Ready to build your first HR technology stack? Start here.

HR tech adoption is growing steadily, as evidenced by its 66% increase between 2020 and 2023. With 12.1 million U.S. employers investing more than $5 trillion in HR solutions and 74% of companies planning to raise their HR tech budgets, the trend is expected to continue.

There’s no mystery to HR tech’s popularity, delivering many proven benefits such as:

- Greater employee productivity: Organizations with a fully integrated HR technology stack saw a 15% increase in employee productivity, according to Deloitte research.

- Better change management: Companies that leverage HR tech are 4 times more likely to successfully manage change and are more efficient in attracting and retaining top talent, according to a PwC study.

- Higher revenue growth: Organizations using advanced HR technology experienced 26% higher revenue growth, according to PwC.

- Improved employee retention: Companies using HR tech had 40% lower employee turnover rates, according to PwC.

- Increased efficiency: Companies that invest in HR technology saw a 22% increase in efficiency, according to PwC.

The evidence is clear: HR technology is no longer a nice-to-have; it’s crucial to an organization’s ability to survive in today’s highly competitive marketplace. With the boost in efficiency, productivity, and revenue growth alone, the sooner you start building your HR tech stack, the better.

It’s been recommended that even early-stage companies benefit: “As small businesses scale and roles become more complex, they may consider tools to manage HR operations. Instead of relying on spreadsheets, small businesses can use HR software for tasks like onboarding, managing payroll, tracking time off, and performance reviews.”

HR technology stacks vary in size. However, according to HR.com’s State of Today’s HR Tech Stack and Integrations 2024, 13% of organizations have only one solution, while 68% have between 2 and 7 HR solutions in their HR tech stacks.

In our blog below, gain the confidence you need to develop the most streamlined, efficient, and effective HR technology stack.

Blog Takeaways:

- 74% of companies plan to expand HR tech investments

- HR tech stacks improve efficiency, employee experience, and compliance.

- Essential software includes payroll, commission management, recruiting, engagement, performance, and LMS platforms.

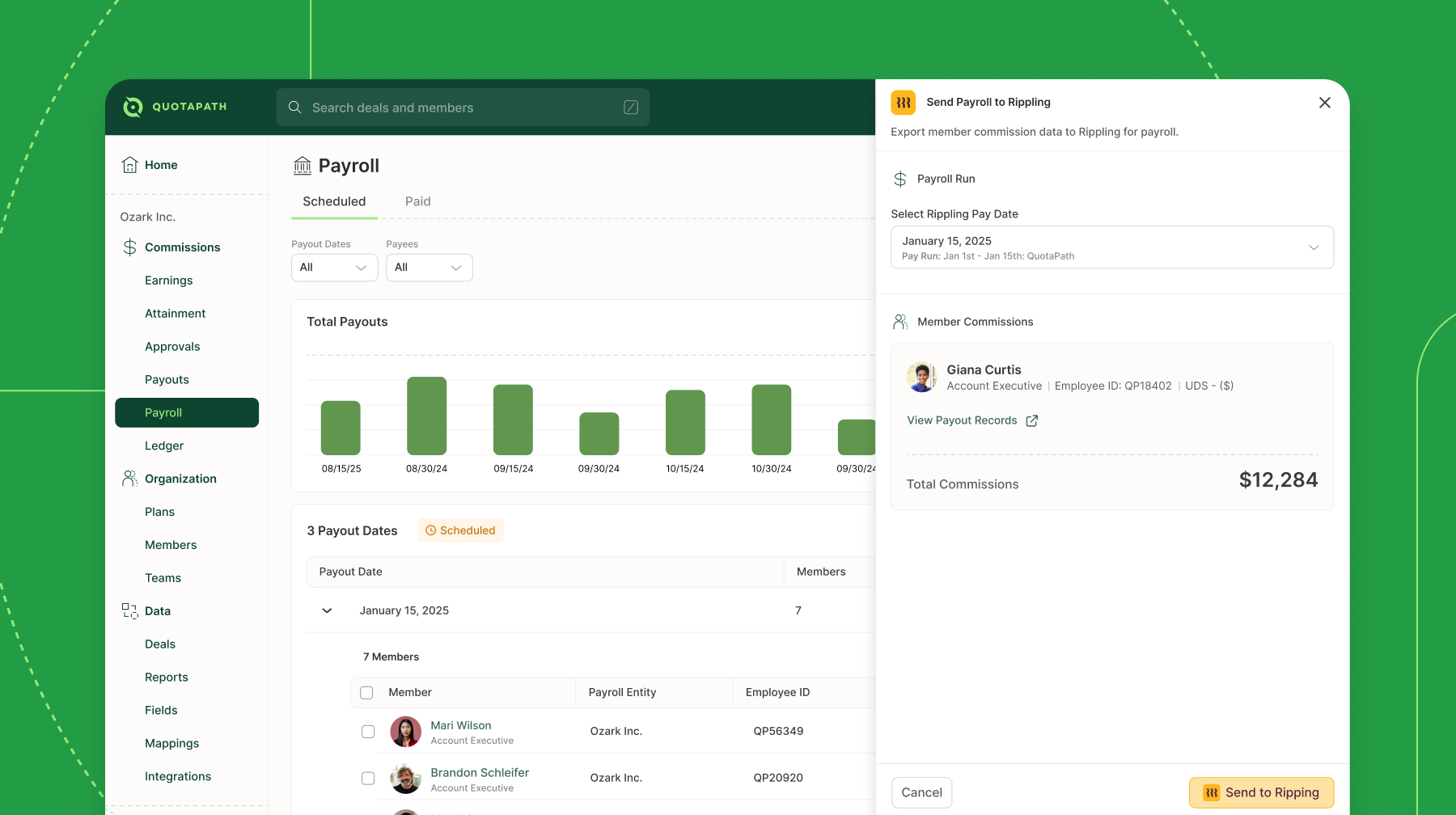

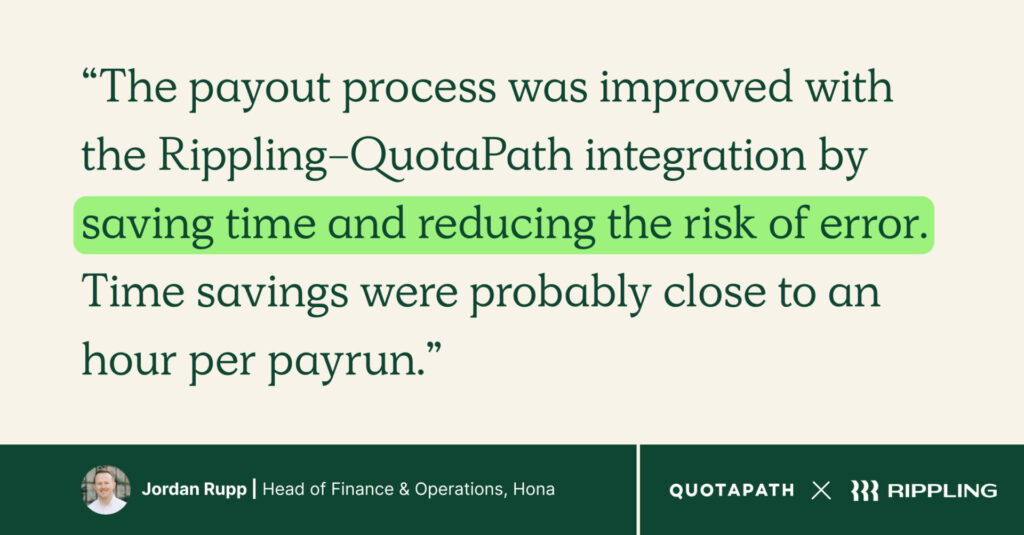

- Integration with Rippling and QuotaPath ensures smooth HR and payroll processes.

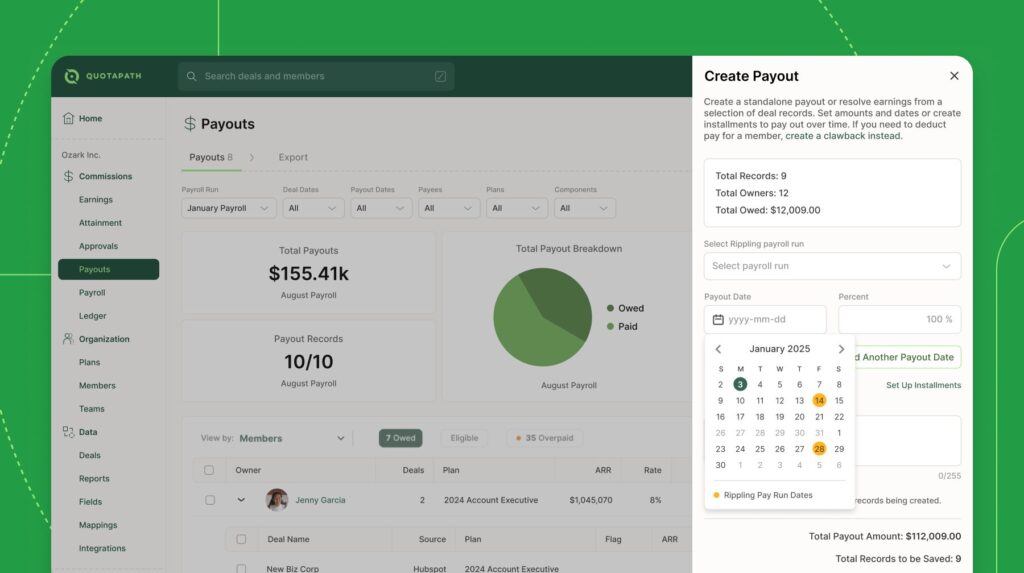

Integrate Rippling with QuotaPath

Automated commission tracking and push directly into your Rippling payrun schedule.

Read MoreWhat is an HR Tech Stack?

First, let’s define it.

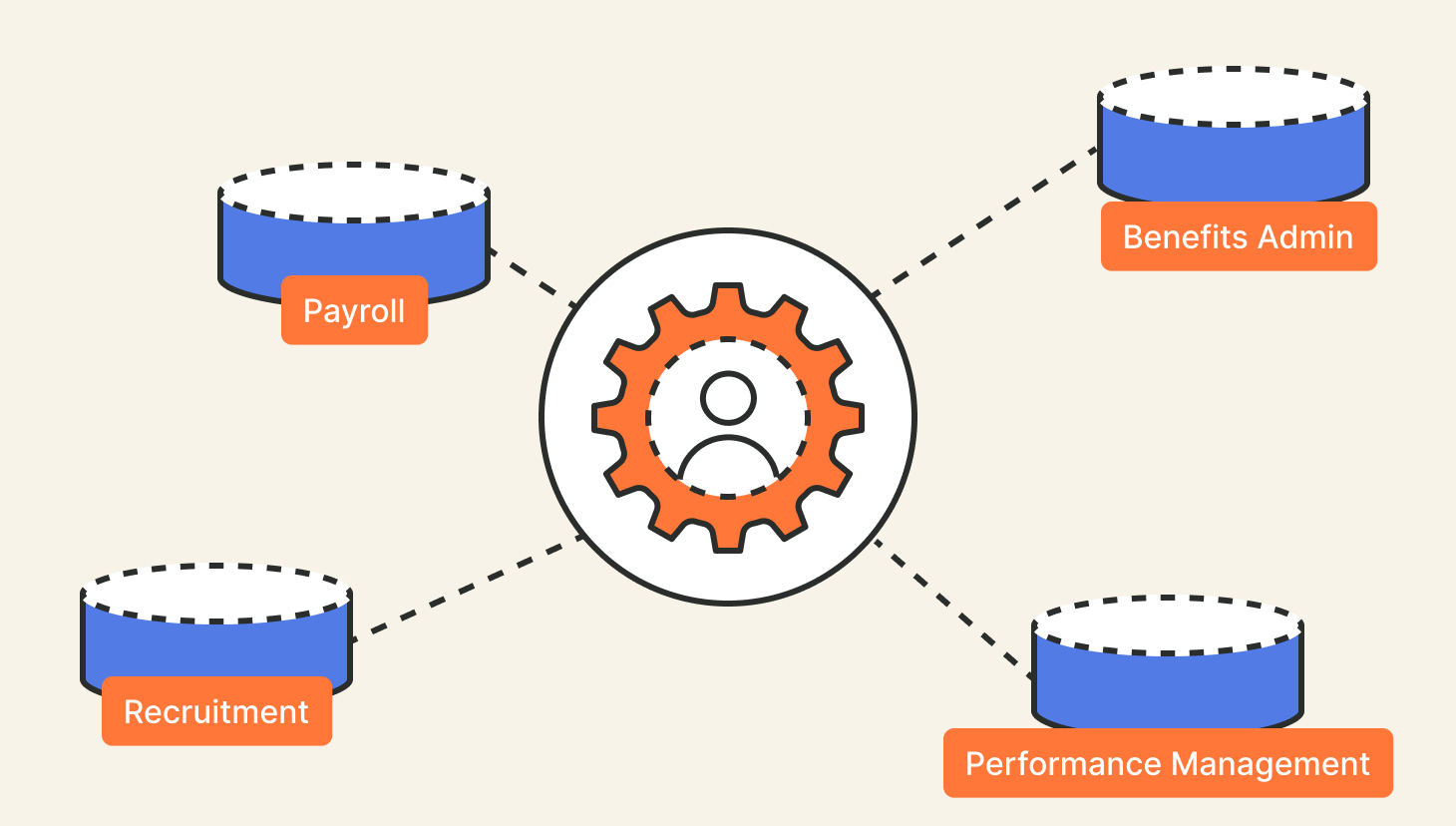

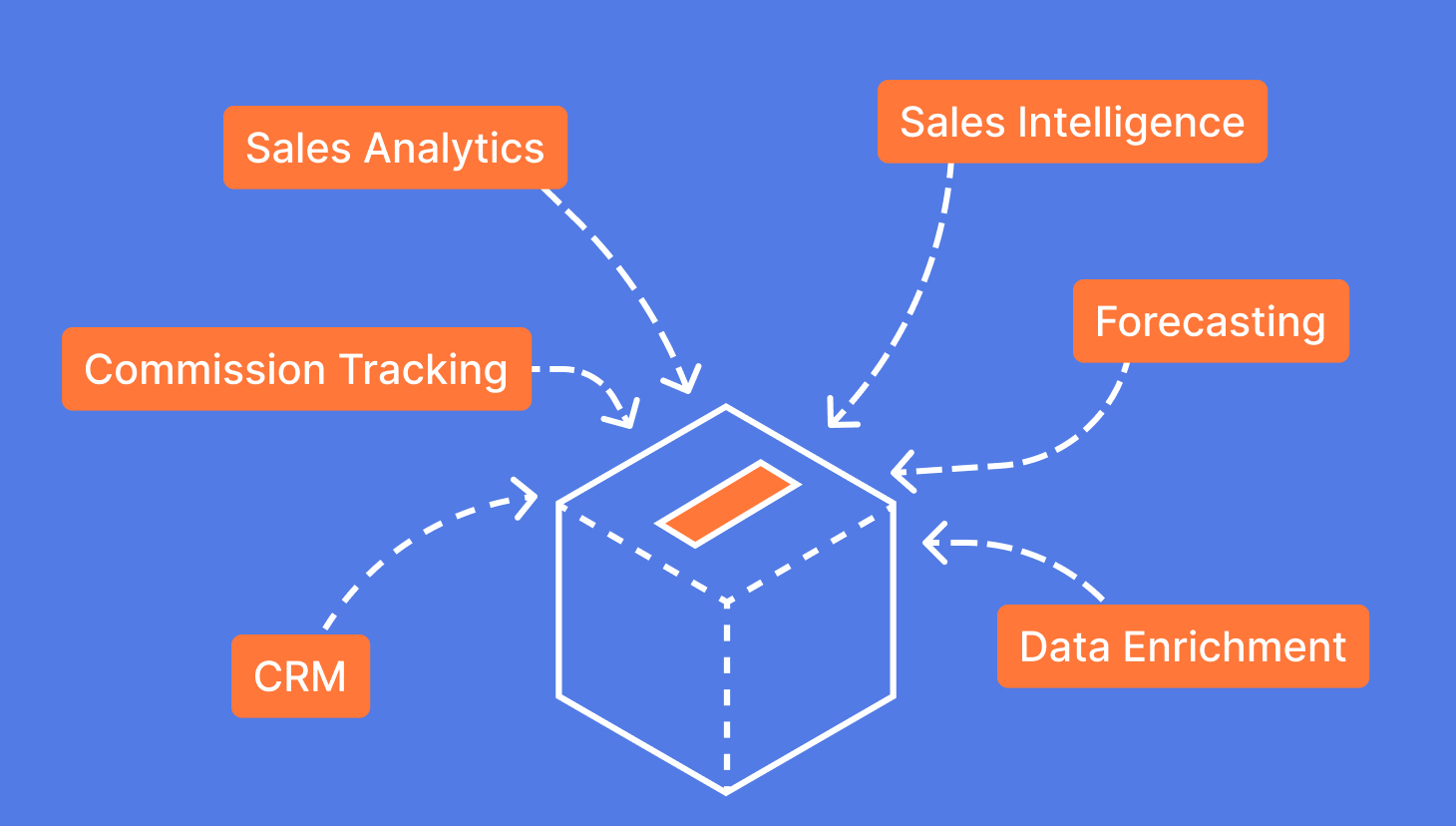

An HR tech stack is a collection of software and digital tools designed to automate and enhance HR functions. These tools can streamline payroll, recruitment, benefits administration, and performance management, ensuring better compliance and efficiency.

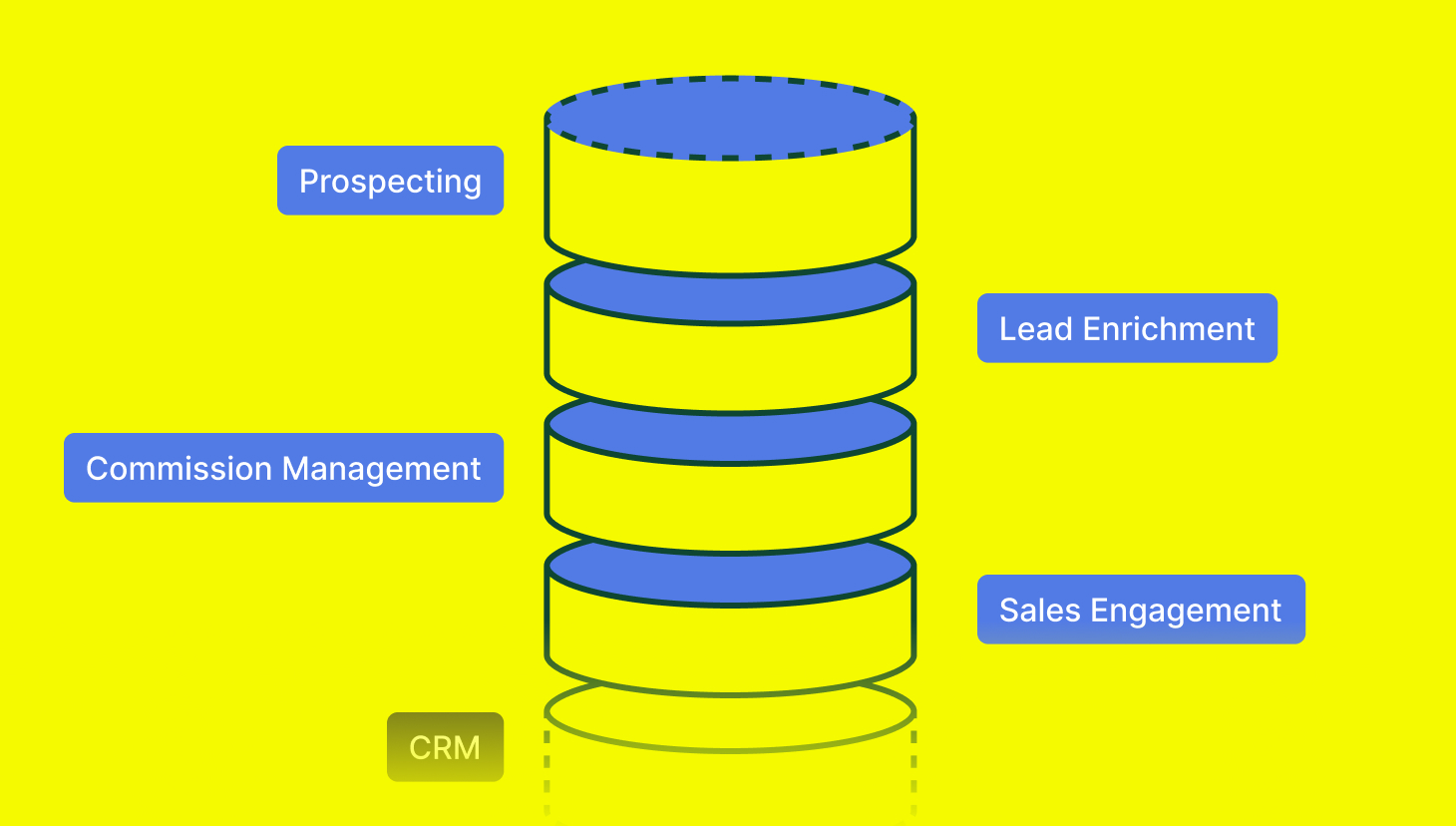

Popular HR tech tools include Rippling and ADP for payroll and compliance, and QuotaPath and Xactly for commission automation. Many HR teams also use Greenhouse and Lever for recruiting, Peakon and 15Five for performance and engagement, and Docebo or TalentLMS for learning management. These platforms offer scalability, ease of use, and strong integration capabilities.

Why Having a Solid HR Tech Stack is Important?

As you can piece together, an effective HR technology stack enables your HR team to work smarter, deliver a better employee experience, and make more informed decisions while adopting the latest tools.

Key Benefits:

The key benefits are as follows.

Increased efficiency: Automating HR tasks reduces administrative burdens, allowing HR teams to focus on strategic initiatives.

Improved employee experience: Digital tools make processes like onboarding and payroll seamless, boosting satisfaction and engagement.

Data-driven decision-making: HR analytics help optimize workforce planning, compensation structures, and talent acquisition.

Design, track, and manage variable incentives with QuotaPath. Give your RevOps, finance, and sales teams transparency into sales compensation.

Talk to SalesSoftware You Should Add to Your HR Tech Stack

Before building your HR tech stack, it’s essential to understand which tools offer the most value. A strong HR technology stack integrates a range of tools that support the entire employee lifecycle, including:

- Payroll software: Handles wages, taxes, and compliance to ensure timely, accurate pay.

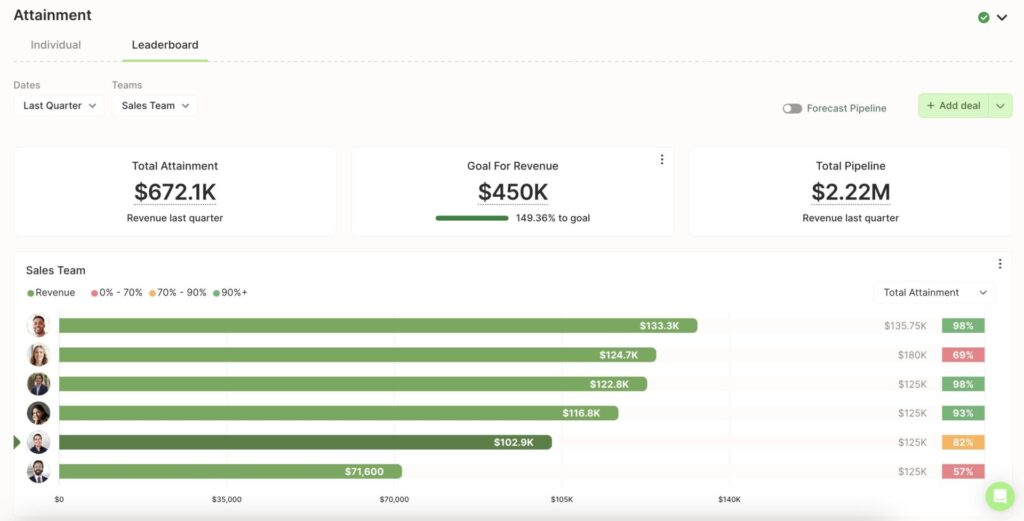

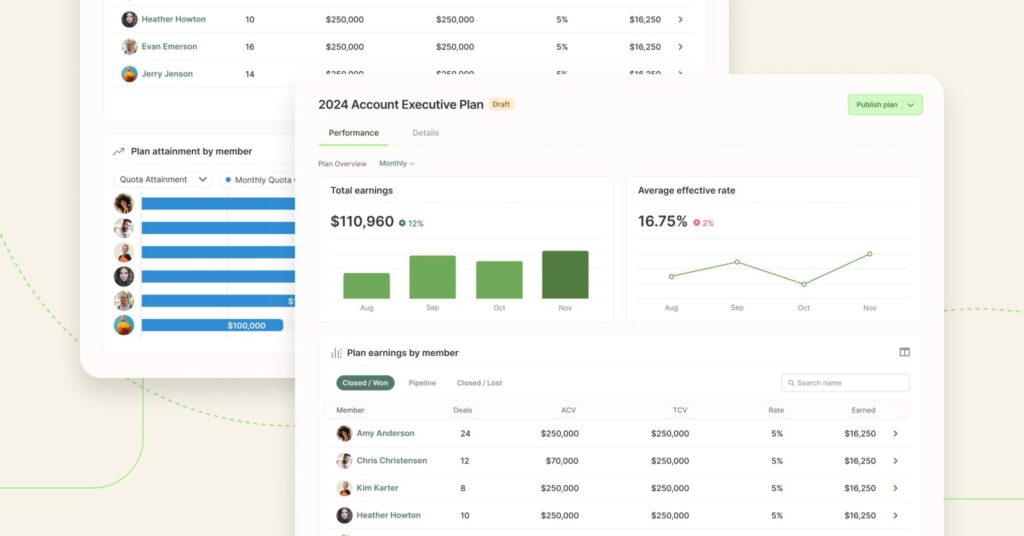

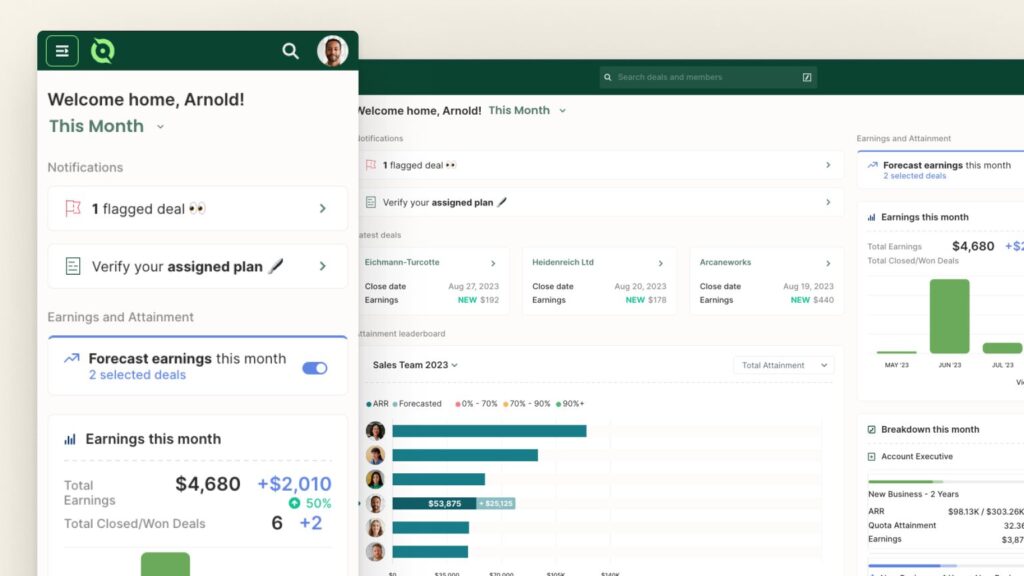

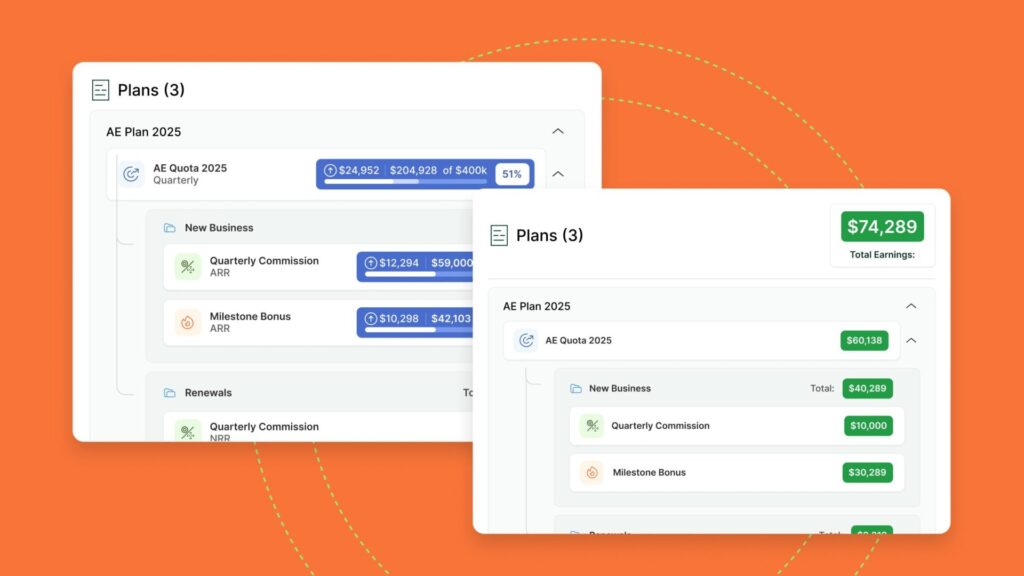

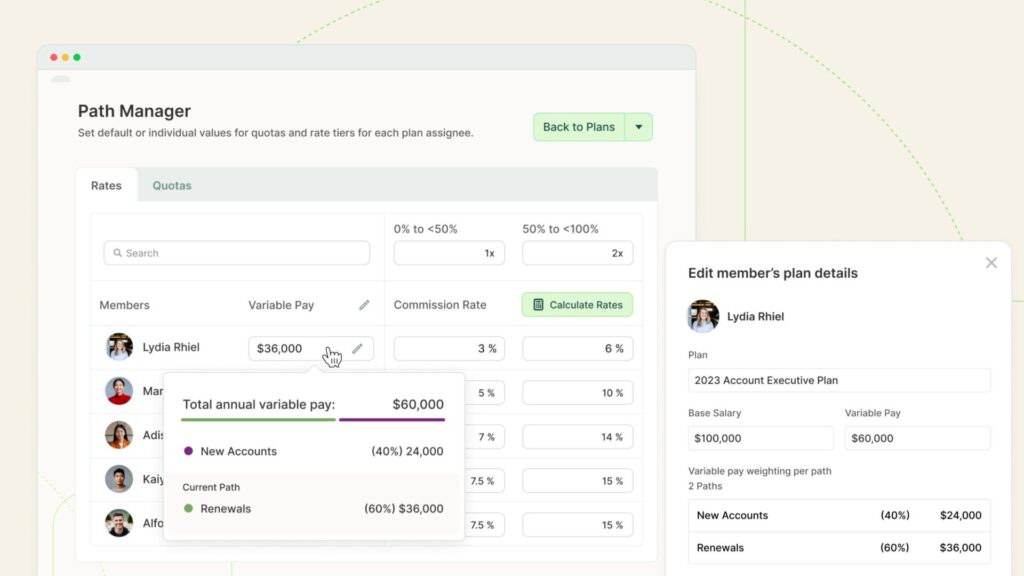

- Commission management software: Tracks and automates variable compensation, especially for sales teams.

- Recruiting software: Streamlines job postings, applicant tracking, and hiring workflows.

- Employee engagement software: Gathers feedback and monitors morale to improve retention.

- Performance management software: Tracks goals, reviews, and feedback to align individual performance with company objectives.

- Learning management systems (LMS: Deliver and track employee training to support skill development.

Together, these tools help HR teams operate efficiently and strategically.

| HR Software Category | Platform 1 | Platform 2 | Platform 3 |

| Payroll Software | Rippling – Runs payroll in 90 seconds, integrates with HR data | ADP – Global payroll processing with compliance automation | Gusto – Ideal for small businesses, automates tax filings |

| Commission Management Software | QuotaPath – Tracks and automates commissions, integrates with CRMs | Spiff – Real-time commission tracking with analytics | Xactly – Enterprise-focused commission automation |

| Recruiting Software | Lever – AI-driven applicant tracking system | Greenhouse – Customizable hiring workflows with deep analytics | Breezy HR – Visual pipeline for easy candidate tracking |

| Employee Engagement Software | Culture Amp – Real-time feedback and engagement surveys | 15Five – Weekly check-ins and performance insights | Peakon – AI-driven employee experience analytics |

| Performance Management Software | Betterworks – Continuous goal-setting and OKR tracking | Lattice – Employee growth tracking and manager feedback | Reflektive – AI-driven performance analytics and insights |

| Learning Management System (LMS) | Seismic Learning – Training and coaching for sales and support teams | Docebo – AI-based personalized learning experiences | TalentLMS – Easy-to-use e-learning platform for businesses |

How to Pick the Right Software For Your HR Tech Stack

That’s a lot of options, huh? When you’re ready to start selecting programs, choose tools for your HR tech stack that align with your processes, integrate smoothly, and support long-term growth.

These steps will help you select the solutions that best suit your organization.

Step 1: Assess Your Needs: Identify key pain points and gaps in your current HR processes. Does recruiting slow you down the most? Onboarding new hires? Payroll?

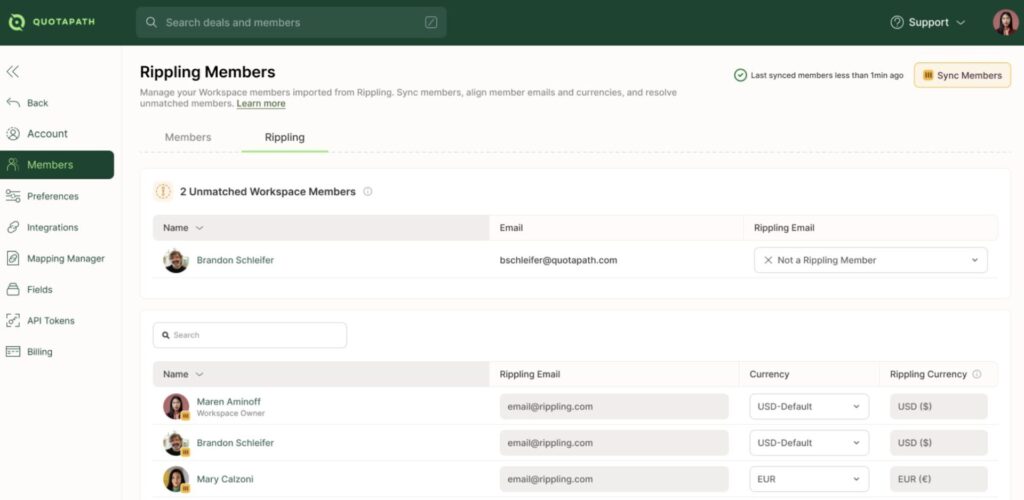

Step 2: Prioritize Integrations: Ensure that selected tools seamlessly integrate with existing systems. Think single-sign-ons for employees, shared data, seamlessly working together to build adoption and workflows, like Rippling & QuotaPath.

Step 3: Evaluate User Experience: Choose platforms with intuitive interfaces to drive adoption among HR teams and employees. Request demos or free trials to test usability and gather input from actual users to see how easy the system is to navigate.

Step 4: Consider Scalability: Opt for solutions that can grow with your company’s workforce. Look for flexible pricing models, modular features, and vendor case studies that show successful scaling in companies of similar size or industry.

HR Tech Stack Challenges

Even the most advanced HR tech stack can create friction. Including the wrong tools or too many, can lead to inefficiencies, data silos, and low adoption rates instead of improving workflows. Companies face several common challenges when building and maintaining their HR technology stack. Here are the most common issues to watch for and how to address them:

Integration Issues

Many HR tech tools operate in silos, making it difficult to sync data across platforms.

- Lack of seamless integration with payroll, benefits, and commission management software can create inefficiencies.

- Solutions: Choose platforms with native integrations (like Rippling & QuotaPath) or use middleware tools like Zapier.

Data Security & Compliance Risks

HR software stores sensitive employee data, increasing the risk of data breaches.

- Companies must ensure compliance with GDPR, CCPA, and SOC 2 standards.

- Solutions: Prioritize software with strong encryption, role-based access, and audit trails.

User Adoption & Change Management

Employees resist change when new tools are introduced, leading to low adoption rates.

- HR teams need training programs to help employees transition smoothly.

- Solutions: Select tools with intuitive UX, self-serve resources, and strong customer support.

Choosing the Right Tech for Business Needs

HR teams often struggle with overlapping functionalities or choosing tools that don’t scale.

- Companies may prioritize cost over feature fit, leading to future inefficiencies.

- Solutions: Conduct a tech audit, prioritize must-have features, and consider future scalability.

Cost & ROI Justification

Budget constraints can limit the number of tools a company can implement.

- Demonstrating the ROI of an HR tech stack investment can be challenging.

- Solutions: Start with core platforms (payroll, commission management, recruiting) and expand as needed.

HR Tech Stack Example

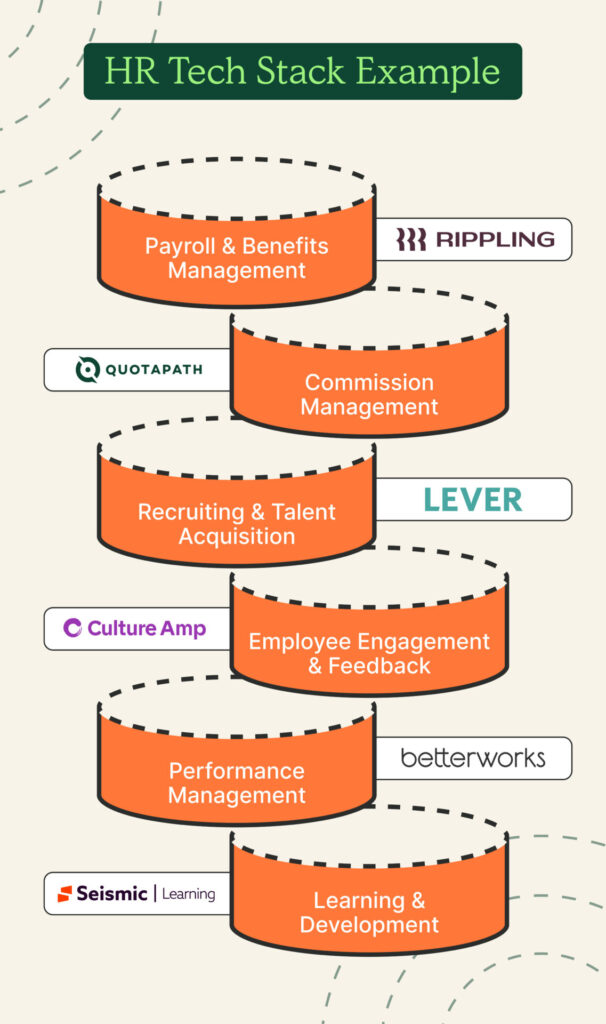

To bring your HR tech strategy to life, it helps to see how different tools can work together in a real-world scenario. An example for a mid-sized company of 50–200 employees, a well-integrated HR tech stack might include:

Payroll & Benefits Management

Rippling: Runs payroll in 90 seconds, seamlessly integrates with HR data, and ensures compliance with tax regulations.

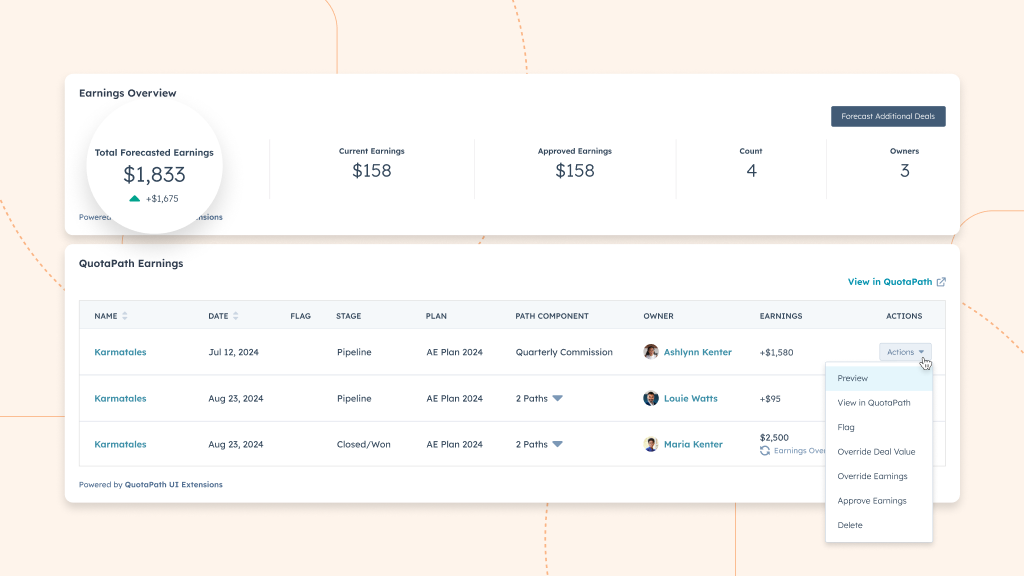

Commission Management

QuotaPath: Automates commission tracking, integrates with CRMs, and provides transparency into earnings for sales teams.

Recruiting & Talent Acquisition

Lever: An AI-driven applicant tracking system (ATS) that streamlines hiring processes, supports collaborative recruiting, and offers deep analytics.

Employee Engagement & Feedback

Culture Amp: Provides real-time feedback, employee engagement surveys, and actionable insights to improve workplace satisfaction.

Performance Management

Betterworks: Enables continuous goal-setting, OKR tracking, and performance reviews, fostering a culture of high performance and accountability.

Learning & Development

Seismic Learning (formerly Lessonly): Offers training and coaching for sales and support teams, with interactive learning experiences to drive skill development.

This HR tech stack ensures efficiency, compliance, and employee satisfaction, helping organizations easily manage their workforce.

Try the most collaborative solution to manage, track and payout variable compensation. Calculate commissions and pay your team accurately, and on time.

Start TrialImplementing Your HR Tech Stack

Rolling out your HR tech stack is a crucial step. To start, audit existing tools and remove outdated software to eliminate redundancy. Create an implementation timeline, prioritizing essential systems like payroll, recruiting, and compliance tools.

Train employees on new platforms and establish usage best practices to ensure a smooth transition. Finally, monitor adoption and performance using HR analytics and adjust as needed. A thoughtful, phased rollout will help your organization maximize the impact of your HR technology investment.Learn how QuotaPath and Rippling work together for effortless commission payments. Then schedule a demo to see it for yourself.

Recent Comments