No sales process is flawless. Your current process may be closing many sales. However, if you poke around enough, chances are you’ll find areas for improvement.

And there’s nothing wrong with that. The world of sales is dynamic—what works today may not work tomorrow. This is why sales process optimization is crucial. It allows businesses to adapt and thrive in an ever-changing marketplace.

If you want to get the most out of your sales process and boost conversions, keep reading this post. We share ten useful strategies to help you achieve this. But first, let’s briefly define sales process optimization.

What is Sales Process Optimization?

Sales process optimization involves refining and improving the effectiveness of each step in the sales cycle, from lead generation through closing and customer retention. This results in improved sales performance, higher customer satisfaction, brand loyalty, and overall business growth.

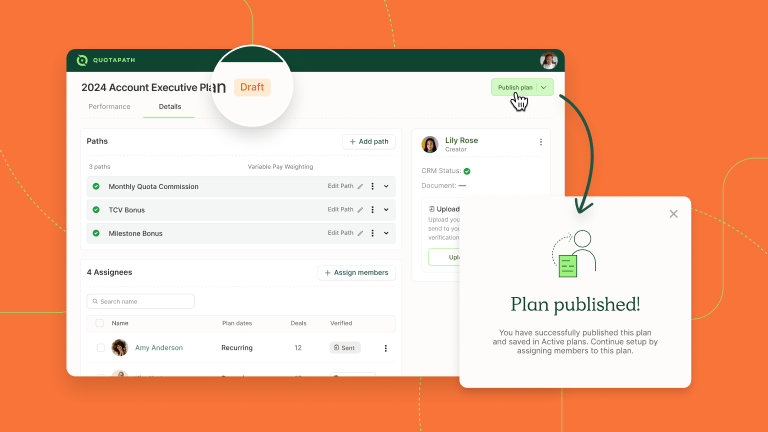

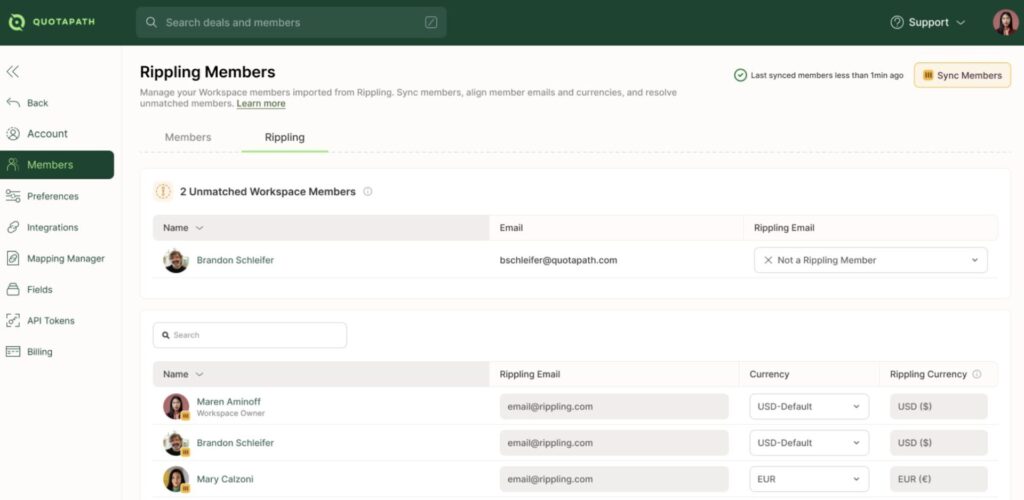

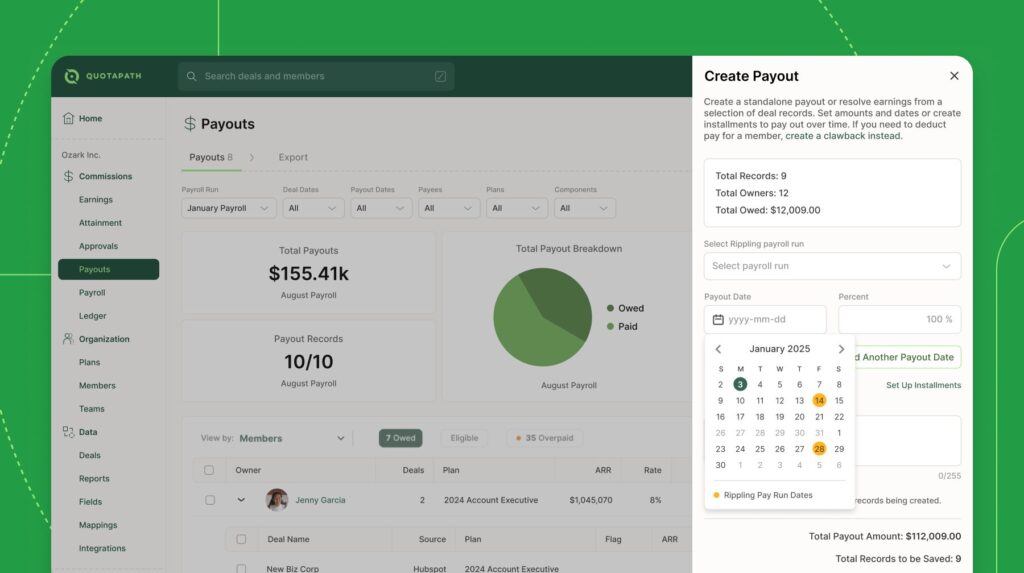

Design, track, and manage variable incentives with QuotaPath. Give your RevOps, finance, and sales teams transparency into sales compensation.

Talk to Sales10 Effective Sales Process Optimization Tactics

Optimizing your sales process doesn’t have to be complicated. The main idea is to analyze your current process to understand what is working and what isn’t. Then, based on those insights, make strategic adjustments to drive better results.

Here’s how you can accomplish this:

1. Start with a Clear Goal

All sales optimization processes that are worth their salt begin with a goal. Define what you want to accomplish at the end of your campaign.

Do you want to increase profit margins, improve customer retention, or lower customer acquisition costs? Whatever it is, outline it. By doing so, you can identify what aspects of your sales process are critical to the overall success of your business.

Ideally, your goal(s) should be SMART (Specific, Measurable, Attainable, Relevant, and Time-bound).

This means that your goals should have a clear objective that your team has a realistic chance of achieving. They should also have defined metrics you can use to assess your performance in real time and clear deadlines for completion. Finally, your goal should relate to your organization’s main mission.

An example of a SMART goal could be to increase profits by 25% within the next fiscal quarter through targeted upselling to existing enterprise clients.

Another approach to ensuring you’re setting realistic goals for your team is demand planning. Demand planning involves using data to predict customer demands and ensure your business can meet them. This helps you identify market opportunities and align your objectives with actual market demand.

Once you establish your goals, you will be clear on how to make strategic decisions that drive measurable business results.

2. Build Your ICPs

ICP stands for ideal customer profile. It describes the perfect customer for your products or services. As a result, your sales team can target the right group. Common categories of ICPs include demographics, firmographics, technographics, behavioral patterns, and buying history.

To determine your ideal customer profile, research your existing and past customers. Analyze their profiles to identify their common characteristics. Then, use those characteristics to identify prospects.

If you are a new business without customers, don’t panic. You can build your ICPs by revisiting your early mission. Consider who you created the product or service for. That’s your ideal customer.

Say your mission is to help small business owners do their bookkeeping with your accounting software. In that case, they are your perfect customers.

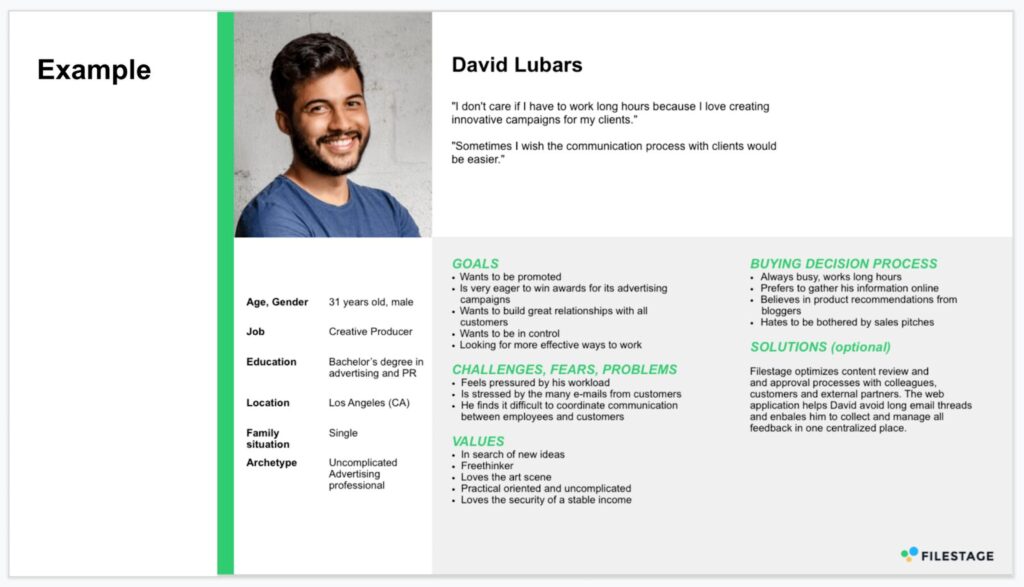

Now, to be even more specific in your customer-targeting efforts, combine your ICPs with buyer personas. Buyer personas zoom in on individual customers within the ICP framework.

So, if your ICPs are small business owners, one buyer persona can be a mom-and-pop shop that struggles with bookkeeping. Another buyer persona can be a virtual assistant who already uses a bookkeeping program but is looking for alternatives.

A well-crafted buyer persona will look like the image below. It will also give your reps an advantage during negotiations.

3. Identify Bottlenecks in Your Pipeline

Another sales process optimization strategy is evaluating your pipeline for friction points and leaks. Even after nailing down your ICPs and buyer persona, you may encounter prospects who simply aren’t suited to your offer. This group either gets stuck at a particular stage in the sales funnel or fails to convert.

When this happens, it means there is a problem with your sales process or offer. In other words, you may have a pipeline bottleneck or leak.

The solution to this is a good lead-nurturing campaign. There’s no point in gaining new leads if you can’t move them through the funnel. Hence, you need to nurture leads over time so that they remember you when they are ready to buy.

Some practical lead-nurturing practices include:

- Creating targeted content

- Connecting with prospects through multiple channels

- Send personalized emails

- Follow up with leads on time

- Use lead-scoring tactics

4. Refine Qualification Criteria

The best solution to many sales process issues is being proactive. That means addressing problems before they become major roadblocks. One such problem is lead quality.

To rectify this, you need to refine your lead qualification criteria. No sales optimization process is complete without this, as key buying indicators change frequently. If you let your guard down for even a few months, your entire sales operation could be misaligned with your ICPs.

As you refine your qualification criteria, you must involve reps. Educate your team about the latest changes. Additionally, train reps to ask targeted questions during discovery calls, sales presentations, and product demonstrations.

5. Empower Your Sales Team

Your sales team is as good as the resources you provide for them. Resources in this context include coaching, technology, and the necessary tools and support systems.

Organize regular coaching for your team. Analyze individual rep performance and team-wide metrics to identify improvement areas. Then, work with reps to improve in these areas.

Your sales team needs proper sales enablement materials to increase their close rates. This includes prospecting plans, sales scripts and templates, product documentation, and even a call recording disclosure script. But if you’re in the early stages, take it slow. Start with essential, bare-bones sales documentation and gradually expand it based on real-world needs and experiences.

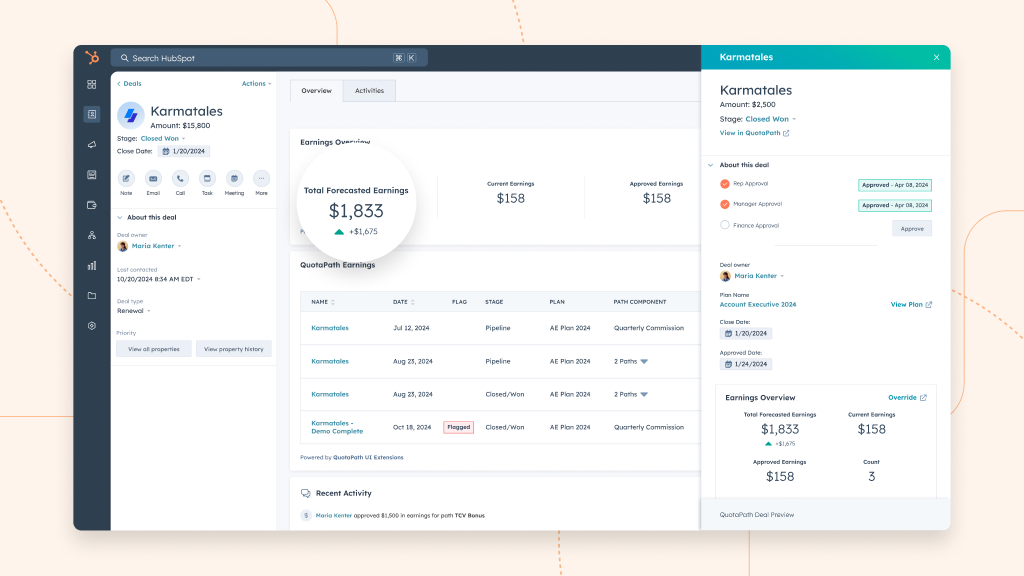

In terms of technology, you don’t have to get the fanciest new tools. A simple CRM that reduces data entry work, has automation tools, and can integrate with current and future tech stacks will suffice.

6. Align Sales and Marketing

While they share the goal of increasing revenue for the business, the sales and marketing teams don’t always agree on everything. But it is in your best interest to change that.

Consistent messaging is a considerable benefit of an aligned sales and marketing team. When both teams sing from the same hymn sheet, it reinforces your brand’s value proposition and increases your chances of closing the deal.

One approach to accomplish this is through an integrated business planning process. This process helps align sales and marketing teams by fostering collaboration, sharing real-time data, and ensuring both functions work toward a common goal.

As a result, marketing teams can provide the right type of content and qualified leads, enabling sales teams to win and retain more customers.

7. Use Automation

Can you close sales without automation? Absolutely!

However, you’ll do so at the pace of an old-fashioned steam locomotive compared to your competitors.

That’s like waving a white flag in this fast-paced, digitized world. So, embrace automation. Your sales reps will thank you!

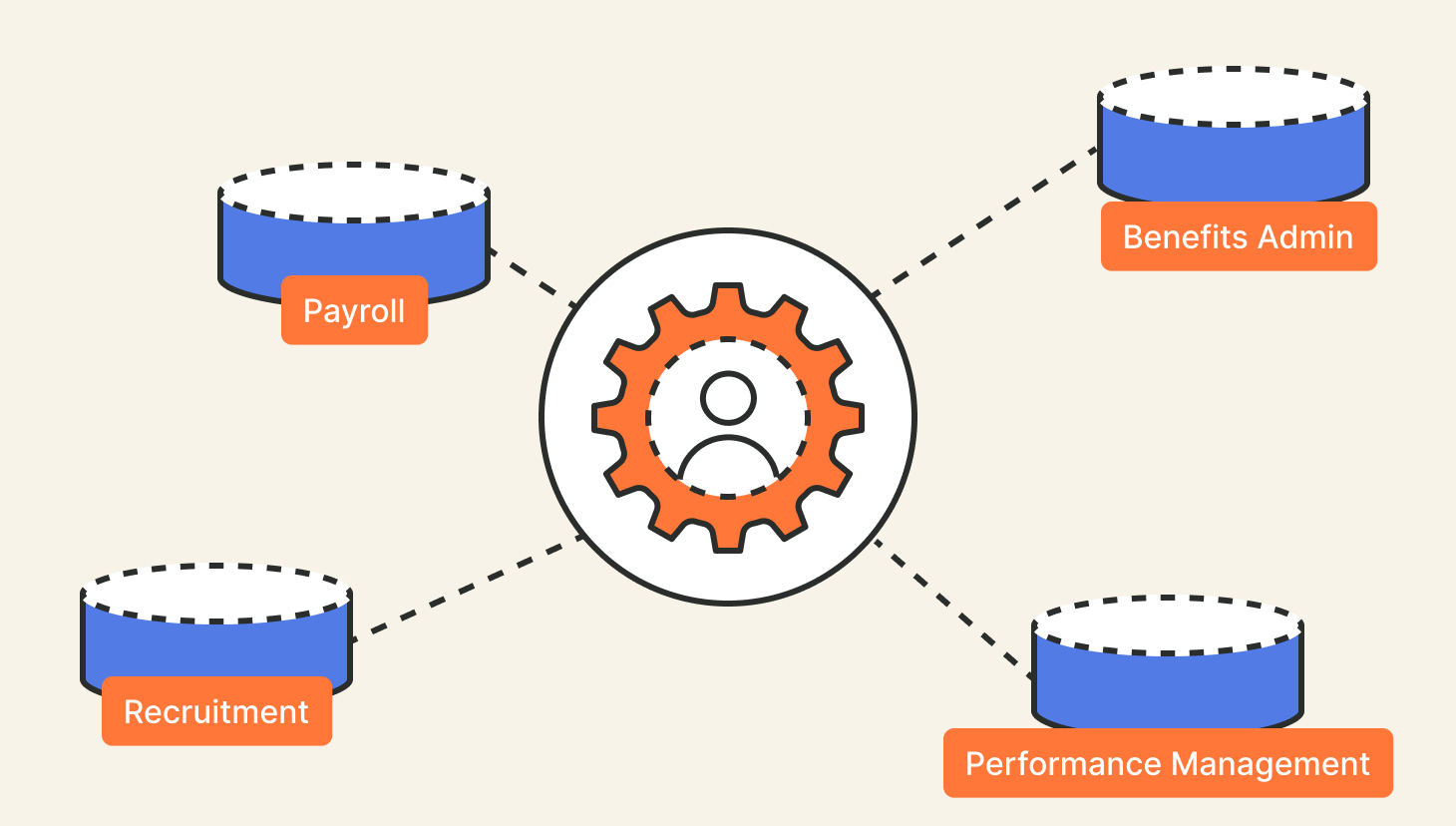

One of the first uses of automation is to streamline recruitment. Through automation, you can quickly and efficiently match the right candidates with job requirements, reducing the time-to-hire and improving the quality of candidates.

Automation can eliminate simple, monotonous tasks like data entry, email follow-ups, and appointment scheduling from your team’s plate. It can also help with prospecting, which many sales reps dread. Other sales activities that can be automated include lead scoring, lead assignment, and dialing.

Thanks to all this free time, your team can focus on human sales, building connections with prospective buyers.

8. Optimize Pricing

Pricing can determine whether or not you close a sale. It is an important factor in buying decisions. If you price your product too high, you can scare off prospects. If you price it too low, it may be perceived as inferior.

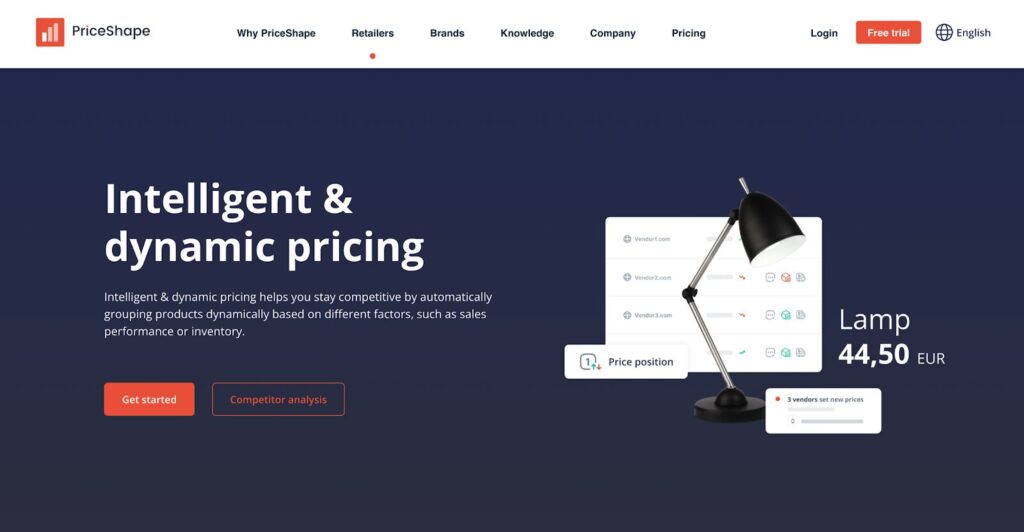

Hence, you must find the balance between competitive pricing and protecting your profit margins. This is where price optimization comes in. It allows you to find the optimal price for a product or service. That way, you can satisfy customers and still make a profit.

Intelligent pricing software, such as PriceShape, can help with this. These solutions analyze market data and competitor pricing in real time to recommend optimal price points that maximize revenue and maintain competitiveness.

You can also consider a tiered pricing strategy. This approach enables your sales reps to be flexible during negotiations. For instance, if a prospect hesitates to commit due to the price point, they can be offered a lower-tier package with reduced features.

This ensures your rep closes the deal without devaluing the product. It also sets the stage for potential upselling or cross-selling later.

9. Leverage Customer Feedback

Sales process optimization isn’t just about technology and metrics. Enhancing your sales process also requires building meaningful human connections.

This means treating potential prospects and qualified leads as more than just numbers on a spreadsheet. You need to show them that you genuinely care about solving their challenges. Otherwise, you risk losing them to competitors who meet these demands.

To prevent this, listen to your customers. Set up surveys, interviews, and focus groups to understand their frustrations. Then, use this information to refine and optimize your sales approach.

In the future, you can send them surveys to measure their satisfaction over time.

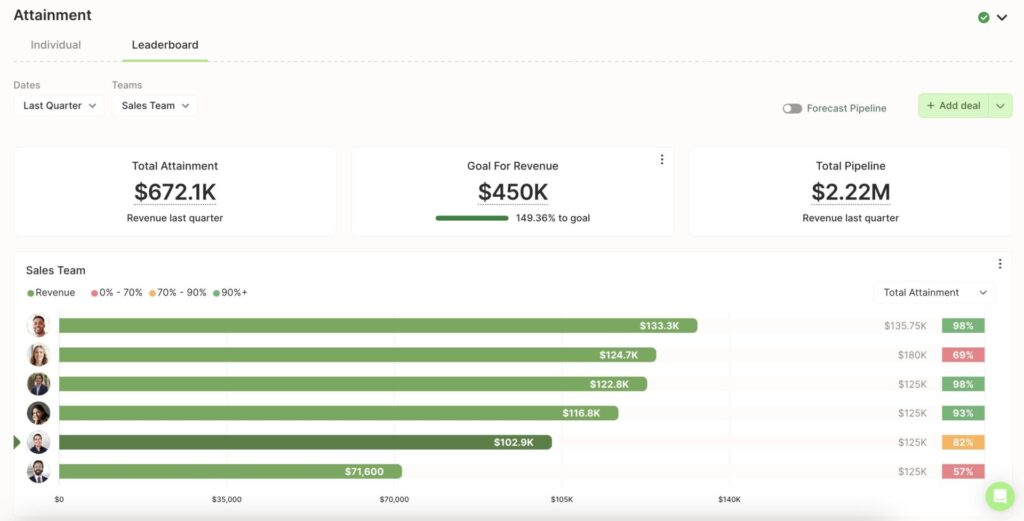

10. Measure Performance and Refine for Future Sales Campaigns

Optimizing the sales process is a continuous effort. You must constantly evaluate performance and iterate on future campaigns.

Consider whether the performance matches the goals you set at the start of the campaign. If you set out to increase revenue, did you achieve the projected revenue growth percentage?

Understand what aspect of your campaign worked and where you fell short. Then, use this insight to optimize your future strategies.

Using rolling forecast best practices can elevate this process. Rolling forecasts provide a dynamic framework for continuously updating performance projections based on real-time data.

For example, if your current campaign is underperforming in a specific channel, a rolling forecast allows you to identify the issue early. This will enable you to make data-driven adjustments and ensure the campaign stays aligned with broader sales goals.

Combining performance measurement with flexible forecasting allows you to refine your current strategies. It also enables you to build a roadmap for more effective, data-informed campaigns. This, in turn, ensures your sales process remains agile and consistently optimized.

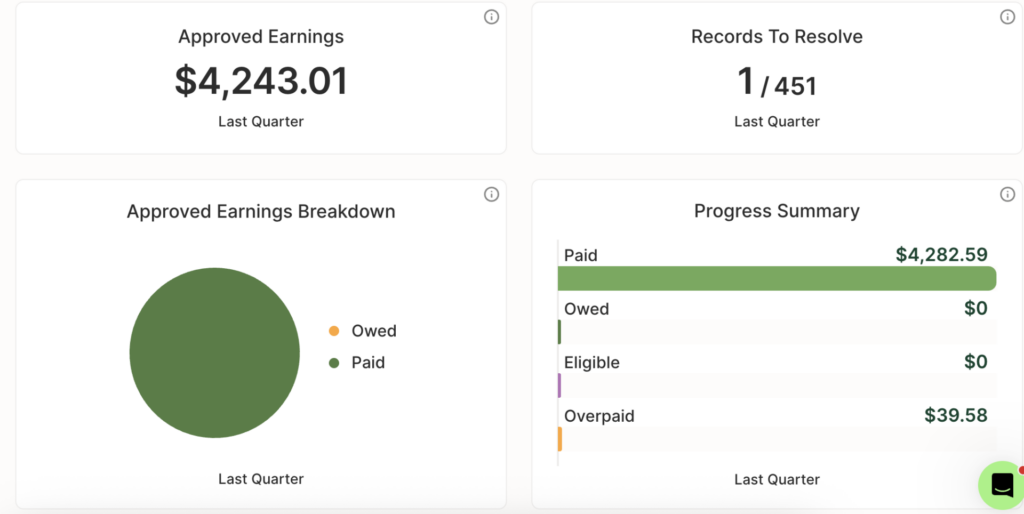

Try the most collaborative solution to manage, track and payout variable compensation. Calculate commissions and pay your team accurately, and on time.

Start TrialBenefits of Sales Process Optimization

A well-implemented sales optimization process has several benefits, including:

Increased Conversions

An optimized sales process will increase conversions by reducing or eliminating frictions that prevent prospects from completing a purchase.

For instance, a well-defined sales process will ensure reps address any customer objections or pricing concerns. As a result, prospects move through the pipeline more efficiently and close deals faster.

Cost Reduction

Sales process optimization can save you money. It can reduce customer acquisition costs and ensure better resource allocation. A comprehensive sales plan identifies your ideal customers, enabling your sales team to focus on them. This saves you time and money.

Improved Efficiency

Sales optimization involves using cloud-based software to streamline workflows. For most businesses, this means migrating their sales data and processes from legacy systems to modern CRM platforms.

While this can seem like a hassle, several cloud migration benefits make it worth it. One such benefit is improved efficiency. Cloud-based platforms help sales teams work faster by automating repetitive tasks and providing instant access to customer data.

Thus, sales teams can focus on building strategic relationships and closing high-value deals.

Higher Revenue

Sales are directly linked to revenue. The amount you sell determines the revenue your business generates. Sales optimization can ensure that the amount is high.

An optimized sales process gives sales reps access to data and the technology to make the right call during each funnel stage. This results in more conversions and, ultimately, higher revenue.

Sales Process Optimization is a Continuous Practice

Sales process optimization helps organizations adapt to changing market conditions. It gives sales teams the tools they need to close more deals.

To implement a sales optimization strategy, you need to assess your current process and identify areas for improvement. Then, you can use this knowledge to develop targeted solutions that maximize revenue and streamline your sales cycle.

However, sales process optimization isn’t a box-ticking activity. It must be a continuous journey of strategic refinement and improvement to get the most out of it.

Recent Comments