms or to use pre-configured reports, then visualize them on dashboards. These analytics and insights support data-driven decisions for modeling effective comp plans. The Spiff platform also allows the testing of new compensation plans against historical performance data confirming they won’t break the budget.

Integrations

Spiff offers CRM integration options as well as ERP, payroll, HCM, and other systems for real-time updates. Integration options include Salesforce, HubSpot, and Excel.

Onboarding and Ease of Use

Although most reviewers felt that Spiff was easy to use, some reported that “the initial setup and configuration are complex.” Another reviewer stated that “Improving the onboarding experience with more comprehensive tutorials or dedicated support resources could help alleviate this challenge and ensure a smoother transition for new users.”

Workflow Automation

Spiff streamlines workflows and automates complex commission structures. They offer real-time visibility for sales teams to drive performance. Spiff facilitates in-app compensation questions and dispute resolution communication and collaboration. Approval workflow automations and prescheduled reports are also possible with Spiff.

Support

According to Spiff’s website, there are additional fees for anything beyond basic support.

Spiff’s support received mixed reviews on review sites. Reviewers were either very happy with the customer support they received or reported that it was slow, with one reviewer reporting “they took over two weeks to attend to my ticket.”

Pricing Model & Free Trial

There is no pricing model or rates posted on Spiff’s website. Our research revealed that they offer a one-size-fits-all rate plan and no free trial.

Try the most collaborative solution to manage, track and payout variable compensation. Calculate commissions and pay your team accurately, and on time.

Start TrialEverstage

Capterra 4.9 / G2 4.8 / TrustRadius 9.4

Everstage is a Sales Commission Software that helps drive business outcomes and profitable growth through incentives and streamlined commission administration.

Commission Features (reporting, modeling, and testing)

Everstage’s commission features include standard and custom reporting to inform data-driven decisions. The Everstage platform allows organizations to model commission plans before publishing them using historical performance data. Then it enables potential comp plan testing to ensure they meet budgetary requirements.

Integrations

Everstage offers accounting, database, HR platform, and CRM integration options including Salesforce, HubSpot, Quickbooks, and Chargebee.

Some reviewers cited that “sometimes the data gets outdated and stuck, especially at the end of the month and the data sync with Salesforce and Everstage gets delayed.”

Onboarding and Ease of Use

Everstage is user-friendly and easy to set up and implement according to reviewers.

Workflow Automation

Everstage provides sales teams with real-time visibility of their quota attainment and earnings through reporting, forecasting, and leaderboards to motivate results. Reporting streamlines performance tracking by delivering analytics and insights for sales optimization. Everstage also automates commission calculations, approvals, user management, and compensation query and dispute resolution.

Support

According to the Everstage website, support includes a dedicated implementation team and 24×5 multi-channel support. No negative reviews were found concerning Everstage’s support.

Pricing Model & Free Trial

No fee structure or pricing was found on the Everstage website and there is no free trial offered.

Palette

Capterra no reviews / G2 4.9 / TrustRadius no reviews

Palette automates sales commissions, preventing errors, and provides sales teams with real-time visibility into commission accruals and payouts. Built to handle even the most complex commission plans, Palette enables businesses to trigger commission payouts based on customer payments and product usage thresholds.

Commission Features (reporting, modeling, and testing)

Palette offers reporting to inform data-driven decisions for sales optimization and compensation modeling. The platform enables testing of compensation plans to visualize their potential impact on cash flow and business objectives.

Integrations

Palette offers Billing, Database, and CRM integration options including Salesforce, HubSpot, QuickBooks, Chargebee, Google Sheets, and Excel.

Onboarding and Ease of Use

Reviewers report that Palette is easy to use and to implement.

Workflow Automation

Palette provides sales teams with real-time access for sales teams to personalized performance dashboards. The platform automates commission calculation and payouts, and generates monthly commission statements for team members. Palette also facilitates in-app dispute resolution, approval routing, and performance monitoring.

Support

Support includes initial training on how to effectively use the Palette application and training on new features as they are introduced. A limit of 3 one-hour admin training workshops per year is offered to onboard new Admins. After initial onboarding, fee-based support for Professional Services is required for support such as training new users and assistance with comp plan creation.

Pricing Model & Free Trial

Palette offers a tiered subscription model based on business size. No pricing is published on their website and there is no free trial.

Qobra

Capterra 4.8 / G2 4.7 / TrustRadius no reviews

Qobra automates commission calculation, validation, and sharing while reducing errors and increasing sales motivation with real-time visibility to improve sales performance.

Commission Features (reporting, modeling, and testing)

Qobra enables reporting to help with data-driven decisions for compensation modeling and allows the performance of plan simulations and tests in a sandbox environment on the platform.

Integrations

Qobra offers data warehouse, financial, HR, and CRM integration options including Salesforce and HubSpot.

Onboarding and Ease of Use

Although there are a limited number of reviews on review sites, there are currently no negative reviews about setup and onboarding and a few reviewers mentioned that Qobra is easy to use.

Workflow Automation

Qobra offers sales teams real-time visibility to quota attainment through dashboards. The platform automates commission calculations, approvals, and dispute resolution.

Support

We couldn’t find any details concerning support services on Qobra’s site. However, reviewers reported positive and timely support experiences.

Pricing Model & Free Trial

No pricing model, rates, or free trial is offered on Qobra’s website.

Design, track, and manage variable incentives with QuotaPath. Give your RevOps, finance, and sales teams transparency into sales compensation.

Talk to SalesTop Revenue Operations and Intelligence Commission Software

As we compare Revenue Operations and Intelligence commission automation software tools, all brands have similarities. However, QuotaPath offers the greatest flexibility and is the most adaptable commission system for businesses ranging in size from startup to enterprise as they scale.To learn more schedule time with a QuotaPath team member or start a free trial today.

RevOps tools FAQs

What is revenue operations software?

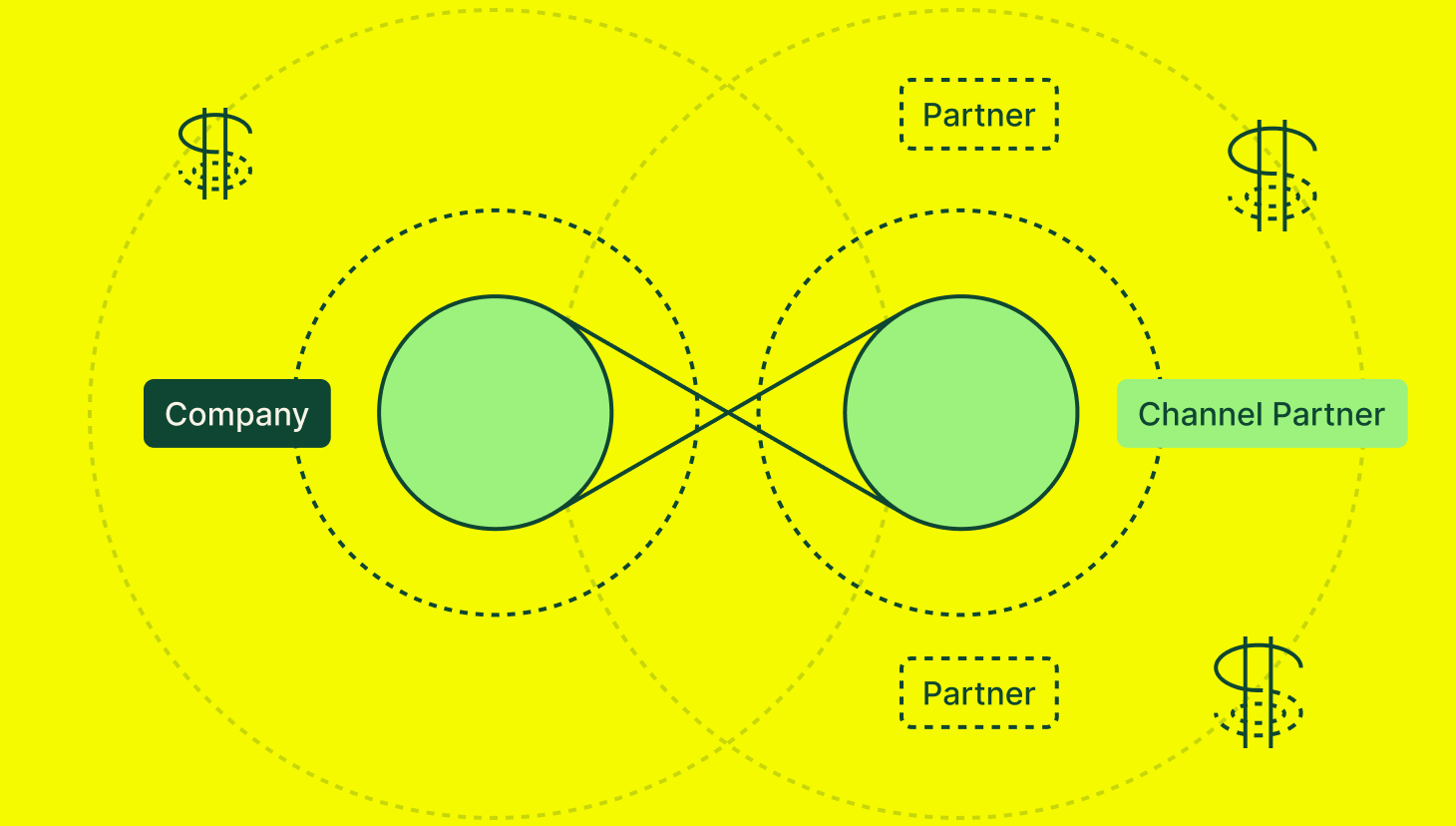

Revenue operations (RevOps) software is a platform that aligns sales, marketing, and customer success teams by streamlining processes, data, and analytics to drive predictable revenue growth. It helps organizations automate workflows, track key metrics, and improve forecasting by integrating with CRMs, commission tracking tools, and financial systems. By centralizing revenue data and optimizing operations, RevOps software enhances efficiency, eliminates silos, and ensures teams work toward shared business goals.

How does rev ops software fit into my sales/marketing tech stack?

RevOps software acts as the central hub that connects and optimizes your sales and marketing tech stack. It integrates with CRMs (like Salesforce and HubSpot), commission tracking tools (like QuotaPath), marketing automation platforms (like Marketo), and financial systems to ensure accurate data flow and streamlined processes. By automating reporting, pipeline forecasting, and compensation tracking, it eliminates silos between sales, marketing, and finance, ensuring that all teams work toward shared revenue goals. With RevOps software, companies gain better visibility, improved efficiency, and data-driven decision-making across their entire go-to-market strategy.

What should I look for in a rev ops solution?

When choosing a RevOps solution, look for seamless integrations with your existing CRM, commission tracking, and financial systems to ensure smooth data flow. Prioritize automation features for reporting, forecasting, and compensation management to reduce manual work and improve accuracy. Finally, choose a platform with clear visibility into pipeline performance and revenue metrics so sales, marketing, and finance teams can align on shared goals.

What is the best rev ops software?

The best RevOps software depends on your needs, but top options include QuotaPath for commission tracking, Clari for forecasting, and Salesforce Revenue Cloud for revenue management. The ideal platform integrates with your CRM, automates key processes, and provides clear revenue visibility. Choose a solution that scales with your business and aligns sales, marketing, and finance teams.

Recent Comments